Why I’m smiling today…

- Stephen McBride

- |

- July 5, 2021

- |

- Comments

This article appears courtesy of RiskHedge.

I’m writing you today with a big smile on my face.

Because humanity just achieved a MONUMENTAL scientific breakthrough.

This breakthrough will save sick children and unite broken families.

It will cure terrible diseases like cystic fibrosis… Huntington's… and sickle cell anemia.

And the disruptive company that made it happen is a RiskHedge stock.

Let me tell you about this miraculous little company...

And because this is such a groundbreaking moment, I’ll even share my investment guidance that’s usually reserved for our premium members.

-

Genomics pioneer Intellia Therapeutics (NTLA) just demonstrated CRISPR gene editing technology works for the first time ever.

In a world first, Intellia successfully edited genes inside the human body in a clinical trial.

This is a HUGE deal…

If you’ve been following RiskHedge, you know gene editing promises to transform how we treat and cure disease.

Often referred to as “CRISPR” technology, gene editing allows scientists to “cut” out bad genes that cause disease, and replace them with healthy genes.

CRISPR technology was first developed roughly a decade ago. Scientists and doctors immediately recognized it as a “Holy Grail” that could forever change medicine.

But there’s been a big problem.

Most folks don’t know that CRISPR has effectively been stuck in “demo mode.”

In order to edit a person’s genes, doctors had to extract the genes from a body... edit them in a lab... then put them back into the body.

This was a complex and costly process that excluded it as a treatment option for the vast majority of folks.

-

That all changed on Saturday.

Intellia edited patients’ genes through a simple IV drip.

It injected a gene-editing drug into the blood of people born with transthyretin amyloidosis, which causes fatal nerve and heart disease.

Patients’ response was overwhelmingly positive. Doctors called the results a “home run.”

Barron’s said: “Gene editing history was just made my Intellia.”

The results were so incredible, they even surprised Intellia. Its chief medical officer said the results were “beyond what we expected.”

-

This is a watershed moment.

Intellia proved for the first time that this game-changing tech can actually work in the human body.

And it reminded me of my favorite four words…

A simple phrase that makes me excited to get up and work every morning…

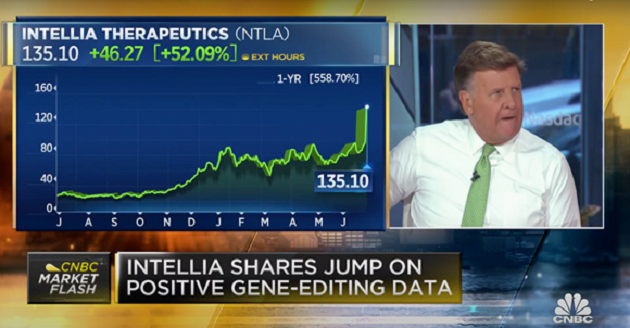

I tuned into CNBC during my lunchbreak on Monday. Intellia’s breakthrough was by far the biggest news of the day:

Source: CNBC

Source: CNBC

Watching the screen, my four favorite words came to mind:

“That’s a RiskHedge stock.”

I love when our readers can say this about a stock that’s changing the world.

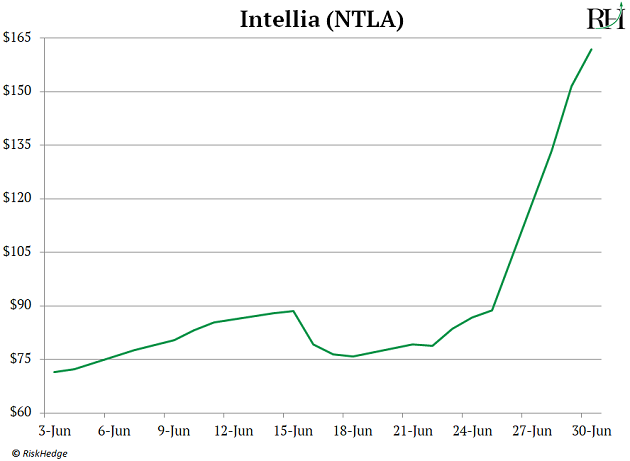

Members of our premium Disruption Trader advisory got into Intellia two weeks ago.

It then jumped 50% on Monday...

And was up another 30% at one point yesterday.

Altogether, Intellia has rocketed 85% since Friday.

To be clear, we did not have advance knowledge of these groundbreaking results.

We had a hunch that good news was coming, based on the unusually strong behavior of the stock.

But these results are shockingly great. Revolutionary.

-

So if you don’t own Intellia yet, should you buy it today?

My short answer is yes, if you treat it as a longer-term investment.

Intellia is now the clear leader in gene-editing—which will rapidly grow as an industry as CRISPR technology is adapted to treat more and more diseases.

Remember, Intellia has jumped 85% in four days. So, there’s not nearly as much immediate upside as when we first recommended it in Disruption Trader three weeks ago. It’s probably not going to jump 85% in the next four days, as it did in the last four days.

If you’re buying Intellia now, ease into a position.

-

Believe it or not, Intellia wasn’t the only RiskHedge stock to make a game-changing announcement in the past week...

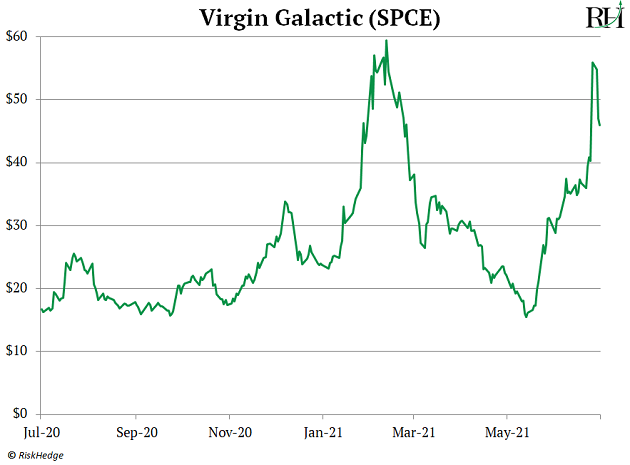

Did you hear one of my favorite disruptors, Virgin Galactic (SPCE), just got the green light to fly into space?

On Friday, the stock jumped 40% when it received approval from the Federal Aviation Administration to fly customers to space.

This marks the first time ever the FAA has licensed a “spaceline.”

In the media, this big news was rightfully overshadowed by Intellia’s generational breakthrough.

But it’s been a very profitable ride for my Disruption Investor premium subscribers. SPCE has now more than tripled since we bought it last year.

Two announcements of this magnitude—happening in the same week—is almost unheard of.

We’re living in the golden age of disruption.

And to be clear, our trades don’t always work out as perfectly as Intellia and Virgin have.

But when they do—I love celebrating together with our subscribers and saying: that’s a RiskHedge stock.

-

Before I sign off, I want to make sure you have a chance to review everything we put together for you as one of our best subscribers.

By now, you’ve probably heard about RiskHedge Reserve…

An exclusive club that gets you permanent access to all of our premium advisories for life, without ever having to pay a subscription fee again.

If you’ve already decided it’s not for you, that’s completely fine. But if you would like to take advantage, I should let you know that this offer comes down at midnight tonight.

So go here to review everything one last time while this link is still active.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com