Who’s Wrong—Me, Justin, or Chris?

- Stephen McBride

- |

- December 21, 2020

- |

- Comments

This article appears courtesy of RiskHedge.

We were in total disagreement.

In fact, over a three-week span back in March and April, my colleagues Chris Wood, Justin Spittler, and I published three separate updates…

All of which urged readers to take a different action.

Remember, this was when the coronavirus lockdowns were crashing the stock market. It seemed like the world was ending. Our subscribers needed guidance.

And yet I urged my readers to buy certain stocks.

Justin urged his readers to sell other stocks.

And Chris encouraged his readers to hold on to their positions.

Fast forward to today and we continue to publish different guidance.

Now, I know what you might be thinking…

- Stephen… what’s the deal? Why the mixed messages?

We get this question in our mailbag often... and I’ll answer it in this issue.

As you’ll see, it’s not a mistake when we disagree. In fact, it’s the main reason we’re wrapping up a truly remarkable year across all of our premium research services…

A year in which our subscribers had a chance to book 14 doubles, including a string of 300%+ winners.

And yet here’s the truth:

If we all agreed on the same approach…

This year would have looked completely different. In fact, our readers might have lost money.

Let me explain…

- Longtime readers know me as the disruption guy.

I focus on world-class, disruptive businesses that will dominate for a long, long time.

I’ve found it’s the absolute best way to grow your wealth safely—no matter what’s going on in the markets.

Back in early April, when the corona crash was in full force, I urged my Disruption Investor subscribers to start accumulating shares in these great businesses.

I encouraged them to use a proven strategy called “dollar-cost averaging”… to plant their seeds in the most dominant and disruptive companies on the planet.

In short, with dollar-cost averaging, you place a fixed dollar amount into an investment on a regular basis. Say you plan to invest $3,000 in one stock. Instead of buying $3,000 in one go, you’ll split it up into, say, six $500 chunks to invest over six months until you’re fully invested.

This way, if the stock declines in the short term, you get the benefit of paying a lower average price.

I knew it was a once-in-a-generation opportunity to pick up shares of companies changing the world… at fire-sale prices. We couldn’t let the opportunity slip through our fingers.

We used this more conservative approach to limit our downside. And it paid off. While we closed out a couple of small losses earlier this year, all fourteen of our current positions are in the green… including three disruptors up 90%+.

- This strategy was right for the types of opportunities I follow... but it was the WRONG approach for Chris Wood’s microcap plays.

Chris pinpoints “early stage disruptor” stocks.

These are microcaps… tiny stocks worth $300 million or less.

These tiny stocks are usually “event driven.” One big announcement can send their shares up hundreds of percent in a flash.

They’re also very volatile… and can decline just as fast.

- Here’s a crazy example…

Back in March, while everything was getting hit hard… microcaps were getting hit the hardest.

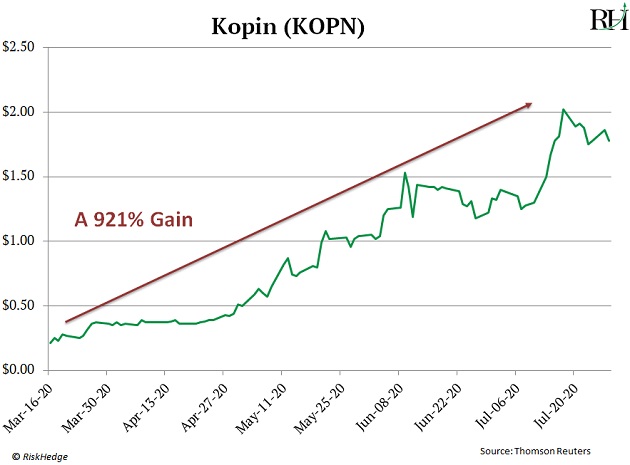

In fact, the shakeout pushed one of Chris’s picks—augmented reality stock Kopin (KOPN)—down 72% at one point. Keep in mind, a stock that’s declined 70% needs to rise 233% just to get back to even.

But Chris insisted on holding on, telling subscribers their patience would be rewarded—and soon.

It takes serious courage and conviction to make a call like that. But sure enough, Chris was right.

From its bottom, the stock soared 921% in just four months:

Chris’s subscribers are now sitting on a solid gain in Kopin... along with several other 100%+ winners that looked “down for the count” in March.

- Justin is a ruthless trader who goes after big, quick profits in fast-moving stocks.

Justin’s disciplined approach has led his premium subscribers to a string of huge wins this year.

I’m talking about gains like:

406% in Livongo (LVGO)… 395% in VectoIQ Acquisition Corp. (VTIQ)… and 298% in Fastly (FSLY)…

Justin’s defining trait is his refusal to tolerate a losing trade. When a trade doesn’t go as planned, he quickly cuts it, takes responsibility, and moves on.

As he puts it: “There are so many moneymaking opportunities... why waste time in a stagnant trade when you can be in a big winner?”

That mindset has allowed him to rack up an impressive win rate. At last count, 18 of his 25 premium trades have made money this year.

But here’s the thing:

- Justin recommends fast-moving momentum stocks.

He targets initial public offerings (IPOs) in his IPO Insider advisory—and “hypergrowth” stocks in Disruption Trader, which I co-edit with him.

With these fast-moving stocks, you need to be able to move quickly from trades that don’t work. In short... this is the right way to play IPOs and hypergrowth stocks... but it would NOT work for my world-class, bigger disruptors that grow your wealth during a longer time period.

This strategy would also NOT work for Chris’s “event driven” microcaps, which you usually don’t want to sell just because the price declines.

- We all recommend different types of stocks, so we all approach markets differently.

That’s why you’ll see different guidance from us… as you should. It means we’re doing our job right.

If we all had the same exact approach for our newsletters, we’d be failing. It wouldn’t work.

I simply can’t invest in giant money disruptor PayPal the same way Justin trades cutting-edge Fastly.

- Hands down, the costliest mistake I see investors make over and over is this:

They seek a “one size fits all” approach to investing.

Folks want one simple method to protect their money in bad times and grow their money in good times.

One easy, five-minute solution that works for all types of stocks under all market conditions.

It’d be nice if markets worked that way, wouldn’t it?

But they don’t. Our RiskHedge editors—and the results they produce—are proof.

It’s why we provide specific, niche services that are 100% focused on the most lucrative parts of the market—like world-dominating disruptors, IPOs, microcaps, and hypergrowth stocks.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com