What I learned in NYC

- Stephen McBride

- |

- January 30, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

[Closing Wednesday: Special invitation to Disruption Investor. Go here for details.]

I’m back home after a hectic few days in New York City.

One of the many reasons I love coming to America: I separately bumped into two RiskHedge members.

Here’s me and Brett at an event in Midtown:

And shout out to Brad in New Jersey. Stay in touch!

If you only watched the news, you’d think NYC is a dirty, dangerous dump.

Truth: NYC is buzzing. Restaurants are packed and people are spending like there’s no tomorrow.

I waited 25 minutes to get into the KazuNori sushi restaurant (on a Monday night). Highly recommend. Only cost $50, and I left stuffed:

Let’s get after it…

- The market is getting stronger, not weaker…

I joined my friend JC Parets of All Star Charts’ Portfolio Accelerator event last week.

It was a room full of technical analysts, who study charts to see how markets are actually behaving to make trading decision:

My #1 takeaway from cycling through hundreds of charts: The market is getting stronger, not weaker.

Big tech stocks carried the market higher last year. Now, you’re seeing the bull market broadening out.

TV gangster Tony Soprano used to say, “I’m in the waste management business.” We’d all be made men like Tony if we had bought Waste Management (WM) stock. It’s making new highs:

Biotech stocks like Regeneron (REGN)… defense contractors like General Dynamics (GD)… and insurers like Allstate (ALL) are also hitting new record highs.

Notice how none of these are tech stocks?

Something I’ve learned over the years is to listen to the market. Are stocks rising or falling… which type of stocks are going up… and how many stocks are participating?

This is all crucial information that can give you a hint about what stocks will do next.

Right now, the market is telling us it wants to move higher.

- How to burn $3 million in one month…

I had breakfast with a well-known Wall Street veteran who asked not to be named.

He told me about a friend who sold his swanky house for $10 million around Christmas and invested it all into one stock: Tesla (TSLA).

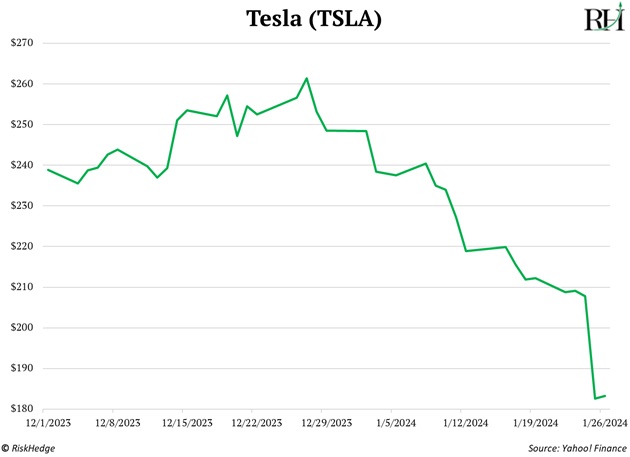

Tesla has fallen 30% since then:

Tesla got absolutely hammered after warning investors that sales growth would slow this year on its recent earnings call.

Imagine this guy explaining to his wife they’re down $3 million in a month… divorce material.

My friend covered the auto sector for a big Wall Street firm for over a decade, so he knows the industry inside and out. He walked me through why it’s one of the worst businesses on the planet.

I agree, which is why we’ve steered clear of investing in electric vehicles (EVs). You need great businesses to complement fast-growing trends.

It’s shaping up to be a rough year for EV-related stocks.

Car rental firm Hertz (HTZ) recently said it was selling 20,000 Teslas and switching back to gas-guzzlers.

The bigger problem is how quickly EVs lose value.

A second-hand Tesla Model X fetched $76,000 in December 2022. Today, you can buy the same model for $49,000. That would make me think twice about buying one.

Put EVs in the “too hard” pile for now. There are easier ways to make money.

And please, never sell your house and put all that money into one stock.

| January enrollment ending Wednesday: Join Disruption Investor for the lowest possible price before Wednesday, January 31. Details here. |

- The stock market crowns a new king…

Microsoft (MSFT) (blue line) just overtook Apple (AAPL) (purple line) as the world’s most valuable company:

Last October, I predicted artificial intelligence (AI) would help Microsoft reclaim this crown from Apple.

Microsoft owns 49% of ChatGPT creator OpenAI. And it’s integrating OpenAI’s cutting-edge tech into its products.

In fact, Microsoft just announced it’s putting an “AI button” into its new keyboards, which will take users straight to its ChatGPT-like assistant, Microsoft Copilot.

Nvidia (NVDA) and Microsoft made new highs last week, while AI laggards like Apple and Amazon (AMZN) fell behind. Talk about the market giving us signals…

It’s telling us 2024 is the year AI takes over. Microsoft is the only big tech stock I’d own. But it’s not the best way to profit from AI.

Microsoft alone plans to spend $50 billion expanding its AI datacenters next year. Another way to profit from this trend is investing in companies powering the AI infrastructure buildout and printing money right now.

We already own several of these stocks in Disruption Investor, and we’re planning to add more in the coming weeks.

I also touched on AI in my recent “Ask Me Anything” session, exclusive to Disruption Investor members who have joined our new community app. If you’d like to be part of future conversations, you can join us here.

- Today’s dose of optimism…

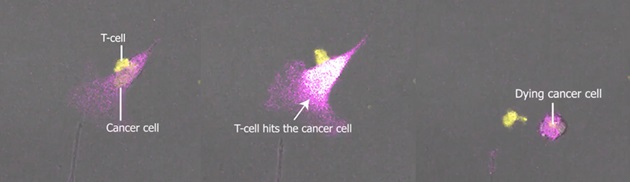

Here’s a truly mesmerising video:

A T-cell—a type of white blood cell that fights disease—killing a cancerous cell.

Here’s what it looks like, or you can watch it here.

Source: @Innov_Medicine on X

We’ve discovered many life-saving breakthroughs over the past 250 years: vaccines… antibiotics… and anaesthetics, to name a few.

But cancer still kills over 600,000 Americans each year.

I’m looking forward to the day when being diagnosed with cancer is no worse than finding out you have the flu: a minor illness that can easily be cured.

It will take time. But I’m optimistic that breakthroughs like CAR T-cell therapy and cancer-killing pills can get us there.

Future’s bright…

Stephen McBride

Chief Analyst, RiskHedge

PS: In 2023, my flagship Disruption Investor advisory beat the market by 100% and posted an 80% win rate. We also held Nvidia, the #1 stock in the S&P 500 all year. For 2024, I expect the market will end the year higher. But the path will be rocky…

If you’re looking for guidance, you can join Disruption Investor at a $100 discount... but you’ll have to act soon. This deal ends at midnight on Wednesday, January 31. Here’s what you get when you sign up.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com