This “Anti-Amazon” Is Saving Mom and Pop

- Stephen McBride

- |

- June 15, 2020

- |

- Comments

This article appears courtesy of RiskHedge.

68-year-old Jan Buerge was days away from losing everything...

For 35 years, she has run World’s Window in Kansas City, a store that sells artisanal items from around the world.

In March, she was forced to close her doors because of coronavirus.

But she didn’t give up. She just needed a plan… and fast.

She snapped pictures of her remaining items. And quickly got them online with the help of her husband and nephew…

Within three days, business was booming. Buerge was shipping baskets made from South African telephone wires… and metal plaques made in Haiti to customers around the nation.

Buerge didn’t do it alone…

As I’ll show you, a once “hated” stock has been a savior for millions of mom-and-pop shops across America.

It handles all the “plumbing” of online selling… Like payments, shipping, and marketing… and it’s poised to rocket higher in the years ahead…

- I’m talking about Shopify (SHOP)…

Shopify helps entrepreneurs create and manage their own online stores.

Its easy-to-use website rescued tens of millions of these small businesses, just like Buerge’s.

In fact, merchants with Shopify stores recouped 94% of lost in-person sales with online orders.

So for every dollar lost to coronavirus, these businesses recovered 94c thanks to Shopify.

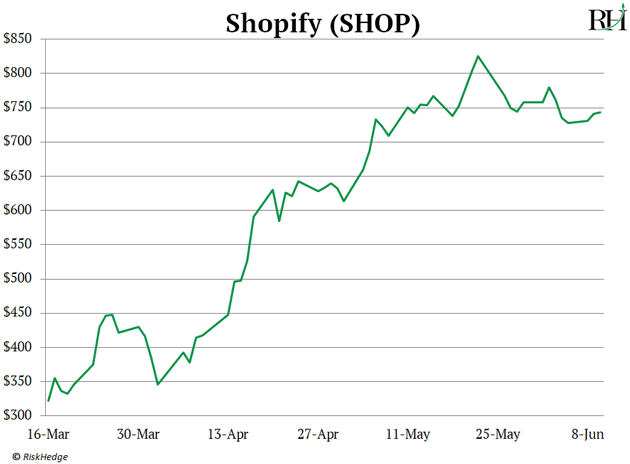

And have you checked out Shopify’s stock recently? It’s soared 90% since the lockdowns started, as you can see here:

- Today Shopify is a Wall Street darling.

But a couple of years ago, it was totally hated.

Think about what Shopify was trying to achieve… run an online marketplace where smaller businesses could sell their goods.

That’s stepping into Amazon’s (AMZN) territory. And how could a tiny startup compete with an 800lb. gorilla like Amazon?

Most investors thought Shopify would be out of business in a year or two.

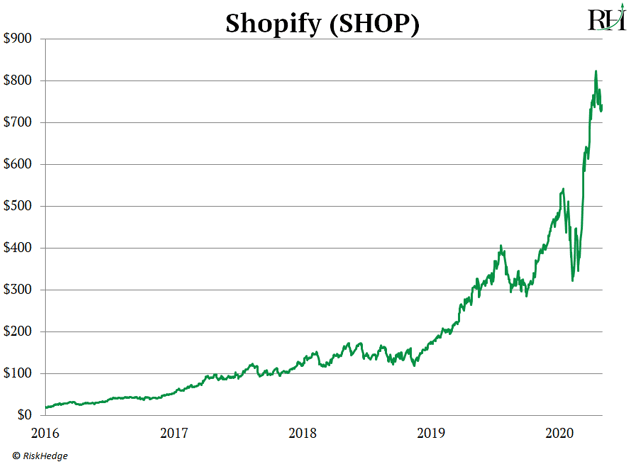

But here’s the thing… folks who bought Shopify in 2016, when it was out-of-favor, are sitting on 3,500% gains today:

It was the perfect “hated” stock play.

(My colleague and RiskHedge Chief Trader Justin Spittler specializes in finding these “hated stock” setups. And with Coronavirus making markets go haywire, he says there are more great setups today than he’s ever seen. He’ll be sharing more on this next week.)

- How did Shopify compete with Amazon?

Selling goods online is a tough business.

You have to build the website… rent servers to handle all the internet traffic… and collect payments.

You have to ship your products… accept returns… and run marketing campaigns. Just setting up an online store is a full-time job and will set you back thousands of dollars at a bare minimum.

So most small businesses looking to sell online chose to partner with Amazon. In fact, roughly two-thirds of goods sold on Amazon come from independent sellers.

Amazon handles all the not-so-fun parts of selling online… but it comes at a cost. Selling on Amazon is like placing your products on another retailer’s shelves. It’s almost impossible to build your brand, and the online gorilla takes a chunk of your sales.

Shopify is the anti-Amazon.

It gives businesses the tools to build their own online store. Think of Shopify like an invisible partner that allows you to build your own brands.

The Economist… Penguin Books… Unilever… Red Bull… Heinz… Budweiser… Pepsi… Nestle…

You wouldn't know it from looking at their websites, but all these online stores are powered by Shopify.

- And now Shopify runs websites for over one million mom-and-pop shops.

Here’s how it works… The company offers a simple tool that helps anyone set up a custom online store for as little as $29/month…

Shopify can even fulfill your orders, which means it holds your inventory at its warehouses and ships your products.

You don’t have to maintain software or servers. You don’t need to hire expensive programmers or be into coding yourself. You don’t have to bother with shipping.

In minutes, you can have a full-fledged online store that’s running on autopilot under your business name… just like Amazon.

It’s like getting a fully furnished retail store with trained sales clerks… all for a few bucks. You just put your products on the shelves, hang a storefront sign, lean back, and watch sales come in.

And Shopify’s business is booming.

In 2012, it had just 42,000 merchants. Today, more than 1,000,000 businesses around the globe have set up an online store with Shopify.

Businesses sold $60 billion worth of goods through its platform last year. For perspective, that’s a 600% jump in sales since it was “hated” back in 2015.

And get this… Shopify is now the world’s 15th largest retailer—online or offline. It sits just behind DIY superstore Lowe’s.

- Think about what Shopify is achieving… it’s opening up the world for entrepreneurs.

Take Jan Buerge and her artisanal store for example. Only folks living in Kansas can visit her store. But with her Shopify-powered store, now she can sell to folks all over America.

By handling all the “plumbing” of online selling like… payments, shipping, and marketing… it leaves Jan free to focus on finding unique artisans around the world.

Shopify is the world’s most disruptive retailer that most investors aren’t paying attention to.

This is a stock to own for the long term as it cements itself as the “anti-Amazon.”

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com