The Ultimate “Tollbooth” Stock

- Stephen McBride

- |

- January 27, 2020

- |

- Comments

This article appears courtesy of RiskHedge.

How many credit cards do you have?

If you’re like the average American, you carry four in your wallet.

And the mailman likely slides a “PRE APPROVED!!” offer for a new one into your mailbox at least once a week.

Chances are your credit cards are from different banks. Maybe you’ve got the Venture Card from Capital One for when you travel. Or the Chase Freedom card, which gives lots of “cash back.” Or the JetBlue Card from Barclays, which racks up “miles” you can spend on JetBlue flights.

You probably have at least one ATM card, too. Maybe from Bank of America... Wells Fargo... or a smaller bank in your town.

If you dumped out your wallet on the table and laid all your cards side by side, you’d notice something odd.

While all the cards are from different banks—and they all have their own special privileges, prestigious names, and color schemes—most have one thing in common:

“Visa” or “MasterCard” stamped on the bottom right.

- Visa (V) and Mastercard (MA) are the ultimate “tollbooth” stocks.

It hardly matters what bank you use. At the end of the day, your card likely needs Visa or Mastercard’s payment network to function.

Over 80 million stores accept Visa or Mastercard. With one of their cards in your wallet, you can buy stuff anywhere in the world.

I lived in Argentina a couple of years ago and spent most of my time in a tiny rural town. The roads were dusty and most locals rode bicycles to get around. Yet I didn’t take out cash once. And I didn’t have to worry about converting my US dollars to Argentinian pesos.

Almost every store and restaurant in that dusty little town accepted my Visa card, no questions asked.

Visa and Mastercard have effectively created a universally accepted money—a “global currency.” $13 trillion flowed through their networks last year. They make money by taking a small cut of each transaction, like a tollbooth on a highway.

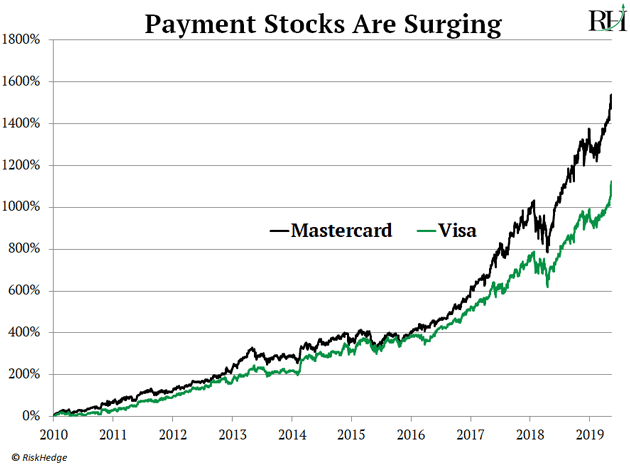

Both Visa and Mastercard are minting record profits, and their stocks have handed investors tremendous gains:

Here’s why this is important for you...

- A few months back, I explained how banks’ stranglehold on money is weakening.

For many decades, we’ve had to deal with banks to move money.

If you wanted to cash your paycheck… wire money... or get a credit card… you often had to talk to a banker.

These days, you can do all these things without ever stepping foot inside a bank. You can even get a mortgage without ever talking to a human banker!

Sending money no longer means writing a check and waiting three days for it to clear. Now you can send and receive money instantly with PayPal’s (PYPL) Venmo. Roughly 50 million Americans use Venmo every month. You can even pay your taxes with PayPal.

Have you ever used Square’s (SQ) little white box that swipes credit cards? It plugs into your smartphone to turn it into a cash register. Over two million small businesses use it to accept cards instead of cash.

And getting a credit card no longer requires filling out piles of paperwork and answering a banker’s questions. Smartphone giant Apple (AAPL) made a splash when it debuted its shiny new titanium credit card last August.

As I said, these disruptors will end banks as we know them. Nobody cares if banks have fancy lobbies with marble floors these days. Most Americans just want a fast and convenient way to manage their money.

I haven’t stepped foot in a bank in years. And foot traffic into branches has fallen close to 50% in the past decade.

Many folks assume “old” money companies like Visa and Mastercard are in trouble too.

- These folks are wrong.

What few people realize is ALL the "money disruptors” I just mentioned are plugged into Visa and Mastercard’s networks.

Apple designed its titanium card to resemble its sleek products. But did you know it runs on Mastercard’s network? You can see the Mastercard logo etched into it here:

Source: Business Insider

And credit cards from PayPal… Square… and Stripe all have Visa or Mastercard logos:

Source: Paypal.com, logodix.com

These disruptors aren’t ripping out the pipes of our financial system and trying to cut out Visa and Mastercard. Instead, they’re partnering with them… sending even more money flowing through their networks.

Remember, each time you pay with a card, Visa and Mastercard collect a small fee.

In fact, even when you pay with your phone, these giants make money. Apple Pay… Google Pay… and Amazon Pay... are simply “apps” built on Visa and Mastercard networks!

- Nobody can touch these “undisruptible” stocks.

How we move money around and pay for things has changed for good.

Yet these changes have only cemented Visa and Mastercard’s dominance.

They’ve built payment networks nobody can match. More than 30,000 banks use their credit cards. There are 3.4 billion Visa cards alone in circulation!

And now partnerships with PayPal, Square, and others are injecting a new wave of growth into Visa and Mastercard.

Visa’s sales shot up 11.5% last year to a record $22 billion. And Mastercard’s revenue jumped 20% to $14.5 billion.

They are two of the most consistently impressive businesses I’ve ever analyzed.

Visa’s profit margins are 5X better than the average US stock. It turns 52 cents on every dollar into pure profit. Mastercard’s profit margins are 3X better than the average S&P 500 company.

If you’re investing for the long haul, you could do a lot worse than owning these two undisruptible tollbooth stocks.

Do you agree with us… or do you think these companies could eventually be disrupted by bitcoin and other cryptocurrencies? Tell me at Stephen@riskhedge.com.

Stephen McBride

Editor, Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com