The end of Silicon Valley

- Stephen McBride

- |

- March 20, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Silicon Valley is dead… Wall Street won’t save these early stage startups… Silicon Valley Bank’s “trickle-up” effect…

-

I’m usually fast asleep by 11 pm… but last Friday, I wanted answers.

Silicon Valley Bank (SVB)—America’s 16th-largest bank—had gone bust earlier that day.

I wanted to find out what was really going on… not what all the major news headlines were telling me. So I reached out to a well-respected Silicon Valley venture capitalist (VC) in my network.

“How bad is the panic in startup land?” I asked.

My phone pinged two minutes later. “Bad. Sh*t's hitting the fan.”

Since then, the Federal Deposit Insurance Corporation (FDIC) has stepped in to bail out SVB’s depositors. In other words, everyone is getting their money back.

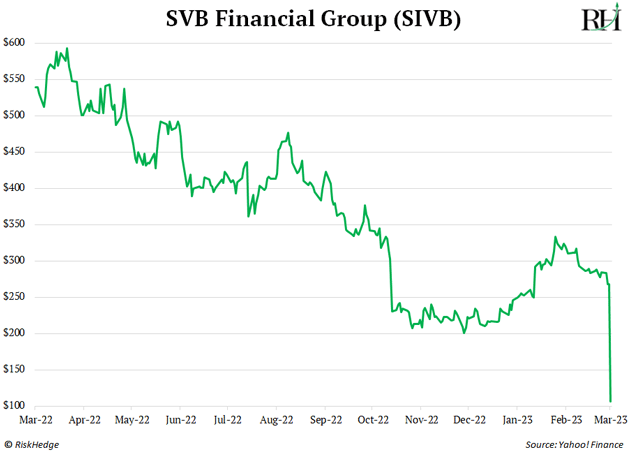

But Silicon Valley Bank was still fed to the wolves. A year ago, it was a $40 billion bank. Now, it’s bust.

And after digging deeper into SVB’s collapse, I’m even more convinced: This marks the beginning of the end of Silicon Valley.

As I’ll show you today, this is a paradigm shift for many of today’s biggest, most popular stocks.

-

Silicon Valley is the greatest moneymaking machine of our lifetimes.

It’s home to many of the most successful companies ever created. World-beaters like Adobe… Apple… Google… HP… Intel… Facebook… Nvidia… and PayPal are all headquartered there.

If Silicon Valley were a country, it would be among the world’s richest. In fact, its economy is larger than Denmark’s and Hong Kong’s!

Not only did Silicon Valley mint a new class of startup billionaires, but the firms it nourished made ordinary investors rich, too.

$10,000 invested into Nvidia, Google, and Apple back in 2010 would have turned into $559,395, $64,245, and $202,755 today, respectively.

Never has so much disruption—and wealth—flowed from one place.

-

Silicon Valley Bank greased the wheels of California’s tech boom...

A culture clash existed between Wall Street and Silicon Valley.

It went something like this:

A bunch of hoodie-wearing hippies running companies out of their parents’ West Coast garages… who don’t even make money?

Sorry, we only offer banking services to clean-shaven Harvard grads with three years of audited financials.

But thanks to SVB, Silicon Valley didn’t need Wall Street. It quickly became the bank for startups. And it did a lot more than clear checks and help with payroll…

It handed out mortgages to tech founders.

It allowed venture capitalists to borrow against their stakes in early stage companies.

It offered “bridge” loans to keep some startups afloat as they waited to close their next funding rounds.

And it directly invested in many startups.

In recent years, SVB banked half of all US tech startups.

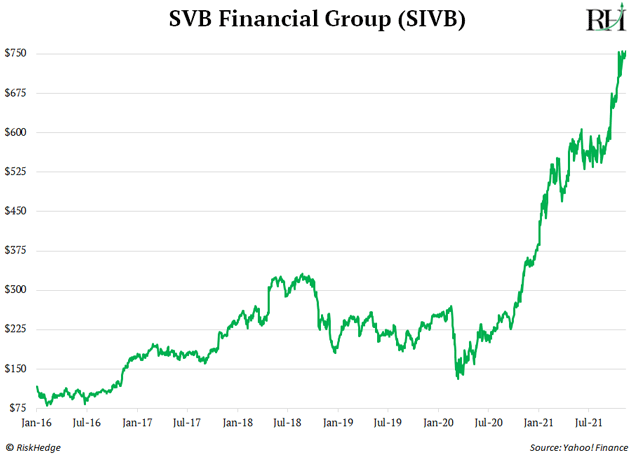

And it boomed alongside the disruptors it served. SVB’s stock surged over 700% between 2016 and 2021:

-

Want to know Silicon Valley’s dirty little secret?

It runs on OPM—other people’s money.

Startups are all about growing fast and worrying about profits later.

Here’s how Silicon Valley’s money machine works…

Some of the world’s richest institutions—pension funds and college endowments—hand billions of dollars to venture capitalists. VCs then throw money at cash-burning startups and hope they get paid back in 10 years.

Last year’s market crash essentially turned off the “OPM” spigots. The amount of money flooding into VC suffered its sharpest drop in more than two decades.

Startups were already tightening their belts. The collapse of SVB is an extinction-level event for Silicon Valley.

The friendly “startup” bank that extended an olive branch during tough times is gone.

And Wall Street giants like JPMorgan aren’t writing checks to money-losing startups.

My VC contact told me, “Firms are clinging to their capital. Everyone I know is in survival mode. The bar is very high for new companies.”

Silicon Valley startups are now starved for funding. Many need to raise money. Most won’t be able to.

Get ready for a “culling of the herd.” Only the strongest will survive.

-

Here’s why this matters for your portfolio…

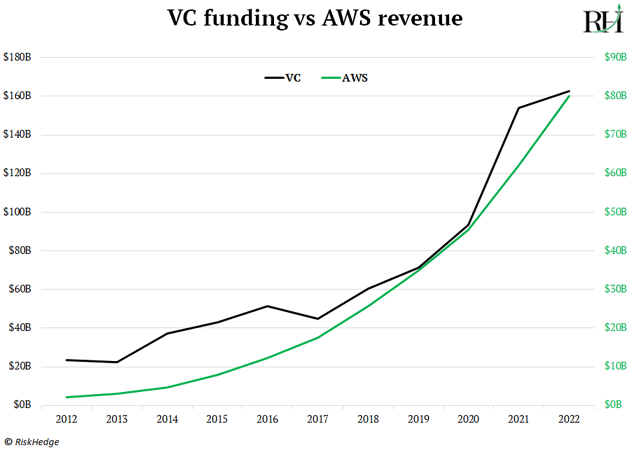

Investors poured $1.3 trillion into startups over the past decade.

You know where a big chunk of that money went? Into the pockets of Google, Facebook, Amazon, and Microsoft. Startups were the #1 customers of big tech.

In an annual letter to shareholders, venture capitalist Chamath Palihapitiya revealed a startling fact: “Startups spend almost 40 cents of every VC dollar on Google, Facebook, and Amazon.”

Practically every startup founded in the past decade ran on “the cloud.” This fueled record profits for cloud providers Microsoft and Amazon.

But that was just the beginning. Once startups were up and running on the cloud, it was time to get customers.

In a world where we stare at screens all day, the best way to be “seen” by potential customers is to buy online ads.

Google and Facebook dominate the online ad market. These two firms swallow up half of all the digital ad dollars in America.

The Silicon Valley startup frenzy led to a decade-long boom for Google and Facebook.

But now that bubble has popped. It’s no coincidence cloud and digital ad growth slowed dramatically last year just as the VC startup machine ground to a halt.

This is the beginning of the end for Silicon Valley.

The startup extinction has just begun. This will have a “trickle-up” effect on many of today’s largest and most popular stocks.

What should you do about it?

Be wary of investing in big tech.

These are NOT the same stocks that marched higher in lockstep for the last 10 years.

They’re going to have to find new ways to grow.

Some will figure it out… and some will die.

In any case, they’re still perceived as dominant, safe, and un-disruptible bedrocks of a portfolio.

Those perceptions are about to be shattered.

Stephen McBride

Chief Analyst, RiskHedge

P.S. Do you agree that Silicon Valley is dead... or am I dead wrong? Let me know at stephen@riskhedge.com.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com