I’m tempering that pessimist on my shoulder…

- Stephen McBride

- |

- September 5, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

It’s the closest thing to a “perfect” stock market indicator.

It’s reliably timed many market tops and bottoms.

And it’s hiding in plain sight.

Longtime RiskHedge readers know exactly what I’m talking about.

The “magazine cover” indicator...

In short: Pay attention to what popular magazine covers are saying. Then, do the exact opposite.

Let me show you what the latest cover is saying… and my top way to “play it.”

- The Economist—one of the most widely read financial magazines in the world—has an almost supernatural ability to nail the tops and bottoms of MAJOR trends…

But not in a good way.

When The Economist writes a glowing cover story about a certain asset or country, it’s usually time to sell.

The opposite is also true.

The Economist thinks some investment is doomed? Time to buy.

Take these two Brazil-themed covers from 2009 and 2016:

The Economist was all bulled up on Brazil in 2009. If you bought the iShares’s Brazil ETF (EWZ) then, you lost roughly half of your money over the following five years.

You would have fared much better buying EWZ in 2016 when Brazil was supposed to be headed for a “disastrous year ahead.” In fact, this negative cover marked the exact bottom for Brazilian stocks.

And then there’s my all-time favorite magazine cover…

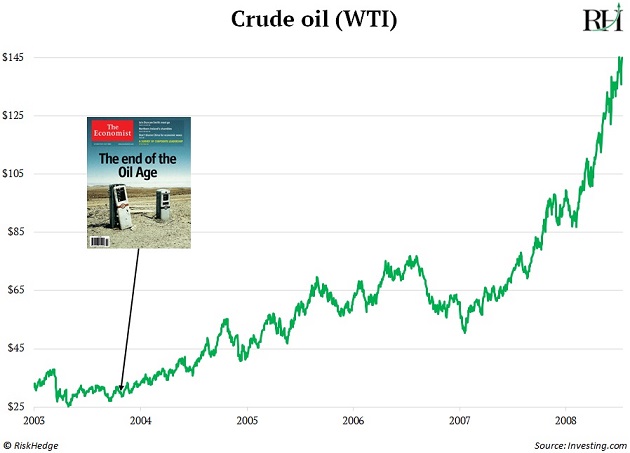

In October 2003, The Economist declared, “The end of the Oil Age.”

Oil was trading around $25/barrel at the time.

Oil then entered an all-time boom. The price of oil 5X’d over the next five years to a record $145/barrel.

You could have made five times your money betting against The Economist.

And these aren’t just “cherry-picked” examples…

- Two Citibank analysts studied roughly 50 Economist covers from the past 25 years that covered an investing idea in either a positive or negative light.

They found 68% (!) of all covers were “wrong” one year after publication.

In fact, if you’d set up a system to trade against Economist covers, you would have outperformed most hedge fund managers.

Buying assets The Economist wrote negatively about would have returned 18% in profits over the following year, on average.

Shorting assets that appeared on a positive cover would have generated average returns of 8% over the next 12 months.

- Why are magazine covers like The Economist such good contrarian indicators?

Folks usually pay attention to an asset only after it’s surged in price.

By the time it makes it to the front cover of The Economist, a majority of the move has likely already happened.

There are few buyers left to come in and drive prices higher. Meaning, we’re usually at the end—not the beginning—of a big runup.

And don’t forget: These journalists are just doing their jobs. They’re not investors. Most of the time, they write about what’s hot in the markets. That’s how you sell issues and subscriptions.

- What’s in the magazine these days?

I currently live in Europe.

And I’m sad about its future.

The continent has become a museum for rich Americans to visit on summer vacations. Tech progress has essentially been outlawed here.

Europe’s economy was roughly the same size as America’s in 2008. Now, the US is almost twice as big!

I want my kids to grow up in a land of “strivers,” not in one that feels like Groundhog Day.

But I had to temper that pessimist on my shoulder when I saw The Economist’s latest cover: “Is Germany Once Again the Sick Man of Europe?”

The last time The Economist printed a bearish cover story on Europe was in July 2022. It suggested I would freeze to death due to a lack of Russian heating oil.

Spoiler: Europe didn’t turn into a giant ice cube.

And if you had bought the Vanguard European Stock Index Fund (VGK), which tracks companies in the major European markets, after seeing that cover…

You would have banked 23% profits over the next year. That’s better than the 18% gains US stocks handed out over the same period.

Now’s another good time to consider buying some VGK.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com