How to ignore stocks (and why you should)

- Stephen McBride

- |

- June 27, 2022

- |

- Comments

This article appears courtesy of RiskHedge.

I know it’s hard to take your eyes off the market…

It’s like watching a slow-motion car crash.

Everyone, not just finance folks, is chatting about the declining stock market. My wife called me, joking she was returning some items to save money.

If you’re like most investors, you’ve probably been fixated on stock prices lately.

Today, I’ll show you why that’s a mistake.

Instead, you should focus on the single biggest driver of stock market returns, which I’ll share in a moment.

-

Truth is unless you’re a short-term trader, you’re better off turning off the stock screens and closing the charts…

If you’re an investor for the long haul like me, prices are a distraction from what really matters…

Superinvestor Warren Buffett told us what it means to be an investor during his first TV interview in 1985:

The real test of whether you’re investing… is whether you care if the stock market is open tomorrow… All the ticker tells me is the price… prices don’t tell me anything about a business.

Read that last part again…

As an investor, you should focus on what drives stock prices: the underlying business.

As Wall Street legend Peter Lynch says, “There is a company behind every stock.”

Sounds obvious… but it’s easy to forget.

And the performance of the business is the single biggest driver of its stock price.

Investment bank Morgan Stanley analyzed stock market returns since 1990 and discovered that 78% of a stock’s performance is driven by profit and sales growth over any five-year period. This jumps to 90% when you zoom out a decade.

In short, the biggest reason a stock goes up over time is because the company grows its sales and profits…

-

“Great, Stephen… but how will that help me navigate this choppy market?

Have you read Thomas Phelps’s 1972 classic 100 to 1 in the Stock Market?

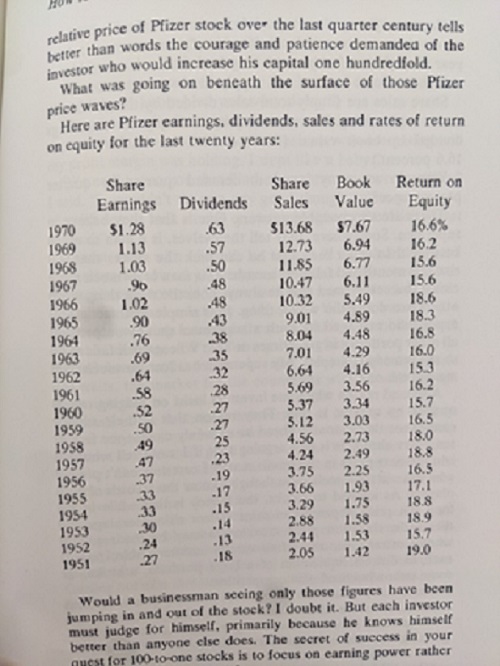

Phelps shows drugmaker Pfizer’s key financial metrics over 20 years. It shows steady, unstoppable growth… and consistently rising profitability.

Source: 100 to 1 in the Stock Market

Source: 100 to 1 in the Stock Market

Phelps wrote: “Would a businessman seeing only those figures have been jumping in and out of the stock? I doubt it.”

I agree. Investors who held Pfizer’s stock through this period made roughly 25X their money.

But I bet only a fraction of Pfizer shareholders realized those gains.

The stock surged throughout the ‘50s and ‘60s, but it didn’t go up in a straight line. There were dips and long periods of underperformance. I’m guessing many investors were shaken out during these rough patches.

But if they ignored the stock price and focused on the business… they would have been much more likely to realize those 25X gains.

You should make similar tables for every stock you own.

You can easily create them in Microsoft Excel and update the numbers when new earnings roll in.

It will help you focus on what really matters: the business.

-

In fact… this simple bit of guidance would’ve led you to buy and hold one of the greatest stocks of all time:

Amazon (AMZN).

Like Pfizer, it achieved unstoppable growth and consistently rising profitability.

That’s a company you would have held onto, right?

Maybe not. Its stock price behaved like a maniac behind the wheel.

Since 1997 its stock fell 95% once and 50%+ four times. And get this… it experienced 20% pullbacks in 19 of its 25 years since it IPO’d.

Despite all that… the stock turned a small $1,000 investment into $120,000 over the past quarter-century.

By the way… Amazon stock is down 42% from its highs today.

Yet, its business is stronger than ever.

-

It’s never been more important to focus on business performance than it is today.

If the year ended today, it would be the seventh-worst year for the S&P 500 ever.

Stock prices show we’re in a bear market, but many businesses are thriving.

Take the world’s largest computer chip maker, Taiwan Semiconductor Manufacturing Company (TSM), for example.

As long-time RiskHedge readers know, the whole world runs on chips these days.

TSMC is the only company in the world producing leading-edge semiconductors, and its business continues to break records.

Sales jumped 60% over the past two years. Last month TSMC achieved its fastest revenue growth in almost a decade. It’s super profitable.

Yet, its stock has plunged 40% since January.

Look at the wide gap that’s opened up between TSMC’s revenues (purple line) and its stock price.

Source: Koyfin

Source: Koyfin

TSMC is just one example of a thriving business with a disconnected stock price.

And that’s our opportunity.

As investors, we have the chance to buy great companies selling at 30%, 40%, or even 50% discounts today.

Many of those same companies are achieving record sales and profits.

-

Ignoring wild swings in stock prices is tough…

However, mastering this ability is key to sustained investing success.

It’s all about the business.

That’s what drives the prices we stare at all day.

If you’re wondering what stocks to buy right now, look for ones with strong businesses that continue to grow in this environment.…

Are you investing in disruptors selling at a discount? If you haven’t yet, what’s stopping you?

Write to me at stephen@riskhedge.com.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com