How to buy bitcoin for $1

- Stephen McBride

- |

- December 7, 2020

- |

- Comments

This article appears courtesy of RiskHedge.

Can you name America’s fastest-growing “bank”?

It’s not Goldman Sachs or Morgan Stanley.

It’s not Bank of America either, which has barely grown in 10 years.

Even financial heavyweight JPMorgan doesn’t wear this crown.

- “New money” disruptor PayPal (PYPL) is growing faster than any regular bank... and it’s not close.

Now, PayPal isn’t a traditional bank.

You can’t walk into a branch and talk to a teller sitting behind a glass barrier. In fact, when most folks read about PayPal, they imagine an internet startup stealing only a tiny slice of Wall Street’s business.

But longtime RiskHedge readers know new money disruptors are eating banks’ lunch. Roughly 350 million people “banked” with PayPal last month. That’s more than any US financial institution.

In fact, PayPal is now more valuable than any bank besides JPMorgan, as you can see here:

If I had told you 10 years ago PayPal would be worth more than firms like Wells Fargo or Citibank, you would have laughed.

But here we are. PayPal has left America’s most powerful banks in the dust.

It’s still growing rapidly, even though it’s very large.

And as I’ll show you in a moment, it recently made a big announcement that will drive rapid growth for years...

One that allows you to buy crypto currencies like bitcoin with three clicks... for as little as $1!

- For all of America’s history, banks have held a monopoly on all things money...

For 99% of Americans, it was impossible to get a house or a car or a college education without a loan from a bank.

Bankers abused this power. They were always a smug bunch. But we needed them... and they knew it.

Now, for the first time ever, disruptors are breaking their stranglehold on finance.

Sending money used to be a lucrative business. In fact, a decade ago, US banks charged you a fat 10% fee to wire money overseas. So if you sent $200, you had to cough up 20 bucks in fees!

But PayPal, TransferWise, and others have seized control of this market. These platforms let you send money instantly… for a fraction of the cost.

In fact, TransferWise now handles more money wires than JPMorgan and Bank of America combined!

- Disruptors have also transformed an industry near to my heart.

Remember the sky-high fees Wall Street stockbrokers once charged?

Back in the 1980s, their “going rate” averaged $45… per trade. And they often raked in thousands in fees depending on the size of the order. Stockbrokers were global jetsetters earnings tens of thousands of dollars a year for simply buying and selling shares.

Free trading “apps” like Robinhood have slashed the cost of investing. Investors can download Robinhood or Square’s Cash App to buy and sell stocks with a few swipes of their smartphones… for free.

And get this… Robinhood now has more accounts than Merrill Lynch.

Do you see the common thread among disruptors like PayPal and Robinhood?

They are disrupting banks by making finance easy and accessible for the little guy.

Think about investing in the heyday of stockbrokers. The lofty fees kept many would-be investors out. How many folks do you think missed out on the bull market of the ‘80s and ‘90s because buying stocks was expensive and hard? Probably millions.

Disruptors have reinvented trading and investing. Now you can manage your portfolio on a smartphone app. Ditto for sending money, getting a loan… and a dozen other businesses that banks used to dominate.

- And did you catch PayPal’s big reveal last month?

Customers can now buy, hold, and sell cryptocurrencies like Bitcoin from their PayPal accounts.

We haven’t talked much about cryptos at RiskHedge yet. These days, it seems everyone has an opinion about them.

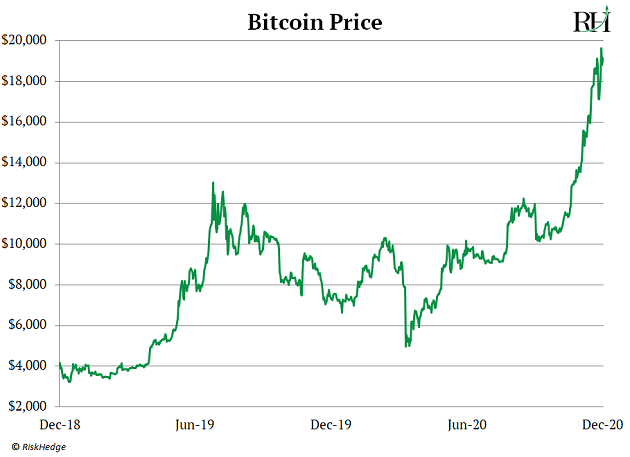

Not only that… Bitcoin has been plastered all over the news recently after surging to a multi-year high:

I’ve talked to many investors who are interested in Bitcoin, but don’t have the first clue how to buy it.

Don’t you have to open a dedicated crypto account?…

Which website should I invest through?...

Do I need $19,000 to buy one bitcoin?

PayPal smashed down all these barriers in one swoop. Its users can now buy and sell bitcoin and Ethereum, another cryptocurrency, from their PayPal accounts.

Remember, these disruptors have thrived by making finance easy and accessible for the little guy. That’s what PayPal is achieving here yet again.

Not many folks have $19,000 laying around to buy a whole bitcoin. Through PayPal, you can now open the app, click the crypto tab… and buy a fraction of a bitcoin for as little as $1!

In fact, over dinner the other night, my wife told me she bought 100 bucks worth of bitcoin on her phone.

- Here’s a little-known fact about crypto and disruptors.

Between 800 and 900 new bitcoin are added to the market on a daily basis.

That’s roughly $16 million worth of bitcoin at today’s prices. And research from hedge fund Pantera Capital shows PayPal and Square users are scooping up 100% of these new bitcoins.

In fact, in the past three months alone, Square users bought and sold $1.6 billion in bitcoin.

Many folks still hold Wall Street titans like Goldman Sachs and JPMorgan in high regard...

That’s due to their past accomplishments, which are fading further into the distance every day.

New money disruptors like PayPal are the future.

I’ve been pounding the table on new money disruptors for almost two years. I’m urging RiskHedge readers to invest in these stocks as they continue to transform banking.

Have you ever bought stocks or bitcoin through an app? Do you want to hear more about bitcoin and cryptocurrencies? Tell me at Stephen@riskhedge.com.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com