Get a Flood of Income From These 5 Water Investments

- Robert Ross

- |

- February 16, 2021

- |

- Comments

We need every last drop of water we can find on this planet. And we're about to need a lot more.

There are 327 million people in America today. By 2050, the US population is projected to climb as high as 440 million. So, the US government is investing heavily in water infrastructure.

PricewaterhouseCoopers estimates that private spending on drinking water infrastructure will total $60 billion by 2027. Over the next 25 years, total spending on wastewater treatment alone will exceed $10 billion per year.

Steady and predictable investment like that is a key reason why American water stocks are some of the safest investments on the market. Many offer solid returns, too.

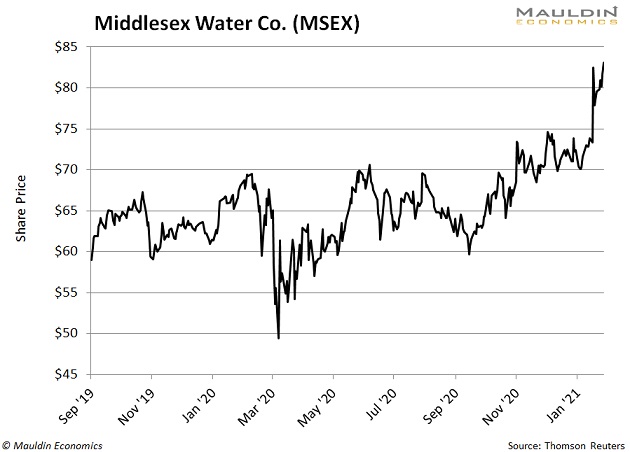

Middlesex Water Co. (MSEX) is one of the oldest water utilities in the US. This business started in 1897, and the stock has been pumping out solid returns for years in the form of capital appreciation and quarterly dividend payments.

2021 looks to bring another flood of profits, with the stock already delivering a solid 9.9% gain so far. Not bad for a low-risk utility play.

There are even more water stocks that would be a great fit for any income investor's portfolio.

- American States Water Co. (AWR): Because of constant demand from California’s growing population, AWR is incredibly stable. And with a safe and reliable 1.7% dividend yield, it is my favorite income-based water play.

- California Water Service Group (CWT): This is another large California water utility. Considering CWT has never reduced its dividend payout in the 35 years it’s paid one, you can rest easy with this one in your portfolio.

- Xylem (XYL): While the company does not pay a dividend, it’s one of the premier water infrastructure companies. It has exposure to global demand for water infrastructure, generating over half of its sales outside the US.

If you prefer to get some broad exposure to the water market, consider buying the Invesco Water Resources ETF (PHO).

PHO holds everything from utilities to infrastructure companies—including all four stocks I just mentioned. It even lets you tap the income spigot through its 0.5% dividend yield.

Bottom line: If you want a reliable income stream, you need look no further than these kinds of unstoppable water investments.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.