Finally, clarity

- Stephen McBride

- |

- November 11, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

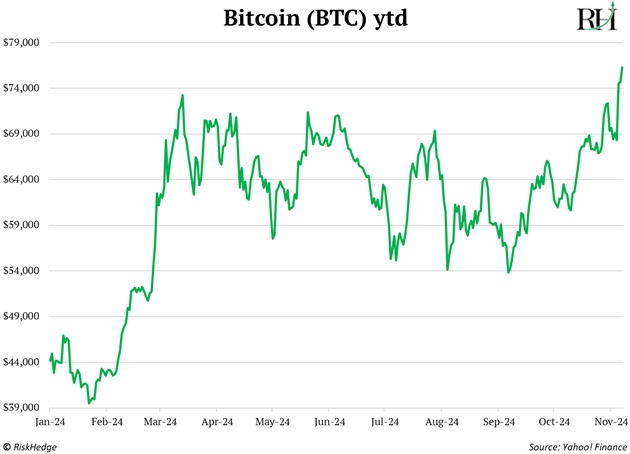

$76,795...

That’s the current price of bitcoin (BTC) as I (Chris Reilly, filling in for Stephen today) write.

It just smashed through a record high on the heels of Donald Trump’s victory:

As Stephen’s said all along, crypto needs regulatory clarity.

Finally, we’re going to get it, and fast. Stephen:

Trump's victory in the 2024 US presidential election marks the end of crypto's four-year regulatory siege, and the implications are far bigger than most realize.

Bitcoin hit new all-time highs. But the real opportunity lies in the coming renaissance of great crypto businesses.

We don’t just have a crypto-friendly president. Over 250 pro-crypto candidates were elected to the House. Crypto critic Sherrod Brown (the man behind the legal assault on crypto) lost his Senate seat in Ohio. This will be the most pro-crypto Congress ever.

Stephen says to expect more crypto innovation and less regulation.

And most important, higher prices, too... now that the war on crypto is over.

He’ll have a lot more to say about how to capitalize on this opportunity next week, so stay tuned. This is an urgent opportunity—many have compared crypto prices to a basketball being held under water by regulators for the last couple years.

Next...

- Congratulations to yesterday’s “free riders.”

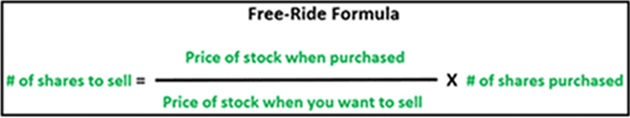

Longtime readers know a “free ride” is a simple strategy our analysts often use to lock in profits when one of our paid recommendations rises 100% or more.

The idea is you sell enough shares to take your initial investment off the table, and then let the rest “ride” risk-free.

Here at RiskHedge, we’ve found it’s the best way to eliminate risk… while still going after big gains.

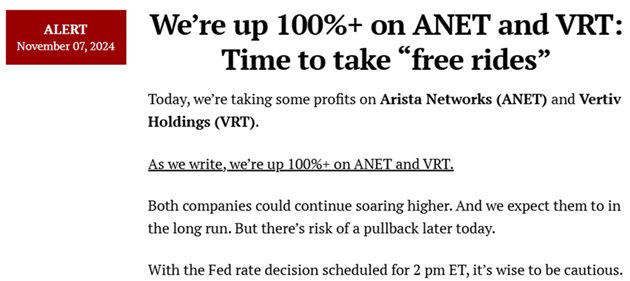

Yesterday, Stephen and his Disruption Investor partner Chris Wood took “free rides” on two of their artificial intelligence (AI) plays: Arista Networks (ANET) and Vertiv Holdings (VRT). Both of which were up 100%+.

Arista provides high-speed networking hardware and software infrastructure that enables AI.

And Vertiv sells the cooling equipment AI data centers desperately need.

Last month, the guys took a “free ride” on Taiwan Semiconductor (TSM), the “monopoly stock” Stephen recently wrote about here.

Sometimes, our readers get frustrated at us for taking “free rides.” I get where they’re coming from. It’s fun to own a stock that’s risen 100%+... and see if that double can turn into a triple or quadruple return.

It can be hard to trim a position that’s made you so much money.

And sometimes, you will forego bigger gains when you take a “free ride.”

But above all else, smart investing is about keeping your capital safe. And this strategy is a way to sleep well at night.

Take a look at your portfolio. If you’re up big on a stock, consider taking a “free ride.” It’s a win-win to keep your upside wide-open while taking risk off the table.

This formula will help you calculate how many shares to sell for your “free ride:”

Moving on... here’s another strategy I think is useful and not used by many investors...

- Have you ever built your own ETF?

You probably own some ETFs. These investment funds trade like a stock and hold dozens, or hundreds, of companies. They’re a great option if you want simple, broad, one-click exposure to a trend.

Don’t want to buy individual chip stocks? Buy the VanEck Semiconductor ETF (SMH).

Having trouble finding a promising biotech stock? Buy them all through the SPDR S&P Biotech ETF (XBI).

But ETFs have their downsides. Here’s Chris in the recent Disruption Investor issue, which published yesterday:

ETFs hold too many stocks for our liking. The most successful investors today don’t follow a blind, broad diversification strategy. They make more concentrated bets on fewer high-conviction plays.

Just four stocks make up more than 60% of Warren Buffett’s Berkshire Hathaway portfolio. (I think he knows a little something about making money in stocks.)

What’s more, ETFs often hold stocks that fail to adhere to the stated purpose of the ETF. Chris again:

Two of the three largest holdings of the First Trust Nasdaq Cybersecurity ETF (CIBR)—the biggest cybersecurity ETF—are Cisco Systems (CSCO) and Broadcom (AVGO).

Broadcom is a great company generating billions in annual revenue from AI. But it’s not a cybersecurity company. Neither is Cisco. Both companies do offer cybersecurity products, but it’s not their primary business.

Here’s another option: Build your own ETF with three or four high-quality stocks.

This way you’re not exposed to junk... and you’re still spreading your risk around while concentrating on a select few high-conviction names.

Stephen and Chris just recommended this strategy in yesterday’s issue. They recommended three world-class cybersecurity stocks, and to buy 1/3 position sizes in each.

They say it’s the perfect way to take advantage of the massive cybersecurity trend. It’s too risky to own one name when even a great company can be headline news after a hack, causing shares to plummet.

You probably remember what happened to CrowdStrike Holdings (CRWD) a few months ago when the company released a buggy software update that took down about 8.5 million Windows computers.

With the build-your-own-cyber-ETF strategy, you give yourself the staying power to be able to overcome the inevitable hiccups.

Chris Reilly

Executive Editor, RiskHedge

PS: In The Jolt, Stephen shows readers how to profit from disruptive new technologies like crypto, AI, and biotech, to name a few. Spot a disruptive trend early enough, and you can ride it to great profits as the rest of the world slowly catches on. Are you ready to get started?

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com