Ethereum ETFs and Nvidia earnings

- Stephen McBride

- |

- May 23, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Thanks to everyone who wrote me regarding my recent “Airbnb for biotech” issue.

It’s clear you’d like more insights from my recent trip to DC. I’ll do just that in an upcoming Jolt.

And speaking of trips, a quick message for RiskHedge Reserve members:

I'm on the road over the next month and will be in Nashville, TN from June 1–2 and Boston, MA from June 3–5. I’d love to meet up if you’re in the area. Just shoot me a message at stephen@riskhedge.com.

Last announcement: If you’ve ever purchased a RiskHedge service, you’re going to receive a special invitation from me in your email tomorrow. Look out for it around 9 am ET.

Let’s get after it…

- Big news: The first Ethereum (ETH) ETFs could be approved as soon as today.

Last month, I told you the first Ethereum ETFs would debut sometime this year. Now, it looks like it could happen any day.

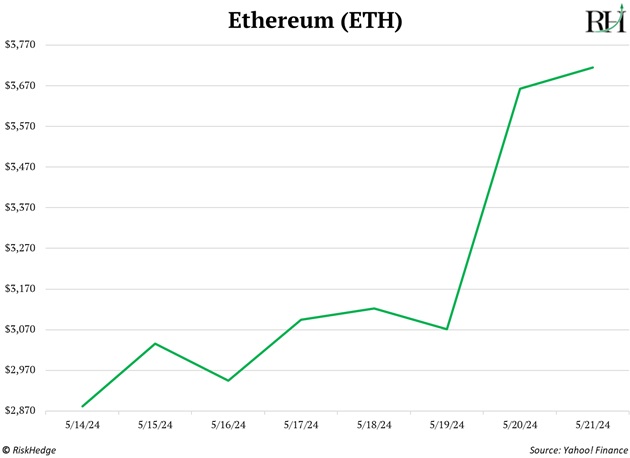

On Monday, Ethereum—the world’s second-largest crypto—rocketed 20% after the odds of an imminent approval soared. ETH sits at around $3,700 as I type:

The US Securities and Exchange Commission (SEC) is reportedly leaning toward approving spot Ethereum ETFs. And it could happen as early as this week.

So, what changed?

I believe political pressure from the White House and Congress forced SEC Chairman Gary Gensler to do a 180.

Crypto is now winning the regulatory battle, and this is huge for the industry. “Anti-crypto” is a losing stance, and the SEC is finally coming to terms with that.

It already approved the bitcoin (BTC) ETFs in January. It was only a matter of time for ETH, although this is much sooner than I anticipated.

And just like the bitcoin ETFs, these new Ethereum ETFs will unlock trillions of dollars of retirement money that were previously off-limits to crypto.

- Up next: ETH $10K?

Once the SEC gives the official thumbs up, I expect ETH to keep moving higher.

In fact, I wouldn’t be surprised to see Ethereum blast above its all-time high within a month after the SEC greenlights the first ETFs. That’s around 25% from today’s price.

Zooming out 12 months or so, the Ethereum ETFs can help push ETH past $10,000.

Ethereum is only one-third the size of bitcoin. That means it takes a lot less money to move its price.

And I’ve pointed out, Ethereum is “candy” for Wall Street.

|

There’s some innovation happening with bitcoin. But it’s nothing compared to Ethereum. ETH raked in $500 million in revenues in March alone—6X more than bitcoin.

RiskHedge Venture subscribers have tripled their money on the Grayscale Ethereum Trust (ETHE) since we bought it last August. This was a bet on the ETH ETF getting approved, and it’s paid off nicely.

Everything I’m hearing tells me the Ethereum ETF is coming, but nothing is ever 100%. If it doesn’t happen, ETH will probably give back its recent gains and retreat to around $3,000. It wouldn’t alter my long-term forecast of ETH $10,000, but it may push it out a bit.

As always, only invest money you’d be comfortable losing.

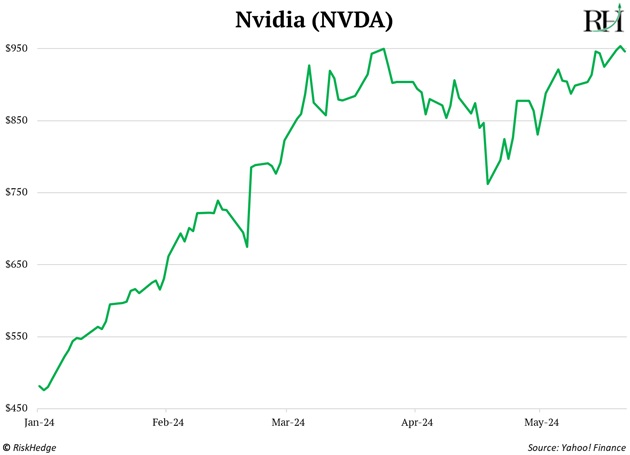

- Nvidia (NVDA) will report first-quarter earnings tonight.

Wall Street expects revenues to have risen 200% and profits to have risen 400% from the same quarter last year.

The bar is sky-high for the world’s third-largest company. If any company can continue to exceed them, it’s Nvidia.

Looking at its chart, it seems like NVDA wants to go higher after consolidating for two months:

In fact, this situation reminds me a lot of NVDA during the summer of last year.

After a massive runup—which saw NVDA soar 225% from January to July—the stock consolidated for five months before going on another tear. (Earnings were the catalyst there, too.)

We’re sitting on big gains in NVDA in my Disruption Investor advisory, so I recommended members take profits for a second time earlier this year. It was the prudent thing to do. By selling half our position, we significantly reduced our risk and are still able to participate in Nvidia’s long-term upside.

If you don’t have a position, don’t overthink it.

We're in the middle of the largest buildout in history (artificial intelligence). Own the winners when the music is playing.

Watch for that invitation from me tomorrow.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com