Dividends aren’t just about the income

- Keith Fitz-Gerald

- |

- June 20, 2023

- |

- Comments

This article appears courtesy of Keith Fitz-Gerald Research.

Howdy!

My bride and I are on our way to Wisconsin this morning where I’ll be speaking 3 times over the next 4 days about current market conditions, where, how, and why to find the best stocks, and more.

Before they shut the cabin door…

Here’s my playbook.

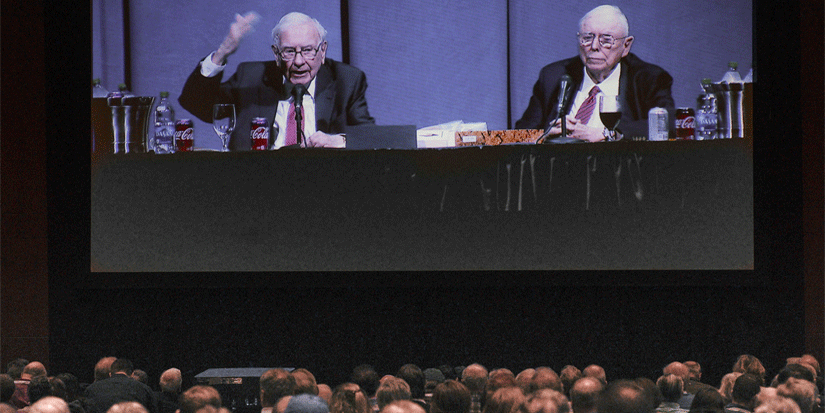

Japan now Buffett’s “second-largest geography”

Business media report that Unka Warren has boosted his share of Japanese trading houses to at least 8.5% of his company’s holdings, making Japan Berkshire’s “second-largest geography” after the US. (Read)

Buffett began plunking down big $$$ into those trading houses—or sogo shosha—in 2020 but is now upping the ante.

That’s great because it reinforces my contention that we’re in the right place at the right time. Upgrade to Paid

The USD won’t so much fall as the yen and other currencies will rise.

Cleveland Clinic sold on Palantir hospital software

The Cleveland Clinic, the largest hospital system in Ohio, was in a pickle. There was a slew of incoming patients, but could they accommodate them all? Palantir’s AI system said they could, predicting that there’d be a large number of discharges that day.

PLTR is not a one-trick pony, and it is proving that right now. (Read) In 2021, the company set out to develop a software solution for hospital operations and succeeded... in only 2 years! According to CNBC, “It can be used to generate real-time and predictive insights into areas like staffing, wait times, and hospital-bed assignments.”

My friend, the super-sharp Amit Kukreja, just did a whole podcast on this. (Watch)

Anybody not paying attention has already missed a 179.11% run off 52-week lows.

Yes, betting against Musk today is STILL like betting against Jobs back in the day

The Model Y doubled US registrations to 127,541 in the first four months of 2023, becoming the #1 passenger car in America. (Read)

What’s more, the company’s Model Y is now in 2nd place after Ford’s F-150 as one of the two best-selling vehicles in the United States.

I hope I’m smart enough to buy more shares.

Increased dividends for 63 years

Many investors are understandably concerned about dividend income, but few understand what an advantage prioritizing ‘em can be.

A study by Hartford Funds shows that companies that increased or initiated dividends delivered returns of 10.2% per year versus the S&P 500, which only gained 7.7% a year. (Read)

What most people don’t realize, though, is that income isn’t just about the income.

At least not to me, anyway.

Every stock comes with a very specific risk profile—that’s why it’s important to place any income stock you own within the context of the bigger picture.

Ask yourself what you want that specific stock to accomplish and why you want to own it, especially this week when volatility could allow you to do a little shopping.

One of my choices, for example, is 17.09% off highs but has invested heavily in oil at a time when that’s off the radar. I don’t have a heckuva lot of trouble seeing oil at $100 a barrel, which is why I own it and encourage members of the OBA Family to do so, too.

Forget shrinkflation… now there’s drinkflation

No doubt you’re as frustrated as my bride and I when you open a bag of chips… and see that they’re less than 1/3 full. Or pay for rolls of paper towels only to learn that they’re smaller and fewer in number than they used to be.

Now there’s drinkflation.

UK’s brewers are reportedly cutting alcohol content in several of their most popular beers but are not charging less. (Read)

Why’s this on my radar?

Simple. Money always goes to where it’s treated best—and in this case, that’s a pint glass.

UK brewers pay less in taxes on drinks with a lower alcohol content... which suggests, not surprisingly, that companies like Shepherd Neame or Green King may be pocketing the savings instead of passing ‘em on to consumers.

Hmmm.

Bottom Line

You’ve already lost if you let losses define you.

Mistakes are tuition.

Learn!

Keith

This article appears courtesy of Keith Fitz-Gerald Research. Keith Fitz-Gerald Research publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at keithfitz-gerald.com