Disrupted old dog of a tech stock

- Stephen McBride

- |

- October 14, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Nvidia (NVDA) CEO and founder Jensen Huang is a very rich man.

His personal net worth ($110 billion) has surpassed the market cap of Nvidia’s longtime rival, Intel (INTC) ($100 billion).

He could buy all of Intel and have $10 billion to spare

This is what total disruption looks like. Intel dominated the semiconductor industry for decades. The idea of little Nvidia—which made chips for PlayStations—being a threat was laughable.

But Nvidia seized the artificial intelligence (AI) chip opportunity while Intel stagnated. Now Nvidia is 33 times more valuable than the old dog, its stock having surged 30,000% over the past decade.

Lesson: Own disruptors; reject disruptees.

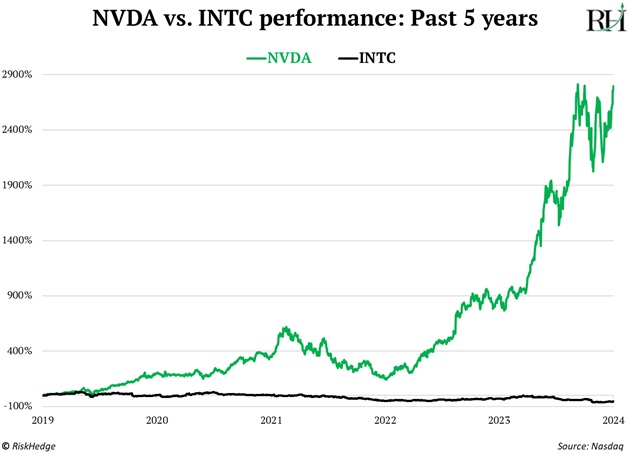

Say five years ago you knew chip sales would explode thanks to AI. Nailed it.

But you picked Intel over Nvidia. Oh, no.

Over the past five years, Nvidia has surged 2,800% while Intel got cut in half:

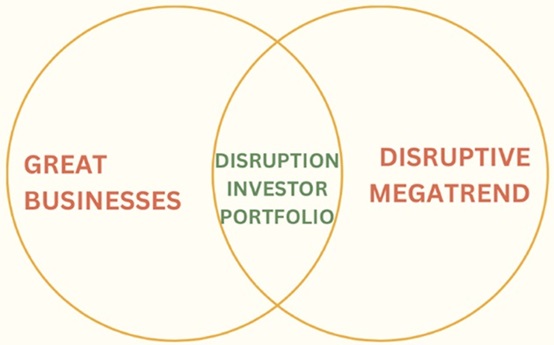

That’s why you must own great businesses profiting from disruptive megatrends. Knowing the megatrend itself isn’t enough. You need a great, disruptive business to ride it.

That’s the sole purpose of our Disruption Investor portfolio—own stocks in the sweet spot of our Venn diagram:

We took profits on Nvidia earlier this year and are reinvesting into other great businesses profiting from the AI buildout.

- Meta Platforms’ (META) new AI specs look like thick reading glasses…

But they’re equipped with Meta AI.

Wearing a pair of Orions is like having ChatGPT on your face.

On vacation and want to translate a foreign menu? Need help fixing a leaky tap at home? Say, “Hey Facebook, help me out”… and the glasses will walk you through it step by step.

Would you buy a pair?

Source: Road to VR

Meta’s AI-powered glasses are my pick for the “next” iPhone.

Apple’s (AAPL) iPhone has been the dominant computing medium for 17 years. But every 15–20 years, we get a new device that changes how we use computers.

There’s no way we’ll still interact with our AI assistants by awkwardly tapping six-inch glass screens a decade from now.

The Orion glasses give us a glimpse of the “invisible” computing age.

Orion’s inward-facing cameras track your eyeballs, allowing them to work like a mouse. You simply look at the app you want to use, then “click” on it by pinching your thumb and index finger together.

My prediction: A decade from now, small screens will barely exist. We’ll simply talk to the AI assistant on our face, and it’ll do everything our phones can today.

Meta (formerly Facebook) is the only big tech stock I’d own today. It’s quietly become an AI powerhouse, and it’s in pole position to create the next great computing device.

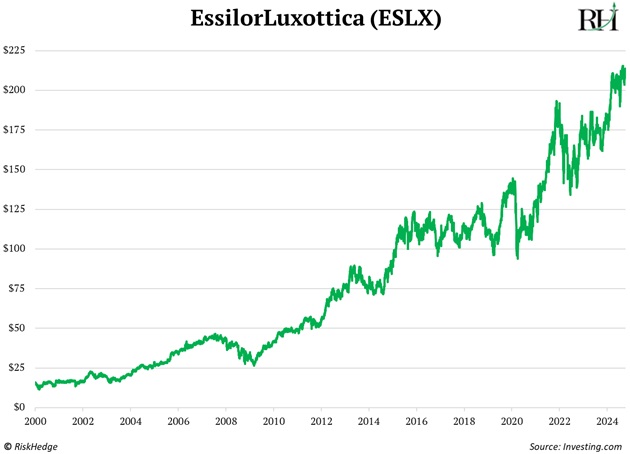

One lesser-known way to profit from AI glasses: EssilorLuxottica (ESLX). The world’s largest eyewear company manufacturers Meta’s current AI Ray-Bans.

I don’t own it, but I should. Its stock has been tearing higher:

- Orion is everything Apple’s Vision Pro should be.

They’re sleek and cool, unlike those clunky $3,000 Apple ski goggles people are embarrassed to wear.

On the left: Sleek. On the right: Dorky.

Sources: The Information; Apple

The iPhone is the most successful product in history. Apple has sold $1.6 trillion worth of them since 2007.

But we’re 17 years into the iPhone era, and Apple is out of ideas.

You can barely tell the difference between the latest iPhone and the one from two years ago. The new phone, which launched last month, was supposed to be packed with new “sexy” AI features.

Have you heard anyone rave about them? I haven’t.

Peak iPhone is in the rearview mirror. Apple’s smartphone sales topped out nine years ago. It kept growth going by hiking prices. But that trend looks like it’s coming to an end, too.

Apple is boring. I bet its upcoming earnings report will reveal Vision Pro sales to be shockingly low.

Apple’s revenues have been flat for two years. Yet it’s trading near its highest valuation in over a decade.

It’s more expensive than Meta, which grew revenues by 25%!

My big tech trade: Long META; short AAPL.

- Today’s dose of optimism…

I’ve written about UATX, the new freedom-of-speech and meritocracy-focused university in Austin, Texas.

I’m thrilled to report the school recently welcomed its first-ever class of 2028.

It’s easy to complain about the decline in American colleges, and plenty of people do (including me).

But a brave few have stepped up to actually help solve the problem. My hat’s off to Joe Lonsdale, Niall Ferguson, Bari Weiss, Pano Kanelos, and dozens of others who I’m sure poured their hearts and souls into making this happen.

Go UATX! I’m heading to Austin on Tuesday to see it myself.

Stephen McBride

Chief Analyst, RiskHedge

PS: Nvidia is the top dog in the AI space right now, but I think money will soon start to shift toward other companies making AI chips and data center equipment as demand accelerates. For more on who could become the next Nvidia, consider joining The Jolt today.

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com