Are you invested in America’s “two-hour boom”

- Stephen McBride

- |

- May 3, 2021

- |

- Comments

This article appears courtesy of RiskHedge.

“It would have to sell every book being sold today to justify its stock price”…

This ended up becoming one of the most laughable things ever said about Amazon (AMZN).

And this line isn’t pulled out of some freebie city newspaper… it’s from a 60 Minutes special back in 1999.

Amazon’s stock price had surged 4,500% over the past two years. The internet shopping pioneer’s sales were soaring triple digits.

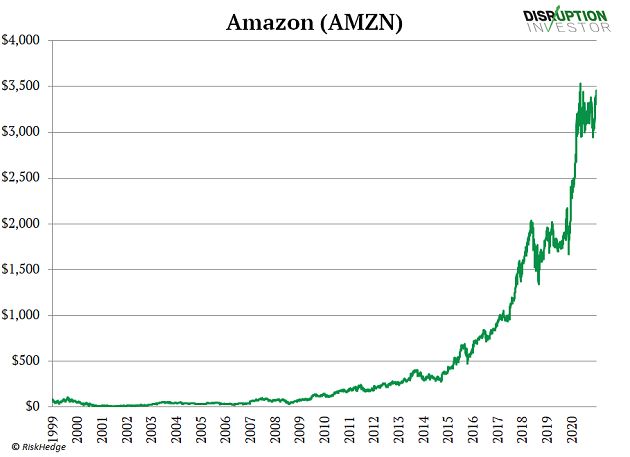

CBS and 60 Minutes thought it was one giant bubble. Take a look at Amazon’s stock since then:

How did a show that prides itself on facts and analysis get is so, so wrong?

- Folks thought Amazon was just a money-losing internet bookstore.

They couldn’t see Amazon’s goal was never to create an online bookstore. It was building an entire delivery system for internet shopping.

Why is internet shopping so popular? Its “killer feature” is being able to click a button and have the items arrive on your doorstep a few days later.

Imagine having to wait two weeks to get your online order? It just wouldn’t work. In fact, seven out of 10 Americans think three-day shipping is too slow.

Amazon basically invented fast online shipping. It spent hundreds of billions of dollars building warehouses that could get your order into the back of a UPS truck in minutes.

This slashed delivery times from two weeks to two days… and changed shopping forever.

- Now the race for two-hour delivery is on.

The lobby of 7 W. 34th Street looks like every other swanky downtown Manhattan office.

But walk past the glowing white marble floors… take the elevator to the fifth floor, and you’re in an Amazon warehouse.

These warehouses are how Amazon can now deliver nearly anything you can think of in two hours or less…

They’re the reason you can put your kids in bed at 7 pm… and have a carton of Ben and Jerry’s ice cream at your front door by 9 pm.

Remember, Amazon became a big deal by pioneering two-day delivery. Now that’s standard. Today, over half of online sellers offer same-day delivery.

The race for faster and faster shipping is never ending. Delivery apps like Doordash (DASH) now offer one-hour delivery in cities like San Francisco.

Armies of delivery drivers used to pick up items from giant warehouses on the outskirts of town. This system breaks when you’re trying to rush someone an order in an hour or two.

Instead, you need a dense network of mini-warehouses close to buyers.

This is why Amazon is transforming NYC offices into storerooms. In fact, it tripled the number of warehouses it uses for “two hour” deliveries in 2020.

And get this… it spent $58 billion boosting its delivery network just last year!

- Last May, I suggested you buy “Amazon’s landlord.”

Internet retailers don’t usually own warehouses.

Instead, they rent space from owners like Prologis (PLD). Longtime RiskHedge readers will remember I called Prologis Amazon’s largest “landlord.”

Its stock jumped 30%+ to a record high since then, and I bet it’s headed much higher.

That’s because the mad dash for ever faster shipping is a gold rush for warehouses. Prologis estimates for every $1 billion in online sales, America needs 1.2 million square feet of warehouse space.

Americans spent a record $860 billion on the internet last year. Office giant JLL forecasts we’ll need another one billion square feet of warehouse room in the next four years. That’s equivalent to around 17,360 NFL football fields.

- Here’s my favorite way to profit from the delivery boom.

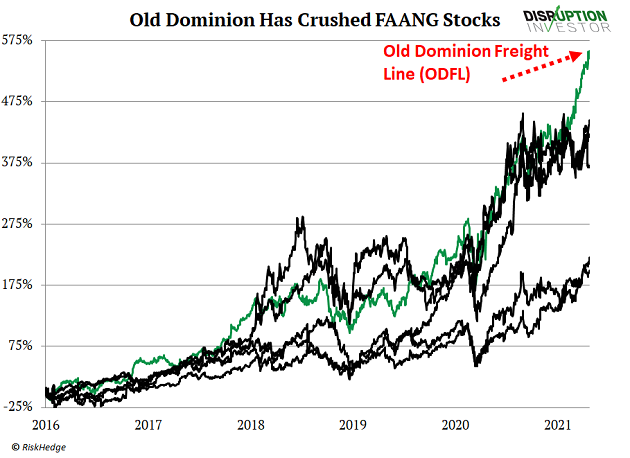

You’ve surely heard of the FAANG stocks before.

Facebook… Amazon… Apple… Netflix and Google have been among the best-performing stocks on the planet over the past decade.

But what if I told you a 90-year old “trucker” has crushed them all?

Old Dominion Freight Line (ODFL) has handed investors 550% gains over the past five years (green line):

Trucking is an iconic American industry. In fact, it’s the most common job in 29 states.

Most folks think truck driving is still loading up 18-wheelers for multi-day trips across the US. But these days, many truckers only drive short distances and get to sleep in their own beds at night.

In fact, online shopping has carved out a whole new business for truckers. Instead of hauling, say, a truck full of Colgate toothpaste to a Walmart across state lines… Old Dominion is more like a “heavy-duty” UPS.

It might deliver a couple thousand lbs. of coffee to Target… then drop a few pallets off to an Amazon storehouse.

- Old Dominion is the “dark horse” of ever-faster shipping.

Remember, instead of having a handful of huge depots, Amazon now leases dozens of mini-warehouses. Problem is… you can only cram so much stuff into these storerooms.

For example, Amazon’s location in downtown NYC is one-eighth the size of its regular delivery hubs. These tight spaces require smaller and more frequent shipments to keep goods in stock.

In other words, what was one big weekly delivery now gets split into multiple drops…

And each time a warehouse gets restocked, truckers like Old Dominion make money.

In fact, Amazon is now Old Dominion’s largest customer. It paid the trucker roughly $200 million in shipping fees last year. Old Dominion’s daily shipments have shot up 50% over the past few years to 43,000 per day.

And my research suggests this delivery boom won’t slow down anytime soon.

Amazon is on a warehouse-buying spree as it moves to two-hour shipping. In the past year, it’s snapped up over two dozen storerooms in New York alone.

Just last month, Old Dominion announced it’s hiring close to 1,000 new truck drivers. This tells you management expects this boom has years left to run.

Old Dominion has been one of the best-performing US stocks over the past few decades. It’s even crushed high-growth tech stocks like Amazon and Google.

It’s my top way to profit as online retailers race to make two-hour shipping the new norm.

Stephen McBride

Editor — Disruption Investor

PS: While Old Dominion is a godsend for Amazon’s business…

This little-known company—which I call “the Amazon Killer”—is disrupting the giant retailer as I type...

To find out what it means—and how to set yourself up to profit—go here to check out my research…

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com