Are you capitalizing on the crypto bonanza?

- Stephen McBride

- |

- November 18, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

The crypto bonanza is in full force.

If you own some, congratulations.

If you don’t, it’s not too late. Because everything—and I mean everything—just changed in a matter of days.

Chris Reilly here, and as Stephen’s been saying, this is the moment crypto investors have been waiting and hoping for.

Donald Trump and the new pro-crypto Congress (comprised of both pro-crypto Democrats and Republicans) are a complete rejection of the anti-crypto folks who’ve dominated government in recent years. This innovative and dynamic sector has been handcuffed by bad regulators. That’s all over now… and prices are moving.

Bitcoin (BTC) spiked to an all-time high on election night and has been off to the races since... at around $90,000 now.

Ethereum’s (ETH) is up around 30% over the past month...

Solana’s (SOL) up even more.

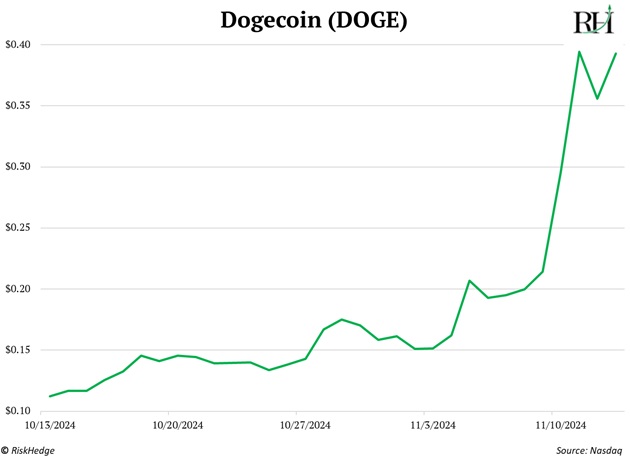

Then there’s Dogecoin (DOGE), which just went from $0.11 to $0.39 in a month:

And it’s still erupting ever since Elon Musk announced he’s set to co-lead the new Department of Government Efficiency—“DOGE” for short:

Source: @elonmusk on X

Of course, Elon’s DOGE and dogecoin have nothing to do with each other. Crypto’s a unique sector where jokes, memes, and stories can drive prices to the moon. It’s the Wild West.

There are silly gambling coins mixed in with truly groundbreaking businesses that are changing the world. There are 20-year-olds getting rich overnight, but plenty of scams. Anything’s possible.

The moves in BTC, ETH, SOL, DOGE, and many others are nothing compared to some of the tinier coins. They’re going ballistic.

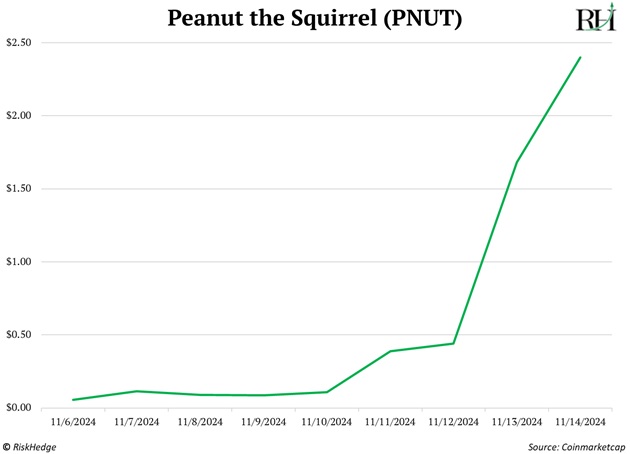

- Did you know there’s a coin for Peanut, the internet-famous squirrel?

Peanut the Squirrel (PNUT) is up a ridiculous 1,340%... in just the past week.

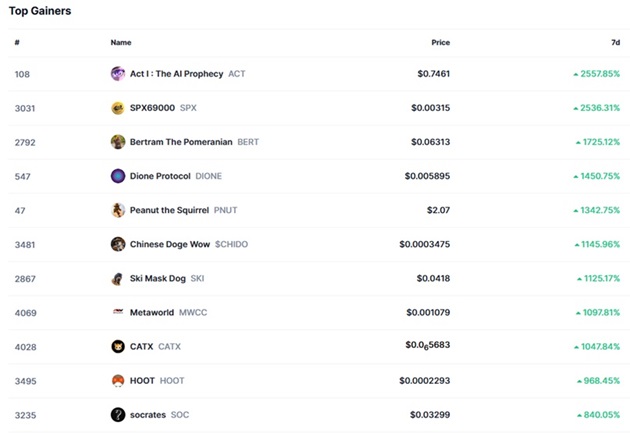

And PNUT isn’t even the highest gainer over the past seven days. Look at this list. There are two coins up more than 2,500%—in one week!

This is a bonanza in every sense of the word.

And while we recommend avoiding the names above, it shows just how excited crypto investors are right now. Their excitement is valid.

If you’re at all interested in capitalizing on the perfect setup in crypto, here’s my guidance: find someone who brings discipline, framework, and experience to crypto.

I’m biased, but I truly don’t know a better crypto analyst than Stephen. He has, from the start, focused on real crypto businesses making real money. As he’s demonstrated, when you do this well, you can profit from a bonanza without gambling.

Take tokenomics, for example.

- Longtime readers know tokenomics are everything in crypto.

“Token” is just another word for a unit of crypto. Tokenomics is one of the most important drivers of a crypto’s price.

Tokenomics set the rules for how a crypto token operates. They determine:

- How many tokens are in circulation

- How new tokens are created

- How old tokens are destroyed

- How the token is used

- And how the token accrues value from the underlying crypto business (if there is one).

Bitcoin, for example, has great tokenomics. Its code ensures there can only ever be 21 million bitcoins in existence. Compare that to dollars, which are constantly being created by the trillion, and it’s no mystery why bitcoin’s price has gone from pennies to $90,000.

More on tokenomics from Stephen in his latest Venture issue, which just published yesterday:

Tokens typically accrue value in two main ways. They can earn a portion of revenues generated by the protocol. Think of this as a “dividend.” Crypto businesses can also burn tokens. You can compare this to “buybacks” in the stock market.

Unfortunately, many crypto founders are purposefully designing tokens with no value accrual, or no path to accrue value. This is to avoid being deemed a “security” by the SEC.

I dig into great protocols with real-world uses all the time. But many of them are uninvestable due to awful tokenomics, which is being caused by a lack of regulatory clarity.

Expect Congress to pass pro-crypto legislation early next year. This will significantly improve tokenomics and open up a new set of opportunities for investors.

If you want to take advantage of these opportunities, now’s the time.

Stephen again (emphasis added):

The past four years of regulatory persecution froze innovation, capital flows, and proper token economics. That freeze is now thawing.

This isn’t just another crypto bull market. This is the legitimization of an entire asset class.

Stephen says we’re entering the best time to own crypto. If you’d like to learn more about what the crypto market looks like post-election—and how to profit from it—join The Jolt today.

Chris Reilly

Executive Editor, RiskHedge

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com