Heed the I.P.A. pattern

This article appears courtesy of RiskHedge, LLC.

The S&P 500 has fallen 5% over the past 10 days…

And leaders like Nvidia (NVDA) are down more.

Meanwhile, more US stocks are now in uptrends—defined by being above their 200-day moving averages—than at any point in the past 18 months.

My two cents on this “confusing” market:

The market was due for a pullback. This was the S&P 500’s longest streak without a 2% correction since 2007.

This is classic “rotation.” Money is pouring out of big, leading stocks and into smaller stocks that’ve been lagging.

As my friend JC Parets of All Star Charts pointed out, “The list of stocks going up is getting longer, not shorter.” This is the sign of a healthy market.

The “average” stock has gone nowhere since March, while big tech stocks melted up. Now the tables look like they’re turning.

That’s no problem for Disruption Investor members, who know great businesses come in all shapes and sizes.

Let’s get after it.

- Tesla sunk 12% on Wednesday after reporting uninspiring earnings.

I’ll take the other side. Tesla (TSLA) is the most undervalued artificial intelligence (AI) stock in the market.

Tesla reminds me of the Superman-inspired Broadway musical, It's a Bird, It's a Plane, It's Superman.

It’s an electric vehicle (EV) company… it’s a clean energy innovator… it’s an AI leader.

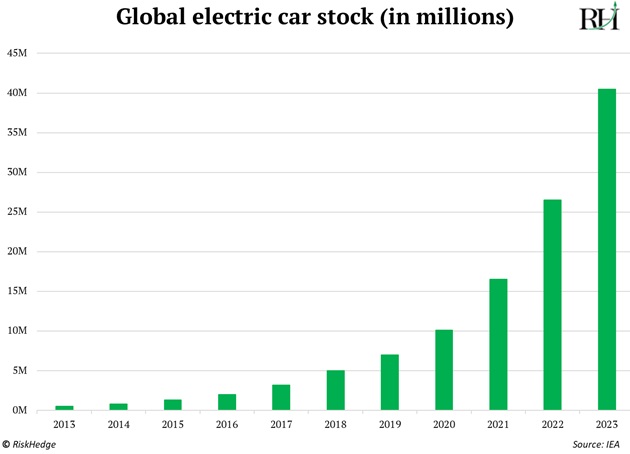

Have you seen a chart of EV sales lately? They’re going parabolic. Hockey-stick growth:

And they’re no longer just toys for rich people. It’s now cheaper to drive an EV in every US state if you charge it at home.

The reason we haven’t invested in EVs is that making cars is an awful business. It’s ultra-competitive. Companies compete away all the profits, leaving shareholders with zilch.

Battery-powered cars are simply “act 1” for Tesla. The real opportunities are self-driving cars and robotaxis (AI on wheels).

|

Every automaker is churning out EVs.

But only two—Waymo and Tesla—are leading the robotaxi race. If Tesla can stay on the cutting edge, this opportunity is worth hundreds of billions of dollars.

Tesla recently pushed back the unveiling of its robotaxi by two months, until October. Investors took this to mean the tech isn’t ready. Fair.

Do you remember what year the iPhone launched? Many people know it’s 2007.

But do you know what month it launched? Probably not. Because it doesn’t matter to the big picture.

Exactly when Tesla launches its robotaxis doesn’t matter. It’s a leader in one of the most important innovations for the next few years.

Invest accordingly.

- “AI’s $600 billion question.”

That’s the title of a new memo from top venture capital firm Sequoia.

It sounds the alarm on the rapidly growing gap between how much companies are spending on AI… and what they’re earning in return.

Amazon (AMZN)… Google (GOOG)… Microsoft (MSFT)… and Facebook (META) will spend roughly $170 billion building AI data centers this year. Yet the top-earning AI startup, ChatGPT creator OpenAI, will only make a measly $3.4 billion this year!

Two thoughts…

#1: New technologies follow the predictable I.P.A. pattern.

Infrastructure comes first, followed by platforms, then apps.

The iPhone launched in 2007… the App Store (platform) in '08… and then apps like Uber and Airbnb a few years later.

It’s easy to forget ChatGPT is only 18 months old. Remember, we’re in the infrastructure phase of the AI rollout.

Turning breakthroughs into moneymaking products takes time. We’re on the cutting edge, but most people still haven’t clicked ChatGPT.

#2: Will the real AI please stand up?

Alaska Air Group (ALK) saved 500,000,000 gallons of fuel last year thanks to its new AI navigation system, which acts like “Google Maps in the air.”

Consulting giant Accenture raked in over $1 billion in AI bookings over the past six months.

But nobody counts these as “AI revenue.”

The big story of the next year will be “old-world” companies making money from AI. This technology will touch everything.

I get “Barron’s Facebook story” vibes reading about how AI companies will struggle to make money. Yes, it’s often unclear at first how to monetize a new, widely adopted technology.

Social media went through the same uncertainty. Barron’s argued that Facebook stock was a “risky bet” in the fall of 2012.

Here’s how the stock has performed since then—posting a 2,000% gain:

Remember, we’re early in AI. Don’t miss the boat because of problems that will be solved in a quarter to two.

And continue to invest in the winners, like we’re doing in Disruption Investor. (Upgrade here.)

- Today’s dose of optimism…

In 1900, the average life expectancy of a newborn was 32 years. It’s more than doubled to 71 years today:

Source: Our World in Data

Fewer parents burying their kids. Grandmas and grandpas living to see their kids’ kids.

The world has lots of problems. But there’s also never been a better time to be alive.

Triumph of the optimists.

Have a great weekend. I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RiskHedge, LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com