AI = dot-com bubble?

- Stephen McBride

- |

- February 17, 2025

- |

- Comments

This article appears courtesy of RiskHedge.

Can the artificial intelligence (AI) boom continue?

Winning AI stocks have handed out huge gains to investors since ChatGPT became the fastest-growing product ever in late 2022.

Chip king Nvidia (NVDA) has surged 660%. Vistra Corp. (VST), which fuels power-hungry data centers, has soared 590%. Palantir Technologies (PLTR) handed out 10X gains.

Those are serious gains in such a short window… leading many to accuse AI of being in a bubble.

Are they right?

- History shows it’s hard to have a bubble without one key ingredient.

That one key ingredient is overinvestment.

Look at the dot-com boom and bust.

Companies, eager to capitalize on the historic boom, laid over 80 million miles of fiber-optic cable across the US.

These companies weren’t wrong. The internet really did transform the world. It just didn’t happen as fast as they expected. Even as late as 2005, 85% of those fiber lines remained unused.

Most of the stocks tied to the fiber-optic infrastructure boom, like Cisco Systems (CSCO), crashed. Many even went bankrupt.

Or look at the Chinese real estate bubble.

Today, “ghost cities” sit virtually empty in China. These vast development projects are full of empty skyscrapers and deserted streets. Some 90 million housing units remain empty in China today. That’s 24 New York Cities!

China’s been dealing with the overhang of this bubble ever since.

History is riddled with similar bubbles. The work-from-home bubble saw companies overinvest in remote tech. During the British railway bubble in the 1840s, companies laid miles of track to nowhere.

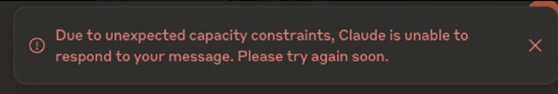

- I get this message every single day from Claude, my AI chatbot of choice:

Source: Claude

If you can’t see the picture, it says: “Due to unexpected capacity constraints, Claude is unable to respond to your message.”

Keep in mind, this is the premium version that I pay for.

It’s the same situation for ChatGPT and all other AI assistants.

That’s because there’s not nearly enough computing power to meet surging demand. The world is dealing with an acute shortage of data centers. That’s the opposite of what causes bubbles.

The biggest, most cash-rich companies are building data centers as fast as they can. It’s still not enough. Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), and Meta Platforms (META) will plow $300+ billion into AI infrastructure this year alone.

As soon as a new data center comes online, it’s immediately working at full capacity.

And it’s not just data centers that are in short supply. AI consumes energy like no tech ever.

When you ask ChatGPT a question, you’re tapping into vast data centers filled with AI chips. Just one of Nvidia’s latest AI chips uses as much electricity as two households. And companies like Meta are building gargantuan clusters of 100,000 chips linked together!

Even a quick chat with ChatGPT uses 10X more electricity than a Google search.

Remember, during the dot-com bubble, companies laid millions of miles of fiber-optic cable that would be used someday.

Meanwhile, we need more data centers, energy, and chips… and we need them yesterday.

There’s been no sign whatsoever that the necessary infrastructure is catching up to the relentless demand for AI. This may happen someday, and I’ll be first to let you know.

- Until that day, you want to invest in the companies on the receiving end of the largest infrastructure buildout in history.

Larry Page at Google has said he’s willing to go bankrupt rather than lose the AI race.

Andy Jassy, CEO of Amazon, said, “AI represents the biggest opportunity in business since the internet.”

Zuckerberg is building a data center so large, it would cover a significant part of Manhattan.

Nvidia has been the poster child of the AI boom so far. Congratulations to RiskHedge readers who’ve owned it since 2018.

But Nvidia no longer has that 20X potential that it realized over the last couple years.

To find those kinds of returns, look for the next generation of AI leaders that are small today, but will grow big tomorrow by building our AI future.

Stephen McBride

Chief Analyst, RiskHedge

PS: The biggest companies on Earth are going all-in on AI, plowing hundreds of billions into infrastructure. In The Jolt, I break down exactly where that money is flowing—and how you can profit. Sign up here for free.

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com