A potential cure for Parkinson’s

- Stephen McBride

- |

- May 6, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

The S&P 500 is taking a much needed breather.

Remember, US stocks surged 28% in six months. After such a huge move, this pullback is perfectly normal and healthy.

Stocks don’t go straight up, even in bull markets. Use this as an opportunity to buy great businesses on sale.

Let’s get after it…

- Last week: cancer vaccines. This week…

A potential cure for Parkinson’s.

Using artificial intelligence (AI), researchers at the University of Cambridge discovered new substances which essentially “block” Parkinson’s disease.

Think of AI like an ultra-fast computer.

It “ingests” mind-bending amounts of medical data then offers new ideas that would take us a lifetime to discover.

AI helped researchers find five “highly potent” compounds which can stop the protein that characterizes Parkinson’s. And it helped them achieve this 10X faster and 1,000X cheaper than was otherwise possible. Woah!

Parkinson’s is the fastest-growing neurological condition worldwide. Solve it, and you eliminate a whole lot of unnecessary suffering.

AI remains underhyped. As I’ve said before, it will help save millions of lives.

|

Most people are focused on chatbots like ChatGPT and Claude, and rightly so. They’re amazing tools and you should be using them.

But AI turbocharging biotech is where the big breakthroughs are happening. We’ll see more innovation in the next five years than we’ve had in the past 50 years.

If we get it right, our grandkids will look back and think, “Wow, how did grandad live in 2024? Such savage times when humans were helpless against all these diseases.”

Never forget innovation is what allows us to live longer, healthier lives.

We had smallpox, so we invented vaccines. Mothers used to regularly bleed out during childbirth, so we created blood transfusions.

AI will help us cure many of today’s biggest killers.

Thanks to the stock market, we can invest in the companies pushing these innovations forward.

We own two world-class biotech companies in the Disruption Investor portfolio. Upgrade here.

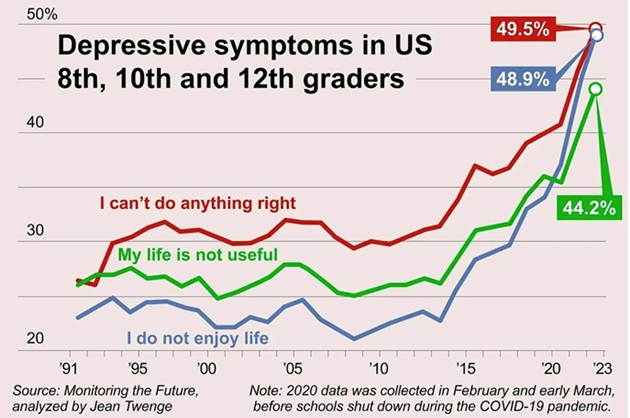

- Why are today’s teens more anxious, depressed, and suicidal than ever?

Professor Jon Haidt’s new book The Anxious Generation is one of 2024’s “must reads.”

I highly recommend picking up a copy, especially if you have kids, grandkids, or even nieces and nephews. It might just save their lives. Seriously.

As I’ve written about, smartphones and social media are a toxic combo for young brains. The Anxious Generation tells us why.

In short, kids used to play outside with their friends all the time. Today they’re talking to each other through six-inch glass screens. This rewired kids’ minds, and not in a good way.

Just look at the data. It’s scary.

Depression is way up since 2012, which was the year most American’s owned a smartphone for the first time.

Source: New York Post

Teens now spend up to seven hours a day on their phones, mostly scrolling through social media. And they’re not reading about how the world is getting better...

The stuff that goes “viral” is almost always negative. A new police shooting… the latest terrorist attack… and some political bickering.

When young minds are exposed to a constant barrage of doom and gloom, who can blame them for feeling down?

Phones are one hell of a drug. And if we don’t set ironclad rules about how we use them, they will ruin us.

Here’s what to do:

#1: Do not buy a smartphone for your child.

The evidence is overwhelming. Giving your kid an iPhone is a very, very bad idea.

If they need a phone, buy a flip phone that only calls and texts. You’ll be able to reach your kids, and their brains won’t be melted by Instagram.

Yes, this will make you an unpopular parent. Sometimes you have to choose between popularity and your kid’s well-being.

A few years from now every half-decent parent will do this. Let’s get ahead of the curve. No time to waste.

#2: Lead by example.

Don’t tell your kids to stay off Instagram when you scroll through Facebook. Show them—with your actions—to avoid this toxic stuff.

When you are at home, don’t have your phone next to you unless you’re expecting an important work call. Put it in a special place so you won’t constantly check it.

This won’t directly help you make money. But it’s one of the most important changes you can make. What use is a great portfolio if you’re miserable because your kids are taking antidepressants?

Put the phone down. You won’t regret it.

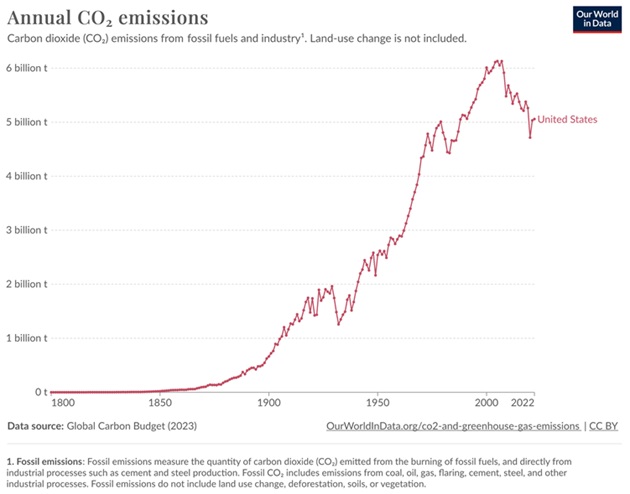

- Today’s dose of optimism…

We’re told climate change is destroying Earth…

That the air we breathe is becoming more toxic by the day…

But the facts tell a very different story.

The number of Americans dying from air pollution collapsed 70% over the past 30 years. Meanwhile, lead in the air fell 99%, and acid rain is down 2/3rds.

And contrary to the narrative, America’s carbon emissions have declined more than 15% since 2000.

Source: Our World in Data

America’s air is cleaner than it’s been in decades mostly due to our shift away from “dirty” coal, and toward natural gas… which emits 55% less carbon.

Now imagine how good our environment could be if America was powered by nuclear energy, which is 98% cleaner than natural gas.

Some environmentalists tell us the only way to save our planet is to drive less… fly fewer miles… and reduce our energy consumption.

But we have another choice. Embrace innovations like nuclear power which allow us to use as much energy as we want, without ruining the planet.

Have a great weekend. I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com