Trump’s Trade War Is Paralyzing Business

-

Patrick Watson

Patrick Watson

- |

- August 6, 2019

- |

- Comments

Note: Patrick is off this week so here is a recent column he thinks you should read again.

The way you feel about yourself affects your behavior... and the economy.

Imagine how you feel when you buy a new suit or dress, then wear it to an important event. You’re probably more confident. You do things you otherwise wouldn’t.

Your clothes are more than cosmetic. By enhancing your self-image, they can help you take more risks and get more done.

The same is true for the economy. Confident businesses and consumers buy more stuff, hire more workers, make more investments. All that adds up to economic growth.

The inverse also applies. If you wear something you dislike to a job interview, you probably won’t perform well because you’ll be less confident.

Unfortunately, much of the US economy is now wearing an ugly, ill-fitting suit that it really doesn’t like. This is changing our behavior… and we probably won’t like the results.

Photo: Robert Couse-Baker via Flickr

Peak Confidence

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

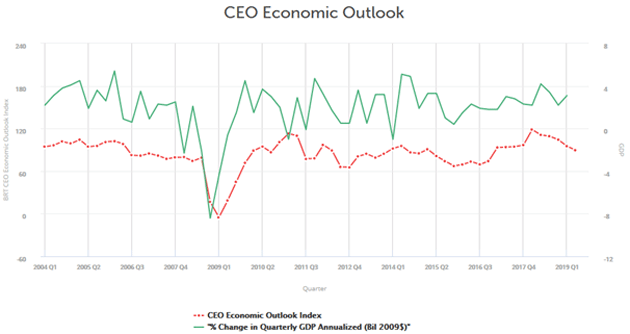

The Business Roundtable’s quarterly CEO Economic Outlook Index tracks what executives expect for sales, capital spending, and hiring over the next six months.

The good news is the index has been above its historic average for 10 consecutive quarters. The bad news is, it fell the last five of those quarters.

CEO optimism peaked in Q1 2018, following a climb that began in Q4 2016. Now much of the confidence has disappeared.

Chart: Business Roundtable

While correlation isn’t causation, those dates coincide with some turning points.

- Q4 2016: Donald Trump wins the US presidential election with a Republican-controlled House and Senate. This sparked hopes for tax cuts and deregulation, which CEOs tend to like.

- Q1 2018: The expected corporate tax cut took effect, giving companies a windfall many used to buy back shares and elevate their stock prices. CEOs liked that too.

Under other conditions, confidence should have continued to grow as the tax cuts stimulated the economy. It didn’t. The tax bill’s passage marked peak confidence.

One reason: the tax changes really didn’t do much for the economy. A new Congressional Research Service study estimates they added only 0.3 percentage points to 2018 GDP growth—nowhere near enough to offset the government’s revenue loss.

Meanwhile, Q1 2018 also marked the launch of President Trump’s trade war, which is now negating the already-small fiscal stimulus. CEOs are noticing it as well.

Photo: Marco Verch via Flickr

Costly Risks

Globalization obviously hasn’t worked as well as hoped. Too many people haven’t shared its benefits while still feeling its costs.

Nonetheless, decades of (relatively) free trade gave CEOs enough stability to make long-term business plans.

That stability is now disappearing. Trump isn’t the only reason, but he’s making it worse.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

The president’s assorted tariff threats are often just threats—but sometimes they turn into reality, and it happens often enough to keep everyone guessing. CEOs can’t ignore him when he talks about things that affect their operations.

This is a problem, as Gavekal Research described in a recent note:

Corporations have been organized to maximize global resources. They must now reorganize to mitigate policy risks, which should come at a cost.

On the margin, this means less goods will be delivered at a higher cost. Some of this cost will be absorbed by reduced margins and some by higher consumer prices.

In its totality, the additional risk in the global trading system points to lower growth and a tougher profits outlook. This calls for reducing risk exposure, including in the US.

As Gavekal says, businesses can usually adapt to the trade war. They find alternate sources, reorganize their supply chains, or make other adjustments. But it takes time and money.

Photo: Pixabay

Coerced Cooperation

The time and money CEOs spend reorganizing is time and money they aren’t spending on other things.

Worse, Trump can change his mind faster than businesses can adapt. So at some point, their best alternative is to simply do nothing. Stop expanding, stop hiring, and just wait for normality to return.

The problem there: it could take some time.

Trump is in office until January 2020, at least. The legal power he is using to impose tariffs and other trade barriers will stay in his hands that whole time, unless Congress takes it back. Which is unlikely because opponents would need a two-thirds majority in both House and Senate to override his veto of any changes.

Hence, we see Trump now using presidential trade powers to coerce cooperation on non-trade issues, like immigration with Mexico. He thinks it worked, so he will probably do it again.

Where will that end? “Hey, Europe. Spend more on defense or I put 50% tariffs on your auto imports to the US.”

In that scenario, Europe would retaliate against US exporters while European automakers might close their US plants, laying off American workers. It would escalate from there.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

Would Trump back down? Maybe, maybe not. No one knows.

Again: Trump has this authority right now, and Congress doesn’t have the votes to take it back. There’s every reason to think he will keep using it.

The trade chaos is slowly but surely paralyzing business, both within and outside the US. Business paralysis will eventually induce recession.

The open question is when. Your guess is as good as mine, but the time is coming.

See you at the top,

Patrick Watson

@PatrickW

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Patrick Watson

Patrick Watson