Tariff Tough Talk

-

Patrick Watson

Patrick Watson

- |

- April 10, 2018

- |

- Comments

International trade policy shouldn’t be headline news. We just need stability, so everyone can conduct business—but that’s not where we are.

Trade and tariffs are all over the news because President Trump is going after China. This vexes financial markets, which want minimal trade barriers.

Regular readers know I’m not a Trump fan… but on this, he’s partly right. China hasn’t reciprocated US trade policies, and some changes are necessary.

However, which policies the president attacks and how he tries to change them is important. Flawed methods usually produce flawed results.

In this case, the problem is more than a flawed method. It’s flawed economics.

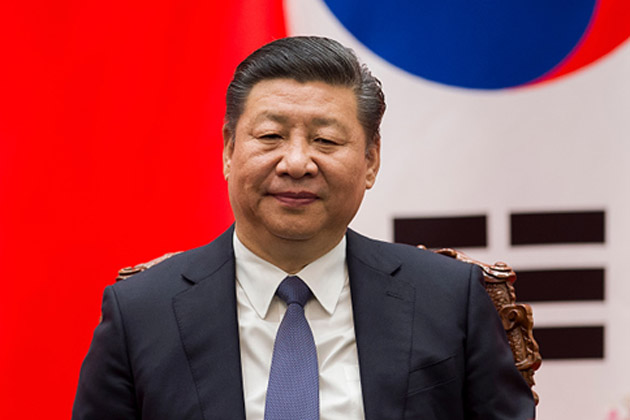

Photo: Getty Images

Little Pieces of Deficit

The president’s tweets and public statements tell us he doesn’t like trade deficits, particularly the one with China. He seems to view it as a win-or-lose proposition.

That’s not exactly right.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

For one, a trade deficit between two nations isn’t unusual. Precise balance would be strange. Countries have different needs, so some import more than others.

Furthermore, it’s not like the side with the deficit loses anything.

In this case, China gets our dollars and we get Chinese-made goods. Your house is probably stuffed with little pieces of the US-China trade deficit.

Is that bad? As an economic matter, it’s just reality.

- Americans want Chinese goods more than we want the dollars spent on them.

- Chinese want those dollars more than they want the goods.

It’s not about winning or losing. Everybody gets what they want.

Photo: Getty Images

Not Winning

There is a wrinkle to this, though. I said, “The Chinese want those dollars,” but they’d prefer to use their own currency. Eventually they will, too, but for now we still settle our trade in dollars.

Just as our homes hold Chinese goods, Chinese bank accounts hold trillions of greenbacks. That’s the other side of the trade deficit President Trump hates so much. It’s the same money.

What do the Chinese do with those excess dollars?

Well, they invest many of them in US Treasury securities—to the point that China is our government’s largest foreign lender.

Some people see this as ominous, fearing China will dump this paper and cause a crisis. But doing so would probably require Beijing to take a big loss, and that’s not its style.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

The bigger danger is that China may simply buy fewer Treasury bonds. This is simple math. Chinese investors can’t buy our T-bonds unless they have excess dollars—and they won’t if the president succeeds in reducing the trade deficit.

See the problem?

- The US government spends way more than it collects in taxes.

- Treasury must finance the difference by selling bonds.

- Someone with dollars must buy those bonds.

- China’s dollar surplus makes it a natural buyer.

If China doesn’t buy our bonds, somebody else will… but probably at higher interest rates. Prices rise when an external force constrains supply. This will raise Washington’s interest costs and further enlarge the debt.

And when Treasury rates rise, other long-term interest rates (like mortgage rates) rise too. That could make home purchases more expensive, reducing other consumer spending and maybe hurting the housing industry.

So attacking this trade deficit problem—which isn’t really a problem—risks making some actual problems even worse. That’s not “winning.”

Photo: Getty Images

Burning Bridges

Now, some say all of this is a negotiating tactic, that the president’s unpredictable tough talk leaves opponents off guard and sets up a “win.”

Such tactics worked for Trump in private business. In fact, the president’s business skill is why many folks voted for him. He promised to negotiate great deals and had a track record for doing it.

The problem: governing isn’t a business.

In a transactional business like real estate, you probably won’t deal with the same counterparty again. Burning bridges behind you can make sense if you have thousands more unburned bridges in front of you.

In politics, both domestic and international, you must negotiate with the same people repeatedly on different topics. If you’re unreasonable on Item A, it also affects Item B.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

Trade negotiations are particularly hard because so many groups have a stake in the outcome. Overt threats rarely help. They might even hurt, by sparking opposition that prevents the other leader from offering concessions.

Photo: Getty Images

Risk for Everyone

Trump is right that China hasn’t always played fair. Many other nations feel the same way. That’s a negotiating tool the US could use to our advantage.

As China’s biggest export market, the US has plenty of leverage. We could have even more leverage by working with China’s other top customers, primarily Western Europe.

But Trump isn’t doing that. He is doing the opposite by openly threatening Canada, the EU, Japan, and other developed countries with tariffs as well. This makes it hard to ask their help against China—and even gives China an opening to seek EU support against the US.

Consequently, the chance of getting significant reforms from China is lower, and the risk of a negative outcome like trade war is higher.

Maybe President Trump sees that as a risk worth taking. But it highlights another key difference between business and government negotiations.

In his real estate deals, the people at risk were Trump himself and the business partners who willingly joined him. As president, he’s generating risk for everyone. No one gets to opt out.

Financial markets see this and don’t like it at all—nor should they. Events could easily spiral out of control, with harsh economic consequences.

China’s response so far is to threaten its own tariffs on US agriculture and other Trump-friendly sectors. They think penalizing the president’s supporters will make him back down.

I’m not so sure, for two reasons:

- First, those same business groups failed to stop the president’s earlier trade actions. Their influence on the White House appears to have waned.

- Second, being punished by China might make the president’s supporters more loyal, not less. Outside attacks often unify people who might otherwise split.

Like what you're reading?

Get this free newsletter in your inbox regularly on Tuesdays! Read our privacy policy here.

If so, the trade fight is likely to get worse before it gets better. So get ready for a long siege.

See you at the top,

Patrick Watson

P.S. If you’re reading this because someone shared it with you, click here to get your own free Connecting the Dots subscription. You can also follow me on Twitter: @PatrickW.

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Patrick Watson

Patrick Watson