Mauldin Academy

Be Frugal, Not Cheap

By Jared Dillian, Editor of Jared Dillian’s Strategic Portfolio

Let me tell you a story about being cheap...

Lehman Brothers hired me in 2001, when I was 27 years old and living in California.

So, I packed up my stuff, moved to New York City, and started a new life.

I had been a Coast Guard officer, a blue-collar guy, making around $45,000 a year.

Now I was going to be a Wall Street guy. Lehman hired 300 associates, and I was one of the 80 in sales and trading.

It was awesome.

One night, a good friend put together a dinner with some other Wall Street guys at a Brazilian steak house.

It was one of the fancy restaurants in town, and I didn’t know what to expect.

After a ton of food, they brought the bill which we were splitting 12 ways (even though the other guys ordered wine and desserts).

My portion came to $80. And I thought, “How am I going to afford to live in New York?”

I had never paid that much for dinner in my life. Up until that point, I might eat out once a week at a cheap Chinese spot, where dinner for two cost $15.

Everyone else thought $80 was no big deal. And it was painful for me. I wasn’t a jerk about it, but the meal really stressed me out, and I’m sure it showed.

I was tight with a buck, and I probably wasn’t much fun to be around at that dinner. I was too worried about how much it would cost.

You know what that means? I was cheap.

The irony here is that I probably had the most money out of everyone at the table.

Partly because I saved like crazy. And partly because I’d bought a condo when I lived in California, and it had doubled in value.

So, there I was, in my late 20s, with a net worth around $200,000, a shiny new job on Wall Street, and my own place.

I could not take the foot off the pedal, even surrounded by friends. Not even for $80.

You don’t want to do that.

Don’t get me wrong, saving early is one of the best things you could do for yourself.

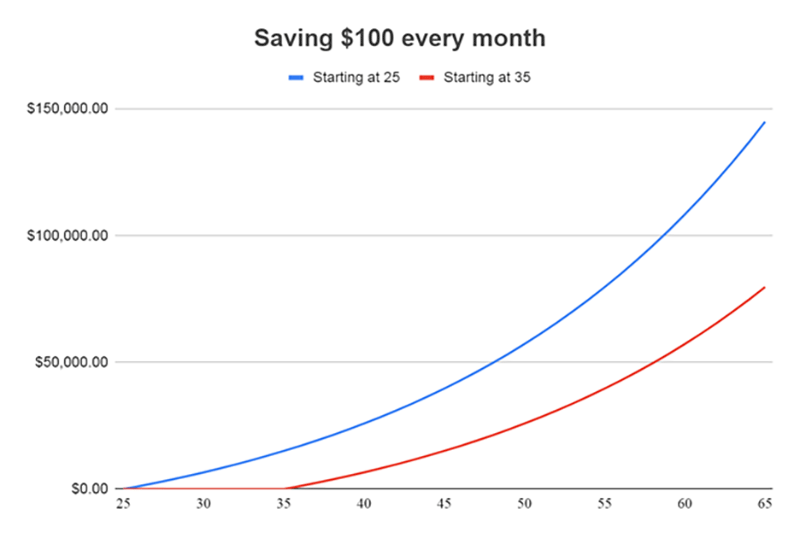

There’s a big difference between saving and investing $100 a month for retirement starting at age 25 instead of 35 because growth compounds.

By age 65, you’d have nearly twice as much in your bank account, assuming just 5% annual returns.

That’s a $65,233 difference, despite contributing only $12,000 more initially.

So, savings: great.

You won’t hear me say anything bad about that.

But...

There’s a big difference between being frugal and being cheap.

Because that’s what I was that day. Cheap.

And it’s easy to tumble from frugal to cheap.

Now, this is not an extreme example.

But if your frugality affects the lives of people around you, you’re in too deep.

Being frugal is living the life you want while saving as much as you can.

Being cheap is building your life around saving money.

You still have to actually enjoy your life.

Also, it’s nobody’s responsibility to pick up your tab but yours.

If you skip on tipping—if it’s the norm where you live—to save pennies, maybe consider not going out to eat.

It’s not the waiter’s fault the system has them rely on tips for their wage.

If you head home when it’s your turn to buy a round... Same thing.

I don’t want to be that guy.

You probably don’t, either.

While we’re at it, you might want to read this article about getting the most out of your Social Security benefits.

Jared Dillian