Your Three Investing Opponents

-

John Mauldin

John Mauldin

- |

- December 24, 2011

- |

- Comments

- |

- View PDF

Tough Year!

Three Opponents in Investing

We Have Met the Enemy and They Is Us

We Are Tool Makers

Individual Investors Have Certain Advantages Over Institutions

We All Need a Coach

Hong Kong, South Africa, Stockholm, and More

It’s Christmas Eve and that time of year when we start thinking about what we did in the past year and what we want to do in the next. Why do we make the mistakes we make (over and over and over?) and how do we avoid them in the future? If it seems to be part of our basic human condition, that’s because it is. Recently I have been having a running conversation with Barry Ritholtz on the psychology of investing (something we both enjoy discussing and writing about). Since I am busily researching my annual forecast issue (and taking the day off), I asked Barry to share a few of his thoughts on why we do the things we do. He gives us even more, exploring the three main opponents we face when we enter the arena of investing.

Barry is the driving force behind The Big Picture blog, often cited as the #1 blog site in terms of traffic (and a favorite of mine!) and FusionIQ, a software service that uses both fundamental and technical analysis. Over the years Barry and I have known each other, we have become quite good friends. If you ever get a chance to catch us on a panel together, you are in for some fun, as we tend to go at it and each other just for the heck of it, while trying to share the little that we have learned along the way. Barry is all over financial TV and now has a weekly column in the Washington Post. And now, let me turn it over to Barry.

Your Three Investing Opponents

By Barry Ritholtz

“Tough Year!”

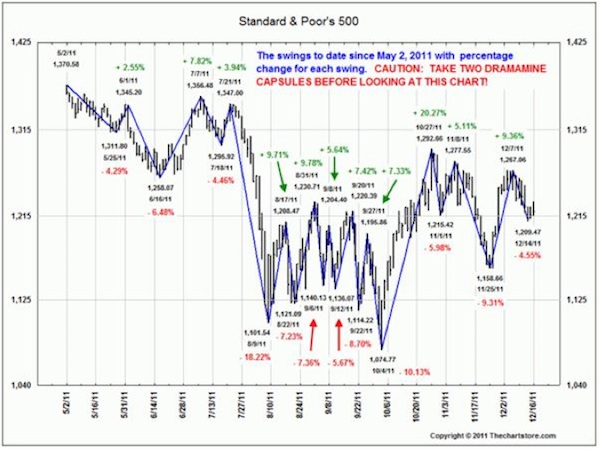

We hear that around the office nearly every day – from professional traders to money managers to even the ‘most-hedged’ of the hedge fund community. This year’s markets have perplexed the best of them. Each week brings another event that sets up some confusing crosscurrent: call them reversals or head fakes or bear traps or (my personal favorite) the “fake-out break-out” – this volatile, trendless market has been unkind to Wall Street pros and Main Street investors alike.

Indeed, buy & hold investors have had more ups and downs this year than your average rollercoaster. The third and fourth quarters alone had more than a dozen market swings, ranging from 5 percent to more than 20 percent. Despite all of that action, the S&P 500 is essentially unchanged year-to-date. It doesn’t take much to push portfolios into the red these days.

Three Opponents in Investing

With markets more challenging than ever, individual investors need to understand exactly whom they are going up against when they step onto the field of battle. You have three opponents to consider whenever you invest.

The first is Mr. Market himself. He is, as Benjamin Graham described him, your eternal partner in investing. He is a patient if somewhat bipolar fellow. Subject to wild mood swings, he is always willing to offer you a bid or an ask. If you are a buyer, he is a seller – and vice versa. But do not mistake this for generosity: he is your opponent. He likes to make you look a fool. Sell him shares at a nice profit, and he happily takes their prices so much higher you are embarrassed to even mention them again. Buy something from him on the cheap, and he will show you exactly what cheap is. And perhaps most frustrating of all, Mr. Market has no ego – he does not care about being right or wrong; he only exists to separate the rubes from their money.

Yes, Mr. Market is a difficult opponent. But your next rivals are nearly as tough: they are everyone else buying or selling stocks.

Recall what Charles Ellis said when he was overseeing the $15-billion endowment fund at Yale University:

"Watch a pro football game, and it's obvious the guys on the field are far faster, stronger and more willing to bear and inflict pain than you are. Surely you would say, 'I don't want to play against those guys!'

“Well, 90% of stock market volume is done by institutions, and half of that is done by the world's 50 largest investment firms, deeply committed, vastly well prepared – the smartest sons of bitches in the world working their tails off all day long. You know what? I don't want to play against those guys either."

Ellis lays out the brutal truth: investing is a rough and tumble business. It doesn’t matter where these traders work – they may be on prop desks, mutual funds, hedge funds, or HFT shops – they employ an array of professional staff and technological tools to give themselves a significant edge. With billions at risk, they deploy anything that gives them even a slight advantage.

These are who individuals are doing battle with. Armed only with a PC, an internet connection, and CNBC muted in the background, investors face daunting odds. They are at a tactical disadvantage, outmanned and outgunned.

We Have Met the Enemy and They Is Us

That is even before we meet your third opponent, perhaps the most difficult one to conquer of all: You.

You are your own third opponent. And, you may be the opponent you understand the least of all three. It is more than time constraints, lack of discipline, and asymmetrical information that challenges you. The biggest disadvantage you have is that melon perched atop your 3rd opponent’s neck. It is your big ole brain, and unless you do something about it, it is going to lose all of your money for you.

See it? There. Sitting right behind your eyes and between your ears. That “thing” you hardly pay any attention to. You just assume it knows what it’s doing, works properly, doesn’t make too many mistakes. I hate to disabuse you of those lovely notions; but no, sorry, it does not work nearly as well as you assume. At least, not when it comes to investing. The wiring is an historical remnant, hardly functional for modern living. It is overrun with desires, emotions, and blind spots. Its capacity for cognitive error is nearly endless. It was originally developed for entirely other purposes than risk assessment in capital markets. Indeed, when it comes to money, the way most investors use those 100 billion neurons or so of grey matter, they might as well not even bother using their brains at all.

Let me give you an example. Think of any year from 1990-2005. Off of the top of your head, take a guess how well your portfolio did that year. Write it down – this is important (that big dumb brain of yours cannot be trusted to be honest with itself). Now, pull your statement from that year and calculate your gains or losses.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

How’d you do? Was the reality as good as you remembered? This is a phenomenon called selective retention. When it comes to details like this, you actually remember what you want to, not what factually occurred. Try it again. Only this time, do it for this year – 2011. Write it down. Go pull up your YTD performance online. We’ll wait.

Well, how did you do? Not nearly as well as you imagined, right? Welcome to the human race.

This sort of error is much more commonplace than you might imagine. If we ask any group of automobile owners how good their driving skills are, about 80% will say “Above average.” The same applies to how well we evaluate our own investing skills. Most of us think we are above average, and nearly all of us believe we are better than we actually are.

(Me personally, I am not an above-average driver. This is despite having taken numerous high-performance driving courses and spending a lot of time on various race tracks. I know this is true because my wife reminds me of it constantly.) [JM here – I am also in the bottom 25%, as my kids constantly remind me!])

As it turns out, there is a simple reason for this. The worse we are at any specific skill set, the harder it is for us to evaluate our own competency at it. This is called the Dunning–Kruger effect. This precise sort of cognitive deficit means that areas we are least skilled at – let’s use investing decisions as an example – also means we lack the ability to identify any investing shortcomings. As it turns out, the same skill set needed to be an outstanding investor is also necessary to have “metacognition” – the ability to objectively evaluate one’s own abilities. (This is also true in all other professions.)

Unlike Garrison Keillor’s Lake Wobegon, where all of the children are above average, the bell curve in investing is quite damning. By definition, all investors cannot be above average. Indeed, the odds are high that, like most investors, you will underperform the broad market this year. But it is more than just this year – “underperformance” is not merely a 2011 phenomenon. The statistics suggest that 4 out of 5 of you underperformed last year, and the same number will underperform next year, too.

Underperformance is not a disease suffered only by retail investors – the pros succumb as well. In fact, about 4 out of 5 mutual fund managers underperform their benchmarks every year. These managers engage in many of the same errors that Main Street investors make. They overtrade, they engage in “groupthink,” they freeze up, some have been even known to sell in a panic. (Do any of these sound familiar to you?)

These kinds of errors seem to be hardwired in us. Humans have evolved to survive in competitive conditions. We developed instincts and survival skills, and passed those on to our descendants. The genetic makeup of our species contains all sorts of elements that were honed over millions of years to give us an edge in surviving long enough to procreate and pass our genes along to our progeny. Our automatic reactions in times of panic are a result of that development arc.

This leads to a variety of problems when it comes to investing in equities: our instincts often betray us. To do well in the capital markets requires developing skills that very often are the opposite of what our survival instincts are telling us. Our emotions compound the problem, often compelling us to make changes at the worst possible times. The panic selling at market lows and greedy chasing as we head into tops are a reflection of these factors.

The sort of grinding market we had in 2011 only exacerbates investor aggravation, and therefore increases poor decision making. Facts and logic go out the window, and thinking gets replaced with naked emotions. We get annoyed, angry, frightened, frustrated – and that does not help returns. Indeed, our evolutionary “flight or fight” response developed for a reason – it helped keep us alive out on the savannah. But the adrenaline necessary to fight a Cro-Magnon or flee from a sabre-toothed tiger does not help us in the capital markets. Indeed, study after study suggests our own wetware works against us; the emotions that helped keep us alive on the plains now hinder our investment performance.

The problem, as it turns out, lies primarily in those large mammalian brains of ours. Our wiring evolved for a specific set of survival challenges, most of which no longer exist. We have cognitive deficits that are by-products of that. Much of our decision making comes with cognitive errors “secretly” built in. We are often unaware we even have these (for lack of a better word) defects. These cognitive foibles are one of the main reasons that, when it comes to investing, we humans just ain’t built for it.

We Are Tool Makers

But we are not helpless. These large mammalian brains of ours can do a whole lot more than merely overreact to stimulus. We think up new ideas, ponder new tools, and create new technologies. Indeed, our ability to innovate is one of the factors that separates us from the rest of the animal kingdom.

As investors, we can use our big brains to compensate for our known limitations. This means creating tools to help us make better decisions. When battling Mr. Market – as tough as any Cro-Magnon or sabre-toothed tiger – it helps to be able to make informed decisions coolly and objectively. If we can manage our emotions and prevent them from causing us to make decisions out of panic or greed, then our investing results will improve dramatically.

So stop being your own third opponent. Jiu jitsu yourself, and learn how to outwit your evolutionary legacy. Use that big ole melon for a change. You just might see some improvement in your portfolio performance.

Individual Investors Have Certain Advantages Over Institutions

One final thought. Smaller investors do not realize that they possess quite a few strategic advantages – if only they would take advantage of them. Consider these small-investor pluses:

• No benchmark to meet

quarterly (or monthly), so you can have longer-term time horizons and different

goals

• You can enter or exit a position without impacting markets.

• There is no public scrutiny of your holdings and no disclosures required, so

you don’t have to worry about someone taking your ideas.

• You don’t have to limit yourself to just the largest stocks or worry about

position size (this is huge).

• Cost structure, fees, and taxes are within your control.

• You can reverse errors without professional consequences – you don’t

get fired for admitting a mistake.

• You can have longer-term time horizons and different goals.

And with those thoughts, good luck and good trading in 2012!

We All Need a Coach

John here. As long-time readers know, I typically suggest that readers find a professional to help them with their investments, as doing it on your own takes time and a certain emotional mindset. Most of us (myself included) don’t have it. But some of you do have the mindset or desire and just need some help. One way to get help is to find a tool, as Barry talked about, that helps you have some objectivity about your stock-picking decisions.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Quick commercial: Barry has developed such a tool for professionals: IQ Trader. I asked him to do a less complicated, less expensive version for my readers. It ranks 8,000 stocks and ETFs and gives specific buy-sell signals based on your criteria. What I like about it is that it uses both fundamental and technical analysis to develop those signals. Fusion IQ puts powerful quantitative tools into the hands of the average active trader. This can be of enormous assistance for the individual investor who wants an objective measure of stocks and sectors.

There’s no math, only easy to use tools. All of the heavy algorithmic calculations are hidden from view. Subscribers get a straightforward system to monitor their portfolios, and easily track potential names in their watch list. Fusion IQ’s email alerts let you know when a stock you are considering reaches predetermined parameters.

Long-term investors who suffered through the downturn in 2007-08 will appreciate the risk-management tools Barry has developed. You can easily keep tabs on your portfolio holdings, as they are monitored for both fundamental and technical changes in character. The Fusion IQ software also monitors and ranks the different sectors of your holdings.

If you would like to learn more or get a subscription, my readers are the first to see the new Fusion IQ Investor site. At $29.95 per month, you get a powerful system to help you manage your portfolio and investing activity. If you are not completely happy, cancel within 30 days for a no-questions-asked, unconditional, full refund. You can learn more at https://www.fusioniqinvestor.com/. I encourage those of you who want to more successfully manage your portfolio and trades to take a look.

Hong Kong, South Africa, Stockholm, and More

It is Christmas Eve tonight, and the kids and friends will be gathering. It is always a good time to sit and enjoy my family. I will go and see my 94-year-old mother this afternoon, as she won’t be able to come for Christmas dinner as usual. Seems she was at church and thought there was a chair underneath her and sat down, only to find there was nothing but hard floor, and she broke her tailbone. She is in a great deal of pain if she moves, so it is best for her to stay in bed while she heals.

My daughter Abbi has let me know she wants to go to the Mavericks game on Christmas Day; and since it is an early afternoon game, dinner will be in the late afternoon. I will set the prime to roasting at a very low temperature so it will not overcook, and then go and watch them raise the NBA Championship pennant for the first time in Dallas. I have been a season ticket holder for about 30 years (since they first came here) and it has been a long, long time to wait for a championship.

Next year is already shaping up to be another year for traveling. I will be speaking in Hong Kong and Singapore in January; Capetown, South Africa in February; and Stockholm, Sweden in March. And all sorts of places in the US, as the schedule starts to take shape.

Have a very blessed Christmas and holiday time. I have a very special letter planned for next week to start you off right for 2012, and then my own forecast will be out on January 5. So much to read and think about. Have a great week!

Your wondering where the year went analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin