The Year of Living Dangerously

-

John Mauldin

John Mauldin

- |

- January 4, 2019

- |

- Comments

- |

- View PDF

Dangerous Addiction

Disappearing Liquidity

Blurry Lines

Dallas, Houston, San Francisco, Baltimore, DC, and Back to San Juan

Double, double, toil and trouble;

Fire burn and cauldron bubble.

…By the pricking of my thumbs,

Something wicked this way comes.

- William Shakespeare, Macbeth, Act IV, Scene I, 1606

Remember when it was a January ritual to fill in the new year on your blank checks? If you’re under 50, probably not. That we can now avoid that chore is one of life’s unsung little pleasures. But this time of year still comes, and by popular demand I must tell you what I think 2019 will bring.

In a nutshell, I expect to spend this year Living Dangerously. Yes, I’m thinking of the 1982 film starring a very youthful Mel Gibson and Sigourney Weaver, based on an earlier Christopher Koch novel. It has an Asian setting and features corrupt politics, neophyte journalists, international intrigue plus a gender-bending Chinese dwarf. If you aren’t sure how all those fit together, then welcome to 2019. We are all stuck in this craziness and can only make the best of it.

Nonetheless, having an outlook still helps. We’re all blasted with too much information and it’s easy to get overwhelmed. I find that having a framework helps organize my thoughts. Of course you have to be flexible and modify the framework when it no longer fits (if the facts change, etc.). But that’s better than floating aimlessly, at least to me.

Another thing that can help is the Mauldin Economics Alpha Society, which is open to new members for a few more days. The Alpha Society is an exclusive “lifetime pass” that gives you all our premium research services and many other benefits for as long as we publish them.

For example, Alpha Society members get to read Over My Shoulder, in which I share some of the fascinating expert knowledge that hits my inbox each week, along with a quick summary to save you time. Recently we sent material from James Montier, Art Cashin, Ed Yardeni, Louis Gave, Peter Boockvar, and more.

That’s just the start. I highly suggest you go here and read about the other valuable Alpha Society benefits. I think you’ll be impressed.

Now, let’s look ahead to 2019.

Dangerous Addiction

After doing this so many times, I think one of the best approaches is to simply ask, “What could go wrong?” Other things being equal, a growing population and increasing productivity will naturally produce a growing economy. But of course other things aren’t equal, and examining the deviations is a good way to reveal what might slow or reverse growth.

As I said in my 2018 forecast and again last week, I think a Federal Reserve policy mistake is our top risk. That’s less a “forecast” and more a recognition of reality, since the mistake is already happening. The Fed is raising rates and reversing its quantitative easing at the same time. They should be doing one or the other, not both. I think the global balance sheet reduction is especially harmful. I think/hope Jerome Powell will realize this in early 2019. If he doesn’t, or the rest of the FOMC disagrees with him, the year could get very rocky, very quickly.

Let’s look at a few things that crossed my inbox in the last month and see if I can piece them together.

I’ve been tough on the Fed but I may actually be understating the danger. My friend Chris Whalen described the problem last week. After noting work by economist Zoltan Pozsar, who said QE-created bank reserves aren’t “excess,” Chris wrote (with my bolding):

The obvious points to take from Pozsar’s work are two: First, the FOMC cannot withdraw the liquidity provided to the US financial system via QE without causing the system to implode. Chairman Jerome Powell needs to publicly state that the Bernanke-Yellen inflation in asset prices will entirely reverse as the FOMC tries to reduce “excess reserves” to pre-crisis levels. Regardless of whether the FOMC raises the Fed funds target rate or not, continuing to shrink bank reserves via QT implies a significant reduction in prices for stocks and real estate.

Second and more important, Powell needs to inform Congress that so long as the Treasury intends to run trillion-dollar-plus annual deficits, the Fed’s balance sheet must grow rather than shrink. To have the FOMC try to follow a narrative set in place half a century ago when fiscal deficits were minuscule is obviously impossible given the Treasury’s borrowing needs. This implies that the FOMC must embrace an explicit policy of inflation that is at odds with the legal mandate enshrined in Humphrey-Hawkins.

As we’ve noted previously, the POTUS is right to criticize the Fed’s policy actions, but for the wrong reasons. The fixation of markets and the financial media on whether the FOMC raises the target rate for Fed funds or not is misplaced, part of a time-worn policy narrative that is completely antiquated. Since 2017, the only important trend in credit markets has been whether the Fed’s balance sheet is shrinking and at what rate. The move in credit spreads that started in August signaled that there is a growing problem with liquidity, yet the FOMC ignored the warning.

To use another metaphor, the Fed’s QE operations left the economy addicted to a highly potent drug from which withdrawal is practically impossible but whose supply is disappearing. That is a big problem. Rising interest rates are secondary. In real terms, short-term rates are still close to zero and will stay historically low even if the Fed keeps hiking. The QE reversal is much more significant. Worse, it’s not just the Fed, as CrossBorder Capital explained in a note last month.

Latest weekly data show the major Central Banks’ aggregate balance sheet shrinking at a record rate (-3.5% in constant US$ terms (3m ann.)). The pace of Fed QE reversal is unabating and the Bank of Japan has slammed on the brakes. Meanwhile, Bank of England liquidity provision continues to decline, and ECB liquidity growth has turned negative. Set against these ever-tighter DM liquidity conditions, the PBoC alone is injecting funds and at a faster pace. In current US$ terms, policy liquidity is shrinking at an even faster rate (-6.8% 3m ann.). The unrelenting Fed and US dollar strength are behind the fall.

My friend Dennis Gartman frequently writes about the US monetary base, particularly when it is falling. This is a graph from last week:

Source: The Gartman Letter

I have always been intrigued by this chart and wanted to know the actual economic data and equations behind it. So, I sent this chart and a few questions to Dr. Lacy Hunt. He kindly opened his mental textbook and share with me the explanation below.

You may, as I certainly did, need to read this a few times and let it marinate in your brain. It is important because there are longstanding academic reasons for all the alarm bells going off in my inbox from other (smarter) writers than I am, and then from my own research; enough to make me nervous. This tells me why I should be.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

From Lacy:

There are two important equations that show the potential power of the monetary base (MB):

1. M2 = MB x m (the money multiplier);

2. World Dollar Liquidity = MB + Foreign Official Holdings of US Treasury Securities

#1 means that that the base is not money but that it can be turned into money but only if little m cooperates. The determinants of little m are known, unlike those of the velocity of money. Currently, MB is declining and m is countervailing to a slight degree, but the drop in the base and the increased Federal funds rate has resulted in sharp slowdown in M2 growth from a peak of 8% per annum to slightly less than 3.9% per annum now. Slower M2 growth resulted in a sharp slowdown in nominal GDP in the third quarter of 2018.

In the fourth quarter velocity of money appears to have declined and combined with slow M2 growth has resulted in an even lower rate of growth in nominal GDP. This trend should continue well into 2019. Thus, the academic economist would say that the aggregate demand curve is shifting downward, cutting the upward sloping aggregate supply curve at a lower rate of growth in nominal GDP, with a reduced pace of growth in both real GDP and inflation.

#2 means that world dollar liquidity declines when the base falls unless it is countervailed by an increase in foreign official holdings of Treasury securities. Both of these components constitute tier one capital and can be leveraged. Presently, both components of world dollar are falling, draining liquidity in global markets. Tangible signs of this include: a sharp slowdown in M2 growth in Japan, the Eurocurrency zone and China, a drop in world stock and commodity prices as well as synchronized deceleration in major foreign economies. Chinese money growth recently fell to the lowest in four decades, while Japanese money growth was below the trough in two of the last three recessions. Equation #2 holds as long as the Fed is de facto the world's central bank.

One other point: Excess reserves have declined far more sharply than the monetary base, serving to severely restrict the US depository institutions. Excess reserves have dropped from a peak of $2.7 trillion to $1.6 trillion. Quantitative tightening cut excess reserves about approximately $400 billion while the first eight hikes in Federal funds rate reduced excess reserves about $700 billion. We don't have sufficient data post the ninth increase in the funds rate to yet measure its impact. QT, if sustained, will reduced excess reserves $50 billion per month in 2019 or $600 billion for the year. Thus, excess reserves would drop to slightly less than $1 trillion by the end of this year.

Peter Boockvar noted last week that in Q4 2017, the Fed, ECB, and BOJ combined asset purchases were $100B per month. The total dropped to zero in late 2018 and this quarter will turn negative, to a roughly $20B per month withdrawal.

We are in a serious pickle. The extraordinary measures central banks took to get us out of the last crisis could make the next one even worse. They seem collectively hellbent on reducing their balance sheets. Avoiding another liquidity crisis will take some seriously active management by the FOMC and central bankers elsewhere, too. I am not confident they can do it.

|

Disappearing Liquidity

We have another problem, partly a result of Fed policy but also other things. The corporate bond market has, to put it in a quaint and polite term, gone berserk. Companies are more leveraged than ever yet investors still clamor to lend them more. Why?

Well, one reason is the Fed’s low rates made debt capital less expensive than equity. Borrowing, whether by issuing bonds or via bank loans, has been cheaper than issuing stock for the last decade. So that’s how many businesses funded themselves.

The problem, as Econ 101 says, is artificially low prices stimulate malinvestment. You might think today’s highly paid CEOs are immune to that, but many are not. We will see some interesting annual meetings next year when executives have to explain why they put their companies in debt to fund share buybacks at double or triple their current stock prices. Which, despite appearances, surely they would not do to boost their option income or bonuses. Especially if we are nearing a late cycle recession, from which that missing cash would have been a handy cushion.

Yield-seeking lenders were equally foolish. They felt forced to take credit risk by the Fed-induced low Treasury rates. Many went too far. We see this in the now-common “covenant lite” loans that surrender many of the protections lenders once considered non-negotiable. Shades of 2005-07. Can’t they remember how that ended? Seriously?

As a result, corporate debt as a percentage of GDP is now at a record high. Note that recessions are proclaimed after the fact and that before previous highs we seemed to enter recession.

Source: Wall Street Journal

As you can see from the recession bars, debt at these levels tends not to end happily. Worse, much of this debt is amplified as “leveraged loans” which I suspect will also not end happily.

How is this a problem? Corporate bond prices are beginning to reflect higher default risk as rates rise and the economy weakens. As those prices fall, some investors will want to sell. That means someone has to buy, and buyers will have every incentive to drive hard bargains.

Remember also, a great deal of this debt is in mutual funds with legally mandated daily liquidity. If more investors want their money than the fund has cash on hand, they must liquidate assets immediately at whatever price they can get.

This is the sort of thing that can quickly snowball into a financial crisis. Something similar happened with commercial paper in 2008, but this has the potential to be even worse… and, if it happens, could come at a time when the Federal Reserve and Treasury can’t help much.

I see serious risk of a corporate bond crisis in 2019, likely beginning in high-yield and leveraged loans but not stopping there.

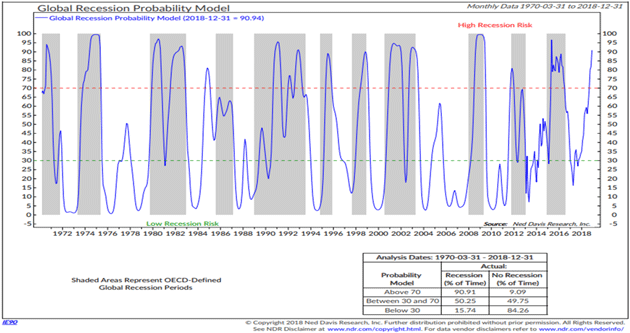

And since we are talking about recessions that have not yet been proclaimed, let me point out again this graph from Ned Davis Research which shows their probability of a global recession. Again, note that we are at levels that have always been associated with past recessions. Just saying, class, we should be paying attention.

Source: CMG Capital Management

Blurry Lines

Meanwhile, we are about to witness new political challenges. With Democrats now controlling the House, there will be no more tax relief, but there will be a lot of other drama as they investigate and resist the Trump administration, which is their right. How the president will navigate this is not yet clear. I am not optimistic. The mostly likely outcome is (at least) two years of legislative gridlock.

However, that may not stop Trump from using executive authority to continue his trade war, particularly against China. The Buenos Aires tariff truce ends March 2. Talks are underway but it will be hard to resolve the many tough issues by then. Especially with Lighthizer apparently still talking about higher tariffs. Really?

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Beijing simply can’t afford to give the US everything it wants without crashing China’s own economy. Maybe there is a compromise in there somewhere but right now color me worried and skeptical. Tariffs may go back up and further bite into US growth at a time when the economy already has other challenges.

Furthermore, few are thinking about the NAFTA update that Congress must ratify. At a minimum, it certainly gives Nancy Pelosi a serious bargaining chip.

Throw in the government shutdown?

All of these: multiple central bank policies, the run-up in high-yield corporate debt, tariff and trade wars, political battles, government shutdown. They are all unforced errors, every one of them. The economy might be able to ignore them individually. Together? It is a witch’s brew for upsetting the applecart.

But set Trump aside for a minute. Greater forces are at work. He’s president not because he created some new tribe, but because he recognized what was happening before others did.

This next section needs a little set up. Bob Lefsetz is a music attorney by profession, but via his e-letter has become one of the foremost music industry critics and observers anywhere. I enjoy when he takes me down musical nostalgia lane (we are roughly the same age and generation), but I find his true value to me is when he talks about one of two things.

First, when he offers seasoned advice to music industry newcomers as well as old pros. I have found many parallels between my own business and the music industry, so I learn a great deal. And over time, I’ve come to realize that these parallels exist in literally scores of businesses. Probably yours as well.

Second, Bob is a committed California liberal. He writes about whatever is on his mind, and sometimes that is political. To his credit, he critiques both Democrats and Republicans. We all tend to live in our own echo chambers among people who agree with us. I find it useful to get outside mine. I learn a lot more that way, and it gives me a little perspective.

Recently, Bob was talking about his dinner in Colorado with an old music industry friend. They were talking about the 1960s and the difference between then and now. And as usual, he went home and wrote about it in a letter titled Talkin’ ‘Bout a Revolution. (You can subscribe to Bob’s free letter at the link. Try him for a month or so, unless your blood pressure can’t take it.)

Then again, the leaders of the sixties revolution were middle class, educated. Whereas today the middle class is shrinking, and everybody’s worried about economics, whether they can eat and have a roof over their head. You could have a minimum wage job and make it back then, now you can’t.

And there are a lot of issues. Shouldn’t health care be a right? The newspapers are debating whether outsiders should get into Harvard. Those in the upper class who’ve sent their kids to private schools don’t want this. So is it class warfare or ideological warfare or…

We can no longer draw clear lines between economic, social, and political trends. There are no geographical lines. In a future letter I’m going to talk about the Fingers of Instability reaching into politics and income distribution, as well as economic fault lines. They all influence each other. One of my 2019 goals is to explore these relationships and what they mean to us all.

Lefsetz ends his piece on a down note.

Or as Rodney King once said, “Can’t we just get along?”

It appears not.

Is change a-comin’?

You tell me.

I think change is a-comin’ and it will affect all of us in significant ways. Your investments, while important, are only part of it. We are losing the ability to work together against common problems. We can’t even agree on what is a problem.

I keep trying to imagine what/who might reunite Americans, and drawing blanks. As Lefsetz says, we don’t have the kind of issues that would do it. Nor do we have any elder statesmen or nationally unifying figures whom everyone respects, much less agrees with. This will make our various problems worse.

In short, I see dangerous times coming. I’d like to be wrong about this, but I don’t think I am. I think 2019 will be a Year of Living Dangerously, followed by the 2020s as a Decade of Living Dangerously. Then we’ll have a Great Reset and enter a new and better world. But we have to get there first.

Double, double, toil and trouble;

Fire burn and cauldron bubble.

Indeed.

Dallas, Houston, San Francisco, Baltimore, DC, and Back to San Juan

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As you read this, Shane and I are likely back in Dallas. Sunday night and Monday morning, I’m briefly in Houston with business partner Steve Blumenthal and the whole team at SMH (more on them next week), then back to Dallas to meet Pat Cox and then we both fly to San Francisco for several biotech conferences, one on new antiaging and even age reversal (yes, really) technologies. Then we both fly to Baltimore for yet another presentation on a developing biotechnological miracle. Then I will somehow finish the next letter, get to Washington DC, meet old friends and fly back to Puerto Rico on Saturday.

We will continue the “forecast issue” next week, dealing with Europe, China, and maybe a little bit more on the US. This letter is running long, so it’s time to hit the send button. You have a great week and a great new year and I look forward to being your partner in crime in the future. We are going to have a lot of fun getting through this together.

Your strapping his seatbelt on analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin