The Beacons Are Lit

-

John Mauldin

John Mauldin

- |

- March 20, 2020

- |

- Comments

- |

- View PDF

It’s Happening

Going to War

We Are Facing a Depression, Not a Recession

What Will It Take?

How Things Are Going to Change and What We Should Do

We Can Do This

Personal Thoughts

In the film version of Tolkien’s Lord of the Rings: Return of the King, there’s a three-minute scene you should watch or re-watch. It is relevant to our situation today. Gondor needed to light the beacons for aid.

At the other end of the beacons, no one is sure whether the very reluctant king will honor the ancient, thousands-year-old treaty. Then you see the doubt on his face turn to firm resolve as he gives the order: “And Rohan will answer.”

Now, in answering, Rohan wasn’t simply helping its ally. The enemy was coming for them, too. They were very aware of that fact. Saving Gondor was the best way to save Rohan.

Today in the real world, we also face a dark, implacable, powerful foe. It is a microscopic virus that we now know is a threat, a very serious one. We in the United States have just seen the beacons. The warning travelled not just a few hundred miles but around the world: from China and Korea, to Italy and Spain, and now here.

The beacons are lit. How will we answer?

It’s Happening

Back in late January, the initial Wuhan outbreak finally caused the Chinese government to impose travel restrictions, close factories, and so on. Over here, some of us immediately knew that would mean supply chain problems. I sent some reports on it to Over My Shoulder members in early February. (Members can read them here and here. Quite interesting in hindsight.)

Later in February, recalling my patented “bug hitting the windshield” metaphor, I said, “It’s beginning to look like virus COVID-19 could be the windshield against which the global economy meets its maker.” We can now strike the “beginning” part of that statement. It’s happening.

I was initially hopeful the virus would spread slowly enough to get us into summer, when it should recede and then we would have a vaccine fairly soon. Neither is happening. I’m now convinced, as I said in my midweek letter that we could lose untold tens or hundreds of thousands of lives, even with drastic action. Without that action, the toll could be millions. As of Friday noon, it appears that we are going to take at least most if not all of the very necessary painful actions.

In that update I referred you to two links. If you didn’t read them already, please do.

If you are someone who is skeptical of scientists, the media, and so on… I’m with you. But this time I am listening because these same experts have been right.

Dr. Scott Gottlieb is not some crazed liberal. He is a physician and public health expert who was appointed FDA commissioner by President Trump. And he, along with Trump NSC biodefense advisor Luciana Borio, wrote, in The Wall Street Journal on January 28 (!) that we should Act Now to Prevent an American Epidemic. Then they wrote again on February 4, saying we must Stop a US Coronavirus Outbreak Before It Starts. Many other experts said the same.

Note, both of those were on the reliably conservative WSJ editorial page. This is not a mainstream media hoax. It is not an anti-Trump plot. It is not clueless professors trying to get funding. This is real and they have been right. You can ignore them if you want. I choose to listen.

I’m saying this strongly because as recently as this week, I’m still hearing from lots of readers who don’t get it. I won’t give examples.

The US lost 2,996 lives on September 11, 2001. We thought that was enough to go to war. And all the experts say the coronavirus will likely kill many more than that, just in the US. Would some of them have died soon anyway? Sure. But so would some of the 9/11 victims. We didn’t use that fact to minimize their loss and we shouldn’t minimize coronavirus deaths, either. This is not a figment of the imagination. It is tragically, fatally real.

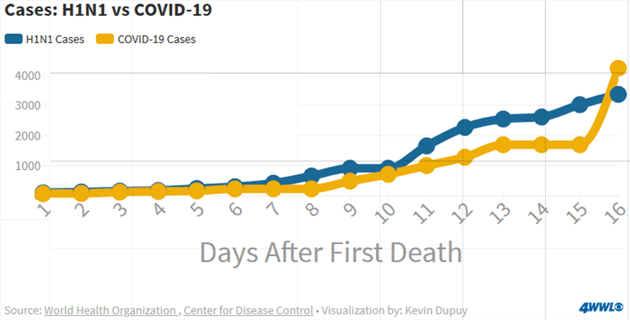

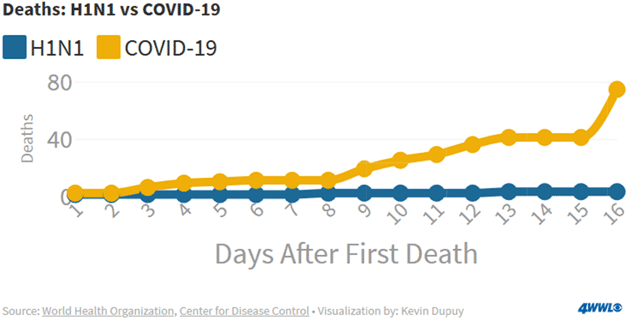

Some want to compare COVID-19 to the swine flu. Let’s look at the facts.

Charts: WWL-TV

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The data shows that, at this point in the outbreak, COVID-19 is spreading faster than H1N1 and is killing many more of its victims. This is not nonsense. It is fact.

We don’t know a lot about the Chinese government’s internal deliberations, but I feel sure they saw curves very much like these. At first, it hid its head in the sand and tried to hide the outbreak from the world as well. Then that became impossible. That is why it took what looked to foreigners like insanely harsh containment measures and rushed to build temporary hospitals.

I don’t think Xi Jinping did that because he is a great humanitarian. He saw a serious threat to China’s people and economy, and possibly his own regime’s survival. So he acted decisively and still saw thousands die.

Here in the US there’s every reason to think our experience could be far worse than China’s without immediate action. It is not confined to just one city; we have large outbreaks on both coasts and more popping up everywhere. All 50 states now have cases. Worse, we are reacting much later than China did. I am convinced that a rigorous national lockdown and social distancing is the only way to stop this from reaching epically tragic proportions. Yes, it will have a huge economic cost. We just have to collectively pay it. The alternatives are worse.

Going to War

Coronavirus is both a public health problem and an economic problem, and the two work against each other. The measures we must take to save lives necessarily mean shutting down large parts of our consumer-driven economy. People are losing jobs and businesses are losing revenue.

Does that mean we simply ignore the virus and let people get sick and sometimes die? No, that won’t work, either. Our healthcare system can’t handle what would happen. It would collapse and be unable to help anyone with anything.

We need to sustain the economy for however long it takes to beat down the virus. That’s going to mean massive fiscal stimulus spending—multiple trillions of dollars’ worth. We are going to have to do for everyone the kind of things we have long done for natural disaster victims—emergency grants, subsidized loans, exemptions from rules, and more.

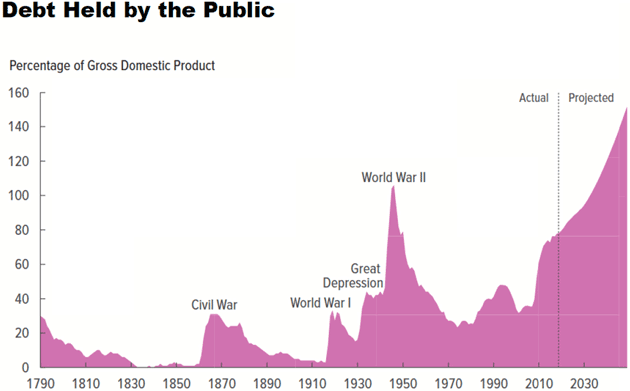

How will we pay for it? There are several ways but they all involve massive government debt and deficits that will shock us. We’re going to figure it out because we have no choice. The good news is, we’ve done this before. We fought and won World War II on a massive pile of debt.

Chart: Congressional Budget Office

Those who experienced the world war years as adults are mostly gone. We know their stories, though. Americans faced their common foe together, with shared sacrifice. Widows bought war bonds with their savings. Common goods were rationed. Every able-bodied male not needed for industry or farming was in uniform, and many women, too. Everyone sacrificed, and it worked.

We must sacrifice this time, too. It’s going to be inconvenient, expensive, and aggravating. We will exceed that World War II peak in the debt chart several years sooner than projected—possibly even this year. I don’t like it, either. But we have to do it.

We Are Facing a Depression, Not a Recession

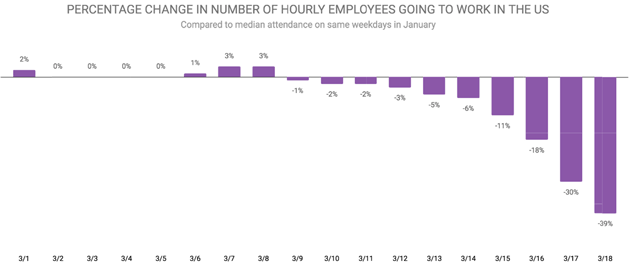

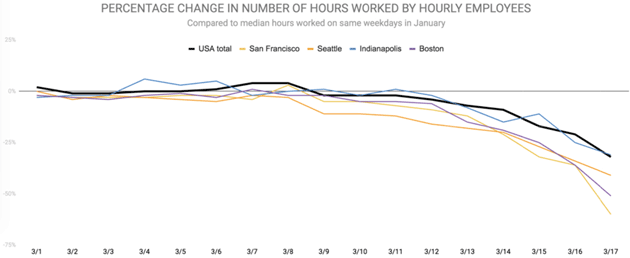

We are already seeing large increases in request for unemployment insurance. It is going to explode. Let’s look at this data from homebase. A stunning 39% drop in the number of hourly employees going to work in the US just in the last 10 days. Is there anybody who thinks that’s not going to increase?

Quoting from homebase:

Many of the hardest-hit cities—San Francisco, San Jose, Seattle, New York—showed steep declines last week that align with the rise in coronavirus cases. Seattle was the first to see significant impact early last week, but other cities quickly caught up. The introduction of forced closures and shelter-in-place orders has furthered the slowdown. San Francisco, Boston, Pittsburgh, New York, and San Jose currently have the greatest reduction in hours worked, down by more than 50% in each city on Tuesday.

3 out of 5 workers in San Francisco did not go to work last week. It will get worse. The reduction in work hours there was 64%. Middle America cities are in the 40 to 50% range.

Mike Shedlock has been tracking government data on employment. You can read his entire take at the link, but extrapolating the loss of jobs would mean an unemployment rate of close to 12% and a U-6 rate of 39%. Even if he is wrong by half, which I don’t think he is, that unemployment number ALREADY is staggering. We are literally down well over 10 million jobs and going to 20 million.

I know that Amazon is hiring 100,000 workers and giving them all a raise. Good on Jeff Bezos. Seriously. But that is only a fraction of 1% of the jobs we are losing. We the People, the government collectively, should step in to help the remainder of those people. The coronavirus is not their fault.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Sidebar: A hotel exec friend who runs 125 hotels has let 90–95% of the staff go. Literally tens of thousands. There are 54,000 hotels in the country. Do the math. Another friend handles the backroom for 2,200 dentists. 80% have shut down as they can’t get the masks and other things they need. There are 100,000 dentists with an average employment of maybe 10 people. Minimum 500,000 employees, plus dentists, without income. Average income per employee is $50,000. Dentists are critical but they have to have the basic gear to do it.

There are literally hundreds of examples. Dear gods…

Nobody in their right mind, given what might happen this weekend (if the rumors are true), can possibly think these employment numbers will not get worse. These are not recession numbers. They are depression numbers.

Let me be clear. The US is facing a deflationary depression. One cannot have the economic impacts we are seeing and think they will magically go away when the virus does. That’s not how economics and business work.

I am not the first person to say it, but we need something like a Marshall Plan for the US. I recognize that Europe and the rest of the world are struggling too. I get it. But the entire world will go into a deflationary depression if we do not solve the crisis in the US. Hopefully an eventually strong US can help lead the world out.

I am calling for significant quantitative easing or whatever you want to call it. I get the irony in that. The Federal Reserve is largely responsible for where we are today, keeping rates too low for too long, and the government running deficits way beyond nominal GDP. These are bad things.

But we have to deal with the situation as it is today. And today, much of our country is under stress and wondering how they’re going to feed their families. How do they pay their rent? Electric bills? 100 other items? Some of us can individually help our family and friends, but collectively we need to step in and help everyone.

Grousing about bad policies and mistakes of the past doesn’t solve the problems we face today. There is no need to punish the average American for bad Federal Reserve policy that they had no control over any more than we should punish them for the coronavirus. Maybe when this is all over we can think about how we ensure better policy in the future.

What Will It Take?

There’s no single perfect answer; we will muddle through this, making mistakes along the way but hopefully learning from them. Any way you look at it, the numbers will be staggering.

Spending even a few trillion dollars to protect everyone’s income during the lockdown period isn’t crazy at all. I think it is the best option available. And we need to do the same for our business so they will be there when we get through this. Not just big business, but every small business as well.

President Trump said the other day that they will help the airlines because the virus is not the fault of the airlines. Quite true. Even though they spent 96% of their profits on stock buybacks. We absolutely have to have the airlines functional when this is over. But perhaps for companies that used their money for stock buybacks, that aid comes with an equity kicker for taxpayers. Nonvoting equity to be sure. But if they ask us to socialize the risk while they spend money on stock buybacks, it’s only fair to expect a little in return. Asking for outright grants? Get real guys (unless it goes directly to employees who were laid off).

Hotels, cruise ships, microbreweries and restaurants, hair salons, and a hundred thousand other small businesses need to survive in order to hire people when we reach the other side. It’s not about whether some business is “mission-critical” or vital to the economy. It’s about all the jobs those businesses provide. To the worker, a job at a cruise company is no different than a job at an airline company. It’s their income and the way they support their family.

Of course, we have to be smart about how we do this. We also have to be fast. Speed trumps everything. I know there is great concern someone might get something they don’t deserve. We all need to get over that. Right now, speed is more important. We have to help as many as possible, as fast as possible. We can sort out the mistakes later, and recover any excess payments via the tax system.

Furthermore, while I cannot reveal my sources, I know for a fact that the unemployment websites of some states have crashed. They simply weren’t built to handle the volume of applications.

We should help people first and businesses later. For one thing, helping people will help businesses by restoring their customers’ confidence and spending power. Some businesses are hurting more than others. The travel industry, restaurants, and many service businesses are in the worst position because they can’t make up lost revenue. This lockdown period means revenue is lost forever to them.

As soon as possible, we should help businesses who agree to use the money to pay their employees throughout this crisis. They actually know who is working and needs the money. Perhaps rent forbearance for a few months in conjunction with loans to landlords?

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

What we absolutely must avoid, in my view, is creating even the perception that regular workers are saving Wall Street or wealthy people in general. That mistake in the financial crisis years is still haunting us.

Fortunately, we can save companies and jobs without rewarding executive incompetence. It’s really not hard. We can save our economy without turning socialist. That’s not hard, either. But it will be expensive. I won’t get into specific plans because they’re evolving so fast. I may not endorse everything the government does, but I strongly endorse doing something rather than nothing.

We could be talking $4–$5 trillion. Everyone knows that I have been a deficit hawk and a scold on debt for over 40 years. I am the anti-Paul Krugman. Except right now, in this particular situation, I think Paul Krugman and I would agree. (I am seriously laughing at myself as I write that.) The stimulus that is being talked about today is not enough. It must be more. Much, much more.

How Things Are Going to Change and What We Should Do

- I can’t say this enough. We are facing the strong possibility of a deflationary depression. That cannot be allowed to happen. That is going to mean significant amounts of government debt, much of which will have to be monetized by the Federal Reserve. I fully get that is risking an inflationary episode as a result.

I am not going to spend a great deal of time next explaining complex economic realities. In order to get inflation, there has to be a significant increase in demand along with an increase in the money supply. We are going to increase the money supply, but it is not clear that demand will significantly increase afterwards at anything like what we had before.

This crisis could emotionally scar a generation just as much as the Great Depression affected our grandparents and great-grandparents. Especially after the Great Recession just 10 years ago. The 1990 recession and the bubble blowing up in Japan, even accompanied by massive monetary stimulus on the order of what we are talking about now, did not result in inflation. The Japanese became savers. It literally changed their habits.

There are ways to control an inflationary episode. There is damn little you can do with a deflationary depression.

- The entire episode will change the way we structurally organize our business lives. Companies are finding out they can do more remote work. Workers will enjoy that. We may not need as much office space. We are also going to find out that we might need less of certain things. I am not going to speculate on what. But that means a lot of jobs that existed pre-crisis are simply not going to come back in any viable form post-crisis.

We cannot keep a small business going beyond a certain point. Pick a number. Three months? Six months? At some point if you as a business owner can’t figure it out, you have to lose government support. You and your employees will have to figure out something else to do. Not unlike it was a few months ago.

- This is important. The country ramped up for World War II. But when the war was over, the soldiers came home and mustered out of the armed services. We cannot stay on a wartime footing for more than a few months after the end of this crisis. No permanent government programs. Period.

I suggest that since we are blowing out the budget anyway, why not sell a few trillion dollars of 100-year, 1% bonds and use the entire proceeds on infrastructure projects over the next four years. No high-speed trains, just replacing our roads and bridges, water systems, and upgrading our grids.

This may seem radical, but the world can absorb those bonds along with the other bonds we will need to sell. The Federal Reserve is not allowed to go into a primary auction. But as soon as those bonds are sold, the Fed can buy them. Why can’t the Fed offer a 1% profit to anyone who would buy that bond and sell almost immediately? Open it up to individuals, if possible, but damn well make sure the banks participate. You don’t have to issue the entire amount on day one, just as the money is needed. Which reduces inflationary risk.

What that does is put people back to work—people whose jobs are no longer viable. And we actually get something for the infrastructure expenditures that will last for generations. Gods know we need to spend money on infrastructure. It is crumbling.

- Let’s assume we keep everybody afloat for six months, although I sincerely hope it is not that long. An extreme lockdown could mean a few months, not six months. What do we do after the virus is contained and we have vaccines?

- UGH. I hate saying this. I truly do. But we may be in a period like at the end of WW2 where the Fed controlled the entirety of the yield curve. Maybe this is the Great Reset 1.0, or a good practice round. Let’s do what we can and learn from it.

We could do the same thing with businesses. It’s an easy way to collect data and present it to the government. I am sure that Zuckerberg, Brin, et al. can whip that up on their own nickel as part of the war effort.

- This may seem like it’s out of left field, but many unemployed workers are already using Facebook. I’ll bet you between Facebook, Google, SAP, and other Silicon Valley computer wizards, they could come up with a way to identify need and connect with the US Treasury to make sure checks go out. In a compliant way. Yes, some people will try to cheat the system. When we find them, we will need to discuss with them what Americans should do in the middle of a crisis. Cheating is not one of them. But I believe the bulk of Americans will do the right thing. Let’s make it quick and easy for them.

We are now all too familiar with the concept of social distancing. We need to think about economic distancing. When we have economic partners who act irrationally, hiding data about a new virus for months, allowing it to spread worldwide, destroying supply chains in the meantime, how much do we want to rely on them in the future? Every major flu of the past 20 years has come out of China. Just saying…

This is a virus we can beat. It is not the zombie virus. But someday it could be, and this is a great test to learn how to deal with it. Let’s not forget these lessons. Countries that want to hide their data are candidates for economic distancing.

- It should be obvious, but we need to think about supply chains. The US is running out of something as simple as mouth testing swabs. It seems the entire world supply is made by two companies. When I was asked where I thought those were, I replied “China.” It is worse. They are both in Milan, Italy. Milan is in lockdown. The swabs are on the dock. But they are in their own kind of quarantine.

- Let’s look at some positives. Jobs and manufacturing were already coming back closer to the marketplaces, albeit using robots and 3D printing. But that still means jobs. That will accelerate. Over time, that means a lot more jobs in North America and Europe. And better supply chains.

We really need to look at where critical medical and socially necessary products are made. We can’t fix it all at once, but we should make a start.

Once the CDC and FDA stopped trying to control things, we’re seeing a “Cambrian Explosion” of innovation and drugs to deal with COVID-19. The Milken Institute has a list of 101 different vaccines and drugs that are in process or are being tested.

Freed of government regulation, doctors are finding that certain drugs already available can reduce the time a patient is sick from 11 days to 4 days. That is a huge increase in survivability. It turns out the malaria drug has a significant effect. Who knew? Well, pretty much nobody until doctors began throwing everything against the wall to see what would stick.

People are beginning to post do-it-yourself ventilators made from parts you can get at a hardware store. Put some of those automobiles and Boeing workers on an assembly line. History note: The first ventilators were made by Boeing for bombers in World War II. American ingenuity can help us a great deal.

- Dr. Mike Roizen asked me to emphasize that there are things you can do to improve your own immunity. His top three are make sure you get a lot of sleep, eat healthy, and manage your stress. I would add as much social distancing as you practically can.

Bill Ackman was right a few days ago on CNBC. Trump needs to lock this country down. I know for a fact that the National Guard is being mobilized in many places. I need to apologize to my friend Governor Greg Abbott of Texas, who was locking Texas down as I sent out my last letter.

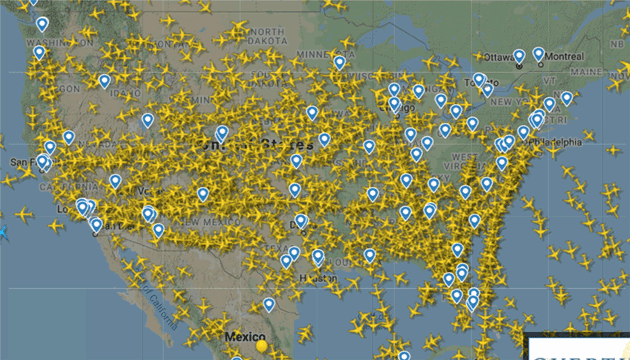

BUT, and this is a big but, look at this real-time flight tracker as of 11 am Friday. Does this look like a matrix for spreading a virus to you? These are flights that are IN THE AIR right now.

Maybe we need to rethink what is necessary flight (as in freight and foods and medicine) and what can be avoided. For at least a few weeks. As the links I provided at the beginning showed, every day of lockdown makes an exponential difference.

I know for a fact that the National Guard is being mobilized in numerous states. One can only speculate about the reason but you don’t do that unless you are planning to take serious action. I hope by the time you get this letter, in less than a few hours after I hit the send button below, that has already been announced.

We Can Do This

We can do this. And when I say “we,” I mean myself and my American investor-readers, because our country has blessed us greatly. We have the means to get through this. Not everyone does. In fact, relatively few do. We are the fortunate ones. This is our calling and our responsibility. Not only can we do it, we must do it.

If you are not in America, you can do it as well. I am pulling for everyone in the world. Every country is going to have to figure out how to deal with its own problems. We need a world that is thriving and growing so that humanity can move forward to a much brighter future.

Personal Thoughts

I’ve given you a lot to think about today. These are my unvarnished thoughts. I want your thoughts as well. I do read every comment and letter. My staff makes sure I get one sometimes LONG Word document of each and every one. I do my best to answer.

You stay safe and healthy and maybe use the time, if you have some, to call friends and family. A phone call is clearly social distancing. But it is much appreciated and will make somebody’s day much better.

Hang in there, there is going to be so much opportunity as we come out of this. And all of the old opportunities that I’ve been saying and talking and writing about over the years are not going away. Just postponed for a few months. Have a great week and I’ll be back again.

As I was doing the last-minute edit, I find my daughter Amanda, who lost both her jobs yesterday, is in the hospital as she lost all feeling on her right side. In the CT scan now. Stress as her husband just went back to school and she was the primary breadwinner with two young girls? This stuff is all too real…

(Publisher’s Note: I am sad to inform you that as we were preparing this letter for publishing, we learned that Amanda has suffered a stroke. John, our thoughts and prayers are with you, Amanda, and your entire family. –Ed D’Agostino)

Your believing we’ll get through this analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin