Tax Reform: The Good, the Bad, and the Really Ugly—Part Four

-

John Mauldin

John Mauldin

- |

- March 1, 2017

- |

- Comments

- |

- View PDF

“The values to which people cling most stubbornly under inappropriate conditions are those values that were previously the source of their greatest triumphs over adversity.”

– Jared Diamond, Collapse, 2005

Tax reform means, “Don’t tax you, don’t tax me. Tax that fellow behind the tree.”

– Russell B. Long, Democratic Senator from Louisiana, longtime chairman of the Senate Finance Committee (and a strong believer in capitalism who was a champion of tax breaks for businesses)

This letter turns out to be the penultimate installment in my now five-part series on tax reform. Part one was an introduction and a discussion of some of the problems of the proposed border adjustment tax. Part two went further into the proposed reforms and reasons for them, focusing mainly on what I liked in the proposal. Part three was a determined evisceration of the border adjustment tax proposal (which I think potentially has all sorts of negative consequences, up to and including starting a global recession). You can read parts one, two, and three by clicking on the links. I also sent as an Outside the Box this past Wednesday, written by Constance Hunter of KPMG, who analyzed the proposed reforms, discussing the difficulties of the proposed border tax as well as other issues.

I hold that it is not fair to criticize a proposal unless you have something else to offer. Next week I will wrap up the letter by telling you what I think we should do – and then offer you the opportunity to create your own tax proposal.

This week we’re going to start the letter talking about why tax reform is one of the most urgent decisions facing the body politic today. Tax reform will set the tone and direction of our nation’s economy, not just in terms of taxes but also with regard to jobs and healthcare and indeed the entire fabric of our social contract. I will also hopefully demonstrate that tax reform will not only affect our tax accounting and payments but, far more importantly, it will largely determine the environment in which we earn our incomes and make our investments. It will have huge implications for portfolio and investment returns. As I have said in the previous letters, this proposed tax reform (whatever form it actually takes) will literally touch everything in our lives. It is critical to get it right.

Let me hasten to say that if we get it wrong, (or at least in terms what I would call wrong) the world will not come to an end; we will Muddle Through, and most of us will still have enjoyable, productive lives – though many of us will have much different lives. It is the people who are in the lower 75–80% of the economy who will be affected far more than those who are in the Protected Class (also sometimes called the elite), whether they are Republican or Democrat. But as we are seeing from the current political turmoil in the United States, a lack of transparency and a failure to achieve a more even distribution of the benefits of our economy is driving a sense of true fear of the future among the populace. Sometime in March I will begin a series called “Angst in America,” in which we’ll deal with the economic underpinnings of why we live in such contentious times.

As we jump in today, let’s start with a little game: On a piece of paper, or at least in a part of your mind where you are habitually honest, write down what you think is the size of the government relative to the size of the private sector in terms of percentage of GDP. We will come back to that exercise in a moment. But first, let’s look at why tax reform is important.

Where Will the Jobs Come From?

(I should note that this issue will have implications for every reader, no matter what country you live in. Future employment trends are going to be crucial, globally.)

This is a broad generalization, which of course will lead to many objections from readers, but for the majority of Republicans in Congress, this tax reform is mainly about jobs. Yes, there are some Republicans who simply want to “starve the beast” by reducing the size and scope of government or who are philosophically inclined to think that income taxes are too high. And I will admit that those are also secondary impulses in most of the Republicans who are primarily focused on jobs. I should hasten to add that there is a reasonable degree of bipartisan agreement that the corporate tax structure needs to be reformed, as it is obviously putting US companies at a disadvantage. If it were possible to deal with just the corporate tax, rather than having to rework the entire spectrum of taxes, I think it would be possible to pass a reasonable bill quickly. But both sides of the aisle want to deal with corporate taxation as a part of the whole rather than to address just its inequities. So we have had no real corporate tax reform for the last two administrations.

For many of the Democrats in the lower house, the majority of whom represent the progressive stream of their party, the concept of tax reform is easy: Simply increase taxes on the rich and redistribute the wealth in some fashion, either through healthcare benefits or other government programs. Note that I said many, not all. And while a significant Democratic portion of the Senate shares that philosophy, not all of them do. There is a dying breed of centrist Democrats. Would to God that we had more of them. (Where is Russell Long when you need him? Oh, I guess his Senate spot is now Republican.)

By the very nature of the political process, politicians are focused on the very near-term future. Upcoming elections, like hangings, have a way of focusing the mind on the here and now. A significant part of Trump’s campaign centered on the angst of the white middle class and the ongoing loss of jobs in the Rust Belt – and that focus gave him his margin of victory. Trump promised to bring those jobs back, a sentiment that resonated powerfully with the electorate.

The problem is that at least 80% of manufacturing jobs were lost not to companies moving factories to China or Mexico but to increased automation. Some estimates run as high as 90%. Those jobs are never “coming back.” They are gone. And that trend is going to continue and accelerate. I fully understand that if we do get corporate tax reform, along with some other reforms, it is quite possible that Apple, for example, would move its iPhone 10 factory to the US. But iPhones are increasingly assembled by robots, and in a few years those and other such products will mostly be made on largely automated production lines, whether in China or the US.

That said, if Foxconn does set up a flat-screen display factory in the US, it would create 30,000+ jobs. Of course, they are asking for US government help and subsidies. Note that Apple has 766 suppliers, of which just 69 are in the US. Manufacturing iPhones in the US would be more about the logistics of getting just-in-time components from those other 700 suppliers, which are all over the world. The additional cost for US-based labor would not be all that much.

And that situation is playing out over hundreds of industries. Much of what we buy today is absolutely reliant on a complex, seamlessly functioning global supply chain. Did you know that an Apple iPhone contains about 75 elements, as in periodic table elements? There is iron, aluminum, carbon, and silicon, of course, but also a host of exotics. Most of those aren’t mined or refined in the United States.

Current or near-term jobs in manufacturing are not the critical issue. We are rapidly entering the Age of Transformation, a period in which change will continue to accelerate until it comes at us blazingly fast. And I’m not talking about just the introduction of new technologies; employment and job creation are also changing extraordinarily quickly.

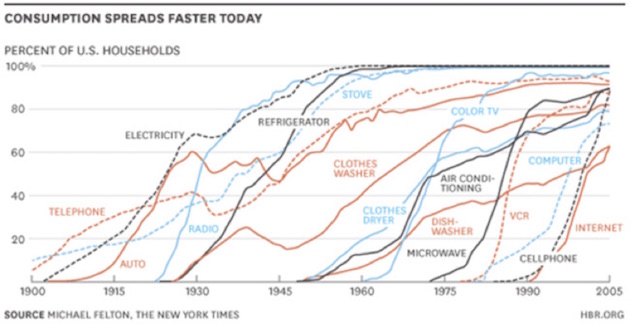

Let’s look at the impact of autonomous (self-driving) vehicles. I am told they are actually available in beta form in Sweden, made by Volvo. Elon Musk promises us an autonomous car by 2020. I wouldn’t want to bet against the man, but I think 2022–23 is more realistic. Then there’s going to be an explosion. Estimates are that by 2030 25% of vehicles will be autonomous. (I want to thank my friend David Galland in his recent column for pointing me to a summary of these figures.) I agree with David that the 2030 figures is likely to be far higher than 25%. The adoption of new technologies happens faster every year. Here’s a chart he used:

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

There are 250 million cars and trucks on US roads today. We buy more than 16 million cars a year, replacing the older part of our fleet. In a world of shared automobiles, which automated cars will allow, we won’t require 250 million cars; we will need far fewer. I could see the total numbers being down 50% by 2030. Autonomous cars are going to be adopted amazingly quickly, especially by Gen X and Millennials. And this Boomer will be an early adopter, too.

Let’s think of the impact. First of all, there are 3.5 million truck drivers, 75% of whose jobs (at least) will be replaced. Ditto for the 250,000 taxi drivers and 160,000 Uber drivers, not to mention the 100,000 Lyft drivers.

Estimates are that automated driving will reduce accidents by 90%. That will obviously reduce insurance costs but will also decimate the ranks of auto insurance agents. Each year 1.3 million people are injured in vehicle accidents, with 40,000 deaths. That’s a lot of hospital visits. Eventually, 90% of those injuries will go away, reducing demand on hospitals and eliminating jobs. We won’t need as many policeman, firemen, and ambulance drivers at accident scenes, either. In total, we could be talking hundreds of thousands of jobs.

And then there are the auto repair companies that make a living off fixing damaged vehicles. There are 500,000 auto repair shops. Obviously, they do more than just repair wrecked cars, but today’s cars and trucks are lasting longer and need fewer repairs. And we are moving to electric vehicles, which have relatively few moving parts, so repairs are becoming much simplified.

There are numerous benefits to autonomous driving, but an increase in total employment is not one of them. Automated driving will create jobs, just not as many as it destroys. The total job loss just in the United States might approach 10 million. These jobs are not going to disappear in year one, but from the point of view of somebody working – and then suddenly not working – in an affected industry, the change will seem like it hit overnight.

And that is just one industry and one technology. Maybe it’s one of the bigger, more dramatic examples, but there are literally hundreds of new technologies that are going to eat up jobs faster than they create them. There are literally tens of millions of jobs in just the US alone that will probably vanish over the next 20 to 30 years. Of course, we have to remember that many jobs have disappeared with the introduction of new technologies every decade for the last 200 years, so this is not exactly something new. The difference is that now it’s happening much, much faster. Rather than moving from the farm to the factory to the office over 10 generations, we will be creating, destroying, and remaking whole industries in half a generation, making the always bumpy transition to a new workforce that much more difficult.

And of course, we need to remember that many new technologies and social inventions will create whole new categories of workers and job opportunities. The road ahead will hardly be a one-way street: all job destruction and no job creation. As we will see, making sure that we create more jobs than we lose is at the heart of tax reform. I promise you, there is a deep, direct connection between tax reform, the creation of new businesses, and employment rates.

The huge generation of Boomers will be retiring and dropping out of the work pool, but absent new job creation, the unemployment rate is going to rise significantly. We are going to get back to job creation in a bit, but first let’s look at a quick snapshot of where we are today.

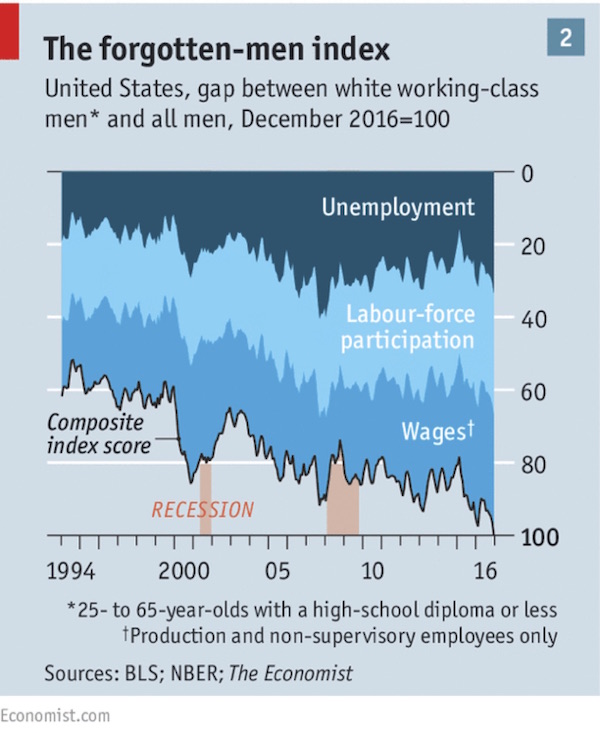

There are 10 million American males between the age of 24 and 64 who have literally dropped out of the workforce, meaning that they have given up on finding a job or are simply not looking. But, focusing on just one subset among those who are 24–64, we see that white working-class males’ labor force participation rate has dropped to 59%. (By working-class males I mean those with a high school degree or less.)

The Economist has created something called a Forgotten Men Index, which shows the gap between white working-class men in particular and all men in general. I bring this data up because white working-class men have become the focus of much current political discussion. The participation numbers are similar or worse for other racial categories except for Asians.

Among the 10 million men not in the workforce – men who are not even looking for a job – 57% of the Caucasian population between 21 and 55 collect disability benefits, which means they can get Medicaid benefits and cheap narcotics: Opioid addiction has become rampant in 50-something men. For the first time in the last 250 years of history, we are watching the probable longevity rates within a demographic segment of the population fall. That specific demographic is working men in their 50s, and the main causes of early death in this cohort are alcohol, drug abuse, and suicide.

Shrinking workforce participation is not a recent trend. It has been happening since the ’60s, through every administration and every tax reform. It seems that with every major technological advance, a certain portion of the working population doesn’t find a way forward to take advantage of the next set of opportunities.

Let me pull a few random quotes from Nicholas Eberstadt’s powerful book Men Without Work. These are just a few of the almost 40 pages that I copied and made notes on from his 200-page book. I could literally write a whole letter just focusing on what I think are important quotes.

The work rate has improved since 2014, but it would be unwise to exaggerate that turnaround. As of early 2016, our adult work rate was still at its lowest level in three decades. If our nation’s work rate today were back to its start-of-the-century highs, approximately 10 million more Americans would currently have paying jobs.

Here, then, is the underlying contradiction of economic life in America’s second Gilded Age: A period of what might at best be described as indifferent economic growth has somehow produced markedly more wealth for its wealth-holders and markedly less work for its workers. This paradox may help explain a number of otherwise perplexing features of our time, such as the steep drop in popular satisfaction with the direction of the country, the increasing attraction of extremist voices in electoral politics, and why overwhelming majorities continue to tell public opinion pollsters, year after year, that our ever-richer America is still stuck in a recession….

All of these assessments draw upon data on labor market dynamics: job openings, new hires, “quit ratios,” unemployment filings and the like. And all those data are informative—as far as they go. But they miss also something, a big something: the deterioration of work rates for American men…

Between 1948 and 2015, the work rate for U.S. men twenty and older fell from 85.8 percent to 68.2 percent. Thus the proportion of American men twenty and older without paid work more than doubled, from 14 percent to almost 32 percent. Granted, the work rate for adult men in 2015 was over a percentage point higher than 2010 (its all-time low). But purportedly “near full employment” conditions notwithstanding, the work rate for the twenty-plus male was more than a fifth lower in 2015 than in 1948.

We will look at Eberhardt’s stats in greater depth in my upcoming series on angst in America. But recent data over the last number of years have begun to show that it is not just the American male who is struggling. The participation rate of female workers is beginning to decline as well.

The trend in the workplace has not been our friend. And any reasonable analysis suggests that in the future the rate at which jobs are being lost to new technologies is only going to double and triple. This is one of the central problems facing society today, not just in the US but all across the developed world. Do you think the trends will be any different in Europe, England, Japan, or China? Those countries will all have their own ways of dealing with this problem, of course; but technology is going to put a strain on the number of jobs available to people without specific technical expertise. And while we would all agree that paramedics require a great deal of technical training, if we need fewer of them because there are fewer accidents (which is a good thing), the paramedic field is just one of 100 different job categories that will feel pressure as technological change transforms the future.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

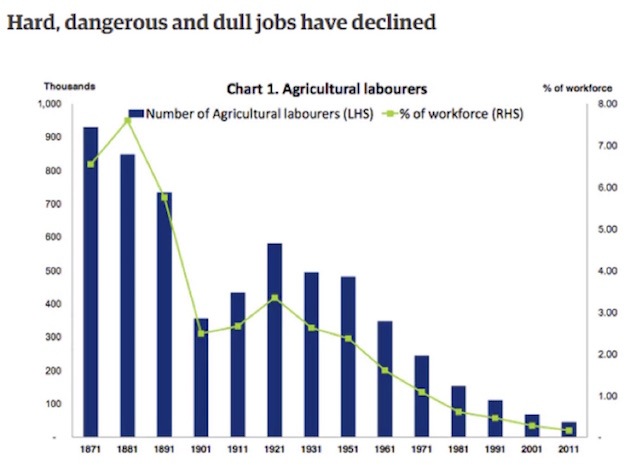

Now here’s where I throw in the plot twist. The research shows that technology has net-net created far more jobs than it has destroyed. You can see this outcome in a wide variety of research over the years, but a recent study by Deloitte (as reported in the Guardian), which drew on data going back to 1871 in England and Wales, found that technology has been a job-creating machine. Part of that is because technology increases people’s spending power, which creates a surge in the demand for hairdressers, bar staff, etc.

Going back over past jobs figures paints a more balanced picture, say authors Ian Stewart, Debapratim De and Alex Cole.

“The dominant trend is of contracting employment in agriculture and manufacturing being more than offset by rapid growth in the caring, creative, technology and business services sectors,” they write.

“Machines will take on more repetitive and laborious tasks, but seem no closer to eliminating the need for human labour than at any time in the last 150 years.”

This pattern has repeated in the US and much of the rest of the world. At least 80% of US workers labored in agriculture at the beginning of the 19th century, but by the middle of that century the number was down to 50%, and today it is substantially less than 2%. And yet we are 16 times more productive than we were 120 years ago. I remember baling hay and throwing those big bales around when I was barely a teenager and the hay weighed almost more than I did. And I worked in the fields from time to time. You took a job where you could get one. It was not a romantic period that I look back and wish I could revisit. (Well, maybe the youth part. But not the hard, dusty labor around scratchy hay bales.)

Seriously, do we bemoan the fact that we’ve lost all those farm jobs? Only if you never had to actually do one of those jobs. And that our food is much less expensive as a percentage of our daily budget? (Unless your spouse forces you to eat everything that is simply labeled organic.)

Do we regret all the people who lost jobs from doing our laundry? Washing our restaurant dishes? Shoveling horse droppings from the street? Oh, you might miss your bank teller, but then you never go to see her/him anymore, do you? Some of us of a certain age remember the milkman who would bring us fresh milk (in recyclable glass bottles). He came at least every other morning. And then there was the ice company that would deliver ice to put in your “icebox,” which would keep food “cool,” on an uneven basis, which was better than simply leaving it to sit on the counter and gather bacteria and mold.

Younger readers may have to click on the link to understand what a marvelous new technology an icebox was, starting in the mid-1800s. Seriously, cutting-edge, life-changing technology. And somebody had to deliver that ice every day. Big heavy blocks of ice. Over and over again. The same route every day. Running the local ice company was a very profitable business. Some 81% of New York inhabitants in the early 1900s had an icebox. (The figure was much lower in the rural South.) But the iceman was a completely different person from the milkman, and they both had to have someone take care of the horses that drew their carts until early in the 20th century, when those remarkable new things called trucks were invented. And now all those jobs are gone.

So now I am here to tell you that technology is not the problem. Technology is the solution. Well, actually I agree it’s the problem if it’s your job. But the solution is to figure out how to get in front of the technology curve or figure out who is in front of it and get involved with them.

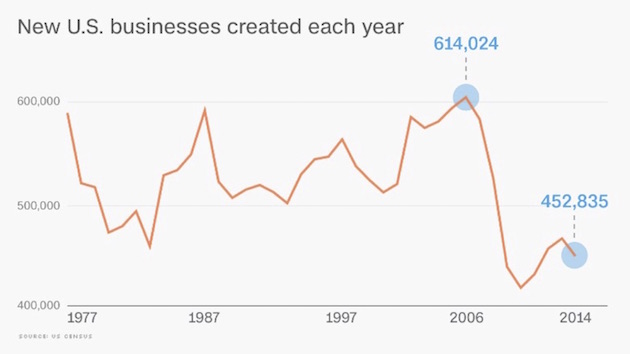

Because, at the end of the day, the data shows that net-net, new job creation comes from small business startups. That is, all of the net new job creation comes from small businesses less than five years old.

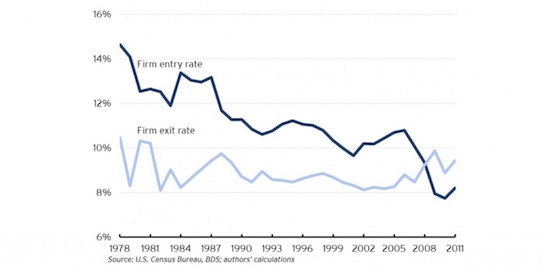

Well, hooray! We are still creating 450,000 new businesses a year. Well, except. Except that we are losing more enterprises every year than we are creating. And we have been since the beginning of the Great Recession.

Part of the problem, as Tyler Cowen describes in his new book, The Complacent Class, is that Americans have seemingly lost some of their entrepreneurial drive. In the 1980s new startups accounted for some 12–13% of all businesses. Today it’s 7–8%. If we want to create an economy that is a jobs machine, we are going to have to have more business startups. Which means that we have to create a climate in which people feel comfortable in launching risky new ventures.

Fewer new businesses means that older companies now represent the largest share of US businesses; and all the data – and I challenge you to find any data that contradicts this (seriously, I would like to see it) – shows that large businesses, as a group, are not net creators of new jobs. They absolutely create new jobs at the front door, but at the back door they are ushering out old jobs. Large businesses are in the business of staying in business. None of them want to be the next Kodak or Blockbuster or Keuffel and Esser. (Miss the significance of K & E? You are young, or if old then not a geek. Details below.)

Large enterprises – those that have more than 500 employees and are more than 10 years old – are net-net destroyers of jobs. For every Google or Apple that is growing its total number of higher-paying jobs, there is a Buggy Whip Corporation or Icebox Corporation that once dominated its industry but is now either defunct or shedding jobs in an effort to stay viable – or else scrambling to change its model and product delivery entirely. This is what Schumpeter called creative destruction, but it is more sympathetically called creative competition. And let’s remember, Google and Apple were once small business startups that for whatever reason (perhaps the genius of their founders) became big and dominant.

Sidebar: Note that Western Union turned down the chance to buy the patents to the telephone. Their reasoning was that they were in the telegraph business. The telephone was something different. They did not realize that they were actually in the communication business. Keuffel and Esser were in the slide rule business. If you don’t know what a slide rule is, look it up, young puppy. I have a 70-year-old, eight-foot classroom slide rule sitting on top of my bookshelves. I bought it for five dollars at an auction over 40 years ago. Every real geek, like me, had at least two or three K & E slide rules, one of which could fit in your pocket while the other was strapped to your side like a six shooter. Come on old geeks, you remember…

Anyway, K & E was offered this new technology called the electronic calculator back in the ’60s, when it could perform only your basic four arithmetic functions, yet the device cost $250. They turned it down, their reasoning being, “Who would want to buy something that can only do a few calculations for $250 when our slide rules can do so much more for a fraction of the cost?” Seriously, we put a man on the moon with K & E slide rules. The company filed for bankruptcy in 1982. Blockbuster? Kodak? Very small startups took them both out.

And with them an enormous number of jobs.

The future is not in old companies that are just getting by or fading. The jobs of the future are in new companies that have yet to be dreamed up. But they will all have to be found and financed.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

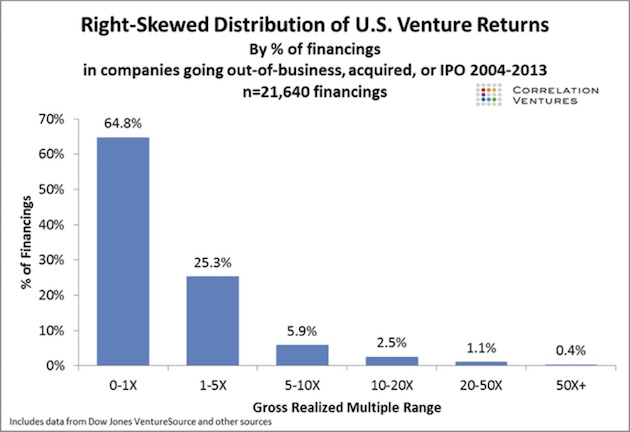

New-business creation is an extraordinarily risky business. Michael Gerber tells us that 80% of all new businesses fail or no longer exist in their original form within the first five years, and 80% of the remaining businesses no longer exist five years after that. The data from seasoned venture capital companies around the country more or less confirms these numbers. Here is a chart that I quickly found:

This is actually one of the more optimistic charts. You don’t need many companies to end up on the far right-hand side of this graph in order to show a decent overall return on investment (ROI). But remember, these are venture capital professionals. When you sit with them, they will tell you that they turn down multiple scores of “opportunities” for every one they jump on. They are supposed to be good at this. And yet two-thirds of their investments lose money. And even with that seemingly dismal track record, people line up to give the best VC firms still more money. Actually, I wish I were big enough to get into that business. A shot at being in on the very beginning of the next Google or Facebook? Priceless.

I have my own checkered past with startups, both my own and others I have helped to finance. Some have been successes; some could be best characterized as tax write-offs; and still others chalked up to “What were you thinking?” moments. That is the nature of entrepreneurship and new-business investing.

If you have the entrepreneurial bug in your gene set, you know what I’m talking about. If you don’t, you may have more money than I do because you have saved yours and not lost it on silly ventures – but you just don’t get it. I have good friends, like Reid Walker, who like to go to Vegas and gamble. I think they are foolish. Wasting money. Can’t they see the odds? And yet I will go and back yet another new venture (my own or others’), even though I know the odds of its success are much worse than I could get in Vegas.

But seriously, I tell myself, this one is different. I can feel it. Just look at the hypothetical performance I calculated. Those potential returns are so sweet. So alluring. I can hit that inside straight. Luck’s going to be a lady tonight.

And every one of those new ventures and the half a million new businesses started every year requires capital. Every $%^&$&^% one of them. Blood and sweat and tears and lots of money. And that money has to come from somewhere.

There are many politicians who think there is a new-jobs fairy. Just give the government more money, and it can create a “jobs program” that will create those new jobs.

Okay, now I’m going to be the guy who told your kids there is no Santa Claus.

There is no jobs fairy. Just call me Mr. Grinch.

All there is, seriously, is a dream factory where some person wakes up and decides they can create a brand-new future that leads to a better world and coincidentally some income for them. Or maybe the desire for income comes first. But then they have to figure out where to get the startup money. Business plans. Credit cards. Family and friends. If you’re connected and in Silicon Valley, maybe an introduction to Kleiner Perkins. And you’d better be damn good if you want to be one of the 5% they choose to back.

Most new businesses are more mundane than high-tech. Hairdressers, bars and restaurants, dry cleaners, and tons of franchise companies. Seriously, franchises are real businesses. For example, 82% of McDonald’s are owned by franchisees. They make between $500,000 and $1 million in profits per year. Various franchises account for over 8% of US jobs. All of the top 50 franchises are rather mundane local businesses – doughnut shops and hair salons and commercial cleaning outfits. Not exactly high-tech but solid jobs nonetheless. Seriously – go to Entrepreneur magazine’s Top 500 Franchise List if you have nothing else to do. Find me a high-tech, cutting-edge startup on the list that is going to be the next Google or Apple. But are these real businesses? Yes. Long-term moneymaking opportunities? Maybe. But costly to start up? Absolutely.

Every one of these new businesses, even the Googles and the Apples, takes new capital to get off the ground. And capital does not fall from the government tree. I have started numerous businesses, and never once did I get a penny from the government to help me. If I made money, the IRS took part of my profits; but if I lost it all, I had to eat that loss myself. So much for the government’s being your partner. (Yes, I know there are a few people who have figured out how to eat at the government trough, but that is a small percentage of the actual successes.)

The new businesses that are going to create the real jobs we need to thrive in the 21st century are still in the dream and garage stages. They’re going to need capital. And they’re going to need people who think they can get a return on their money when they invest, whether they’re putting up their own money or persuading someone else to come in with them.

What we are going to confront next week – and this is the answer to my question at the beginning of the letter – is that total US government spending – federal, state, and local – is more than 35% of the US economy, not including the increase in the national debt every year. Private business is less than twice the size of government and has to support all those government expenses. Yes, I know that some of that support is circular since government employees pay taxes, but their taxes don’t increase the size of the pie. Now, some of you will argue that 35% is less than the 50% or so in many European countries, but that is not the point.

Every dollar of income that goes into paying taxes and supporting the government is a dollar that can’t be invested in a new business and thus create new jobs. I get that that is a simplistic statement. Some people’s savings are simply their savings that they never invest in any new enterprise. And then there are people with my genetic defect who have the entrepreneurial bug and can’t help themselves. They take all their savings and new profits and plow them back into new ventures (rather than going to Vegas).

But on average, the data clearly shows that the more capital there is in a country, the more entrepreneurial capacity there is. And if you tax that capital too heavily, then you’re going to have less entrepreneurial activity. That is substantiated across countries and time in all of the research.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Seriously, show me research that demonstrates that higher-tax countries have more entrepreneurship and business creation than lower-tax countries do. I double dog dare you to come up with something that is not data-manipulated (or from a very small sample) that can even come close to demonstrating that entrepreneurship is not related to available capital. I triple dog dare you.

There is a simple reason that the United States has been an entrepreneurial hub: We have traditionally taxed less than other countries. You can come up with other reasons, other cultural factors, and other explanations; but as an entrepreneur and a businessman and an economist, looking at all the literature, for me it really does boil down to availability of capital. And have you been watching the explosion of new businesses in China as capital becomes available?

Please don’t give me this mumbo-jumbo BS about Federal Reserve interest rates and job growth. If you are starting a business, interest rates make damn little difference. You can’t borrow money from traditional sources anyway, except on your credit cards, which probably carry high interest rates. And maybe you can induce friends and a few other people to take less interest than that on their loans to you, which you have to guarantee. The businesses that are helped by lower interest rates are larger businesses that already have access to the credit window at their banks. But all the research – and I mean ALL the research – shows that large businesses are net destroyers of jobs. So maybe lower interest rates help them destroy fewer jobs, but low rates are not helping them create new jobs.

According to my friends who are talking to people in the Trump administration and my contacts in the Republican Party leadership, the new administration truly gets that job creation is its most important product. From what I hear, Steve Bannon is extraordinarily focused on creating new jobs.

And the Republican leadership understands that cutting taxes and putting more money into the hands of potential entrepreneurs is the way to create jobs. You can call that trickle-down if you want to; but I swear, when I was starting out in my 20s, trying to scrape together every penny (literally), driving 20-year-old cars and kiting checks to start my first business, I didn’t feel like there was anything trickle-down about my efforts. There wasn’t anywhere down from where I was.

There is a reason that some of the fabled startups were born in parents’ garages. That was the only place those young upstarts could afford! And every penny they made got plowed back into the business, over and over again. It wasn’t until much later in the business cycle that they began to live like rock stars. At the beginning, they were just like me. They would wake up at 2 AM and their stomachs would be in knots because they didn’t know where they were going to get the money to pay their employees or the electric bill or to give their wives enough money for food for the kids. Somebody had to actually pay them for their hard work or their great new product so they could turn around and pay what they owed to everyone else. So they got up the next morning, very early, and hit the ground running, believing they could make it happen.

That’s an entrepreneur. And when you tax them and regulate them and create all sorts of obstacles, you don’t get the new jobs they can create. That’s just a fact, Jack. You can live in your %*&^%*&^ ivory towers and point to data flows, and they don’t mean a thing because the data can tell you whatever you want it to tell you. The reality is, it all happens down on the front lines, where entrepreneurs wake up every morning trying to figure out how to make their businesses bigger, better, badder, meaner, leaner, faster. And they try to motivate their (often few) employees to sign on to the vision, for a paycheck – and, in a few cases, a piece of the future.

And that, right down on the bottom line, is why tax reform is so important. I can disagree with Chairman Brady and Speaker Ryan over the specifics of their tax plan, but I wholeheartedly and enthusiastically endorse their vision that we have to let entrepreneurs keep more of their earnings so they can put them back into growing their businesses. (And at the same time, we can’t blow out the budget deficit.) I am Chairman Brady’s biggest cheerleader! Just not so much on one not-so-small tax-reform detail.

And note that if the businesses don’t reinvest and change, they die. You are either in the business of living, or you’re the business of dying. Businesses that live are taking the capital that they make and putting it back into growing their businesses.

Give them less capital, and they grow less. That is manifestly true across time and nations.

Now, what I’ve outlined above says absolutely nothing about how the government should be involved in what we as a collective national social enterprise are doing to more graciously extend the benefits of a changing and improving culture to all of our citizens. Two entirely different topics. I get that we need to more evenly distribute the benefits of future growth. I also understand how those future benefits will be created. And therein lies a chicken-and-egg problem.

It all comes back to Keynes versus Hayek, as does damned near everything economic and governmental. Is it demand, or is it income? Which is primary? The questions about the role of government, and all of the questions I have posed, come down to that root conundrum.

Next week we will get my answer as to what I think the best tax solution is. And I’ll give you the tools to create your own plan. Which I will readily admit might be better than mine! I can pretty much guarantee that my answer will anger 80% of my readers. I am just not sure which 80%. In the hopefully not-too-distant future I will be able to segregate you and know how to write a tax-reform proposal that will make you happy, readers. (Just kidding. I think that would be a huge invasion of privacy, and I would never do it. There’s just too much Hayek in me.)

So that is why this tax-reform process is so important. The longer we wait to build the entrepreneurial foundation for creating the future and the jobs of the future, the less certain and the more frustrating our future will be. We have an opportunity to do something big this year. As in really BIG.

Or we can do nothing. Or do something that will only kick the can further down the road. And if we do that, how do you think the market, which is expecting a big tax-reform bill to come through, will react? The Trump bull market will quickly morph into the Trump bear market. Which do you think will be remembered? Seriously.

Next week we will look at why tax reform is so hard. When you actually look at the numbers, it is enormously complex, and nothing is easy. The Republican leadership in Congress has an extraordinarily difficult job to do to actually come up with a tax plan that can pass both the House and the Senate and that will actually make a difference. Anybody can pass a tax plan that won’t make a difference and call it “tax reform.” We have a once-in-a-lifetime opportunity to really change things.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In the words of Barry Switzer, one of the greatest football coaches of all time, “There’s only one most important thing. Don’t fumble the @%#$@# ball.” In 2017, the Republicans have the ball. Here’s hoping they don’t fumble it.

I will be in New Jersey March 14 and 15. I will be speaking at Summit, Red Bank, and Hackensack, New Jersey, in the two evenings and a lunch. This event is free and is sponsored by my friend Josh Jalinski, who is known as “The Financial Quarterback” on weekend morning radio, which he dominates in the New York/New Jersey area. My good friend Steve Blumenthal will also be doing part of the presentation. The events are already close to capacity; but if you would like to come, drop an email to Tina@jalinski.com and she will get the time and specifics back to you. This is for individual investors – I look forward to seeing you.

As part of the launch of my new portfolio management company, I will be hosting regular dinners at my home for independent brokers and advisers, where we will share with you the specifics of how we are going about changing the way you manage the core of your portfolio. As I keep saying, the key is to diversify trading strategies, not just asset classes. Technology has allowed us to do some marvelous new things, and portfolio diversification in order to smooth out the ride is one of them. One of my goals is to be able to help brokers and advisers get their clients through the storms that we all know are coming as the world struggles to figure out how to deal with the massive amounts of debt and government obligations that are building up. Maybe not this year, but at some point there has to be a great reset, and you need to be able to get your clients through it. If you would be interested in attending to learn more about what we’re doing, drop a note to me at business@mauldinsolutions.com. Give me your name and what firm you are with. We’ll get back to you ASAP. We will start holding the first of my chili dinners late in March and then on a regular basis here in Dallas.

Last night the Mavericks gave Shane and me a game ball during halftime, recognizing the fact that I’ve been a season ticket holder for 32 years. I’ve seen some great basketball and some pretty ugly basketball in those times, but the NBA is still the most beautiful of all sports. There’s just something about the fluid power and grace of the athletes as they fly through the air doing things that we mere mortals can’t (?) do. It’s nice if your team can win an NBA championship, and I’ve seen some of those – and other times we were just oh so close. Then there are the times when it’s just best to throw in the towel and go young and get some draft choices. I’ve lived through it all and expect to be watching 32 years from now. And the players will be bigger, better, faster. Somehow.

I’ve come a long way in those 32 years. My first tickets were literally in the corner on the back row at the highest level of the old Reunion Arena – basically the worst tickets in the arena, but then they were only two dollars apiece. Parking cost me more than the tickets did. We would smuggle our soft drinks in (obviously, back in the days before you had to walk through a scanner or have your pockets searched).

But for two dollars I got to watch Magic Johnson, Larry Bird, Moses Malone, Michael Jordan, Julius Erving, and Isaiah Thomas – all the stars of that era. I got to see Kareem sink skyhooks. Best-spent two dollars of my life. As business got better my tickets got better, until I finally have some of the best tickets (at least for the price) at the American Airlines Center. One of my few indulgences. I have ticket partners, so I only go to about 10 to 12 games a year, but I really enjoy them.

And no, I don’t know Mark Cuban. Well, I have met him three or four times when we used to work out at the same gym. He is basically a gym rat like me. He trains pretty hard and is intense as he prowls the gym floor. He has struck me as a nice guy when we’ve talked. He has randomly sent me a few emails over the years, commenting about things or thanking me for saying something nice about the Mavericks. He may be the most intense owner in the NBA, which I think is a good thing. He runs a smart business, but I really believe he is more focused on winning than on making money on his basketball team.

Time to hit the send button. You have a great week, and hopefully this week I’ll make my deadline and have the letter to you on time this weekend.

Your thinking hard about the jobs of the future analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin