Storms and Patterns

-

John Mauldin

John Mauldin

- |

- August 18, 2023

- |

- Comments

- |

- View PDF

Everything about human life has a rhythm. It is literally built into our bodies: Your heart beats in a repeating pattern that keeps you alive. Your breath is another pattern. Repetition is natural for all of us individually and for the societies we create together. Every society has its own rhythms and traditions.

But there are larger, less formal patterns as well. My last three letters (see Turning Time Part 1, Part 2, Part 3) reviewed Neil Howe’s new book about the Fourth Turning. Today we’ll look at another set of patterns observed by my friend George Friedman in the geopolitical realm. George’s view of how patterns shape countries is different but not inconsistent with Neil’s generational cycles.

The remarkable part, in my opinion, is how both point to a severe crisis later this decade or in the early 2030s. Later in this series we’ll look at Peter Turchin’s work that has the same conclusion, yet from a radically different perspective. When all these thoughtful people independently send the same kind of warning signal from different disciplines, I think we should be paying a great deal of attention. And planning for our own individual/family/company and even national responses.

George Friedman’s ideas I will describe below come from his book The Storm Before the Calm, unluckily published in February 2020 just as COVID consumed everyone’s attention. I hope to put his ideas back in the spotlight because they’re even more important and relevant today. Talking to George this week, he said even with 3+ years of hindsight, he wouldn’t change a thing, although he has written a somewhat lengthy epilogue.

The Storm Before the Calm goes into much more detail than I can here. I strongly urge you to read it—and soon. These events are unfolding rapidly, and the pace will only quicken as the crisis approaches.

|

Navigating the financial landscape with John Mauldin: |

An Invented Country

Let’s begin with a distinction George considers critically important: The United States isn’t like other countries. Its uniquely powerful role in the world relates directly to its unique origins.

Other great powers can trace their “nationhood” back much further. France, for example, already had a distinct culture, language, religion, and national identity centuries before Europeans began settling in the New World. The European explorers found here a vast continent, populated by indigenous peoples who were eventually overwhelmed, either by force or by foreign diseases to which they had no immunity. It wasn't the prettiest of pictures. The various European groups along with slaves from Africa, some Asians, and the remaining Native Americans blended into something entirely new in a relatively short time. Two hundred years isn’t that long in the major nation building process.

This is important because it makes comparisons fail. No large nation in terms of population has ever developed like the US has or with the kind of geography the US has. The US is truly unique in geopolitical terms, making its path through history unique as well.

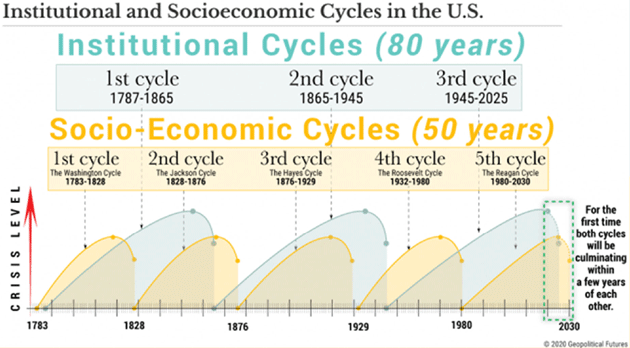

Examining US history since independence, George observed two repeating patterns: an 80-year institutional cycle and a 50-year socioeconomic cycle. Each cycle peaked with a defining crisis, and we are approaching a point in which both waves will crest at about the same time.

This is why George sees a rough period coming. For the first time, we will have an institutional crisis and a socioeconomic crisis together.

Source: Geopolitical Futures

Incidentally, this is a key difference in Neil Howe’s demographic theory, which emerges from the human life cycle. The Turnings happen everywhere, though not every country is on the same timetable. The institutional and socioeconomic cycles George describes are US-specific. They have global importance, however, because the US is so large and influential.

Two Kinds of Crises

In the book George describes how US history unfolded through these cycles. As a history buff I found that part fascinating. As an investor and citizen, though, I want to know what they mean for the near future.

It helps to compare the current cycle crests with their previous iterations. Let’s start with the 50-year socioeconomic cycle. George pegs the last peak in 1980, meaning the 1970s were the critical period. What was happening?

On the social side, George points to what we now (rather quaintly) call the “Sexual Revolution” as key. Changes in sex-related attitudes, marriage, no-fault divorce, abortion, birth control, women’s rights, all combined into a huge social change.

Economically, the country faced inflation but also instability in what had been a national treasure, the automotive industry. Remember the Chrysler bailout? That was 1979, and it helped produce Reagan’s 1980 win and begin a new cycle.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Now roll forward 50 years. Sex and gender issues are again leading the national discourse. The court ruling (Roe v. Wade, 1973) that helped launch the previous cycle has been reversed, leading to great controversy with political effects. Economically, we are seeing the crown jewel technology industry lose much of its shine. It will survive, just as the auto makers survived, but may never regain its previous exalted position. (Technology is always changing, of course. Railroads and electricity were once the cutting edge. Communications of all types changed our culture. But then while they remain important, they are no longer the dominant new thing.)

All that means the country is in social and economic turmoil at the same time as yet another cycle—the institutional cycle—is peaking, too. George says this cycle runs about 80 years, beginning with the Constitution’s passage. The first crisis came 78 years later with a highly destructive Civil War that settled not just the slavery issue, but also the federal government’s supremacy over the states.

The second institutional crisis, again about 80 years later, was World War II. Combined with the various Great Depression programs, it redefined the federal government’s role in the economy. With Bretton Woods it also reordered the global financial system, giving the US undisputed leadership—at least for a few decades.

This period produced “government by experts.” FDR and then Truman (understandably, given the magnitude of their challenges) gave unprecedented authority and influence to those thought to have special abilities. This persisted after the war, seen most recently when Presidents Trump and Biden both turned over COVID crisis management to experts who, while well qualified in their specific narrow fields, couldn’t provide the kind of cohesive leadership the country really needed.

That failure may prove key to what lies ahead.

Failing Experts

As George notes, we haven’t seen the two cycles intersect in this way before. This makes anticipating events even more difficult but it seems likely we will face social crisis, economic breakdown, and structural political change—all at the same time. What will that look like? We should know soon.

George points to one fundamental, overarching problem that encompasses both cycles. In the last 50‒80 years we Americans have lengthened our lifespans while also reducing reproduction. This is wonderful in some ways but is also causing serious problems—socially, economically, and politically.

The economic part you probably know. The demographic changes produced a growing excess of retirement-age Americans, who (unless they keep working) are no longer productive but continue consuming goods and services. Here’s a chart showing the ratio between elderly (65+) and working-age (15-64) Americans.

Source: Connecting the Dots

In 1980, the peak of the last socioeconomic cycle, the US had 5.9 working-age residents for each elderly person. That ratio will have dropped almost in half (to 3.1) by 2030. This is why Social Security and Medicare are unsustainable as presently structured. Something will have to change in the next 5‒10 years, and any way we do it will produce a lot of anger. We will cover this in detail when we begin to explore what I call The Great Reset (not the Davos version which they used well after my coining of the term—and which have VERY different meanings!).

Could this mark the socioeconomic crisis George projects for this same period? Maybe. Or, if we’re lucky, advanced biotechnology might solve some of the health challenges surrounding old age, reducing healthcare costs and enabling older people to stay in the workforce if they so choose. In that event, we would still have a crisis but for different reasons.

In fact, George summarized this view in his Friday morning essay this week (emphasis mine):

“When I was young, the Armageddon that people feared was a population explosion that would overwhelm food supplies. No one at the time could have predicted the effects of birth control and the shift in gender roles. Reproduction became an elective project, and universities were filled with earnest students committed to reducing the population without mass murder….

“How then does this end? I will stay with my original forecast that it will be solved by researchers developing solutions that keep the elderly productive until they die. If this happens, then the workforce can stabilize, and society doesn’t have to choose between well-being and barbarism [of abandoning the elderly]. I foresee a solution; the population will not eat us out of house and home. But until then there will be unrest. The solution to that problem has created a vast new problem that will end in a new crisis. People don’t act until the fear of the devil is placed on them and another crisis threatens everyone. Only the evil fail to see it.”

The institutional crisis is clearer, in George’s view. He believes, as in the pre-Civil War period and the Great Depression, people will have a sense of catastrophe, a belief everything is failing—even the government itself.

In our conversation this week George told me COVID showed, again, how our government has problems dealing with emergencies. That’s not a partisan thing; it’s more a feature of our constitutional system. The Framers designed the government to be slow and inefficient. This has advantages but also leaves us vulnerable when something unexpected happens. We respond slowly.

Trying Everything Else

Now, combine this with the whole “experts” problem. COVID is only the most recent example. It also goes back to the War on Terror, the 1990s financial crises, Vietnam and McNamara’s Pentagon “whiz kids.” The 2008 financial crisis, too. Something bad happens and presidents call in the experts who tell them what to do. Their ideas don’t work, we try others, and eventually get it right.

Cue the Churchill quote: “You can always count on the Americans to do the right thing after they have tried everything else.”

But meanwhile as we try everything else, things get worse.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The Federal Reserve is a similar case. In 1913, after decades of severe banking and financial crises, it was decided we should have a central bank led by a panel of eminent, non-political experts. The sentiment wasn’t wrong; giving control of the money supply to Congress would have its own problems. But the experts are hardly infallible. This is now becoming obvious in many different ways.

And that non-political goal? It is morphing into an elitist, paternalistic (in the true meaning of that word) organization whose leaders wrongly believe they are wise enough to fine tune and control a large free market economy of 330 million people, let alone shape the global world around them. And whose views and philosophies are increasingly, patently problematic. As an example, why is the obviously flawed Phillips curve still even mentioned in polite society? Any business that tried to adopt such an obviously flawed—if not failed—philosophy would soon go out of business. Yet we cede even more power to these “experts.” In the US, in our drive to “try everything else” first, typically the currently “easy” solution, which gives someone else the power to solve the problem, we do seem to make everything worse.

George very recently wrote an epilogue to The Storm Before the Calm. It is a fascinating analysis of where we are today in George's typically blunt manner. Quoting a few paragraphs from the end:

“For this to happen, the federal government must be restructured. The post-World War II model of a deep interlocking of private life with a federal government helmed by experts, poorly overseen and managed by those who can’t see the unintended consequences of expertise, has been outstripped by reality. It is not the size of government that matters but its claim to authority….

“The first institutional cycle [the Revolutionary War] did not define the relationship between federal and state governments. The second [the Civil War] established the primacy of the federal government but did not set its limits. The third [WW2] created almost complete [federal] domination of the states. All were in their time what was needed.

“It follows that the next cycle will be one that accepts the federal government’s primacy but will necessarily require the creation and institutionalization of a new level of expert—the generalist—to make certain that the area experts are both effective and non-contradictory.

“The deeper problem is citizens’ access to the government. Here, I expect that the core relationship of government to states will remain, albeit with two notable changes. First, the states will have at least an informal role in federal decision-making. Second, the states, much closer and more sensitive to their citizens’ interests, will become a channel for allowing citizens to petition their government. This will, in turn, result in curbing unilateral federal authority over states, and shift the World War II model to one that is collaborative or adversarial, both of which achieve the same end.”

This to me is an important insight and one we should pay attention to as we try to navigate the rest of this decade. What we lack, in George’s view, are “generalists” to weigh the competing interests and make decisions for the public good. They can and should get expert advice, but we have to separate that authority/expertise from decision-making over the breadth of society. The decisions should be made by someone responsible to the whole country and selected by the whole country—the president, in other words.

George expects the president whom we elect (or reelect, if it’s Biden) next year to have a very difficult term, dealing with one crisis after another. The 2028 election, if he is right, will then bring a dramatic shift that clears out the system. He expects turbulence but then smoother sailing. Hence his book title, the “storm” before the “calm.”

Is all this necessary? No, but it’s seemingly how we do it here. George thinks the US is as wealthy and powerful as we are because we have these crises. Periodically we remove incompetent leaders and flush out the system, which lets us start over. And every time we start over it’s from a higher base.

Again, I’m only scratching the surface of George’s book. You should read it (AND his epilogue) to get the full wisdom.

I have been a fan, friend, and promoter of George’s writing and thought for almost 20 years. I have often recommended his letter as “must reading.” Let me do so again.

George and his team do multiple essays and geopolitical summaries every week, keeping his readers much better informed than the vast majority of the media world. He is offering a much-reduced subscription to my readers ($59—which is a bargain!) plus his 60-page epilogue updating his thoughts on the current climate PLUS his recent essay, a contrarian analysis of Russia. There is so much material to ponder, which will help shape your response to the coming crisis. You can subscribe by clicking here.

London, Paris, and Dallas

We have finally set the dates and rough itinerary for Europe. Shane and I will fly to London and play tourist and see friends. She is fascinated with all things Anne Boleyn, so we are going to see Hever Castle (which locals tell me is fun) and other sites before taking the Chunnel to Paris mid-week, to again play tourist and see friends culminating in Charles Gave’s 80th birthday on Saturday the 9th. Then she will return to Puerto Rico, and I will go to Dallas for a few days to meet with my partner and see friends (see the theme here?). I have noticed a pattern on my recent travels: I don't exercise and come back home stiff and somewhat weaker, needing my gym. I'm going to have to avoid that on future trips.

I know there are more than a few happenings in the finance and economic worlds, and we will get back to those in a few weeks. But I think it is critically important that we begin from a base of understanding our own culture, history, and society for us to be able to adequately recognize what is going on around us. Treasury bond yields and a rising deficit tell us something about the world as it is today, but to put it in context, we must understand our past and how human nature seemingly repeats itself, or at least rhymes.

And with that it's time to hit the send button. Let me wish you a great week. I will be spending time with friends and researching, but also a group of us will get together to watch the first Republican debates. And while we may learn something, I expect to be more amused/entertained than educated in this somewhat preliminary bout. But I will still watch… You have a great week and don't forget to follow me on X!

Your intending to exercise on this coming vacation analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin