Stall Speed Economy

-

John Mauldin

John Mauldin

- |

- September 18, 2020

- |

- Comments

- |

- View PDF

When Cornwallis surrendered to George Washington at Yorktown in 1781, tradition has it that the British band played an old English children’s folk tune, “The World Turned Upside Down.”

Painting by John Trumbull

If buttercups buzz’d after the bee,

If boats were on land, churches on sea,

If ponies rode men and if grass ate the cows,

And cats should be chased into holes by the mouse,

If the mamas sold their babies

To the gypsies for half a crown;

If summer were spring and the other way ‘round,

Then all the world would be upside down.

In this letter I find myself recommending policies that not that long ago would have been extraordinarily distasteful to me. Yet, unless we pursue them, our economy will truly be turned upside down. I fully recognize these things have a cost. But the cost of inaction is much higher.

Our economic prospects looked bleak back in March and April. Much of the economy was closed down, we didn’t know how bad the virus would get, and it was hard to see a good outcome.

Now the outlook is relatively better. Unemployment, GDP, and other indicators aren’t great but they’ve improved. Yet a “better” outlook isn’t necessarily a good one. It’s just “not as bad.” Today’s numbers would be considered terrible if we weren’t comparing them to truly disastrous numbers from last spring. We avoided the worst because generous fiscal income replacement and business lifelines maintained consumer spending, and in some cases increased it.

If you fly a lot as I do (or used to), you’ve heard the term “stall speed.” An airplane needs to go a certain speed in order to stay aloft. The math behind that idea is pretty simple: lift from the wings must be equal to or greater than the plane’s weight. Lift, in turn, comes from the engine creating forward motion relative to the air. No air flow over the wings means no lift and no flight.

In economic terms, we stayed above stall speed by forcing extra fuel into the engine. The resulting forward motion gave the economy the lift it needed. Now the fuel is running out.

If this plane stalls, as is a real possibility, we won’t like the result. Today we’ll talk about why that is and how to stop it.

No Reserves

The first point to observe: unlike airline passengers, we don’t all share the same forward momentum. Some of us are even going backwards.

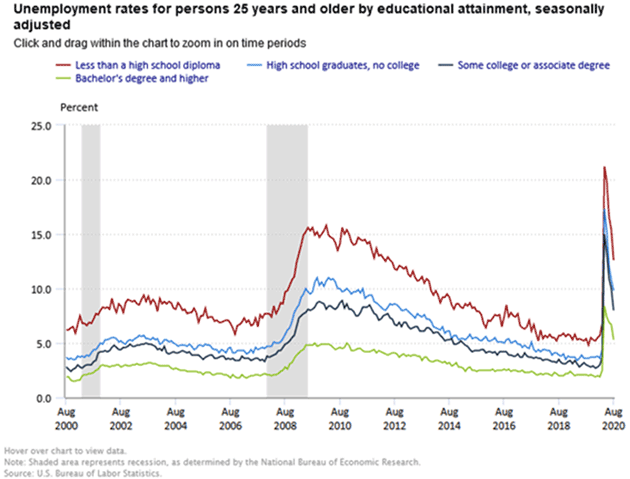

Income loss comes mainly from job loss. This year’s job losses have been concentrated in lower-wage service jobs, often held by less-educated workers.

Source: BLS

Unemployment rose across the board but was much higher for those with less education. As of August, the headline unemployment rate was 8.4%, but it was 11.8% for non-high school graduates and only 5.6% for college graduates.

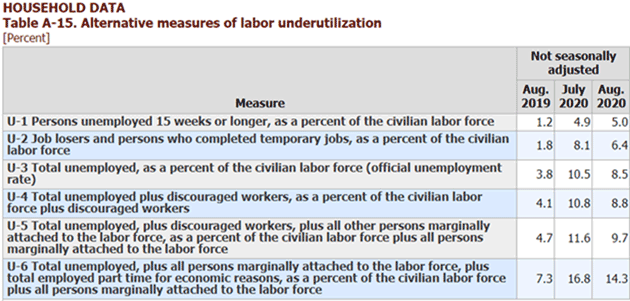

Continued unemployment claims from states suggest the monthly report undercounted the jobless workers. I assume there was some seasonal adjustment that made the difference, but seasonal adjustments are worthless during this crisis. “U-6” unemployment is a far better indicator of where we really are.

Source: BLS

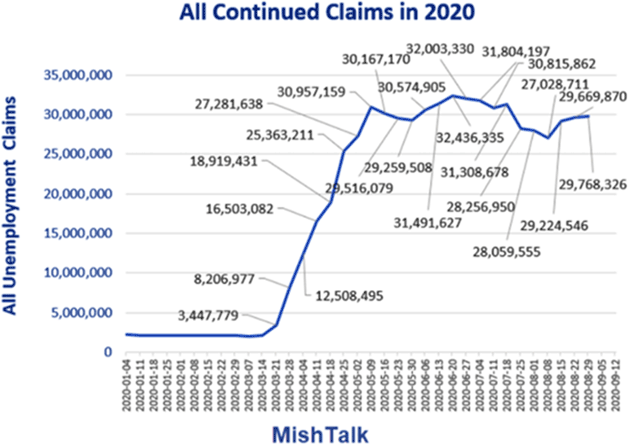

My good friend Mike Shedlock (Mish) does an extraordinarily good job tracking the vagaries of unemployment during this crisis. Including both state and federal benefits shows a far larger number. The chart below includes gig workers, the self-employed, people who have exhausted their state benefits, etc.

Source: Mike Shedlock

Anybody with any connection to the real economy knows people are still falling through the cracks. We just have no way to measure it. As I mentioned, U-6 is 14.3%. I’ll bet you a dollar to 47 doughnuts that real unemployment is closer to 16%. The rest of Mike’s post points out that while things are improving, the rate of improvement is slowing down. But back to my main point.

For a while, “unemployment” didn’t necessarily mean income loss because Congress temporarily increased jobless benefits by a flat $600 weekly, while also sending out $1,200 per person checks, actually raising some workers’ incomes. That expired at the end of July. Trump’s stopgap measures have replaced some of it, in some states, but the amounts are much smaller.

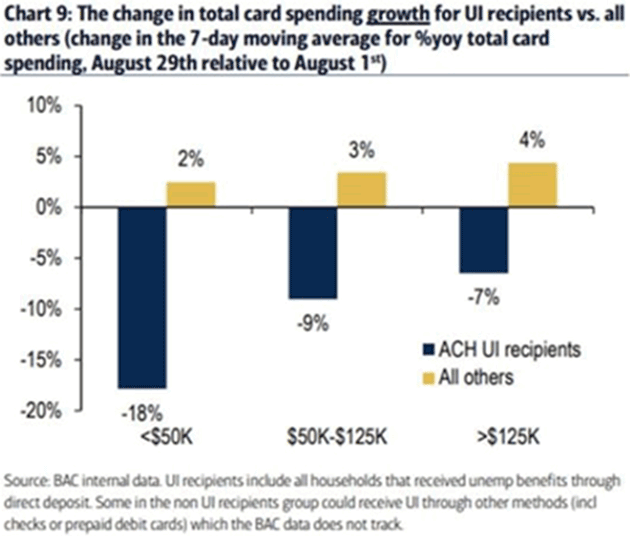

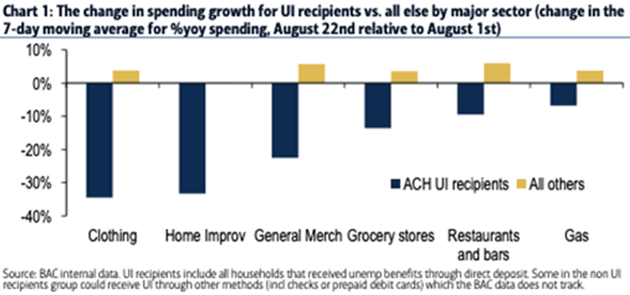

This is already showing up in consumer spending. Banks can track this because most of the benefits are delivered electronically. They can analyze spending patterns for unemployment benefit recipients vs. everyone else. Here is what happened at Bank of America in August.

Source: Ernie Tedeschi

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As benefits dropped, bank card spending growth fell for UI recipients while continuing to grow for everyone else. The drop was worse for lower-income consumers.

This shouldn’t surprise us. Long before COVID-19, a large part of the population spent practically all its income. Those who lost their jobs in March/April and haven’t been rehired have little choice but to cut spending. They have no reserves and little borrowing ability.

A few years ago, I wrote that 60% of America had less than $500 in savings. I haven’t seen recent data, but it is hard to imagine it’s gotten any better. The point back then was that Americans were living paycheck to paycheck. The point now is that many Americans are living unemployment check to unemployment check.

It’s easy to forget that the enhanced unemployment benefits helped more than the unemployed people. In many cases, the “recipients” were simply conduits. They received money from the government and immediately sent it on to their lenders and landlords. The fiscal stimulus kept those people afloat, too. And its ending will hurt them, too.

In fact, the income loss hits across the board. Bank of America also knows where unemployment recipients have been spending, since it processes their card transactions.

Source: Ernie Tedeschi

We see spending affected most in discretionary items like clothing, but also in grocery stores. And remember, this is only just beginning. Benefits payments come in arrears, so many people still got the higher amount in early August.

Quick math: If 20% of the adult population reduces spending 25%, the net effect is consumer spending falls 5%. That, alone, leads to an even deeper stall-speed recession. It will generate more layoffs and bankruptcies, meaning more unemployment, until something gives the economy the lift it needs.

Pointing Fingers

Our gridlocked US political system initially reacted to this crisis with surprising speed, passing several relief bills in March and April. At that point, they expected it would be a few weeks of lockdown then everyone would go back to work. The goal was to “freeze” the economy in place, compensate those who couldn’t work, and target aid to small businesses, airlines, and other affected sectors. The plan had flaws but, under the circumstances, was an impressive example of cooperation and compromise.

Less impressively, the Federal Reserve began throwing liquidity in all directions. This kept financial markets functional and banks open, but at the cost of blowing a market bubble that will, when it pops, negate most of the benefits. Fed officials knew this, I suspect, but also knew they had to do something. They don’t have the tools to directly stimulate employment or capital spending. Jerome Powell has said many times that fiscal policymakers need to do their part.

The politicians, predictably, split on partisan lines. House Democrats passed a $3+ trillion bill that would extend the pandemic unemployment programs, disburse aid to states and localities, give benefits to their favored groups, etc. It has gone nowhere in the Senate, where Republicans object to both the bill’s size and some of the recipients. Pelosi had to know it was a nonstarter, just as Senate Republicans knew their $650 billion bill was a nonstarter. But I admit that I am surprised that it has taken them this long to find a compromise. It’s getting to the point where it is beyond serious.

The economy is just barely at stall speed, coasting along on the previously generated momentum but unable to accelerate. It can only stay in the air so much longer, and our pilots are pointing fingers at each other instead of restarting the engines.

Blood Sport

“Wait a second, Mauldin,” you may be saying. “You’re sounding mighty Keynesian here.” You are correct. My track record for the last 40 years is pretty much in favor of smaller government and government spending, lower taxes, etc. But now the world is upside down. Quoting John Maynard Keynes, “When the facts change, I change my mind. What do you do, sir?”

We are in an unprecedented situation. Close to 30 million workers are on unemployment benefits, and that’s after a partial recovery that is now tapering off. Those benefits are the only thing keeping us out of an outright depression that frankly could be worse than the Great Depression (and I don’t think that’s a hyperbolic statement), and they are about to disappear. I fully recognize my own philosophical flip-flop here. But I would rather be called a hypocrite than see millions suffering.

The fact is, we haven’t seen anything like this before. It’s not just another recession. The pandemic and our efforts to control it unleashed economic demons. We need an exorcist or at least some holy water. Instead we get boring sermons. I’m alarmed and you should be, too.

Philippa Dunne and Doug Henwood calculated this week the stopgap benefit payments, cash for which is coming from FEMA disaster relief funds, are almost exhausted (my emphasis):

FEMA is reporting that it’s spent $30 billion of the $44 billion allocated by the executive order, though all that spending has not showed up in the Daily Treasury Statement yet. In any case, the program will run out of money in a week or two. In fact, a number of states have already run through their allowances. The program will be history before the month is over. And that $44 billion is a bit more than half what the CARES Act program spent in its peak month, June—$80.4 billion. With nearly 28 million people drawing traditional and expanded pandemic benefits, a lot of people are suffering sharp cuts in income now and Congress doesn’t seem to be motivated to address the problem.

I think we have to give Trump at least an A in creativity, if not strict constitutionality, for his $300 a week plan. Congress has “power of the purse” but refuses to use it. I’m sure administration lawyers are looking for other creative financing, but there are important limits as to what the president can do. The much better way would be for Congress to do its job, because so much more is needed.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

One objection to the extra unemployment benefits is they give some recipients more than they made while working, thereby creating a disincentive to work. That is indeed a problem, though with the Labor Department reporting 2.5 unemployed workers for every job opening, it is far from the only challenge (see chart below). But it’s easily solved if the right people want to solve it.

Source: BLS

In fact, some in Congress are actually talking sense. A new bipartisan House Problem Solvers Caucus unveiled a compromise proposal last week that may break the stalemate. It would, among other things, resume the pandemic benefits at $450 a week for two months, then cap the amount to not exceed $600 or the worker’s previous wage, whichever is less.

From my point of view, an even better compromise would be to very slowly reduce the unemployment benefits to provide incentive to go back to work. But that means jobs have to be available. Right now, we have already lost 100,000 businesses and it wouldn’t surprise me if that number doubles, or at least significantly increases, over the next 6 to 12 months. That will be partially offset by new businesses being created, but there will be a lag time.

(Sidebar: Let’s get real. Economists and analysts who use historical precedent to predict this recovery are committing mathematical economic malpractice. There is no historical analogy. This recovery is going to take longer, absent a vaccine which may be available later this year, but will take 6 to 9 months to actually deploy. And it may have to be an annual vaccine. There is just so much we don’t know about this virus. Back to the letter…)

On the downside (from my perspective), the Problem Solvers compromise bill would give state and local governments $500 billion. I think states and local governments should cover their own expenses with their own taxes. But that’s the nature of a compromise: No one gets everything they want. You get a little, give a little, and move forward.

That last item is a major sticking point for Senate Republicans. Yet, even there may be a compromise. Limiting the grants to actual revenues lost should get enough Republicans to go along. It would work like this. Say under the current compromise proposal, state A would get $4 billion. But its revenue is actually only down $2 billion, still a large sum. If you replace just the lost revenue, they would at least get something. Neither side will be happy, but that is the nature of a compromise.

I realize we are in a contentious election season. Feelings are running high. I wish more people would realize our economic challenges transcend politics. We will still be in deep trouble whether Trump or Biden is president next year, and regardless of which party controls the House and Senate. Neither side has all the answers. We need them to set aside the rhetoric and take care of all Americans.

My friend the late Pat Caddell, the famous Democratic pollster, used to say later in life (and on my stage to great applause) he wasn’t a Democrat or a Republican, but an American. In these tough times, I’m trying to adopt that same attitude. Politics shouldn’t be a winner-take-all blood sport. Making it one invites chaos because winners and losers still have to live together.

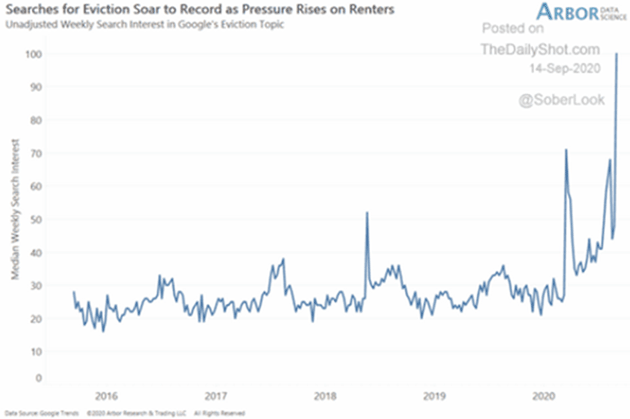

And living together becomes difficult if you don’t even have a place to live. Eviction notices are on hold right now, but not for long. Look at this chart:

Source: Arbor Data via The Daily Shot

We feel sorry for the poor people who are evicted, especially those with children. But landlords are quite often small businesses too, with mortgages that banks expect to be paid. It’s a vicious circle.

I plan to write another letter about the forces that brought us to this place. For now, I hope everyone understands we are on the edge of a cliff. Moves that would normally be harmless could spell disaster. We need leaders to represent all their constituents, not just those who voted for them. This necessarily means compromise. Yes, I’m using that word a lot. It’s not profane. It is a way to get things done. And right now, compromise may be the only way to keep this plane in the air.

Keeping the plane in the air is more than just avoiding a crash. It’s giving us the chance to bring it to a future runway safely.

It’s not all bleak. Even if true unemployment is 15%, it means 85% of us are employed. A free market economy with 100,000 “unemployed” entrepreneurs will soon figure out how to create jobs for the rest.

I am not saying a recovery is years off or impossible. I am optimistic we will recover, but it is not going to be a typical 12-month cycle to see recovery begin. We have to buy ourselves and those entrepreneurs some time to figure out what a post-COVID-19 world looks like. The more time we can buy, the stronger the recovery will be.

I get that adding debt will be a drag on economic growth. That can’t be helped. There’s a hole in the boat and we have to plug it, and while doing so we have to bail and row.

The world is going to be repriced. Everything. We are going to have to find new uses for a lot of things now in surplus, like strip malls and office space, lots of equipment, and those new uses may require lower prices. All while technology is disrupting our world in ways we don’t understand. No one ever said it would be easy.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The 85% of us who are working need to help those who aren’t. Bigger tips. Donations to food banks (have you seen some of the lines for food banks? Depressing.). Look around your own community. Are there ways you can help the at-risk population? We are seeing an epidemic of depression and suicide. Reach out to your neighbors who are lonely. I am sure you can think of your own ways. Then just do it.

In the meantime, call your senators and representatives and tell them to do their @#$%# job. Don’t yell at them for compromising. Support them when they do. We can resume yelling at them when unemployment is 6%.

Gym Time and Bear Market Timing

Something very good happened last week. The governor opened up more of Puerto Rico, including my gym. But what Puerto Rico really needs is jobs. The US Congress and the local government need to enact tax reform for pharmaceutical companies to come here. This used to be a pharmaceutical manufacturing powerhouse. The buildings are still here and it can be so again. 50,000 high-paying jobs would make a monster difference to this island.

To give the locals credit, they have introduced extraordinary incentives to build solar energy plants, and theoretically the bondholders who own the power company bonds can lease the lines to companies that build solar capacity. The local power is so expensive (for good reasons, as we are an island) that solar can be a much cheaper alternative. All that construction would create jobs. And one thing Puerto Rico does have is lots of sun and land for solar plants. Now some entrepreneur just has to make it happen.

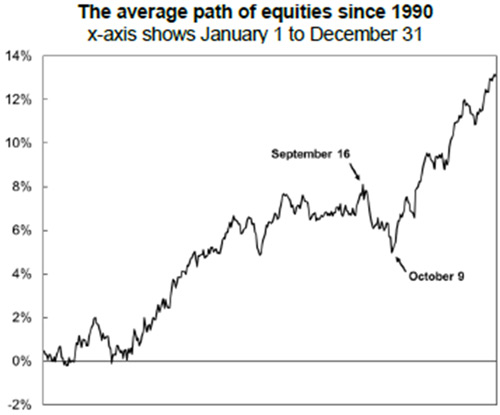

Finally, I posted this on Twitter today from my friend Brent Donnelly. You should follow me here. I get to do a lot more fun, quick posts there. This is an historical reason why the next few days in the markets could be rocky:

Source: Brent Donnelly

And with that, I will hit the send button and wish you a great week!

Your planning on being in the gym more analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin