So Goes the Year?

-

John Mauldin

John Mauldin

- |

- January 28, 2022

- |

- Comments

- |

- View PDF

You’ve heard the old stock market adage, “As goes January, so goes the year.” If so, 2022 will be a wild ride.

Of course, in this context “wild” doesn’t necessarily mean a loss. But it could, and given the well-documented human tendency to buy high and sell low, actual investors could easily lag behind even dismal-looking benchmarks.

The old and often-maligned, “It’s different this time,” is undeniably correct, too. We have never in market history seen anything comparable to the last two years. The virus itself, the fiscal and monetary policies it provoked, the market response to those policies… none of it has been remotely “normal.” We can’t rely on precedent when everything is unprecedented.

Today I want to wrestle with this problem. We’ll review what may be the most compelling bear case I’ve seen in a long time, along with some other unpleasant data. Then we’ll look at some equally compelling reasons those views may be wrong. The best metaphor I can think of is Christopher Columbus seeking a new route to Asia. He and his crew had only a vague idea where they were going… and no idea at all what they might run into first. We’re in truly uncharted waters.

Here I need your implicit promise. If you read the first section, you must read the second and third sections. I don’t want to leave you out on the ledge. The first two will generally be the opinions of others. The final section will be my own.

Multiple Bubbles

By the numbers, 2021 was a great year for stocks. The S&P 500 rose almost 27% in the course of setting many all-time highs. I was dubious that could happen but didn’t rule it out. Goldilocks came through with some help from Jerome Powell. The easiest monetary policy in history remained edible well past its sell-by date.

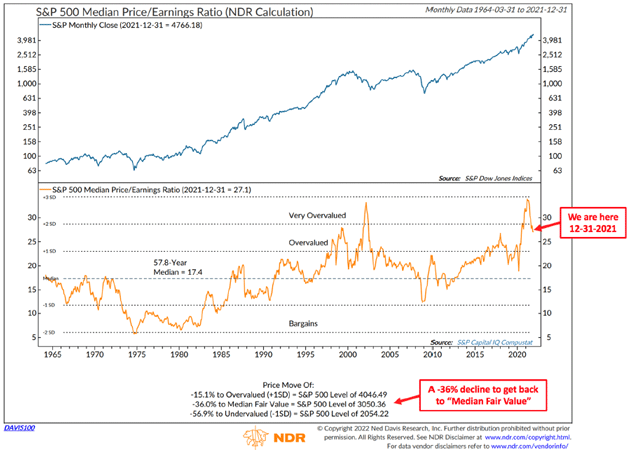

Those who thought the market overvalued a year ago weren’t necessarily wrong. Many different metrics said so. However, math allows an overvalued market to become even more overvalued, as this one did. The same could happen again, but we can have high confidence it won’t keep rising forever. At some point investors will be unwilling (or unable) to buy at these prices, forcing a downward adjustment. That point is certainly closer now.

As he did last year, this month GMO co-founder Jeremy Grantham, who has truly seen it all since the 1960s, issued a fascinating market outlook titled Let the Wild Rumpus Begin (a very clever quote from the fabulous children’s book, Where the Wild Things Are.)

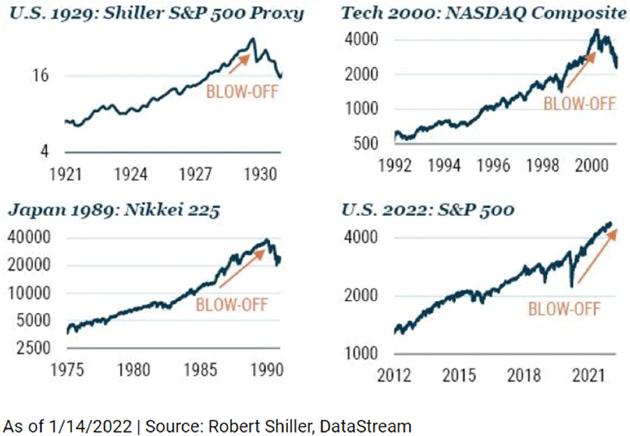

Grantham’s subtitle succinctly captures his theme: (Approaching the End of) The First US Bubble Extravaganza: Housing, Equities, Bonds, and Commodities. In his view, this is a stock market bubble and more. Other asset classes are in equally precarious positions. He talks about the stock and other markets as being multiple standard deviations from trend. He refers to the two standard deviation differential as a 2-sigma event and the rare occurrence of a three standard deviation differential as a 3-sigma event and thus a “superbubble.” Quoting:

All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average.

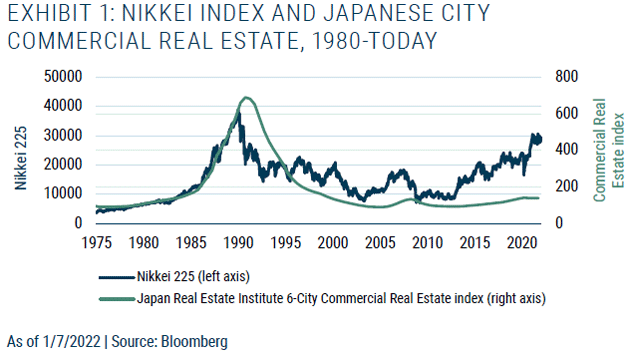

Today Grantham says we are in the fourth superbubble of the last hundred years. In his view, the 2008 crisis was mainly a housing bubble. Stocks were just “normally” overvalued and had a “normal” bear market. What he sees now is quite different and it’s not just stocks. The closest historical comparison is Japan in the late 1980s, when stocks and real estate both climbed to nosebleed level at the same time.

Rather than summarize, I’m going to quote a key section from Grantham’s piece. It is so clear and compelling, I think you should get it straight from the source. Here’s Jeremy Grantham.

“The Dangers of Multiple Asset Bubbles at the Same Time”

“The Japanese case, in particular, made one thing pretty clear: while it is dangerous to have a bubble in equities—for the loss of value can cause a shock through the wealth effect that can get out of control, which was a part of the problem in 1929 and the ensuing slump—it is much more dangerous to have a bubble in housing, and it is very much more dangerous to have both together. The economic consequences of the double bubble in Japan are arguably still playing out. Exhibit 1 shows that neither the equity market nor land have yet recovered their 1989 peaks!

Source: GMO

“But now, for the first time in the US we have simultaneous bubbles across all major asset classes. To detail:

“First, we are indeed participating in the broadest and most extreme global real estate bubble in history. Today houses in the US are at the highest multiple of family income ever, after a record 20% gain last year, ahead even of the disastrous housing bubble of 2006. But although the US housing market is selling at a high multiple of family income, it is less, sometimes far less, than many other countries, e.g., Canada, Australia, the UK, and especially China. (In China, real estate has played an unusually important and unique role in the extended boom and thereby poses an equally unique risk to the economy and hence the rest of the world if its real estate market loses air exactly as it appears to be doing as we sit.)

“Second, we have the most exuberant, ecstatic, even crazy investor behavior in the history of the US stock market. The US market today has, in my opinion, the greatest buy-in ever to the idea that stocks only go up, which is surely the real essence of a bubble. (Interestingly, where other developed countries lead in housing prices, they lag the US in equity prices. Some, such as Japan, by so much that they are merely slightly overpriced today.)

“Third, as if this were not enough, we also have the highest-priced bond markets in the US and most other countries around the world, and the lowest rates, of course, that go with them, that human history has ever seen.

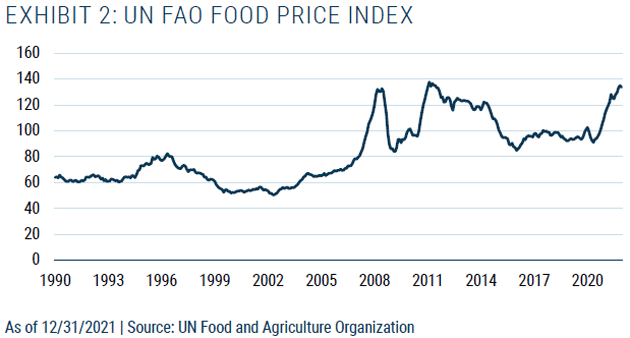

“And fourth, as gravy (as if we needed any) we have broadly overpriced, or above trend, commodities including oil and most of the important metals. In addition, the UN’s index of global food prices is around its all-time high (see Exhibit 2). These high prices are important as they push inflation and stress real incomes. The combination, which we saw in 2008, of still-rising commodity prices with a deflating asset price bubble is the ultimate pincer attack on the economy and is all but guaranteed to lead to major economic pain.

Source: GMO

“What our financial leadership should know is that multiplying these risks—these three-and-a-half bubbles—will multiply the total shock if the damage occurs simultaneously. And this package presents more potential for writing down perceived wealth than at any previous time in history. We wrote in 2007 that deflating US housing prices could directly lose $10 trillion or well over half a year’s GDP if house prices declined to moderately below trend—which they did. But at that time the bond market was merely overpriced at the risky corporate end and the stock market merely normally overvalued. (The stock market still halved in price in sympathy, if you will, with the main event—housing and housing-related debt.)2 Yet despite that recent pain, all of the economic and financial dangers that are now building up from multiple major bubbles do not appear to be considered especially dangerous by the Fed or most of its equivalents around the world. In fact, the warning signs appear to be barely noticed at all.”

There are plausible arguments these four markets aren’t as bubble-like as Grantham thinks. We’ll look at some in a minute. Nonetheless, it is significant and ominous to have all this happening at the same time. It wouldn’t take all four (if they are all truly bubbles) to set off a calamity. A serious breakdown in any one of the four assets he cites—housing, stocks, bonds, commodities—would probably trigger at least one of the others, like the housing breakdown triggered the bear market in 2008 (in large part because it also involved a recession). That would be bad even if it ends there, and it may not.

Let’s look at some rather disturbing metrics on the stock market. We will let the charts speak for themselves. First from the GMO piece linked above:

Source: GMO

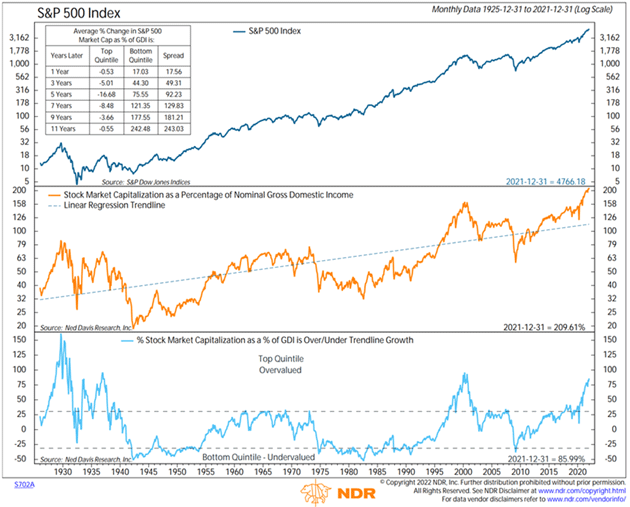

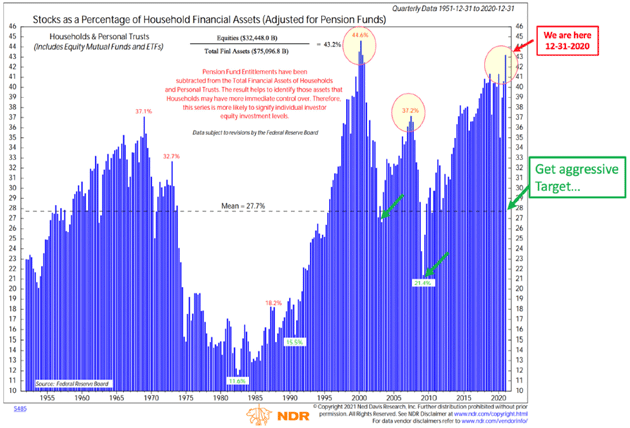

Here are several charts from my friend Steve Blumenthal’s recent letter. More to raise your eyebrows:

Source: CMG

Note the periods of above and over trend and what happened after in this next chart. See good entry points?

Source: CMG

Again, note historic entry points and what happens after peaks, and remember, we don’t know what constitutes a peak until long after it has been reached and rolls over.

Source: CMG

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

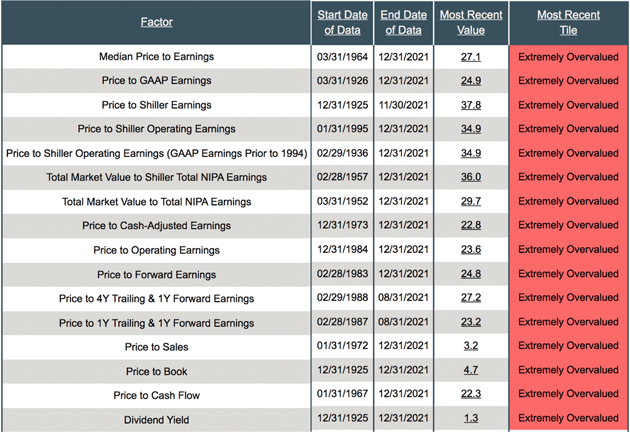

After showing multiple charts about what is expected to be future 10-year returns based on valuations, especially from peaks, Steve shows us this summary of various indicators in their current condition (from the prestigious and top-notch Ned Davis Research):

Source: CMG

Ouch. Now, a different approach.

No Credit Crunch

The economy is a giant machine of near-infinite complexity. Predicting the sandpile’s collapse may be all but impossible. And even if it is possible, brilliant people can see the same data and reach different conclusions. My good friend Ed Yardeni (whom I’ve been following for almost 25 years—time certainly flies) looked at Jeremy Grantham’s piece, acknowledged it makes some good and unsettling points, then offered his own counterpoints.

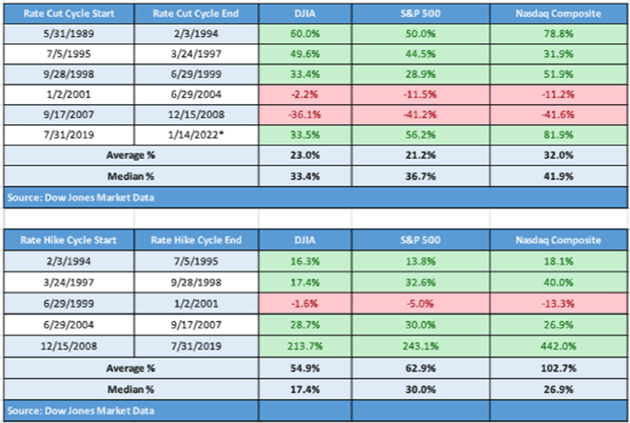

He began by saying bear markets usually spring out of recessions, which are usually triggered by credit crunches. What causes a credit crunch? Often it’s the result of monetary policy tightening. The Fed, while not there yet, is headed in that direction. But it matters a great deal how much the Fed tightens. Here’s Yardeni.

“It’s hard to imagine that the Fed will cause a credit crunch by raising the federal funds rate. It is widely expected that this rate will be up to 1.00% by year-end 2022 and 2.00% by year-end 2023. One reason that’s hard to imagine, as we have observed recently, is that there’s probably $3 trillion of excess liquidity in M2, as measured by its latest reading and the pre-pandemic uptrend in this series. It’s also hard to see inflation becoming so intractable that the Fed is forced to push the federal funds rate up to recession-causing levels, i.e., a ‘Volcker 2.0’ scenario.”

In other words, rates are now so deeply negative, the Fed can hike quite a bit without affecting credit conditions. Ed thinks inflation won’t get out of hand and provoke a Volcker-like tightening. If so, then credit could keep flowing fast enough to keep markets happy, though perhaps not at the recent torrid pace (or small corrections here and there).

Yardeni also thinks we will avoid recession this year. This is important. As we will see, recessions make a monster difference. A slowdown in goods spending is likely but it would give businesses opportunity to boost depleted inventories. Services spending should rise once we get past this Omicron wave and, along with pent-up vehicle demand, boost the economy later this year. This will keep inflation moderate and give the Fed a better shot at the “soft landing” scenario.

But most important, Yardeni thinks the stock bubble Grantham sees, if that’s what it is, is already deflating. The meme stocks, SPACs, and cryptocurrency booms are all losing air quickly with no dire impact on the rest of the market, at least so far. The giant tech stocks that have led the broad market higher (what Yardeni calls the “MegaCap-8,” still $11 trillion total market cap) are also correcting. Quoting:

“The S&P 500’s MegaCap-8 stocks (i.e., the eight highest-capitalization stocks in the index) collectively peaked at a record high on December 27 and fell 14.0% through Friday’s close. The MegaCap-8s account for about 50% of the market cap of the S&P 500 Growth stock price index, which peaked on December 27 and is down 13.0% since then through Friday’s close.”

Smart tech funds are getting pummeled (cf. ARKK), the Russell 2000 is down considerably, and my beloved biotech sector is off more than 30%.

Source: MarketWatch

Thus, significant portions of the market are already in bear market territory. But as Yardeni points out, the MegaCap-8 are still holding up.

As for the other bubbles, Yardeni thinks energy and commodity demand is in line with a global economic rebound from the pandemic depths. (I roughly agree.) It doesn’t look like speculative excess to him. Similarly, US housing prices are being bid higher not by speculators, but by would-be homeowners facing a serious shortage of homes for sale. He agrees bonds look bubbly, but doesn’t seem concerned with yields already so low.

So we have two compelling but opposite outlooks. What’s an investor supposed to do?

“Two Bubbles Off Dead Center”

Growing up and even through my 40s, working on construction and home improvement projects, I would use a bubble level. My dad used to say when something wasn’t quite right, “It’s about two bubbles off dead center.” That seems a good description for the economy today.

As I file this article January still has 1.5 trading days to go, but it doesn’t look good. Historically, years with a negative first month have still ended positively most of the time—but a lot less so than years that began strong. Call me cynical, but I don’t think the kind of investors who now dominate the daily flows will be happy with a 2% year. Much less a -20% one.

Yet we have to remember that little legend you see on every prospectus and fund advertisement: “Past performance is not indicative of future performance.” Unlike the path-dependent central bankers I’ve criticized, stock market investors are free to bail out anytime. Or to stay in, or jump in deeper. As long as they have cash (or access to credit), they can do crazy things longer than we think possible.

Combine this with the truly unique economic environment. This isn’t a normal business or credit cycle. Everything around us is a few bubbles off dead center, quite frankly. Every economic data series has a giant black hole in 2020. We see what happened but it resembles nothing before or since. Combine that with an over-the-top easy monetary policy and none of the past performance metrics we looked at above have the same validity that they might have following a normal recession.

So how to respond? I’ve said for a long time, even before COVID, the 2020s would be a time for rifles and not shotguns. If you own “the market” via index funds or ETFs, then the market is what you’ll get. That may be fine and appropriate for some people, but I don’t know who they are. I personally prefer strategies that don’t need the market to behave a certain way. They aren’t easy to find and, sadly, aren’t always available to the small investors who need them most, but they do exist.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

If your assets are in the right place then you don’t have to worry so much about bubbles, whether they will pop or keep getting bigger. It won’t affect you so much either way. That’s a big part of the “freedom” we all seek.

Now the question you really want me to answer: Are we going to have a bear market? The answer is certainly, but I’m not sure when. And it makes a difference when it happens.

There are two types of bear markets. Those not associated with recessions, like 1987 and 1998, tend to have quick V-shaped recoveries. Bear markets that coincide with recessions usually last longer. This MarketWatch chart shows the difference.

Source: MarketWatch

Let’s war game here. Many equity segments are already in bear markets, except for value stocks, serious dividend stocks and the mega-cap 8 or 10. As Yardeni noted, the MegaCap-8 are off 14% as of a few days ago. If they drop 25%, the rest would likely fall more (as an average) generating at least a 30% decline. That would certainly qualify as a bear market. But if we avoid recession, history says a relatively rapid recovery is likely.

As I’ve long said, the Fed has painted itself into a corner. Trying to restore something like normal, with positive real rates and a reasonable balance sheet, won’t be easy. The Fed will need a lot of luck to kill inflation without causing a recession.

Powell does have a few things going for him. The economy is relatively strong right now. As Omicron recedes, more people will come back into the workforce and fill the demand for labor. The more time Powell can buy, the better the supply chain situation gets. That will help on the inflation front. He could possibly get rates above 1% (oh, the horror!) and inflation near 3% and falling. The markets will notice the world is not ending, setting up that V-shaped recovery.

Now it may not recover to all-time highs in the short term, but a reasonable bounce off the lows seems possible. Beaten-down stocks will be “on sale.” Rifle shots are warranted.

That means we have to pay considerable attention to GDP. A recession is possible given the obviously tightening monetary policy, QE going away, and no possibility of any reasonable physical stimulus. That would probably mean a more serious bear market and slower recovery.

Not every tightening period has led to recession. But ending the massive QE we have had for almost 2 years and raising rates by a predicted 2% over two years, with the possibility of actually quantitative tightening? In a period of inflation? Oh yes, recession is very possible.

And remember, inflation is more than supply chain issues. The details in the inflation numbers will be very important, too. Recession odds grow if Powell has to go further than currently expected to stamp out inflation.

Valuations don’t always signal tops or bottoms, but they are useful for projecting long-term returns. With where we are today, index fund returns will likely not be very good. Rifle shots are the key.

Parting shot: Massive quantitative easing from Fed leaders from Bernanke through Powell (and including Greenspan’s easy monetary policy) helped produce massive wealth disparity in the US. Something like 80% of stocks are owned by the top 10%. The bottom 50–60%? As Grantham says, they are a rounding error.

The Federal Reserve bears significant responsibility for creating today’s social climate and divisions. Unintended consequences, for sure, but consequences nonetheless. This is academic Keynesianism run amok. But that’s a story for a different letter…

Living with a Chef in Puerto Rico

With no travel scheduled, which everyone knows is fattening, I have actually reached my target weight of 184 pounds, unseen except for brief periods in decades. My peak was 213. Helping that is Shane, who has been taking lessons from a local “celebrity chef” and is now studying with a vegan chef (which I must confess is less exciting to me). But between not traveling, eating healthier meals, and maybe exercising more, I seem to have lost weight without really trying.

The letter is already long, so I will hit the send button. Follow me on Twitter. We do have some fun there. Have a great week!

Your happy to be in nontraditional assets analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin