Preparing for a Credit Crisis

-

John Mauldin

John Mauldin

- |

- September 10, 2011

- |

- Comments

- |

- View PDF

The Consequences of Austerity

Euro Break-Up – The Consequences

Welcome to the Hotel California

The Slow March to Recession in the US

Preparing for a Credit Crisis

What Can You Do About the Weather?

Europe, Houston, New York, and South Africa

“I am sure the Euro will oblige us to introduce a new set of economic policy instruments. It is politically impossible to propose that now. But some day there will be a crisis and new instruments will be created.”

- Romano Prodi, EU Commission President, December 2001

Prodi and the other leaders who forged the euro knew what they were doing. They knew a crisis would develop, as Milton Friedman and many others had predicted. They accepted that as the price of European unity. But now the payment is coming due, and it is far larger than they probably thought.

This week we turn our eyes first to Europe and then the US, and ask about the possibility of a yet another credit crisis along the lines of late 2008. I then outline a few steps you might want to consider now rather than waiting until the middle of a crisis. It is possible we can avoid one but, as I admit, whether we do (and the extent of such a crisis) depends on the political leaders of the developed world (the US, Europe, and Japan) making the difficult choices and doing what is necessary. And in either case, there are some areas of investing you clearly want to avoid. Finally, I turn to that watering-hole favorite, the weather, and offer you a window into the coming seasons. Can we catch a break here? There is a lot to cover, so we will jump right in.

The Consequences of Austerity

The markets are pricing in an almost 100% certainty of a Greek default (OK, actually 91%), and the rumors in trading circles of a default this weekend by Greece are rampant. Bloomberg (and everyone else) reported that Germany is making contingency plans for the default. Of course, Greece has issued three denials today that I can count. I am reminded of that splendid quote from the British ’80s sitcom, Yes, Prime Minister: “Never believe anything until it’s been officially denied.”

Germany is assuming a 50% loss for their banks and insurance companies. Sean Egan (head of very reliable bond-analyst firm Egan-Jones) thinks the ultimate haircut will be closer to 90%. And that is just for Greece. More on the contagion factor below.

“The existence of a ‘Plan B’ underscores German concerns that Greece’s failure to stick to budget-cutting targets threatens European efforts to tame the debt crisis rattling the euro. German lawmakers stepped up their criticism of Greece this week, threatening to withhold aid unless it meets the terms of its austerity package, after an international mission to Athens suspended its report on the country’s progress.

“ ‘Greece is “on a knife’s edge,”’ German Finance Minister Wolfgang Schaeuble told lawmakers at a closed-door meeting in Berlin on Sept. 7, a report in parliament’s bulletin showed yesterday. If the government can’t meet the aid terms, ‘it’s up to Greece to figure out how to get financing without the euro zone’s help,’ he later said in a speech to parliament.

“Schaeuble travelled to a meeting of central bankers and finance ministers from the Group of Seven nations in Marseille, France, today as they face calls to boost growth amid increasing threats from Europe’s debt crisis and a slowing global recovery.” (Bloomberg: see http://www.bloomberg.com/news/2011-09-09/germany-said-to-prepare-plan-to-aid-country-s-banks-should-greece-default.html)

(There is an over/under betting pool in Europe on whether Schaeuble remains as Finance Minister much longer after this weekend’s G-7 meeting, given his clear disagreement with Merkel. I think I take the under. Merkel is tough. Or maybe he decides to play nice. His press doesn’t make him sound like that type, though. They are playing high-level hardball in Germany.)

Anyone reading my letter for the last three years cannot be surprised that Greece will default. It is elementary school arithmetic. The Greek debt-to-GDP is currently at 140%. It will be close to 180% by year’s end (assuming someone gives them the money). The deficit is north of 15%. They simply cannot afford to make the interest payments. True market (not Eurozone-subsidized) interest rates on Greek short-term debt are close to 100%, as I read the press. Their long-term debt simply cannot be refinanced without Eurozone bailouts.

Was anyone surprised that the Greeks announced a state fiscal deficit of €15.5 billion for the first six months of 2011, vs. €12.5 billion during the same period last year? What else would you expect from increased austerity? If you reduce GDP by as much as Greece attempted to do, OF COURSE you get less GDP and thus lower tax revenues. You can’t do it at 5% a year, as I have pointed out time and time again. These are the consequences of allowing debt to get too high. It is the Endgame.

[Quick sidebar: If (when) the US goes into recession, have you thought about what the result will be? A recession of course means lower GDP, which will mean higher unemployment. That will increase costs due to increased unemployment and other government aid, and of course lower revenues as tax receipts (revenues) go down. Given the projections and path we are currently on, that means even higher deficits than we have now. If Obama has his plan enacted, and if we go into a recession, we will see record-level deficits. Certainly over $1.5 trillion, and depending on the level of the recession, we could scare $2 trillion. Think the Tea Party will like that? Governments have less control than they think over these things. Ask Greece or any other country in a debt crisis how well they predicted their budgets.]

The Greeks were off by over 25%. And they are being asked to further cut their deficit by 4% or so every year for the next 3-4 years. That guarantees a full-blown depression. And it also means lower revenues and higher deficits, even at the reduced budget levels, which means they get further away from their goal, no matter how fast they run. They are now in a debt death spiral. There is no way out, short of Europe simply bailing them out for nothing, which is not likely.

Europe is going to deal with this Greek crisis. The problem is that this is the beginning of a string of crises and not the end. They do not appear, at least in public, to want to deal with the systemic problem of too much debt in all the peripheral countries.

Without ECB support, the interest rates that Italy and Spain would be paying would not be sustainable. I can see a path for Italy (not a pretty one, but a path nonetheless) but Spain is more difficult, given the weakness of its banks and massive private debt. These are economies that matter.

How do they get out of this without a debt crisis on the scale of 2008? By coming to grips with the problem. Germany is apparently doing that this weekend, by preparing to use the money it was going to pour into Greece to shore up its own banks. That is a much better plan. But as a well-researched report (by Stephane Deo, Paul Donovan, and Larry Hathaway in the London office – kudos, guys!) from UBS shows, solving the problem will be very costly. The next few paragraphs are from their introduction.

Euro Break-Up – The Consequences

“The Euro should not exist (like this)

“Under the current structure and with the current membership, the Euro does not work. Either the current structure will have to change, or the current membership will have to change.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

“Fiscal confederation, not break-up

“Our base case with an overwhelming probability is that the Euro moves slowly (and painfully) towards some kind of fiscal integration. The risk case, of break-up, is considerably more costly and close to zero probability. Countries cannot be expelled, but sovereign states could choose to secede. However, popular discussion of the break-up option considerably underestimates the consequences of such a move.

“The economic cost (part 1)

“The cost of a weak country leaving the Euro is significant. Consequences include sovereign default, corporate default, collapse of the banking system and collapse of international trade. There is little prospect of devaluation offering much assistance. We estimate that a weak Euro country leaving the Euro would incur a cost of around €9,500 to €11,500 per person in the exiting country during the first year. That cost would then probably amount to €3,000 to €4,000 per person per year over subsequent years. That equates to a range of 40% to 50% of GDP in the first year.

“The economic cost (part 2)

“Were a stronger country such as Germany to leave the Euro, the consequences would include corporate default, recapitalization of the banking system and collapse of international trade. If Germany were to leave, we believe the cost to be around €6,000 to €8,000 for every German adult and child in the first year, and a range of €3,500 to €4,500 per person per year thereafter. That is the equivalent of 20% to 25% of GDP in the first year. In comparison, the cost of bailing out Greece, Ireland and Portugal entirely in the wake of the default of those countries would be a little over €1,000 per person, in a single hit.

“The political cost

“The economic cost is, in many ways, the least of the concerns investors should have about a break-up. Fragmentation of the Euro would incur political costs. Europe’s ‘soft power’ influence internationally would cease (as the concept of ‘Europe’ as an integrated polity becomes meaningless). It is also worth observing that almost no modern fiat currency monetary unions have broken up without some form of authoritarian or military government, or civil war.”

Welcome to the Hotel California

Welcome to the Hotel California

Such a lovely place

Such a lovely face

They livin’ it up at the Hotel California

What a nice surprise, bring your alibis

Last thing I remember, I was running for the door

I had to find the passage back to the place I was before

“Relax,” said the night man, “We are programmed to receive.

You can check out any time you like, but you can never leave!”

- The Eagles, 1977

You can disagree with the UBS analysis in various particulars, but what it shows is that there is no free lunch. It is not a matter of pain or no pain, but of how much pain and how is it shared. And to make it more difficult, breaking up may cost more than to stay and suffer, for both weak and strong countries. There are no easy choices, no simple answers. Like the Hotel California, you can check in but you can’t leave! There are simply no provisions for doing so, or even for expelling a member.

The costs of leaving for Greece would be horrendous. But then so are the costs of staying. Choose wisely. Quoting again from the UBS report:

“… the only way for a country to leave the EMU in a legal manner is to negotiate an amendment of the treaty that creates an opt-out clause. Having negotiated the right to exit, the Member State could then, and only then, exercise its newly granted right. While this superficially seems a viable exit process, there are in fact some major obstacles.

“Negotiating an exit is likely to take an extended period of time. Bear in mind the exiting country is not negotiating with the Euro area, but with the entire European Union. All of the legislation and treaties governing the Euro are European Union treaties (and, indeed, form the constitution of the European Union). Several of the 27 countries that make up the European Union require referenda to be held on treaty changes, and several others may choose to hold a referendum. While enduring the protracted process of negotiation, which may be vetoed by any single government or electorate, the potential secessionist will experience most or all of the problems we highlight in the next section (bank runs, sovereign default, corporate default, and what may be euphemistically termed ‘civil unrest’).”

Leaving abruptly would result in a lengthy bank holiday and massive lawsuits and require the willingness to simply thumb your nose in the face of any European court, as contracts of all sorts would have to be voided. The Greek government would have to “conveniently” pass a law that would require all Greek businesses to pay back euro contracts in the “new drachma,” giving cover to their businesses, who simply could not find the euros to repay. But then, what about business going forward?

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Medical supplies? Food? – the basics? You have to find hard currencies for what you don’t produce in the country. Greece is not energy self-sufficient, importing more than 70% of its energy needs. They have a massive trade deficit, which would almost disappear, as who outside of Greece would want the “new drachma?” Banking? Parts for boats and business equipment? The list goes on and on. Commerce would slump dramatically, transportation would suffer, and unemployment would skyrocket.

If Germany were to leave, its export-driven economy would be hit very hard. It is likely that the “new mark” would appreciate in value, much like the Swiss Franc, making exports from Germany even more costly. Not to mention potential trade barriers and the serious (and probably lengthy) recession that many of their export and remaining Eurozone trade partners would be thrown into. And German banks, which have loaned money in euros, would have depreciating assets and would need massive government support. (Just as they do now!)

Can a crisis be avoided? Yes. But that does not mean there will be no pain. We can avoid a debt debacle in the US, but doing so will mean reducing debt every year for 5-6 years in the teeth of a slow-growth economy and high unemployment. It will require enormous political will and mean many people will be unemployed longer and companies will be lost.

Ray Dalio and his brilliant economics team at Bridgewater have done a series of reports on a plan for Europe. Basically, it involves deciding which institutions must be saved (and at what cost) and letting the rest simply go their own way. If they are bankrupt, then so be it. Use the capital of Europe to save the important institutions (not shareholders or bondholders). Will they do it? Maybe.

The extraordinarily insightful and brilliant John Hussman recently wrote on a similar theme. He is a must-read for me. Quoting:

“The global economy is at a crossroad that demands a decision – whom will our leaders defend? One choice is to defend bondholders – existing owners of mismanaged banks, unserviceable peripheral European debt, and lenders who misallocated capital by reaching for yield and fees by making mortgage loans to anyone with a pulse. Defending bondholders will require forced austerity in government spending of already depressed economies, continued monetary distortions, and the use of public funds to recapitalize poor stewards of capital. It will do nothing for job creation, foreclosure reduction, or economic recovery.

“The alternative is to defend the public by focusing on the reduction of unserviceable debt burdens by restructuring mortgages and peripheral sovereign debt, recognizing that most financial institutions have more than enough shareholder capital and debt to their own bondholders to absorb losses without hurting customers or counterparties – but also recognizing that properly restructuring debt will wipe out many existing holders of mismanaged financials and will require a transfer of ownership and recapitalization by better stewards. That alternative also requires fiscal policy that couples the willingness to accept larger deficits in the near term with significant changes in the trajectory of long-term spending.

“In game theory, there is a concept known as ‘Nash equilibrium’ (following the work of John Nash). The key feature is that the strategy of each player is optimal, given the strategy chosen by the other players. For example, ‘I drive on the right / you drive on the right’ is a Nash equilibrium, and so is ‘I drive on the left / you drive on the left.’ Other choices are fatal.

“Presently, the global economy is in a low-level Nash equilibrium where consumers are reluctant to spend because corporations are reluctant to hire; while corporations are reluctant to hire because consumers are reluctant to spend. Unfortunately, simply offering consumers some tax relief, or trying to create hiring incentives in a vacuum, will not change this equilibrium because it does not address the underlying problem. Consumers are reluctant to spend because they continue to be overburdened by debt, with a significant proportion of mortgages underwater, fiscal policy that leans toward austerity, and monetary policy that distorts financial markets in a way that encourages further misallocation of capital while at the same time starving savers of any interest earnings at all.

“We cannot simply shift to a high-level equilibrium (consumers spend because employers hire, employers hire because consumers spend) until the balance sheet problem is addressed. This requires debt restructuring and mortgage restructuring. While there are certainly strategies (such as property appreciation rights) that can coordinate restructuring without public subsidies, large-scale restructuring will not be painless, and may result in market turbulence and self-serving cries from the financial sector about ‘global financial meltdown.’ But keep in mind that the global equity markets can lose $4-8 trillion of market value during a normal bear market. To believe that bondholders simply cannot be allowed to sustain losses is an absurdity. Debt restructuring is the best remaining option to treat a spreading cancer. Other choices are fatal.”

See (http://hussmanfunds.com/wmc/wmc110905.htm for the rest of the article.)

You think the world’s central banks and main institutions are not worried? They are pulling back from bank debt in Europe, as are US money-market funds. (Note: I would check and see what your money-market funds are holding – how much European bank debt and to whom? While they are reportedly reducing their exposure, there is some $1.2 trillion still in euro-area institutions that have PIIGS exposure.)

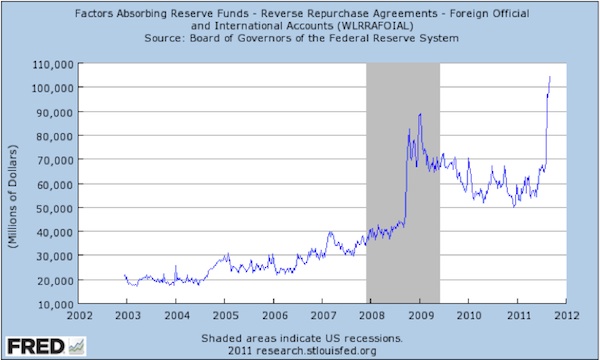

Look at the following graph from the St. Louis Fed. It is the amount of deposits at the US Fed from foreign official and international accounts, at rates that are next to nothing. It is higher now than in 2008. What do they know that you don’t?

The Slow March to Recession in the US

Until there is a real crisis in Europe, the US will continue on its path of slower growth. Economists who base their projections on past history will not see this coming. Analysts who base their earnings estimates on recent performance are going to miss it (again.) Note: analysts, as I have written numerous times in this letter, are so very, very bad as a group at predicting future earnings that I am amazed people pay attention to them; but they seemingly do. They consistently miss tops and bottoms. That is the one thing they are very good at.

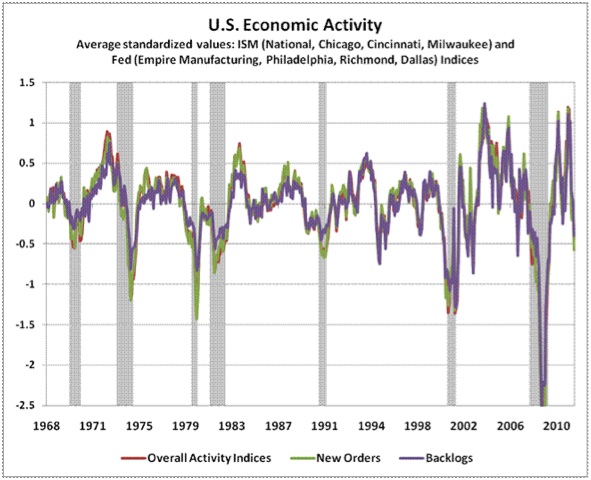

John Hussman, in the same report, offers the chart below, which is a variant on themes I have highlighted in past issues, but with his own personal twist. It is a combination of four Fed indices and four ISM reports. And it has been reliable as a predictor of recessions – one of which it strongly suggests we are either in or heading into.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

And recent revisions to economic data suggest that companies are going to have even more trouble making those powerhouse earnings that are being estimated. As Albert Edwards of Societe Generale reports this week:

“… at the start of 2011, productivity trends took a remarkable turn for the worse – especially compared to what was initially reported. An initial estimate that Q1 productivity grew by 1.8% was transformed to show a decline of 0.6%. A slight 0.7% rise in Q1 ULC (unit labor costs) was transformed to show a staggering surge of 4.8%! In addition to that 4.8% rise, ULC rose a further 2.2% in Q2. But the news gets even worse Last week the BLS revised the ULC rise in Q2 up from 2.2% to 3.3% QoQ. US non-farm business unit labor costs are now rising by 2% yoy. That is very bad news for profits. Bad news for equities. And because the pace of ULC is a key driver of inflation (upwards in this instance), it is bad news for an increasingly criticized and divided Fed.”

Preparing for a Credit Crisis

There is so much that could push us into another 2008 Lehman-type credit crisis. As I say, it is not a given, but the possibility should be on your radar screen. Lehman may have been the straw that broke the camel’s back, but there were a lot of other problems. Prior to 2008, we had seen several large companies in the financial world simply disappear. REFCO comes to mind. Not a whimper in the markets. But Lehman was one of a dozen problems all over the world resulting from the larger subprime crisis. Howard Marks of Oaktree writes about simultaneous problems in the markets and what happens:

“Markets usually do a pretty good job of coping with problems one at a time. When one arises, analysts analyze and investors reach conclusions and calmly adjust their portfolios. But when there’s a confluence of negative events, the markets can become overwhelmed and lose their cool. Things that might be tolerable individually combine into an unfathomable mess whose extent and ramifications seem beyond analysis. Market crises are chaotic, not orderly, and the multiplicity and simultaneity of contributing causes play a big part in making them so.”

I did an interview with good friends David Galland and Doug Casey of Casey Research yesterday. They are decidedly more bearish than I am, so wanted an “optimist” to sit on their panel. But they forced me to admit that some of my optimism depends on the probability of US political leaders doing the right thing. Depending on your opinion about that, you are more or less prone to think there is a crisis in our future. And while I like to think it is not me showing a home-town bias, I think Europe has worse problems and a tougher situation than the US. A crisis there is more likely, I think.

But whether you want to make it 50-50 to 70-30 or (pick a number), there is a reasonable prospect of another credit crisis. So what should you do?

First, think back to 2008. Were you liquid enough? Did you have enough cash? If not, then think about raising that cash now. When the crisis hits, you have to sell what you can for what you can get, not what you want for reasonable prices.

I am personally raising more cash in my business. I usually invest money as soon as I can. Now, I am still investing, and you too should still put money to work in places that you think have the potential to do well in a crisis. Go back and see what worked in 2008 and buy more of it! Long-only funds did not work. Those that were more nimble did.

In the next crisis, opportunities to buy assets on the cheap will grow, so having some cash will make it easier to buy things you want to own for the next 10-20 years, whether income-producing or just something you want for fun.

Think through your portfolio. In 2008 I watched investors liquidate solid funds, or sell off assets at fire-sale prices, because that was the only way they could raise cash, when that was the time to invest more, not redeem. Make sure you are the “strong hand.”

Understand, I am not saying sell your conviction stocks. I have some and am buying more. But no index funds, no long-only, unhedged funds. I make very specific choices when it comes to long-only investments that I am looking to hold over and beyond a ten-year horizon. And those are risks I want to take (at least today).

I do not want to own anything that looks like an index fund or long-only mutual fund. Think 2008. I want funds and managers that have an edge and have a hedge, preferably both.

I would not be long money-center bank stocks or bonds, not in the US and especially not in Europe. I have had private off-the-record conversations with Republican leaders. There is simply no willingness to do another TARP-like bailout of bondholders and shareholders. I believe them. As Hussman suggested, this time bondholders will lose. I just don’t know which ones will be ready, and there are lots of other places to deploy assets. If you feel you have some special insight, then be my guest; but I just see too much risk for the potential reward, especially in large bank bonds that pay so little. That is not to say they are all equally bad – certainly not the regionals with less exposure to Europe. But do your homework.

(Caveat: I do think even the GOP leaders will have to cave in and allow the government to be “debtor-in-possession” of the too-big-to-fail banks we allowed to exist under the really bad financial bill called Dodd-Frank, which needs to be repealed and replaced. We have to preserve the system, but not shareholders and bondholders, who will lose this time.)

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Think through your business. Banking relationships are not what they used to be. Spend time now getting commitments. Remember the odd spike in 2008 in bank lending? It was from credit lines being drawn down. But no one got new lines at the time. What can you do if sales get tough? What can you do to increase market share when your competitors start to pull back? The winners in 2008-09 were the companies that increased innovation and did not pull back (according to a Boston Consulting Group survey).

If you plan correctly, the next crisis will be an opportunity for you and not a personal crisis. And you will be better able to help those who need it.

A special note. In a few weeks I will be sending out an email that will contain a link to a totally free treasure trove of business and marketing ideas you can use to keep your business at the cutting edge, whether you are established are just starting out. It is one of those things I can do that costs me very little, but that sometime may mean a lot to you. I am just glad to be in the position to help a little.

I know I sound rather stark at times, but I really don’t want you to dig a hole and get in and cover yourself up. I do not. While we are perhaps somewhat more cautious, we are also looking for ways to grow and be more aggressive here at my business. I will keep repeating: look for the opportunities. They are there. Just gauge your risk appropriately.

What Can You Do About the Weather?

The answer is, not very much, but you can prepare. I have arranged for my readers to get the latest copy of the Browning Newsletter, written by Evelyn Browning Gariss, who I think of as one of the world’s greatest climatologists. Her letter is a monthly must-read for me, and it is a steal at $250 a year. You need to read it for a few months to get the feel for it, as you may find it full of new terms, but you’ll soon get the hang of it. There are in fact patterns. And this winter we are sadly being set up for what may be a repeat of last year’s weather in the Southern Hemisphere, and rain at the wrong time in the US, during harvest. You can read the latest issue at my website, http://www.johnmauldin.com/frontlinethoughts/browning-newsletter-0911. (You will need to type in your email address to get it.)

Europe, Houston, New York, and South Africa

I leave in a few weeks for a whirlwind trip to Europe (London, Malta, Dublin, and Geneva) and then back. A quick trip to Houston for a conference (https://www.webinstinct.com/streettalkadvisors/) and then I fly to New York for the weekend, where I will be speaking at the Singularity Summit, which is October 15-16. This is an outstanding conference, and I am honored to be asked to speak. It is really a bunch of wild-eyed futurists (like your humble analyst) getting together to think about what the future holds for us. For two days I get to be an optimist, if only in the longer term! Ray Kurzweil is the guiding light, and he has assembled an all-star cast. You can learn more at www.singularitysummit.com/. For those who can make it, I think you will come back amazed and more positive about the future of our world. And you can see videos of previous conference presentations at their website – well worth an evening or two or three, and the price is right. But if you can make the conference, you will enjoy the experience and meet new friends. And then I’ll fly to South Africa for two nights, and head back home.

It is good to have Tiffani back in Dallas and home and in the office. She has been in Europe for most of the summer, staying with friends and working from there. Even with Skype, it’s just not the same. And she did bring the granddaughter back with her! And one of the twins and her husband have moved back to Dallas, so 6 of 7 are now local. The other is coming soon, I hope! Dad likes to have his kids near.

It has been a very hectic week. Can I get busier? And computer issues have been a plague. To deal with it, we purchased two new HP laptops, and one will now be a mirror, so I will not go down if my computer fails. It is just too cheap not to do it, and lost time is frustrating and costly. I am amazed at what you can get for $1250: 8 gigs of RAM, a terabyte of memory – more power than I can use – cool 17-inch screens, a fingerprint reader camera, and I think there is even a grill attachment somewhere.

And speaking of grills, we did get a new one for Labor Day. About 30 people were here, and I spent most of the day cooking. It was time for fun and family and friends. I need more times like that to remind me of the real values in life, and why we will get through all this hassle. The future was in my home, and what a future it will be! My plan is to hang around a long time to see them enjoy it.

This Sunday Rich Yamarone (of Bloomberg) will be here to brave a family brunch gathering. Then Barry Habib shows up on Wednesday for a day-long planning session on a new venture, ending with a great meal somewhere. (This food theme keeps recurring!) Have a great week. And find some great food of your own! Enjoy life’s pleasures!

Your actually losing weight in spite of the great food analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin