Open Letter to the Next President, Part 4

-

John Mauldin

John Mauldin

- |

- April 2, 2016

- |

- Comments

- |

- View PDF

An Open Letter to the Next President, Part 4

Where to Find $1 Trillion of Free Money

Making America Competitive Again

New York, Dallas, and Abu Dhabi

For the past three weeks I’ve been discussing the economic realities the new president will face when he or she takes office next January, using the device of an “open letter to the next president.” Mostly, we’ve been dealing with the economic realities that other countries face and with how difficult the global economic climate is going to be during the next president’s first four years. I briefly outlined last week the stark reality of what will happen to the deficit and national debt in the next four years, and I offered a chart of what would happen if (as I think likely) we have a recession within four years. The deficit would immediately blow out to $1 trillion. That figure is before any stimulus and in all likelihood does not include the significant amounts that will have to be spent on unemployment reserves, etc.

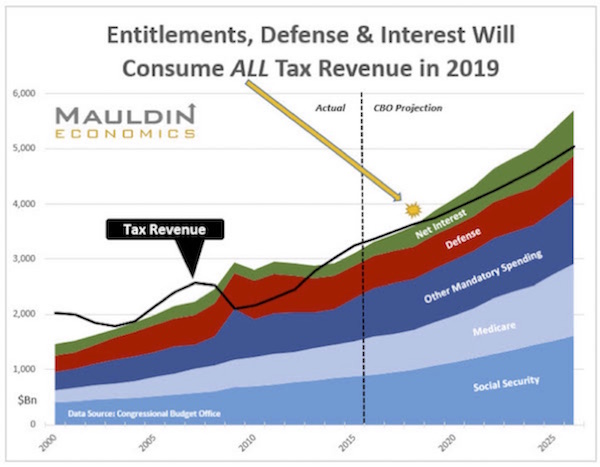

Just to refresh your memory, let me reproduce the two key graphs. The first shows that entitlements, defense, and interest will consume all tax revenue by 2019. Thus, any spending beyond those three items will require the United States to borrow money and continue to grow its soon-to-be $20 trillion debt.

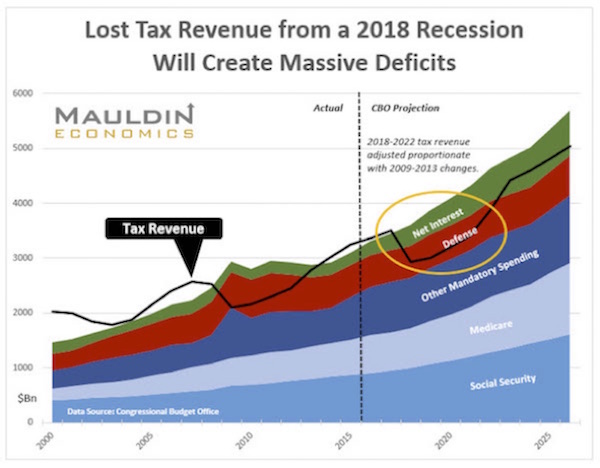

This second chart shows what will happen if we have a recession in 2018 and if lost tax revenue is roughly what it was during past recessions (in terms of a percentage of overall spending). The deficit would quickly rise to $1.3 trillion a year and according to current CBO projections would not fall below $1 trillion over the following 10 years. Even at low interest rates, net interest expenses become bigger than defense spending during that period. And I should point out that the chart below does not increase net interest expense in line with what will be a much larger rise in debt. If anything, the chart below understates the amount of net interest that will accrue.

Today we are going to look at what the next president might do in response to recession – and possibly even to prevent a recession. I actually think a positive path can be found, but following it will take an enormous political effort and a big shift in the current environment of noncooperation.

In trying to outline how we might proceed, I am reminded of a story about a small Baptist church in a rural area of Eastern Kentucky. The preacher decided to talk to his congregation about the evils of sin. He started out by declaring that he was against the sin of lying, the sin of adultery, the sin of theft, and the particularly pernicious sins that accompany dancing. As he was warming to his topic, he was getting a steady chorus of amens from the assembled, which of course stoked his enthusiasm.

So he decided to get to one of the real big sins on his list. He announced that he was against the sin of making and drinking moonshine. At which point five members of the congregation, including two of his deacons, stood up and started to walk out. Somewhat baffled, he asked, “Where are you gentlemen going?”

“Well, pastor,” drawled one fellow as he walked out the door, “it seems to me that you done stopped preachin’ and gone to meddlin’.”

(For my non-US readers who might be scratching their heads at this, the mountainous areas of the Southeastern US are famous for their “nonregulated” (read illegal) “moonshine” liquor production. In certain areas, the production of moonshine was widespread during prohibition and continues today. Those of us of a certain age can remember sipping such illegal contraband from fruit jars. For my French and European readers, think of your countries’ “Eau de Vie” (for my US readers, that’s “water of life,” and it’s every bit as potent as moonshine. Both can be used either as a beverage or as paint thinner. Back to the main plot.)

This letter is definitely going to fall into the category of meddlin’. I can pretty much guarantee that no matter where on the political spectrum you fall or which economic philosophical camp you pitch your tent in, the policies that I’m going to recommend to the next president will horrify you. You will think that these are unbelievably bad choices. And the irony is that in some cases I’m even going to agree with you. But hard choices are what we have come to. We have a divided nation that’s not going to be any less divided after the coming election, and no one is going to get what they want.

An Open Letter to the Next President, Part 4

Dear Mr. or Ms. Future President,

Last week we looked at what will happen to the budget deficit and national debt if we enter into a recession during your first term in office. I think you will agree that the picture looks ugly. As it happens, a whole host of economic analysts are worried about just that possibility. Their concern is summed up by this statement from Bill Gross:

The reality is this. Central bank polices consisting of QE’s and negative/artificially low interest rates must successfully reflate global economies or else. They are running out of time. To me, in the U.S. for instance, that means nominal GDP growth rates of 4–5% by 2017 – or else. They are now at 3.0%. In Euroland 2–3% – or else. In Japan 1–2% – or else. In China 5–6% – or else. Or else what? Or else markets and the capitalistic business models based upon them and priced for them will begin to go south. Capital gains and the expectations for future gains will become Giant Pandas – very rare and sort of inefficient at reproduction. I’m not saying this will happen. I’m saying that developed and emerging economies are flying at stall speed, and they’ve got to bump up nominal GDP growth rates or else.

You, as the next president, can help get GDP moving again. But let’s be clear, if we slog along in the same general direction, entrusting our national future to the same general policies we follow today, there will be a recession on your watch. If you wait until there’s a recession and then hope the Federal Reserve will do something to pull us out of a nosedive, it will already be too late. The good news is that there are policies you can enact during your first 100 days in office to radically alter the growth path of the United States. The bad news is that those policies are going to be politically difficult to effect and you are going to have to spend a great deal of the new political capital you have to do so. But it will be the most important thing you do in your first term. (If, on the other hand, you don’t act decisively, it may be your only term.)

It is not news to you that there is political gridlock in Washington. Republicans and Democrats in Congress don’t agree on the economic policies I’m going to suggest. There are entrenched ideas on both sides of the aisle about the best way forward; and, to be generous, those ideas are mutually exclusive. Your problem is that you need to balance the budget. One side wants to do it by cutting spending, and the other side wants to do it by raising taxes and spending even more. The country seems to want a great deal more healthcare but doesn’t want to actually pay for it. How can you satisfy both Republicans and Democrats while at the same time creating a few million jobs in the very short term to forestall a recession?

You are going to get Congress to compromise. That means giving each side something it wants badly enough to be willing to let the other side get something it wants and needs. Here is what I think you could do. Let me note that numerous economists and politicians will tell you that different pieces of what I am suggesting are impractical or are philosophically just plain wrong. It’s just that they won’t agree as to which pieces are the problem. Your task is to get them to compromise so that something can actually be done.

Where to Find $1 Trillion of Free Money

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

When there is another recession, the Federal Reserve is going to cut rates back to 0% and will likely enter into another round of aggressive quantitative easing. (Interest rates and QE are just the tools they have left in their bag.) They will do this even though their own economists don’t think quantitative easing works all that well as far as Main Street is concerned. QE is very good at propping up stock prices, but it didn’t do much for the economy and just made the rich richer, breeding a lot of resentment.

The problem from the Federal Reserve’s standpoint is that they would like to pursue a different type of quantitative easing, but they are actually quite limited in what they can do by the Federal Reserve Act. In order for the Fed to buy other types of assets or move money more directly into the economy, Congress would have to amend that act. You may not have been paying much attention to the debate going on about the Federal Reserve, but I can tell you, there is zero appetite among the Congressional leadership to bring up anything like the Federal Reserve Act. Doing so has the potential to be a real circus. But you need Congressional leadership to do this so that you can accomplish your agenda, so you’re going to have to sit on the leadership and tell them to control their members. You need some amendments to the Federal Reserve Act.

Specifically, what you want to do is to authorize the Federal Reserve, the next time they feel they need to use quantitative easing to stimulate the economy, to be able to issue 40-year 1% bonds that can be used to repair the infrastructure of states and municipalities all across the nation. These should be projects that would be self-liquidating and capable of paying off the bonds, just as any general revenue bond issuer would, over the 40 years. No boondoggles and no bridges to nowhere. Focus on water systems, electric grids, bridges, roads, public transportation, airports – things that everybody understands as basic infrastructure. Estimates are that we need to spend about $2 trillion (on the low side) to bring our infrastructure up to date.

Understand, you don’t want to be seen as dictating policy to the Fed, which is supposed to be an independent entity. The Fed will guard that independence quite fiercely. No, you are merely giving them another tool to use. Now, they can still do QE in the same way they’ve done it in the past and never take up the new tool you’ve given them – that would be their decision – but I believe they are politically smart enough to take a hint.

Of course, that doesn’t help you right away. We all remember the last time we tried to find “shovel-ready projects” in order to do stimulus. Turned out there weren’t so many. So what can we do in the meantime?

We get creative. It turns out the Federal Reserve has added about $3 trillion to its balance sheet in the past few years. That money is sitting in US government bonds and government-guaranteed mortgage assets. As those assets are paid off, the Fed is reinvesting the money back into other bonds and mortgage assets.

So-o-o-o, when you are authorizing those new infrastructure bonds, you give the Fed the right to begin to buy them today. As soon as the commission you create to oversee the issuance of the bonds is up and running, cities, counties, and states can begin to offer their projects for immediate funding.

And those projects are going to create hundreds of thousands if not millions of jobs as they come online during the first few years of your first term. That is stimulus we can believe in, and it will help forestall a recession. Further, all those new jobs will carry salaries that will increase consumer spending in local communities and generate a wave of related private investment.

From a political standpoint, this is probably the easiest thing you will get to do. You are starting with a few trillion dollars already available to boost the economy without raising that money by taxing US citizens. What politician is not going to love that? All you are doing is taking an asset that the Federal Reserve already has and that is basically useless and turning it into a productive asset. If only the rest of my suggestions were as easy.

Making America Competitive Again

The second easiest part of my proposal is to cut the corporate tax rate. Everyone in Washington, DC, on both sides of the aisle, pretty much agrees that US corporate tax rates are too high. The reason they haven’t cut them is that politicians want to make corporate tax cuts part of a larger tax reform plan. They all feel they’re being pushed to give up something on taxes, and they want corporate taxes to be part of the deal. Understandable, and you are going to have to offer them a bigger tax reform package, but this is the easy part.

The hard part is that you need to go farther than they are thinking of going today. You need to get bold.

Looking around the world, companies try to locate in countries that are the most tax friendly to their profits. That is why Apple, Google, and thousands of other American businesses have trillions of dollars in cash accounts overseas: if they brought the money back they would have to pay an outrageous 35% tax on it. What businessman in his right mind wants to reduce his working capital by 35%?

Further, as nearly all of you candidates have noted, too many very large corporations in the US (and many more not-so-large ones that fly beneath the radar) are allowing themselves to be “acquired” by foreign competitors, because to do so significantly reduces their taxes and benefits their shareholders. Some of you have sat on the boards of public companies, and you know that you are supposed to put the shareholders at the top of the list of people you serve. Your job is to make sure they get the maximum benefit from their investment in the company. Reducing US taxes is regrettably one way to do so.

Right now, the corporate tax rate in Ireland is 15%. The rest of Europe is pretty annoyed with Ireland for charging such a low rate, but their reaction hasn’t stopped Ireland from doing so. The country is seeing a massive benefit in terms of income and job growth, not to mention the increased travel- and housing-related income that comes with so many businesses locating in Ireland. Now, I have nothing against Ireland – the country of my forebears – but the reality is that, all things being unequal, the US would be a better place to locate your business. And the thing to do, then, is to make all things even better than equal.

Why not propose and enact a 15% US corporate tax rate? Yes you could propose 20% or 25% and it would be better than what we have, but what we want is for all of those companies that left the United States and are no longer paying taxes to decide to come back and pay us that 15% tax. And that should be 15% on every dime they make above $100,000. The tax form should be very simple. Put the amount of money you made in Box A, subtract $100,000, and pay 15% of the amount in Box B.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As a way to get politicians to go along with such a low rate, offer to enact a 10% rate on the international profits of all these companies, so that no matter where US corporations make their money, they are paying something to the US. A 10% rate isn’t going to change their investment decisions, and they are likely to just bring the money home at that point, putting it to work in our institutions and infrastructure (especially if we improve our infrastructure so that we are more competitive.)

As part of this program, you’re going to offer to get rid of all deductions. Period. End of story. If it doesn’t fall under normal GAAP accounting guidelines as a deduction, it’s a profit and needs to be taxed. Get rid of the 3,000 or so special tax benefits for various and sundry corporations and industries. That means hedge funds don’t get carried interest, oil depletion allowances become subject to normal depreciation, new assets are written off over the useful life of the asset, and so on.

You’re dropping their taxes to a point where companies will probably be just as well off and maybe even better off without the deductions, as they will no longer need to pay their lobbyists to work so hard to wheedle special favors out of Congress.

Not only will this tax program make our companies more able to compete in an increasingly global environment, it will actually encourage them to bring a lot of their manufacturing back to the United States, thereby boosting our employment with jobs that pay well.

And I know that dropping taxes from 35% to 15% might seem like it would result in a big loss of revenue; however, if you add in my proposed 10% corporate tax on international earnings, I think there will actually be an increase in revenue. In any event, the program will be much closer to revenue-neutral than you might imagine. Current corporate practices of maximizing deductions and squirreling money offshore really do make a difference.

The above two suggestions are the “easy” parts of the proposal. Now we have to figure out how to cut income taxes to a low personal flat rate, make sure that you get enough increased revenue to balance the budget and still be able to fund the healthcare we want, and figure out how to get the lower-income portion of the population a big boost in their take-home pay. But let’s take up those stimulating challenges next week – along with a few structural changes we’ll need in order to make sure everybody decides to hold hands and cooperate.

New York, Dallas, and Abu Dhabi

I leave on Sunday for a meeting with my Mauldin Economics partners, Olivier Garret and Ed D’Agostino. There are lots of things happening; New York is kind of a middle ground where we can all find ourselves in the same room. Then I change hotels to head towards Wall Street, where I will be on CNBC Monday afternoon, then jump over after the NYSE closing to share some libations with Art Cashin and the rest of the Friends of Fermentation. I think even Jeff Saut, chief muckety-muck of something important at Raymond James, will be there, as we are both scheduled to present the next day at Chip Romer’s Tiburon Conference. Chip brings investment industry executives together once or twice a year to talk about the state of the industry. And right now we’re talking about an industry that is in a big state of flux. I look forward to sitting with other people and learning.

(Check with me on Twitter for specific media times next week.)

Afterward, I am home for a month, where I will focus on writing my book and losing that last 10 pounds of superfluous weight prior to my conference in late May. The week before the conference I will be going to speak in Abu Dhabi. I was delighted to find out that you can actually take a direct flight from Dallas to Abu Dhabi. I started playing around a little bit and found out that there are several direct flights to the Middle East on various carriers. Dallas is a remarkably convenient town to get in and out of if you have to travel a lot.

The Strategic Investment Conference is coming along nicely. I have only a few more speaking and/or panel slots to figure out. I think we are going to maintain our tradition of making each year better than the last. If you haven’t registered yet, we are very close to sold out, as we expanded the space slightly and were able to take those who were on the waiting list. If you’re interested in coming, I suggest you get on the waiting list, as there are always people who cancel in the last few weeks. You can get on the list by clicking here.

And I know a broken headset is not a life-changing event, but yesterday the microphone I use to dictate into the computer as I write these letters finally broke. It’s not Logitech’s fault, because it lasted much longer than it should have, given the abuse I heap upon it in my travels, stuffing it into my bags. I had kinda, sorta taped it together so that I could still work, until finally I realized that I could just go to Amazon and order one and it would be here in a couple days.

I was surprised to find out that I could get the microphone delivered the same day I ordered it – for free. I have to admit that I was skeptical, even though I’ve read about Jeff Bezos working on delivery times. I wondered if a drone would appear on my balcony with my packages!

So I just clicked the button and forgot about it until I got a call from the front desk a few hours later, saying that my package had arrived. I think I know what the margin was on the inexpensive headset, so I’m not sure how Amazon can afford to deliver. It would have taken me the better part of two hours to drive to the store, find and buy the product, and get back, plus pay for the gas. I just find the whole business rather amazing. I know, it’s a bit ironic that somebody who’s writing a book on what the world will look like in 20 years can be surprised by fact that the changes he’s predicting are already happening.

By the way, I was able to get the latest, wireless version of my microphone, which was a lot cheaper than my old, tethered microphone was when I bought it. In theory I can even tap a button and shift from my computer to my iPad, listen to music, or talk on the telephone.

I wonder if I can order the new Tesla from Amazon. I’m not certain if it comes with one-day delivery….

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

You have a great week as we ponder whether Washington, DC, can actually break through its terminal gridlock next year. If it doesn’t, then, as Bill says, “Or else what? Or else markets and the capitalistic business models based upon them and priced for them will begin to go south.”

Your hoping we can avoid that southern drop analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin