Forgotten Lessons

-

John Mauldin

John Mauldin

- |

- July 15, 2022

- |

- Comments

- |

- View PDF

“Those who cannot remember the past are condemned to repeat it” is a well-known quote that’s also incomplete. You can remember the past vividly and still have to repeat it. This happens when, for instance, powerful people forget (or ignore) important lessons that affect everyone.

In politics, we can often limit the damage by voting out the offenders. It’s more difficult with institutions designed specifically to avoid such accountability, like the Federal Reserve System.

In my opinion, the Fed’s failure to heed clear lessons is a major cause of our current economic problems. Today we’ll look at an example as we continue exploring William Chancellor’s forthcoming book, The Price of Time: The Real Story of Interest.

Over the last two weeks, including my last letter John Bull and Two Percent, we saw how persistently low interest rates have been creating speculative bubbles for centuries. This was well understood long ago by writers like Walter Bagehot, who were well known to Federal Reserve leaders like Alan Greenspan and Ben Bernanke. It’s not some ancient secret.

Yet these people, whose very job is to know the lessons of the past, either forgot them or chose to ignore them. Today we’ll look at how this manifested in the 2008 crisis period—and set up the conditions we face today.

|

[Attention] The Fed is acting aggressively to “fight inflation,” but if history is any guide, the response will likely be too little, too late. Discover what you can do now to protect your retirement wealth. |

Welcome, Goldilocks

At the Strategic Investment Conference in May, we had a special guest who had a front-row seat in the Greenspan/Bernanke Fed. Tom Hoenig was the Kansas City Fed president from 1991 to 2011, which put him on the policy-setting Federal Open Market Committee that whole period. He said that it all began innocently. Here’s part of my May 27th Rock and a Hard Place letter.

“The initial mistakes seemed innocent. The Fed became more accommodating to markets in the Mexican peso crisis, then later with Asian and Russian debt crises. These were indeed bad situations. The Fed had to respond, which it did, preventing the markets from imploding. Wall Street hailed Greenspan as a genius. This was the genesis of the overconfidence Bill White talked about, and other central banks had it, too.

“Hoenig saw early on the Fed was really just bailing out hedge funds. Later, he saw them announcing policies with open-ended, ‘for a considerable period’ commitments. This came to be called the ‘Greenspan Put.’

“I think we all kind of knew what was happening, but it’s still startling to hear this inside description. Fed officials knew full well their policies were creating asset inflation—higher stock and real estate valuations, etc. They thought that was fine as long as it didn’t become broader price inflation. Which it wasn’t, at least according to the Fed’s benchmarks.”

Central bankers began to think the Fed could manage its way out of any crisis. This extreme hubris helped cause a series of major monetary policy mistakes, leading to the Great Recession (and now to a “Second Great Recession”). A few wise men and women sitting around a table thought the enormously complex economy was subject to their simple decisions. It wasn’t then and it isn’t now.

This is how bad situations often begin. People do something risky, nothing terrible happens, so they push a little more. Eventually they push too far. Greenspan pushed the Fed away from its previously boring lender-of-last-resort role to a more active market participant. Chancellor describes how it began in 1987.

“A couple of months into his new role, in October 1987 Greenspan was confronted with the worst stock market collapse since 1929. He responded by cutting the Fed funds rate and flooding Wall Street with liquidity. The stock market bounced back. Shortly afterwards, the Fed switched its attention from attempting to influence the growth of bank borrowing to directly targeting interest rates.”

This is hard to understand now, but for a long time the Fed didn’t “manage” interest rates like it does now. It mostly focused on keeping banks liquid, letting the market adjust interest rates by itself. Yes, such a thing is actually possible. The 1987 Crash and the Savings & Loan Crisis that followed seem to have changed that philosophy. [I should note that the Savings and Loan Crisis was due to policy-driven error. Again, the government reaching in to “save the day.”] Here’s Chancellor again.

“After the Savings & Loan Crisis at the turn of the decade, when more than a thousand US mortgage banks, ‘thrifts,’ failed, the Fed funds rate was cut to below 3 per cent, its lowest level for many years and roughly half the prevailing rate of (nominal) GDP growth. Greenspan wanted to help Wall Street out: Cheap short-term borrowing enabled banks and hedge funds to mint profits by ‘riding the yield curve.’ A pick-up in US productivity in the mid-1990s suggested that the natural rate of interest was rising.

“At the same time the prices of imported goods were falling and inflation remained dormant. If the rate of interest tracks the return on capital, then American rates should have climbed in tandem. But this didn’t happen. Instead, short-term interest rates were held below the growth rate of the US economy for most of the period between early 1992 and the end of the decade.

“Thus, in the face of a positive supply shock akin to what the United States had experienced in the 1920s, the Greenspan Fed remained accommodating. Another New Era beckoned—but, so as not to frighten those with long memories, it was renamed the New Paradigm or the Goldilocks Economy, being ‘not too hot, not too cold.’”

Looking back, that era was clearly the genesis of our current woes. Greenspan (with many accomplices) saw how he could make the markets happy by keeping interest rates lower than circumstances justified. Everyone loved Goldilocks. And, as Tom Hoenig told us, that practice continued through the 1990s as the Fed repeatedly “saved” the market from various crises.

This worked only due to that “positive supply shock” Chancellor mentions. A perfect storm—the internet boom, European unification, the Soviet Union’s collapse—let Greenspan get away with risky policies his predecessors would never have tried.

|

In this episode of Global Macro Update, Ed D'Agostino and George Friedman, founder and chairman of Geopolitical Futures, discuss the very sad news of the assassination of former Japanese Prime Minister Shinzo Abe last week and... the massive geopolitical story the mainstream media is overlooking... and why Japan’s Liberal Democratic Party strongly favors eliminating Article 9 and what that means for the Pacific... and much more. |

Desirable Distortion

After a decade or so of the Fed congratulating itself for repeatedly saving the world, Ben Bernanke joined the board in 2002 and became its chair in 2006. With an academic background studying the Roaring 1920s and subsequent Great Depression, you might think Bernanke would have brought some caution to the Fed. Not so. Chancellor says he did the opposite.

“Bernanke provided the intellectual ballast for Greenspan’s practice of ignoring asset price bubbles. Since bubbles were said to be impossible to identify in real time, Bernanke said, monetary policy shouldn’t act pre-emptively against them but should deal with their aftermath.”

The fact that the Fed was intimately involved in creating those asset bubbles seemingly never crossed their minds. Hubris leads to its own kind of blindness.

I think time has shown this was a terrible mistake. Asset bubbles are a kind of inflation, and fighting inflation is clearly the Fed’s responsibility. But consumer price inflation seemed low at the time, so other bubbles may have seemed more tolerable—particularly bubbles representing profit opportunities. No one complains about inflation when it shows up in their investment accounts or housing prices. That is just their reward for being diligent and buying stocks and houses at the right time.

With inflation off the table, the Fed shifted to worrying more about deflation. Chancellor goes on.

“Bernanke was a strong advocate of acting—this time pre-emptively—against deflation, though. In November 2002, he suggested that the Fed could arrest a decline in prices under any circumstances—if necessary, it could drop ‘helicopter money’ (i.e., newly printed dollars) into the hands of the American public. In the spring of 2003, the Fed funds rate was cut to 1 per cent, where it remained for over a year. Over the following five years, the Fed’s key policy rate remained well below the country’s rate of economic growth. The era of easy money had well and truly begun.”

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The easy money quickly and initially found its way into housing, forming a bubble that would be quite problematic a few years later. Chancellor notes the Fed knew this was happening.

“At a congressional hearing in November 2002, Greenspan noted that the Fed’s low interest rate policy had boosted home sales and construction. ‘Mortgage markets,’ observed the Fed Chairman, ‘have also been a powerful stabilizing force . . . by facilitating the extraction of some of the equity that homeowners have built up.’ In fact, in the decade up to 2008 Americans extracted a grand total of $9 trillion in home equity. Mortgage equity withdrawal sounds pretty harmless, but in truth it is a fancy name for households getting into debt.”

Chancellor quotes from the transcript of a 2004 FOMC meeting when then-Governor Donald Kohn said their “policy accommodation” was distorting asset prices. Kohn said,

“Most of this distortion is deliberate and a desirable effect of the stance of policy. We have attempted to lower interest rates below long-term equilibrium rates and to boost asset prices in order to stimulate demand.”

Both Greenspan and Bernanke were in the room when Kohn said this. The record shows neither expressed any reservations. Kohn himself called the distortion “desirable.” So, by 2004 the Fed had made a full transition. Its leaders knew their low interest rates were distorting the economy and they liked it. Moreover, under Bernanke the Fed made a deliberate decision to ignore asset bubbles until they popped, seeing its job as simply repairing the damage.

The housing bubble did indeed pop, causing quite a bit more damage than the Fed seemed to expect.

Baby Steps and Blame Shifting

All this was quite a frustrating situation at the time. Many of us saw the train wreck coming, but we weren’t on the FOMC. I wrote about the subprime crisis beginning in late 2006 and all through 2007. I was quite detailed about the risks involved although I underestimated the loss by a few trillion dollars. Unfortunately, I did not have the hundreds of millions of dollars in a hedge fund it took to get involved in The Big Short. But I got to watch it in real time looking over the shoulders of my friends. Which was an interesting view but didn’t make me any money.

Even today, some of those on the FOMC who should have known continue denying their low rates set up the crash. Chancellor describes the blame shifting.

“Bernanke inclined to the view that poor financial regulation was to blame for the credit excesses prior to the Lehman’s bankruptcy (this did necessitate taking some personal responsibility since the Federal Reserve, which Bernanke chaired from early 2006, was the chief US financial regulator). Among policymakers, the regulatory interpretation of the financial crisis won the day.

“At the same time, the role played by monetary policy in the run-up to the crisis was downplayed: the Federal Reserve’s decision to take its policy rate to a post-war low and hold it there for eighteenth months; keeping the Fed funds rate below the economy’s growth rate for five consecutive years; the extremely slow pace of tightening, with rates hiked at ‘baby steps’ so as not to scare the financial markets; the intentional stoking of the housing market and encouragement of households to get into debt; and the opening of the monetary spigots—all were conveniently forgotten.”

Something else happened, too. The Fed’s policies enabled financial engineering that shifted a lot of mortgage financing to the short end of the yield curve.

“The riskiest subprime loans were priced off short-term rates, including the option of adjustable-rate mortgages with their negative amortization feature (in which interest was rolled up with the principal). It was only after the Fed’s easy money policy was launched that credit growth picked up, financial leverage soared, housing markets bubbled, underwriting standards declined and the repackaging of subprime mortgage debt into collateralized debt obligations took off. Low interest rates fed the demand for credit, while financial innovation increased its supply. The explosive growth of the market for complex mortgage securities was driven in large part by a desperate search for yield at a time when interest rates were at multi-decade lows.”

Let me get a little technical here. Banks are in the business of maturity transformation. They borrow short-term money (i.e., your “demand deposit” checking account) and use it to make long-term loans (30-year mortgages, etc.). This puts them in an inherently illiquid position, which is why they need a lender of last resort. Many learned this painfully in the S&L Crisis. It was still fresh on their minds in the early 2000s.

The chance to profitably borrow short while also lending short was pretty attractive at the time. Mortgage securitization also gave originating lenders (i.e., consumer-facing banks) an easy way to transfer credit risk off their books to yield-hungry bondholders. And it all generated very juicy fees every time they sold European pension funds those subprime mortgage bonds. It was all a virtuous circle that worked really well, until it didn’t. Hence the Great Recession. Fed policy enabled all of it.

The Fed under Greenspan and Bernanke forgot (or ignored) lessons stretching back to Bagehot in 19th-century England. You might think that painful experience would have motivated their successors to study the past. It didn’t. Janet Yellen and now Jerome Powell continued to disregard history.

Hollow Men, Hollow Markets, Hollow World

My friend Ben Hunt has a very insightful essay on hubris and the Federal Reserve. I told him we seem to be singing off the same hymnal, except that he sings far more eloquently than I do. Since it goes along with our theme, let’s look at a few paragraphs. (Just for the record, Ben is on my must-read list and he’s kindly opening that link to public access through Monday. You should read it while you can.) Quoting:

“We are a husk of ourselves. A wealthy and pampered husk of ourselves, sure, where I find myself disappointed if the local liquor store has only five different artisanal mezcals to choose from, but a husk nonetheless. Sometimes I wonder what the 5th-century Roman equivalent of artisanal mezcal would have been.

“How did this happen? Here, I’ll show you.

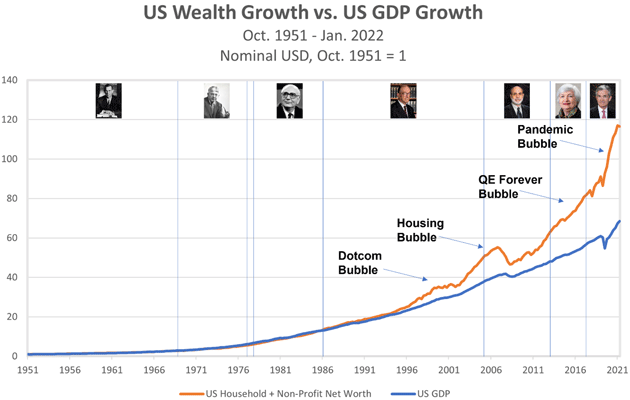

“By using nominal dollar measurements we avoid issues of inflation, and by comparing growth rates we avoid issues of stock (wealth) vs. flow (GDP). …because I believe this:

“As a people, you can’t be a lot richer than your economy grows without stealing that wealth from someone else.

“Maybe it’s stolen (sorry, I mean extracted or taxed or traded for) from people in other countries through colonial terms of trade. Maybe it’s stolen (sorry, I mean pulled forward) from future people in your own country through artificially low interest rates, monetized debt-driven stimulus, and an increasingly levered financial system supporting increasingly non-productive mal-investment. Insert monocle-wearing Hmmm emoticon here.

“By the way, nothing that I described in the prior paragraph is the exclusive or even predominant domain of one political party or the other. If you insist on saying, for example, that debt-driven stimulus policies are a Democratic party thing against which the Republican party stands in staunch opposition, then I will present you with a bound copy of the 2017 Tax Cuts and Jobs Act and just start laughing at you.

“Also by the way, I believe that a modest national debt and modest leverage in the financial system are good things, not bad things. I believe that a gold standard is a pretty terrible way to run a monetary system. I believe that deficit spending is entirely justified across a pretty wide range of national exigencies. And as I’ll discuss at length in a bit, I believe that central banks play a crucial and necessary role in the modern world.

“None of these things—a fiat currency, fiscal flexibility with the ability to take on substantial debt, an autonomous central bank with wide-ranging authority over monetary policy and financial system regulation—are at odds with the basic idea that our wealth as a people should grow hand in hand with the growth of our economy.”

There is much more wisdom in Ben’s letter, but this is the critical point. We have financialized our economy beyond the limits of our actual GDP growth and physical wealth. All asset wealth is now virtual. It is going to take some extreme dexterity to not be hurt in the next Great Recession.

Next week we will finish this series, looking at how Yellen and then Powell fostered a powerful inflationary bubble (seriously—9.1%? This is what the best and brightest give us?) with no way out but through. To even imagine a soft landing reveals a certain Disneyland-type mentality. This is not Jiminy Cricket and wishing upon a star.

The point is to get through with as many of your assets intact as possible, and with a little dexterity, some profits at the end. However, sadly, business as usual, which means buy and hold index funds, is not going to be the way to do that. Until next week…

Family, NYC, and Cleveland?

Those of you with grandchildren will understand my complete euphoria in getting to spend three days with three of my granddaughters. Amanda and Abigail (along with their husbands Allen and Stephen) brought Addison, Rylee, and Brynlee (ages 4-9) to mi casa. They are at that special age when cuddling up next to their Papa John is just the thing to do. We are so far apart with COVID and all, I have missed seeing them grow up. My firm resolution is in the future not to let that happen again.

I am off to New York on Sunday and a series of dinners and meetings, then back home Thursday. I really look forward to seeing old friends, many of whom you know. Have a great week and hopefully you’ll have some time with family and friends. There is always a bull market in family and friends! And by the way, don’t forget to follow me on Twitter! I am almost at 50,000 followers. Just another 114 million to go and I’ll be right up there with Justin Bieber.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Your getting old is not for sissies analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin