Forecast 2014: “Mark Twain!”

-

John Mauldin

John Mauldin

- |

- January 18, 2014

- |

- Comments

- |

- View PDF

It’s All About the Earnings

The Trouble with Earnings

What Would Yellen Do?

Forecast 2014: “Mark Twain!”

Argentina, Vancouver, Edmonton, Regina, and Home

Piloting on the Mississippi River was not work to me; it was play — delightful play, vigorous play, adventurous play – and I loved it…

– Mark Twain

In the 1850s, flat-bottom paddlewheel steamboats coursed up and down the mighty Mississippi, opening up the Midwest to trade and travel. But it was treacherous travel. The current was constantly shifting the sandbars underneath the placid, smoothly rolling surface of the river. What was sufficient depth one week on a stretch of the river might become a treacherous sandbar the next, upon which a steamboat could run aground, perhaps even breaching the hull and sinking the ship. To prevent such a catastrophe, a crewman would throw a long rope with a lead weight at the end as far in front of the boat as possible (and thus the crewman was called the leadman). The rope was usually twenty-five fathoms long and was marked at increments of two, three, five, seven, ten, fifteen, seventeen and twenty fathoms. A fathom was originally the distance between a man's outstretched hands, but since this could be quite imprecise, it evolved to be six feet.

The leadsman would usually stand on a platform, called "the chains," which projected from the ship over the water, and "sound" from there. A typical sound would be expressed as "By the mark 7," or whatever the depth was. In modern English language, it is interesting to note that the expression "deep six," refers to this old method of measuring water. On the Mississippi River in the 1850s, the leadsmen also used old-fashioned words for some of the numbers; for example instead of "two" they would say "twain". Thus when the depth was two fathoms, they would call "by the mark twain!" (bymarktwain.com)

And thus a young Samuel Clemens, apprentice Mississippi riverboat pilot, would take the "soundings" and from time to time would sing out the depth of two fathoms as "By the mark twain!" We think that is how he found his pen name. In Life on the Mississippi, Mark Twain describes sounding: "Often there is a deal of fun and excitement about sounding, especially if it is a glorious summer day, or a blustering night. But in winter the cold and the peril take most of the fun out of it."

The pilot would much prefer to hear the sweet sing-song call of "no bottom," as that meant there was no danger of running aground. "Mark twain," or 12 feet, was getting rather shallow for some of the larger vessels and so sounded a note of caution.

On their surface today the markets seem as smooth and flowing as Old Man River, but are there sandbars lurking in the depths? Will the journey this year be as fast and easy as in the last five? Can we plunge on into the night, relishing the call of "No bottom" that we are hearing from the bulls? Or is that a cry of "Mark twain!" telling us to be cautious?

Perhaps we should take our own soundings from the data to see what might lie up ahead. This week, in the third part of my 2014 forecast, we'll look in particular at the US markets as a proxy for markets in general. (This letter will print a little longer as there are lots of charts.)

But first, I am pleased to announce that my friend former House Speaker Newt Gingrich will be at my conference this May 13-16 in San Diego, joining (so far) Niall Ferguson, Kyle Bass, Ian Bremmer, David Rosenberg, Dr. Lacy Hunt, Dylan Grice, David Rosenberg, David Zervos, Rich Yamarone, Code Red coauthor Jonathan Tepper, Jeff Gundlach, Paul McCulley, and a few more surprises waiting to confirm. Nothing but headliners, one after the other.

When I first broached the idea of our conference with Jon Sundt, the founder of cosponsor Altegris, the one rule I had was that I wanted the conference to be one I would want to attend. The usual conference boasts a few headliners, and then the sponsors fill out the lineup. I wanted to do a conference where no speaker could buy his way onto the platform. That means we often lose money on the conference (hard as that may be to imagine, at the price, I acknowledge); however, the purpose is not to make money but to learn with – and maybe have some fun with – great people. We do put on a great show, and my partners make sure it is run well. But the best part will be your fellow attendees. A lot of long-term friendships are forged at this conference. You can learn more and sign up at http://www.altegris.com/sic.

For over a dozen years I have regularly compared notes on S&P 500 earnings with my friend Ed Easterling. For Ed, the subject borders on an obsession. I am, of course, far more reserved in my enthusiasm. We have co-authored numerous articles, and Ed never fails to call to my attention anything unusual that happens on the earnings front. He is the ultimate data wonk, and I say that in an affectionate way. Ed has what I think is one of the best data research sites anywhere at www.crestmontresearch.com. So this week I read his latest email, about the uptick in the forecast earnings of the S&P 500, with considerable interest.

As they do at this time of year, S&P posted an update to their 2014 EPS (earnings per share) forecast. For newbies, "as-reported" earnings are earnings as reported to the tax authorities, and we can more or less think of them as real earnings. "Operating earnings," on the other hand, are what companies like you to pay attention to. They exclude one-time charges and other things that companies find inconvenient. I call operating earnings "EBIH earnings" – earnings before interest and hype.

S&P conveniently gathers forecasted earnings data from numerous analysts and amalgamates it in one big spreadsheet along with the history of actual earnings. You can access their spreadsheet here. The data we will be looking at will come from the first tab, but there is also a lot of data commentary from Howard Silverblatt, the longtime curator and maven of all things earnings.

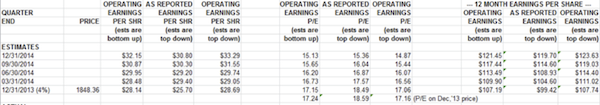

The forecast for 2014 as-reported earnings was $106 in late December. Now it's $119.70 – up 13% from the previous forecast just two weeks ago and up 20% versus the 2013 estimate of $99.42. Since 2013 has concluded, that number will be revised only slightly. Silverblatt says the revised figure is based upon an improved outlook rather than something technical like an accounting change.

The table below is a screenshot from the Excel spreadsheet. Note that, depending on which set of earnings you want to use (and Ed and I prefer to use as-reported as opposed to operating earnings), if the forecasters are right, then the P/E ratio at the end of 2014 will be in the neighborhood of 15, less than the long-term average and down considerably from today's. This can only be described as a bullish number.

Ed notes in a quick email, which spurred a long telephone conversation, that "The 2015 forecast is still a month or so away – yet just imagine the bull stampede if it comes in +15%. That'll would take the figure to $138 and a forward "next year" P/E of only 13 when the trailing 20-year Shiller P/E10 is 25.4."

I would have ended that sentence with an exclamation point (!), but Ed is more even-tempered in his writing. Still, a price-to-earnings ratio of 13, published on the official S&P website for all the world to see, would have the bulls salivating. It would even have me close to "pounding-the-table-bullish," as a true P/E of 13 is quite favorable for the long term (say, ten years). So should we take the forward-looking view? If that P/E ratio of 13 based on today's price of the S&P 500 turns out to be the reality, another 30% year is well within the scope of possibilities and might likely be considered the most probable outcome.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

And the markets seem to think that will be the case. Lately, it seems every week (and sometimes every day) brings a new all-time high. For fans of Mad magazine, it's an Alfred E. Newman world: "What? Me worry?" Volatility is back at pre-crisis lows, as the chart below illustrates.

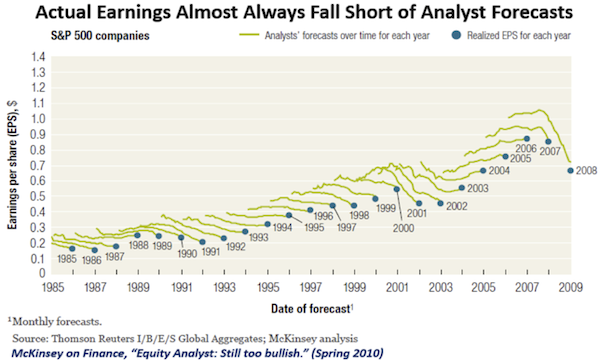

This kind of news would normally point to prosperity across the real economy and call for a celebration – but take heed: prices do not always reflect reality, and analysts' expectations consistently tend to overstate actual earnings, as you can see in the following graph from a 2010 McKinsey on Finance Study, Equity analysts: Still too bullish. When that graph gets updated next year, we will see that nothing has changed.

For the record, I was citing similar research back in 2003 in my book Bull's Eye Investing. In fact, there was a whole chapter on the topic of analysts' estimates. They also tend to be too bearish at market bottoms. Basically, analysts tend to forecast for the near future more of what has happened in the recent past. At turning points they really miss the boat.

If we look at recent years in light of long-term valuations and market behavior, we see that the combination of high and rising valuations, low and suppressed volatility, and a relatively weak trend in real earnings growth is a proven recipe for poor long-term returns and market instability.

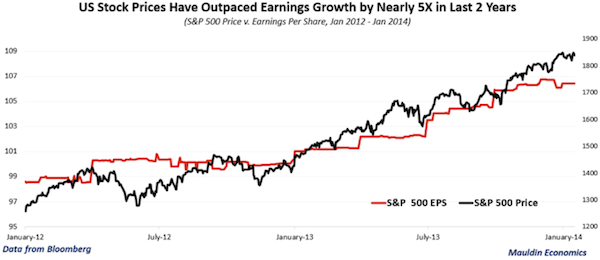

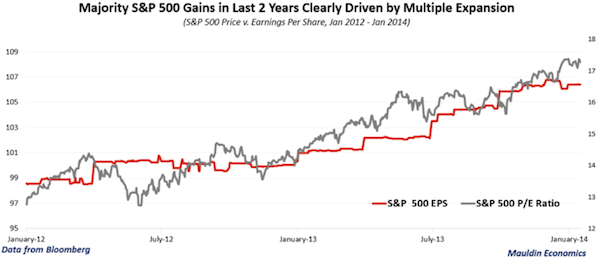

The S&P 500 Index returned 32% excluding dividends from January 1, 2012, through January 17, 2014. Over that time frame, real earnings grew by less than 8%...

… while the trailing 12-month price-to-earnings multiple has expanded by nearly 30%, from 12.8x to 17.3x.

That means most of the recent gains in US equity markets have been driven by multiple expansion, in spite of sluggish real earnings growth. Despite an improvement in the real earnings trend since I dug into US stock market valuations, multiple expansion, and earnings last August, the disproportionate amount of gains attributable to multiple expansion versus gains attributable to earnings is a clear sign that sentiment, rather than fundamentals, may be the dominant force driving the markets higher.

Of course, the simple trailing 12-month price-to-earnings ratio can be misleading at critical turning points if you are trying to handicap the potential for long-term returns. For example, the collapse in real earnings during the global financial crisis sent the S&P 500's trailing P/E multiple through the roof by March 2009. So, while trailing P/E is a useful tool for understanding what has already happened in the market, Dr. Robert Shiller's "cyclically adjusted price-to-earnings ratio" (commonly known as the "Shiller P/E" or "CAPE") is far more useful for calculating a reasonable range of expected returns going forward.

As I wrote back in August 2013 when the prevailing Shiller P/E sat near 24, this approach won't help you much with short-term market timing; but current valuations have historically proven extremely useful in forecasting long-term returns. In his book Irrational Exuberance (2005), Dr. Shiller shows how this approach "confirms that long-term investors – investors who commit their money to an investment for ten full years – did do well when prices were low relative to earnings at the beginning of the ten years. Long-term investors would be well-advised, individually, to lower their exposure to the stock market when it is high … and to get into the market when it is low."

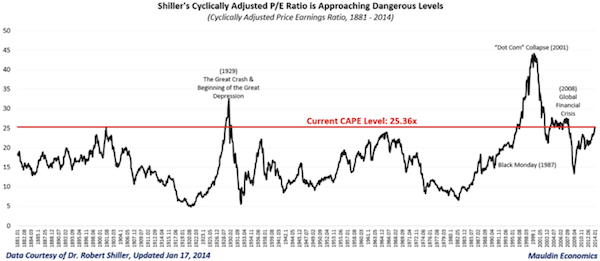

As you can see in in the graph above, compared to the more common trailing 12-month P/E ratio, the Shiller P/E metric essentially smooths out the series and helps us avoid false signals by dividing the market's current price by the average inflation-adjusted earnings of the past ten years. Historically, this ratio has peaked and given way to major market declines at around 29x on average (or 26x excluding the dot-com bubble), and it has bottomed in the mid-single digits.

Not only does today's Shiller P/E of 25.4x suggest a seriously overvalued market, but the rapid multiple expansion of the last few years, coupled with sluggish earnings growth, suggests that this market is also seriously overbought. Today's markets are just slightly less expensive than the 27x level seen at the October 2007 market peak and are only modestly below the levels seen before the stock market crash in 1929. Although we are nowhere near the all-time "stupid" peak of 43x reached in March 2000, a powerful narrative drove the markets to clearly unsustainable levels then, and a powerful narrative is driving markets today. In many ways, faith in the Federal Reserve today is roughly equivalent to faith in the words dot com in 1999.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

While it may be impossible to accurately predict when this policy-driven market will break, history suggests it would be very reasonable for the secular bear to eventually bottom at a P/E multiple between 5x and 10x, opening up one of the rare wealth-creation opportunities to deploy capital at truly cheap prices.

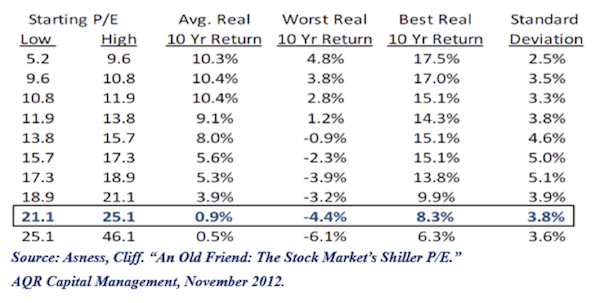

Sometimes we have to wade through what may seem like deceptively dry technical details to sort out compelling conclusions, but I hope you'll focus on the main idea: We are not talking about the potential for a modest 20% to 30% drawdown in the US stock market. If the historical relationship between Shiller's P/E and consequent returns is any indication, we are talking about the potential for a 50%+ peak-to-trough drawdown and ten-year average annual returns as bad as -6.1%, according to the chart below from Cliff Asness at AQR. Such a result would fall in line with somewhat similar deleveraging periods such as the United States experienced in the 1930s and Japan has experienced since 1989. There is no way to sugarcoat it: too much equity risk can be unproductive and even destructive in this kind of economic environment.

But where there is danger there is also opportunity. I believe this is a terrific time to take some profits and diversify away from the growth-oriented risk factors that dominate most investors' portfolios.

On that front, keep a lookout for a special report that we will release in the next week to share five critical steps you can take to defend your portfolio from economic disasters, bankrupt governments (or governments that are testing their borrowing limits), and increasingly desperate governments. It will be a free report for all Thoughts from the Frontline readers, and we hope you will share it with everyone you know.

Let's be clear: earnings growth of 8% last year in a nominal GDP growth world of 4% is rather outstanding. Good on management in general to capture profits from something other than simple global growth. But how long can earnings in general continue to grow faster than the general economy? Understand, that is quite possible for an individual business, and it's why stock picking is an important part of the investment process. But research shows that the long-term trend is clearly that earnings of the broad corporate business world are highly correlated with GDP growth. How could it be otherwise? Again, not for individual businesses, but for the aggregate of all businesses.

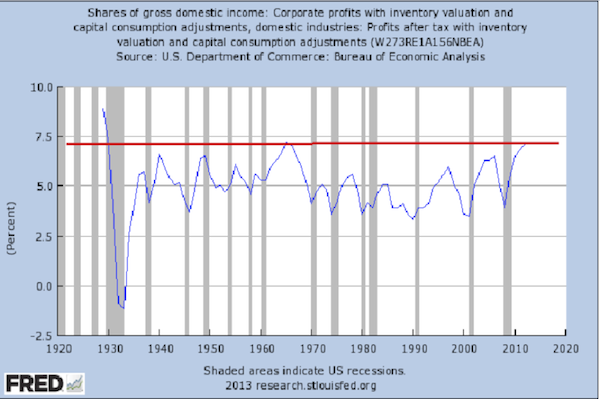

Profits are at an all-time high, as this chart from the FRED database of the St. Louis Fed illustrates. This series is mean-reverting. There is nothing that says profits cannot go higher, but the visual suggestion is that we are closer to a reversal than a breakout.

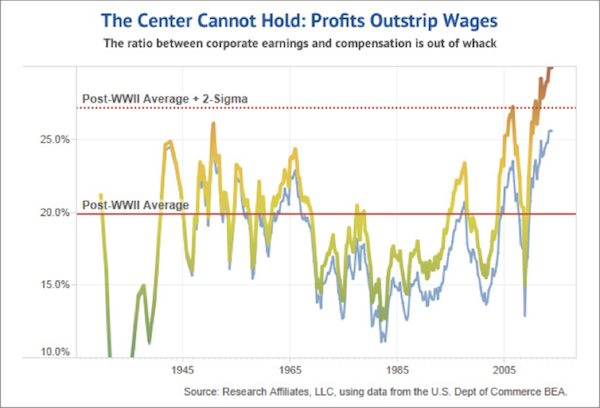

Why is this so? Part of the reason is that labor is getting less of the pie. The following chart from my friends at Research Affiliates (headed by Rob Arnott) shows that the longer-term correlation with labor costs is at a point where a correction is due, which does not bode well for longer-term profit growth.

Over the last year, this topic has been a large part of the conversation that I have had with Rob, one of the more thoughtful people I dialogue with. This recent post summarizes some of that conversation:

The macroeconomic cause of today's profits bubble can be understood as a quarter century of politically facilitated globalization. During the 50 years following WWII, we lived in an open global developed economy containing less than one billion people in Europe, North America, Australia, Japan, Korea, Taiwan, and a handful of others. Some countries were growing faster, some slower, but the technological level and population growth rates were not very different across the predominant countries within this relatively open global economy. The shares of income to labor and capital varied cyclically but tended to revert toward long-term averages.

Beginning in the 1990s, we experienced a seismic shift in our global political economy. Approximately three billion people began to join this open global economy: about one billion each in China and India and another billion or so in Russia, Eastern Europe, South America, and Southeast Asia. Average wages, level of technology, and amount of accumulated capital in the countries of the aspiring three billion lagged far behind those enjoyed by the one billion in the developed world. Imitation and appropriation is far easier than innovation and invention, so catching up has been rapid for those nations willing to make even modest concessions to the aspirations of their citizenry. For the past quarter century, the capital and technology accumulated by the old equilibrium advanced global economy has been suddenly shared across a labor force and populace that quadrupled.

This tectonic shift in our global political economy produced some winners and some losers. Incomes of many of the three billion newly joined rose quickly. Global poverty rates have plummeted. Meanwhile, wages in the old advanced-economy countries stalled, at least partly in response to competition from the lower wages welcomed by workers in developing countries.

Profits grew to a much larger share of output and an unprecedented percentage of wages and salaries [see chart above]. To be sure, if we adjust wages to include the value of benefit programs and entitlements, we aren't quite at all-time highs in profits-to-total compensation ratios. But, even here, we're darned close to unprecedented records. In both cases, the five- and ten-year averages are at new highs. These longer-term trends are fueling popular unrest.

The Fed is clearly looking at labor and employment. We will delve into this topic (once again) in a future letter; but before we close, this post from my friend Dan Greenhaus, Chief Global Strategist at BTIG, will give us a view on the latest JOLTS (Jobs Opening and Labor Turnover) data. (The word on the street is that incoming Fed Chair Janet Yellen does not look simply at the unemployment number.)

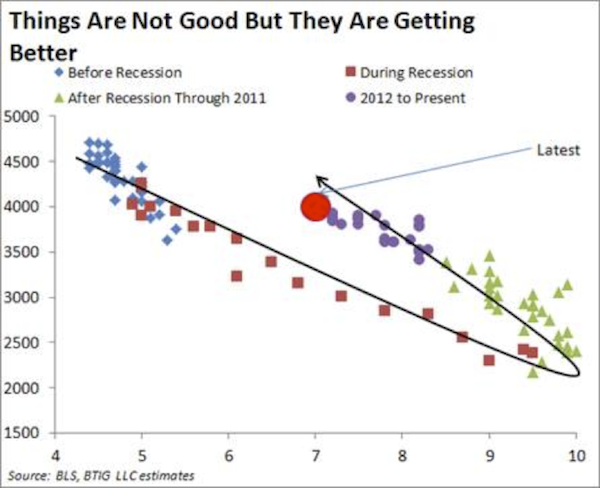

What matters right now is the chart below, a chart to which [it] surely pays [to pay] attention. The chart plots the unemployment rate along the horizontal access and the aforementioned number of job openings along the vertical axis. The chart details the two-variable relationship as the economy entered and then exited recession.

Slowly but surely, the economy is moving back towards a "normalized" state in which job openings are increasing while the unemployment rate is decreasing. Before the recession, four million job openings was associated with an unemployment rate of roughly 5.0%. Today, the same number of job openings is associated with an unemployment rate of 6.7% while just a few months ago, nearly four million job openings was associated with an unemployment rate of 7.8%.

This normalization is good news and is further evidence that the labor market is healing. Janet Yellen is surely paying attention.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The surface of the market waters looks smooth, but the data above suggest caution as we proceed. Perhaps slowing the engine and taking more frequent soundings (or putting in closer stops!) might be in order. The cry should be "Mark twain!" Let's steam ahead but take more frequent readings and know that a course correction may soon be necessary.

And just so you know that you should take any forecast from me with multiple grains of salt, I am going to close this letter without having touched on the rest of the world markets. I know that only three weeks ago I said the annual forecast "issue" would be three issues, and now I see it will be at least four. Apparently, I am not very good at forecasting even the few things I should be in nominal control of. The legal types might like me to say something like "Often wrong, but seldom in doubt."

Argentina, Vancouver, Edmonton, Regina, and Home

This letter sees a change in a relationship I have enjoyed for several years. As some of you know, my letter is translated into Chinese, and I have had the pleasure of working with a capable young translator with the exotic-sounding name of Shadow Wong. It has been a true delight, and I will miss our banter and her cheery attitude. She is in a transition, so I will have a new translator as of next week – but she will be missed. I thank her for her perseverance and tolerance over the years, and I commend her for the consistent excellence of her work.

I have decided to spend some R&R time back in one of my favorite places in the world, Cafayate, Argentina. Some of my friends and partners have built a true world-class resort and development in a lovely mountain valley in northern Argentina. The only way to get there is through a magnificent canyon that stretches for miles. You arrive at a picturesque little village with lots of cool venues, all the amenities of a great resort, and a beautiful settings among mountains that change their colors and moods all day as the sun moves. I am going at the end of March, if you want to join in. The development has some 30 countries represented among its residents and has attracted a bunch of conservative libertarian types, which makes for great conversation. You can see a few pictures at www.lec.com.ar. Drop me a note if you want to know more.

I am on the plane back from Tampa as I finish this note. I spent the afternoon meeting with scientists and researchers at the Rosskamp Institute there. My associate Patrick Cox arranged the meeting. What I heard and the research I saw makes me truly optimistic about the potential for a cure for Alzheimer's in maybe less than ten years. And they were doing lots of other work as well. Later that evening Pat and I and an associate compared notes on what we are learning about the coming changes. I like being around Pat because he makes my normally very optimistic view of the future seem not just sanguine but very realistic – and over the years his optimism has proven correct. The pace of change is just accelerating. I hesitate to share some of what we are learning as it just sounds so science-fictionish, but the world of tech is advancing on a thousand fronts. Keeping up with it all is difficult, but Pat and his team have launched a new, free tech digest and website at www.mauldineconomics.com/tech/tech-digest. Subscribe and join us as we explore the Human Transformation Revolution.

I am off on a tour of Vancouver, Edmonton, and Regina starting Monday and then back Friday to enjoy life at home for a few weeks, although I may make a quick trip to DC and NYC for some meetings.

I am settling into my new place. It has turned out even better than I had hoped, and not just the look and feel. It has become the magnet for my kids that I had wanted to create. It is a very comfortable place for us all to gather, share meals, and just hang out. We designed it with that in mind, and to watch it happen feels very good. Worth the hassle and the money. In family terms, it is a great investment. And at the end of the day, creating family togetherness is one of the true ways that we can create value, and that's one trend that does not ever have to revert to the mean.

I had fun researching the Mark Twain reference, and I let Google lead me down a few memory lanes. Not the most productive use of time, perhaps, but enjoyable. Have a great week.

Your buying arctic weather gear analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin