European Resurgence

-

John Mauldin

John Mauldin

- |

- July 31, 2020

- |

- Comments

- |

- View PDF

One of COVID-19’s many less-than-obvious consequences is the way it makes us look inward. Facing mortality has always done that, of course. West Texas Judge Roy Bean reportedly said, “Nothing focuses the mind like a good hanging.” For the vulnerable and those of us of a certain age (ahem), this virus goes beyond the normal daily risks.

The difference this time is we are vulnerable based on proximity. The virus threatens us only if it is physically near. That’s one reason Americans didn’t take it seriously at first. It was far-way Chinese and Italian news. Like reading about the all-too-terrible prospect of China’s Three Gorges Dam collapsing, or the current famine in Africa. You know it’s bad, but it’s not in your backyard.

Then, as the virus spread here, our protective measures required heightened awareness of local conditions. Whether that stranger is getting too close to you may be more important than events overseas.

As a result, we haven’t paid enough attention to some important developments elsewhere. Big things have been brewing in Europe. The same continent that two years ago I said was going through “monetary drug withdrawal,” is now set to outpace US growth by a wide margin. And US growth, which had led the world for years, now looks likely to lag it.

That turnaround has potential major market consequences, which can be either good or bad depending on the market. We need to pay attention. What happens around the world affects us and our markets. The global connectivity may be slightly less today, but it is not going away. Today we’ll review what is happening and what it could mean for you.

But first, we have to take a quick look at a few US numbers. From Peter Boockvar today:

… we continue to wait for Congress to make a deal with the unemployment benefit extension the main focus. To quantify, with 30mm people collecting benefits, that extra $600 is $18 billion per week of extra cash that people have been getting. That’s about $72 billion per month. That’s $216 billion over the past three months. Big money that Amazon and Apple have been big beneficiaries of since they are vendors of choice. Facebook and Google have certainly benefited from PPP money so any extension of that will be relevant too. To repeat, according to a University of Chicago study, 68% of those collecting this money has been getting more than what they made prior with the median increase of 34% above. I’ve seen a few different proposals on an extension. One, that won’t likely happen, is just reducing it to $200. Another is scaling it down in the coming months to eventually $300 by October. So, an extension will happen, but the rate of change will slow.

If that were to continue, it would further expand US debt, on top of all the other programs contemplated. The US deficit is not going down anytime soon, nor is anyone else’s. China is using massive debt driven infrastructure spending to maintain even 2–3% GDP growth. Anything less will call into question the current government’s legitimacy. Countries all over the world are doing the same: using debt to shore up growth and employment.

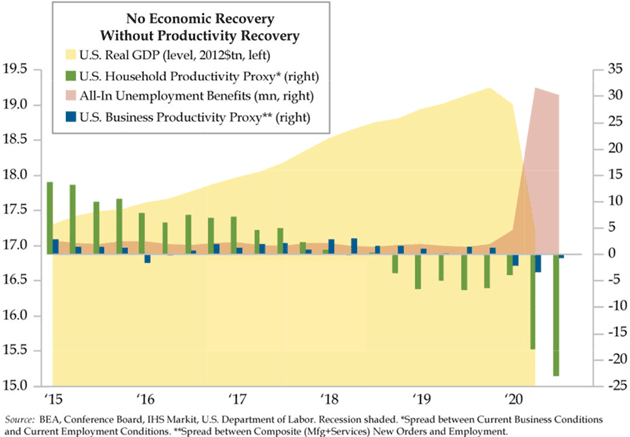

Our friends at Quill Intelligence offer this chart. US household productivity has been dropping for two years. Business productivity has begun to drop coincident with the COVID recession.

Source: Quill Intelligence

Two major points:

First, reduced federal and state assistance will negatively impact consumer spending. Clearly, the federal unemployment assistance was being spent. (The PPP program is a disaster, giving money to companies that don’t need it and not to hotels and other small businesses in any usable form. Unless Congress acts soon, the hotel industry will simply collapse and take two million jobs with it, plus another six million dependent upon the industry. I would argue that hotels are at least as important as airlines.)

Second, future headlines will talk about recovery in terms of quarter over quarter. Twelve months from now, we will talk about year-over-year, which of course should be better (we desperately hope!) And while that will be good, true recovery analysis will use 2019 quarterly numbers as the comparison.

Recovery is going to take years. The world is being repriced. By the end of August, I expect well over 100,000 small businesses (and a few large ones) to have permanently closed. It’s going to take these entrepreneurs more time and money than you might think to figure out a new game plan in a completely different business landscape.

And that brings us to Europe. They have their challenges, too.

Bridge Too Far

People have dreamed of a “united Europe” since the end of World War II, and with good reason. The continent is so varied (geographically, linguistically, and culturally) it was long prone (as in for 2,000 years) to unproductive and occasionally destructive conflicts. No one liked that part, but the question was how to have both consistent economic policies and national autonomy.

The European Union is an attempt to do that. The smaller Eurozone currency pact is another. Both have advantages and drawbacks, which the Greek debt crisis highlighted. More recently, Italy has been the spotlight.

The core problem: It’s hard to sustain common policies and/or a common currency without a central authority that can issue common debt. And to do that, the central authority needs taxing power.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

That was a bridge too far for many in the UK, which is why it never adopted the euro currency and one of the reasons it finally left the EU completely. Some other members were none too happy, either. Many observers, including me, were skeptical the monetary union could hold together in a world where decentralization was the dominant trend.

Then came COVID-19. Now it seems to have changed everything, but that wasn’t the case at first. Back in March/April (which now seem like ancient history, I know) the virus hit Italy and Spain very hard. Members of the “open borders” alliance started closing borders instead, along with hoarding medical supplies and generally blaming each other. It was ugly for a time. EU breakup talk grew noticeably louder.

About that time, American news coverage turned to our own outbreaks, and we mostly tuned out Europe. European leaders, realizing US weakness guaranteed a global recession, saw an existential threat to their export-dependent economies. Hardliners turned suddenly flexible.

They could do this because they also managed to get the virus under some semblance of control. They did so by various means, but in most cases through longer and stricter shutdowns than we saw in the US (Sweden being the obvious exception). It took a terrible economic toll. Europe is not virus-free by any means. Daily life isn’t back to normal. Parts of Spain are having outbreaks, prompting the UK and Germany to impose travel restrictions. But the EU countries generally handled the pandemic far better than the US has, and they are now recovering faster. We can debate the reasons, but political structure and cultural cohesion seems to be part of it. As sometimes happens in families, crisis brought an otherwise dysfunctional group together.

Common Solution

Germany and France are the EU’s two largest economies and top exporters. Between the self-inflicted shutdown damage and the global recession, both entered this spring facing serious economic harm. Angela Merkel and Emmanuel Macron realized the only feasible solution would require drastic steps many EU members, particularly Germany, had previously resisted.

Let’s stop here and note something. In the US, we are accustomed to Congress approving legislation by majority vote. Someone always loses. The EU operates more by total consensus. Nothing major happens unless every member government agrees. That makes reaching agreement harder, but they have more “buy-in” once made.

So back in May, Macron and Merkel agreed the EU should make huge loans and grants to hard-hit countries. This was partly self-preservation. Their own economies need those other countries to buy French and German goods.

Understand, without aid, Italy was on a trajectory to leave the EU. There is (still) a significant anti-EU movement in Italy. Why be part of a monetary union which would let your nation collapse is not an unreasonable question, especially if you are already prone to be an EU skeptic.

Merkel and Macron and others recognized the danger. The EU helped Greece, even if they did force Athens into a five-year depression. The idea of a country leaving was unthinkable. The EU without Italy collapses. Brexit was a wake-up call for EU leadership.

Personal story: Three years ago, I was in Frankfurt giving a speech to a German pension fund conference. I was told the 200+ attendees represented the significant majority of German pension assets. With the host’s permission, I asked the attendees if they thought the EU was a good thing. 90% plus raised their hands. I then asked them if they would be willing to finance some of the southern European countries in a crisis to keep the EU together. Less than 10% raised their hands. Reminding them that Germany was 50% exports, and that a euro that was primarily German would be much higher relative to southern Europe and would devastate Germany and their economy, would you consider helping southern Europe? About 90% still sat on their hands.

These were economically sophisticated people. They understood exactly what I was saying. I followed up that conversation in the halls and at dinners and found little difference in their public and private postures. I came away realizing that if this group was so determined not to use German financing to help southern Europe, what would the good German burghers of Bavaria think? Macron also has sizable opposition within France. For Merkel and Macron to recognize the need for a pan-European finance plan, and actually have the ability to bring it about is utterly amazing.

The plan will effectively give the EU its own fiscal policy, going beyond the various smaller support measures taken in the last euro crisis. I have long noted that there has been no monetary union anywhere in history that did not eventually encompass fiscal union. For Europe, this would mean mutualization of much of the national debt. I have always felt that without that mutualization, the EU would eventually break up. Make no mistake, the latest European plan is one small step leading to an even bigger leap to a closer European Union. How did this come about?

A group of nations in northern Europe, Germany being the largest, have long blocked such ideas on “moral hazard” grounds. Those objections appear to have dissipated, at least for this first €750 billion package. Staring your own economic mortality in the eye has a way of doing that. It very much focused their collective minds. But give Merkel and Macron credit, too. They persuaded other leaders to swallow their pride/reservations and got all 27 members to agree.

My friend Ian Bremmer, top geopolitical expert at Eurasia Group, called it, “by far the most successful and proactive display of international leadership since the pandemic began (and, indeed, since the end of the great recession in 2008–2009).” That’s not something he would say lightly. He went on (this is from his July 27 private client letter):

In the near term, everyone’s a winner—something we’re not saying much in these pandemic days. German Chancellor Angela Merkel and French President Emmanuel Macron push a pro-European integrationist agenda, weakening euro-skeptics both at home and across the continent. European Commission President Ursula von der Leyen can tout a successful government-led response to a 10% plus economic contraction, one that doesn’t further burden member states with higher debt levels and limited fiscal space. The Italians and Spaniards get desperately needed support, boosting both of their governments against (what had been) growing anti-establishment surges at home. While existing populist leaders in east Europe had their potential vetoes bought off by ensuring there were limited political conditionalities for transfer. Even the so-called frugal countries, led by Dutch Prime Minister Mark Rutte, were able to pocket sufficient political for their domestic constituencies, some rebates on their EU budget contributions and the ability to delay payments should economic policymaking by recipient states not result in serious economic restructuring (labor market and pension reforms) that the ‘Frugals’ want to see.

This has wider implications, too. The poorer states that will receive this money are also the ones where populist and anti-EU feelings are strongest. The loans and grants should draw them at least somewhat closer to the union.

Bottom line: The very real possibility, just a few months ago, of Brexit-like feelings leading to an EU breakup now seems off the table—at least for a few more years. Pro-EU leaders have successfully used the pandemic to expand EU power and buy off the opposition. This is a major change in the Zeitgeist. It will have financial consequences everywhere. The principle that the European Commission can issue bonds and collect taxes to pay them is now established. This is a big deal.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

But let’s translate that into how you can profit from that transition.

Relative Stumbles

Active traders and investors know of something called a “spread” trade. It’s used when you think one asset will rise more than another one. You buy the faster-gaining one and short the laggard. What matters is the “spread” between them, not the direction. You’re betting that the loser will be weaker than the winner, whether they both go up or down or not.

We may shortly see something like that with the US and EU economies. Whatever happens in the next year or so, Europe seems likely to outperform. That might mean it just shrinks less, but it would still matter. Consider what we know:

- The EU has, for now at least, suppressed COVID-19 cases to a much lower level. This is allowing Europe to resume some semblance of normal economic activity.

- Meanwhile, rising cases and deaths in the US have compelled some governors to reimpose business and movement restrictions. Extensive precautions seem likely to continue into autumn as schools reopen (or try to) and the normal flu season begins.

We also have widespread street protests and a contentious election, neither of which helps the public health response.

US growth projections are all over the board. This year’s second quarter was brutal. We can still hope for a Q3 “bounce,” but it is becoming less likely that it will be as significant as hoped, on a year-over-year basis. The latest Atlanta Fed GDPNow Q3 estimate is +11.9%. That would be nice but still leave us deep in the hole. It will seem significant and make for great headlines. But in any case, it is hard to see the US economy outpacing the EU.

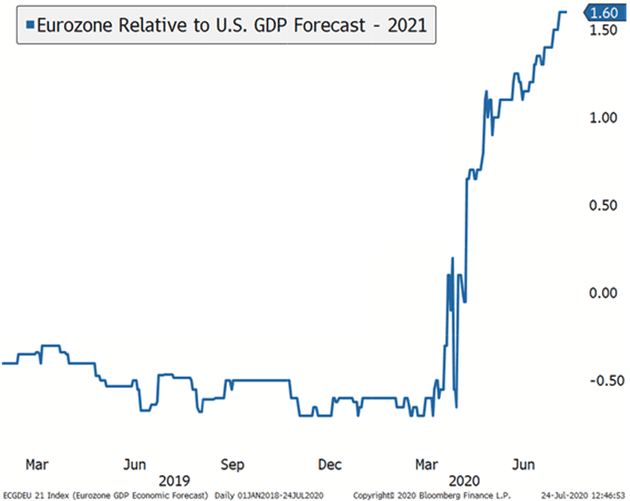

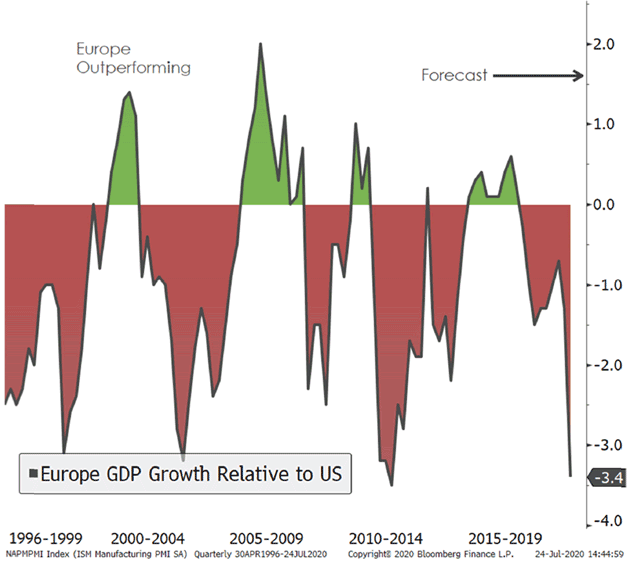

My friend Sam Rines of Avalon Advisors shared these charts showing Eurozone GDP is expected to outpace US GDP by 1.60 percentage points in 2021. That’s huge. If it happens, it will be the Eurozone’s best relative growth since 2007. Pay attention to the second chart.

Source: Avalon Advisors

Source: Avalon Advisors

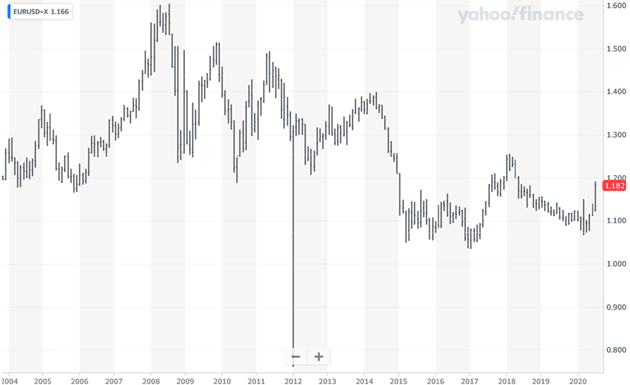

Now, look at those periods of European outperformance and notice how the euro strengthens relative to the dollar during those periods. When the US significantly outperforms the eurozone, as it did in recent years, the euro drops relative to the dollar. It came close to hitting the one-dollar mark—or parity. It is now back to $1.18. We could see the euro rise much further as Europe outperforms the US in the coming year or two.

Source: Avalon Advisors

We also have the Federal Reserve pledging to keep interest rates near zero. This “lower for longer” outlook has an effect on the US dollar. It has been relatively strong because our rates, while low, are at least not negative as in Japan and much of Europe.

Normally, a weaker dollar has benefits. It makes US exports cheaper. But with most of the world now trying to be as self-sufficient as possible (in addition to being in recession), we probably shouldn’t expect anything like normal trade volumes.

The most obvious winner in this is gold. Lower interest rates reduce (or actually eliminate) the opportunity cost of holding a non-yielding asset. While low growth is keeping the inflation outlook mild, it isn’t zero. That helps gold, too.

Now, a great deal of this depends on the pandemic. It could get either better or worse on both sides of the Atlantic. If human trials are positive, a vaccine could be available early next year. More sanguine analysts think we won’t see a vaccine until late 2021. In any case, key questions will be how fast it can be distributed, and who would get it first.

Same for treatments. If scientists find a drug that prevents most fatalities and reduces hospital stays, it might restore enough confidence to get consumers out again. Travel could resume without fear your life is at undue risk. A treatment is far more likely within the year.

Remove the virus from the equation and we return to an economy governed by the other factors that preceded it. From the point of the spread trade, it is likely you would see the US once again outperform and the euro fall. Sic transit gloria.

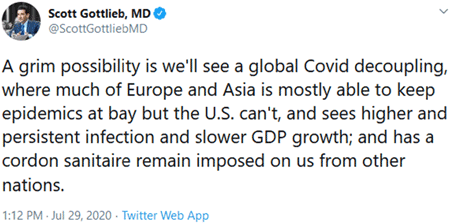

That pre-COVID economy wasn’t especially great, but it was far better than what we have now. We may be entering a radically different world for the next year or so, one in which US economic leadership is no longer assumed. Exactly what that would look like is unclear. Former FDA commissioner Scott Gottlieb has a guess.

Source: twitter

(By the way, you really should follow me on twitter. I highlight items like this, as well as make my own observations here.)

That would be ugly all around, especially for the dollar, but it’s possible if we don’t get a vaccine or treatments fairly soon—or at a minimum get the virus under control. Imagine a world in which Americans can’t leave and foreigners can’t enter, while Europeans can cross borders far more freely. What does that do to each side’s relative economic growth?

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

But I’m an optimist. I believe we will get out of this, one way or another. I can’t tell you when or how, nor can I promise it will be easy, but I think we will stumble through. Let’s try not to scrape our knees any more than necessary.

Tropical Storms, Hurricanes, and Puerto Rico

It is hurricane season in the Caribbean. I have friends asking if we are okay in Tropical Storm Isaias, as their news reports sounded rather dire. I am still getting used to Puerto Rico’s weather patterns. The island is large enough to affect storms. They tend to hit the eastern/southern side first, then the mountains and rain forest generally reduce the effects by the time the reach Dorado Beach, where I live, on the northern coast nearer the western tip.

Using my pool as an unofficial rain gauge, we got about 4+ inches of rain over 36 hours. Never as heavy as a West Texas thunderstorm, but steady rain nonetheless, and not much wind at all. Electricity went out across the island, although those of us fortunate enough to have generator backup didn’t notice all that much.

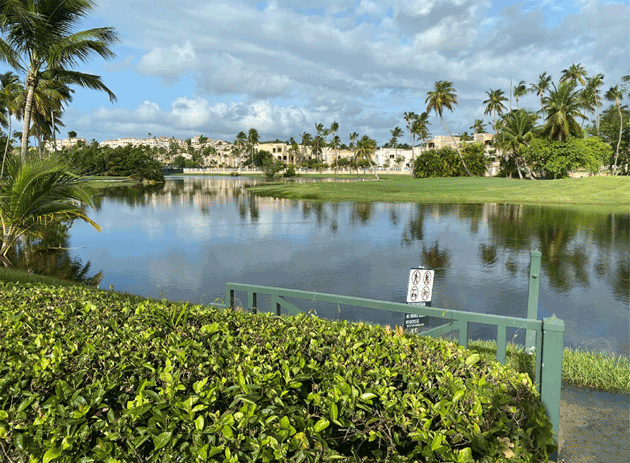

That was not the case on the eastern side. My friends there report massive rains and significant winds, with some trees down across roads. Here are pictures (thank to my friend Sean McCaffrey) from the Las Palmas golf course. These “lakes” are not water hazards. They were the fairways a few days ago. Some of the greens are now island greens. That’s a lot of rain.

All in all, not too bad as storms here go, although many areas are still without power accompanied by the usual damage. But the forecast is that it will be category two Hurricane Isaias by the time it hits Eastern Florida. That is a far more significant event than we faced here. I wish my friends there Godspeed.

As an aside, Puerto Rico is also getting earthquakes for the first time in 40 years. The last truly big one was in 1918. We have had a few of significant size over the last few quarters. Again, the earthquakes usually originate on the south side and we barely feel them in the north. Like hurricanes and tornadoes and severe storms in Texas, one will eventually come your way.

Now we all deal with the pandemic, which has been a far greater destructive force, in terms of lives and ongoing health issues and of course the economy. Like Roseanne Roseannadanna:

Source: Pinterest

Have a great week and be careful out there!

Your wondering what the next thing is analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin