Digital Shiny Objects

-

John Mauldin

John Mauldin

- |

- November 18, 2022

- |

- Comments

- |

- View PDF

Financial crises are really about trust. They tend to occur when people lose trust in assets, institutions, or people they had thought trustworthy. Whether the lost trust was a consequence of the crisis, or its cause is a different question. But they do seem to go together.

Sometimes trust is misplaced from the beginning. No one should have ever believed that tulips were guaranteed wealth, but plenty of intelligent people did. Other times the trust is initially justified but events negate it—events that may not be obvious until much later.

At some point, the pain from misplaced trust becomes so large that we begin to question our trust in everything around us. Who else could disappoint me? Thankfully, most trust catastrophes are small, contained situations. But they can become systemic, affecting entire systems.

All this came to mind as I read about the collapse of cryptocurrency exchange FTX. Its users—many of whom were hoping to escape a state-controlled financial system—can now only hope a state-controlled bankruptcy system eventually recovers some of their assets (talk about irony). I suspect they will be waiting a long time.

I haven’t written much about crypto because, quite frankly, I’ve never felt the attraction. I’m not against the concept; I understand the philosophical libertarian argument. But I keep trying to find a “use case.” Yes, I can avoid public/government scrutiny of my financial activities but so can all kinds of bad actors. I trade the inherent problems of fiat currencies for a different set of problems.

Cryptocurrencies can be extraordinarily useful for people in emerging countries with problematic currencies. But if you are in most of the developed world, the volatility and risk of cryptocurrencies has so far been greater than that of your local currency. Yes, the dollar is depreciating due to inflation. I can manage that with reasonable planning. Using Bitcoin or another cryptocurrency simply changes my risk exposure.

(Note: I am a huge believer in blockchain ledger systems, which have many other applications. I’m not sure cryptocurrencies are the best and highest use of this technology.)

The FTX episode is interesting because it says something about the risk environment and who investors “trust” with their money. I hesitated to write about this; simply raising the topic will probably get me attacked from all sides. It’s important, though, so I’ll put on my flak jacket and tell you what I think.

First, I’d like to share some exciting news. Along with my partners at Mauldin Economics, Olivier Garret and Ed D’Agostino, we recently launched a new partnership with Keith Fitz-Gerald of Keith Fitz-Gerald Research. Separate companies, but working together to serve you.

Keith and I have been friends for over 20 years. I respect the vision and clarity of his research. A private investor, educator, and researcher with 42 years of experience, Keith began his career at Wilshire Associates and today is principal of The Fitz-Gerald Group, a private market research company exploring non-linear prediction, stock selection, and investor education. Recently, he founded One Bar Ahead, a trading research advisory.

Keith’s a prolific writer, a fantastic wit, seemingly everywhere on TV and YouTube, and one hell of a stock picker. I recently signed up for his free daily market note, Morning! 5 with Fitz, and it’s quickly become one of my favorite reads. To sign up for yourself and get to know Keith better, simply click here.

Assets, Not Currencies

I distinctly recall my first exposure to the digital currency idea. It was around 2012 at a gold conference. I had just finished speaking about the economy and markets when two young people with a video camera approached and asked if they could interview me about “bitcoin.”

I had no idea what they meant. They enthusiastically explained it was digital money invented by a mysterious person named Satoshi that anyone could acquire by solving some math problems. I can’t emphasize the word “enthusiastically” enough. This was going to replace gold with a secure, anonymous digital “currency.” It would keep governments from debasing their currencies and make all your financial transactions anonymous.

“Okay,” I replied, “that sounds innovative.” And that was pretty much all I could give them. It was completely foreign to me at the time. And yes, I should have just invested $5,000 and moved on. (Unfortunately, not the first nor the last life-changing-in-hindsight trade I will miss. Shoulda, woulda, coulda…)

As I learned more, I still didn’t see the attraction. In theory, I’m exactly the kind of person who should like a non-government currency. I am generally not happy with central banks, I value my privacy, and I (mostly) trust market forces to deliver whatever we all need. I was once quite a gold bug for similar reasons.

But I try to be an ethical pragmatist. I’m attracted to whatever works (again, within my ethical framework). If digital tokens could actually function as our currency and prevent political and central bank manipulation, I’d be all aboard. I have not seen evidence that is the case.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

For a host of practical reasons, replacing government-issued currencies requires governments to give up power, which they will naturally resist. Governments love power. They don’t surrender it easily, even relatively benign, market-friendly governments, much less the more doctrinaire authoritarian statists.

This doesn’t make digital assets useless; it just means they are assets, not currencies.

In fact, this brings up one of my real fears. All the good intentions seem to have sparked interest in governments everywhere in creating their own digital currencies: Central Bank Digital Currencies (CBDC). I really don’t want my government to be able to track all of my individual transactions. I don’t want to be in what is essentially a spy state like China, where they know everything and you end up with a digital profile. I don’t want a social credit score that can be used to control me. I worry that a CBDC, which we will be assured has many benefits, will evolve into a Chinese-type social credit score or a Big Brother watching me a la 1984.

But that brings us back to the trust issue and FTX.

Intermediary Problem

Bitcoin was the original cryptocurrency but numerous others now exist, each with its own design and characteristics. The common thread is they exist on some kind of blockchain-like distributed ledger. You “own” them only to the extent you can prove it to the network, and they have value only if you can transfer them to someone else.

Therein lies the rub. Providing the necessary proof is difficult because you also have to do it anonymously. More than a few early enthusiasts lost access to their bitcoin because they misplaced or forgot their passwords. This is a huge risk. Without digital credentials, your asset is gone. You can’t just reset the password.

This is a technological evolution of the same problem gold owners have always had. You have this valuable object someone could easily steal. How do you keep it secure, yet accessible when you need it?

With gold you can buy a safe, bury it in the backyard, or stuff it inside the mattress. These methods are only practical for fairly small amounts, and still aren’t perfect. A determined thief, given time, can crack your safe.

For those reasons, gold owners often store their gold with some kind of intermediary, like a bank safe deposit box (which is what I do) or a private gold depository. Or they may keep it in some kind of securitized form, like any of several gold bullion ETFs. Those are safer in some ways, but the fact remains someone else has your gold. You have to trust they will a) not lose it and b) return it on demand.

This same problem exists in crypto. You can keep it under your direct control, which is an important feature to some people. Generally, however, people would like to do something with their cryptocurrency. Trading directly can be somewhat cumbersome so exchanges became the solution. The problem is, the exchanges are still trying to figure out how to get the whole transparency thing down. Not to mention the technology—Mt. Gox was just the first of what has now been several that had problems and collapsed.

The layers of trust sometimes go even deeper. Investors trusted their financial advisor who trusted a fund manager who trusted FTX. All these people now have a lot of explaining to do. This kind of trust, once broken, is very hard to regain.

If the FTX drama ends there, then it will have been just drama—terrible for those involved but leaving others unharmed. Will it end there? Right now, it doesn’t look like it will. There appears to be a great deal of contagion brewing.

I think that FTX has the potential to be the biggest financial debacle of our lives. Bigger than Enron, bigger than Madoff.

When the Tide Goes Out

The good news for the non-crypto economy is that firms like FTX have limited connections to the conventional banking system. Their problems shouldn’t spread as widely as a Lehman-like collapse would. They also aren’t part of the government-backed protective schemes like FDIC and SIPC, so taxpayer risk is minimal, too.

But that doesn’t mean this failure will have no effect. It goes back to the concept of trust we were discussing.

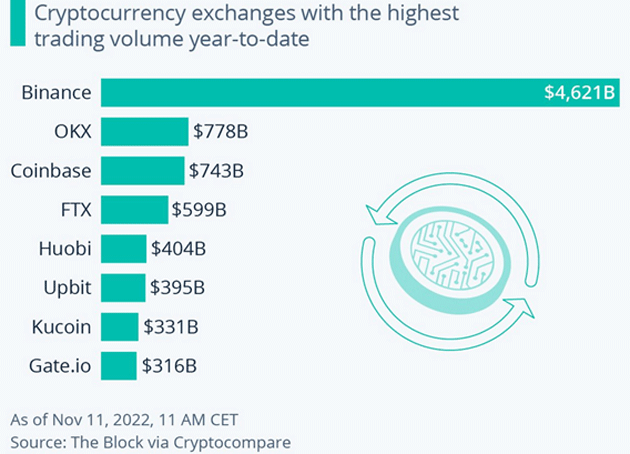

For one thing, FTX wasn’t the only player in this space, or even the biggest one. Here’s a list of the top cryptocurrency exchanges, ranked by trading volume.

Source: Liz Ann Sonders

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

FTX was far behind leading Binance which has a staggering $4.6 trillion in trading volume this year. (Much of that represents the same assets changing hands repeatedly, so the asset value is lower.) Regardless of how you look at it, though, this isn’t a small industry. FTX was big and had several peers in the same range. I have no reason to think any of them have the same kind of problems. I also have a hard time ruling it out. These “exchanges” aren’t like the NYSE. They don’t have the same kind of—if any—regulatory oversight, independent audits, and public visibility.

This lack of intermediaries means doing business on a crypto exchange requires an extraordinary amount of trust. I suspect FTX founder Sam Bankman-Fried saw this, which is why he developed a, shall we say, “memorable” persona and spent the last few years appearing on every crypto-related stage and screen that would have him. At every venue he would talk about values and charity. He is evidently very good at getting people to believe him. Familiarity is the first step to gaining trust. He worked hard to cultivate it.

Others helped. “SBF,” as Bankman-Fried is known online, had many celebrity endorsements, both the Hollywood kind of celebrities and the financial kind. A number of top venture capital funds invested in his endeavors, providing a kind of tacit endorsement. People assume VCs conduct the appropriate due diligence before they invest. If they did so with FTX, they seem to have missed a few things.

Exactly what happened with FTX is still unclear. The more we learn the more astonishing it actually is.

The now-bankrupt FTX has a new CEO, John Ray. He is quite well known for walking into financial disasters and trying to sort them out. Enron was his first brush with fame, but you don’t get to do Enron unless you already have a solid reputation. He was a bulldog and the Enron creditors loved him.

Ray went on to handle other lesser known but equally difficult situations. When you bring John Ray in to solve a problem, you know it’s a REALLY big problem. Here is what he said in a recent bankruptcy filing:

“I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources, and systems integrity.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals, this situation is unprecedented.”

The more you dig into this the more you are amazed at the lack of adult supervision. SBF and his executive team took customer money and “lent” it to Alameda Research (effectively themselves), and then tried to trade their way to profits, lending themselves massive amounts of money along the way. Read this note from Forbes.

“FTX bankruptcy filings released Thursday revealed that FTX founder Sam Bankman-Fried, his cofounder Gary Wang and two other executives received a total of $4.1 billion in loans from his Alameda Research trading firm.

“Of that total, $1 billion went to Bankman-Fried in the form of a personal loan, while $2.3 billion went to an entity he controls, Paper Bird (Bankman-Fried has told Forbes that he owns 75% of the entity, with Wang owning the rest)—so that’s another nearly $1.73 billion at Bankman-Fried’s disposal. FTX’s Director of Engineering Nishad Singh got his own loan of $543 million, while Ryan Salame, the co-CEO of FTX’s Digital Markets subsidiary, received a $55 million personal loan.

“The obvious question: Where did all that money go? There are two principal areas we know about so far: political donations and personal investments.”

At this point there are more questions than answers. FTX clients should have asked them sooner, perhaps, but you can bet they’ll do it now. And not just with the crypto part of their portfolios. Again, it’s the trust issue.

The answers they get (or non-answers) will probably expose some other mistakes. Then what? If you have money in something that turns out to not be what you thought it was, you look for a way out. You try to sell. But to whom? Finding buyers may be hard when everyone is suddenly asking the same awkward questions all at once.

A very famous person who is sadly all too familiar with FTX was asked this week if everyone should redeem from any crypto exchange they were on. Long pause and silence. You can’t say yes because we know what happens when everyone tries to leave the room at the same time. But the implication was there.

Trust Comes Easy

Now, consider what else is happening. We have the highest inflation in decades, which is making the Federal Reserve tighten interest rates. We don’t know how long that will continue; I think into mid-2023 and maybe beyond if inflation doesn’t drop fast enough.

This will probably trigger a recession that hits the earnings of companies whose shares are priced for perfection. Meanwhile higher financing costs are making it more expensive to own all kinds of leveraged assets.

In other words, we already have the conditions for a major repricing of risk. In the same way people trusted FTX with their crypto, they’ve trusted CEOs to deliver strong earnings. They’ve trusted fund managers to buy the right stocks. They’ve trusted central bankers, regulators, and politicians to choose wise policies.

All that trust comes easy in a bull market. Warren Buffett, who has seen more bulls and bears than most of us, famously said, “Only when the tide goes out do you discover who’s been swimming naked.”

I’m very confident in saying many, many people are swimming naked in this market. It’s felt pretty good for quite a long time. But one reason it’s felt good is they aren’t really naked. They’ve had an unnaturally long high tide to cover themselves. That tide will go out at some point. I don’t know if FTX will be the turning point, but it could be. And if it’s not FTX it will be something else.

It will be supremely ironic if the asset class that tried to render “trust” unnecessary proves how critical trust is.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I get the whole desire to be independent. The problem is that humans, whether you believe in design or evolution, depend on other humans from birth. Infants are totally dependent on their parents and especially their mother for their very survival. Not all species are like that. Ours is, and we continue depending on each other in various ways through our whole lives.

In a world where the division of labor is at its greatest in history, we are forced to trust the “market,” people literally all over the world, who we will never meet, to deliver food, energy, and a host of goods and services. We have no choice. That’s good; it has enabled humanity to achieve amazing things and move billions out of poverty, given us longer lives and so many good choices. But it requires trust.

Trust is precious, something to be carefully protected. And when bad actors destroy that trust? You and I can deal with it, but the person down the street or across the country or world? Can they?

Who do you trust? I think FTX has the potential to call that into question for a host of theoretically unrelated issues. The answer is going to end up being radical transparency. FTX was a massive failure of due diligence.

I have done a large amount of due diligence on funds and managers as part of my day job. I wrote a chapter on due diligence in Bull’s Eye Investing almost 20 years ago. I listed 120 questions investors should asked advisors and fund managers. Today that list would be longer but the #1 issue? Transparency. If you don’t get it, then close your notebook and politely figure out how to walk away.

Reagan was right. Trust, but verify.

Dallas, Tulsa, and Family

I am in a wicked cold and snowy Denver tonight and having to write late into the night to get this letter to my editorial team on time. I literally cut over half the letter in my second edit. Hard to simply stop writing and editing. My editors will no doubt cut another 20%. Sigh. So much left unsaid, I will have to come back and opine on the whole crypto world at a later date.

Being on stage with Vitaliy Katsenelson was just an absolute pleasure. I will write more on his book, Soul in the Game, but suffice it to say I will be giving a copy to all my kids for Christmas. I wish I had read it 50 years ago. And what a fabulous audience. I wish I could sit down with all of them one on one. Such great stories and questions.

I will fly back to Dallas on Saturday and meet up with Shane. We will spend a few days meeting old friends and family before heading off to Tulsa where all the kids and grandkids will gather. I will be cooking prime rib and mushrooms and leaving the other important items to my now adult family.

My son Chad and his SO Dannielle came up from Colorado Springs to the CFA dinner tonight. What a pleasure. I smile when I look at him from the stage. Fully cowboy, hat and boots, not the young teenager who was into rap and such. Such a difference. He drove me back to my hotel, amazed I did not recognize the country music stars that were on his playlist. Tennessee Whiskey? I am still grinning.

And with that, time to hit the send button. You have a great Thanksgiving, my favorite holiday. I hope you get to spend it with family and friends. I have so much to be thankful for. And follow me on Twitter!

Your really thinking about trust analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin