Collateral Damage

-

John Mauldin

John Mauldin

- |

- December 31, 2011

- |

- Comments

- |

- View PDF

What Next? Where Next?

A World with Too Much Debt

Debt Restructuring and Write-Offs

The Euro Zone: Pouring Fuel on the Flames

What If… ?

The Year(s) Ahead

Auld Lang Syne

"Whoever cannot seek the

unforeseen sees nothing for the known way is an impasse."

― Heraclitus, Fragments

Which path will we take? If we could only grow our way out of our sovereign debt problems. But growing debt creates even more problems if not dealt with, making it even more difficult to deal with; yet getting the debt and deficit under control brings its own form of pain. As I keep pointing out, there are no easy choices left. Some countries must choose between difficult and very bad, and others are faced with either disaster or calamity. Greece simply gets to choose what it wants to be the cause of a depression. Long and slow or fast and deep? Choose wisely.

It's that time of year when we start thinking about what the next may hold for us. I am reading and thinking a great deal about my annual forecast issue next week, taking some time off from my usual Friday missive; so this week we look at what I think is one of the best pieces of analysis I have read in the past few months. It is from a private letter for the Boston Consulting Group, and Dan Stelter graciously allowed me to let my friends read it.

Follow this thinking carefully and then think through their outline of what a country would have to do to leave the euro, which starts at the subhead entitled "What if… ?". Then ask yourself what do you need to do. The short answer from me is that you need to consider more what you already own rather than what you should buy.

At the end of the letter is a link to an in-depth review of what scenarios businesses should be considering, but it will also work for individual investors. Now, let me turn it over to Dan and David.

Collateral Damage

What Next? Where Next?

What to Expect and How to Prepare

January 2012

This paper covers some familiar ground in order to remind readers of the interplay among the most important economic developments, considers the scenarios for which companies should prepare, and suggests some steps that prudent companies may wish to consider. For those readers who are well acquainted with the economic scenarios described, we suggest that you start reading at "What Should Companies Do to Prepare?" beginning on page 13, below.

The economic travails of much of the West are reaching a decisive stage as the year ends. In 2008, we predicted sluggish recovery and a long period of low growth for the West in a two-speed world. This picture does not now properly reflect the downside risks. The policy of "kicking the can down the road" is failing, as the intensifying crisis in the euro zone and the failure of the G20 summit in late October clearly demonstrate. As to December's European summit, we describe its impact later in this paper.

Such extreme uncertainty is challenging for companies trying to prepare their budgets for next year—or, more fundamentally, trying to plot their strategic course. It helps to have a clear understanding of what may happen and why it may happen. So before we address the question of which scenarios to expect and how to prepare, let us remind ourselves about the root of the problem: the West is drowning in debt.

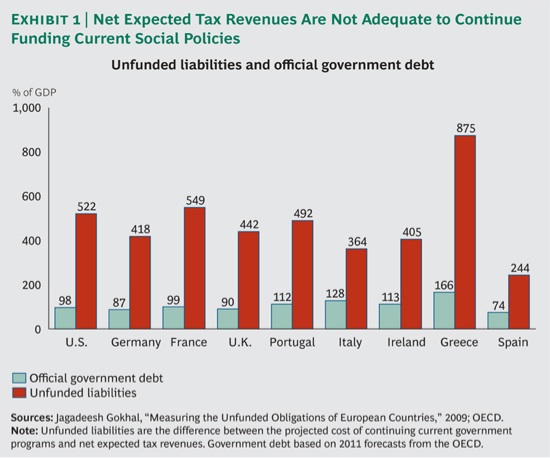

A World with Too Much Debt

Total debt-to-GDP levels in the 18 core countries of the Organisation for Economic Co-operation and Development (OECD) rose from 160 percent in 1980 to 321 percent in 2010. Disaggregated and adjusted for inflation, these numbers mean that the debt of nonfinancial corporations increased by 300 percent, the debt of governments increased by 425 percent, and the debt of private households increased by 600 percent. But the costs of the West's aging populations are hidden in the official reporting. If we included the mounting costs of providing for the elderly, the debt level of most governments would be significantly higher. (See Exhibit 1.)

Add to this sobering picture the fact that the financial system is running at unprecedented leverage levels, and we can draw only one conclusion: the 30-year credit boom has run its course. The debt problem simply has to be addressed. There are four approaches to dealing with too much debt: saving and paying back, growing faster, debt restructuring and write-offs, and creating inflation.

Saving and Paying Back. Could the West simply start saving and paying back its debt? If too many debtors pursued this path at the same time, the ensuing reduction in consumption would lead to lower growth, higher unemployment, and correspondingly less income, making it more difficult for other debtors to save and pay back. This phenomenon, described by Irving Fisher in 1933 in The Debt-Deflation Theory of Great Depressions, can result in a deep and long recession, combined with falling prices (deflation). This is amplified when governments simultaneously pursue austerity policies—such as we see today in many European countries and will see in the U.S. beginning in 2012. A reduction in government spending by 1 percent of GDP leads to a reduction in consumption (within two years) of 0.75 percent and a reduction in economic growth of 0.62 percent. Saving (or, more correctly, deleveraging) will reduce growth, potentially trigger recession, and drive higher debt-to-GDP ratios—not lower debt levels. Indeed, during the early years of the Great Depression, President Hoover—convinced that a balanced federal budget was crucial to restoring business confidence—cut government spending and raised taxes. In the face of a crashing economy, this only served to reduce consumer demand.

For the private sector and government to reduce debt simultaneously would require running a trade surplus. So long as surplus countries (China, Japan, and Germany) pursue export-led growth, it will be impossible for debtor countries to deleverage. Martin Wolf put it trenchantly in the Financial Times: "The Earth cannot, after all, hope to run current account surpluses with the people of Mars." The lack of international cooperation to rebalance trade flows is a key reason for continued economic difficulties.

Saving and paying back cannot work for 41 percent of the world economy at the same time. The emerging markets would have to import significantly more, which is unlikely to happen.

Growing Faster. The best option for improving woeful debt-to-GDP ratios is to grow GDP fast. Historically, this has rarely been achieved, although it can be done—for example, in the U.K. after the Napoleonic Wars and in Indonesia after the 1997/1998 Asia crisis (although Indonesian debt levels were nowhere near contemporary highs in the West). Attacking today's debt mountain would require reforming labor markets or investing more in capital stock. Neither is happening.

Politicians are unwilling to interfere in labor markets given today's elevated levels of unemployment. Moreover, empirical evidence shows that the initial impact of such reforms is negative, as job insecurity breeds lower consumption.

Companies can afford to invest significantly more, as they are highly profitable. The share of U.S. corporate profits in relation to U.S. GDP is at an all-time high of 13 percent (as are cash holdings), yet corporate real net investment (that is, investment less depreciation) in capital stock in the third quarter of 2011 was back to 1975 levels. But companies are reluctant to invest while demand is sluggish, while existing capacities are sufficient, and while the outlook for the world economy remains highly uncertain.

The aging of Western societies will be a further drag on economic growth. By 2020, the workforce in Western Europe will shrink 2.4 percent, with that of Germany shrinking 4.2 percent.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The inability to grow out of the problem is bad news for debtors. Look at Italy, for example: Italian government debt is 120 percent of GDP. The current interest rate for new issues of ten-year bonds is 7 percent—up from 4.7 percent in April 2011. If Italy had to pay 6 percent interest on its outstanding debt, such a high rate would materially increase the primary surplus (that is, the current account surplus before interest expense) that Italy would need to run in order to stabilize its debt level. If we assume that Italy's economy grows at a nominal rate of 2 percent per year, the government would need to run a primary surplus of 4.8 percent of GDP (calculated as 6 percent interest incurred on its debt minus 2 percent nominal growth multiplied by 120 percent debt to GDP) just to stabilize debt-to-GDP levels; the latest forecasts show only a 0.5 percent surplus for 2011. Any effort to increase the primary surplus through austerity and tax increases runs the risk of creating a downward spiral. When investors start doubting the ability of the debtor to serve its obligations, interest rates rise even further, leading to a vicious circle of austerity, lower growth, and rising interest rates.

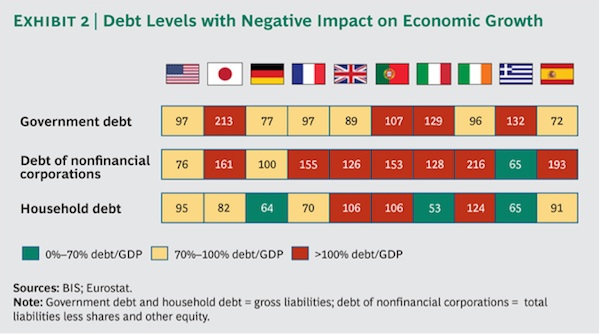

Debt in itself makes it more difficult to grow out of debt. Studies by Carmen Reinhardt and Kenneth Rogoff and the Bank for International Settlements show that once government debt reaches 90 percent of GDP, the real rate of economic growth is reduced. This also applies to the debt of nonfinancial corporations and private households. Exhibit 2 shows the current debt level of key economies by sector. In all countries, the debt level of at least one sector is beyond the critical mark. Somewhat perversely, only in Greece are the two private sectors below the threshold. And only in Germany and Italy (in addition to Greece) do private households have a debt level below 70 percent of GDP.

[Note: For those not familiar, the flags represent the US, Japan, Germany, France, Britain, Portugal, Italy, Ireland, Greece, and Spain, in order. – JM.]

Debt Restructuring and Write-Offs

We explored this option in our last paper (Back to Mesopotamia: The Looming Threat of Debt Restructuring, BCG Focus, September 2011). Assuming a combined sustainable debt level of 180 percent of GDP for private households, nonfinancial corporations, and governments, we estimated the debt overhang to be €6 trillion for the euro zone and $11 trillion for the U.S. We argued that (some) governments might be tempted to fund this through a one-time wealth tax of 20 to 30 percent on all financial assets.

The target level of 180 percent can be debated (and was debated by many readers of Back to Mesopotamia), but a level of 220 percent would still imply a debt restructuring of $4 trillion in the U.S. and €2.6 trillion in the euro zone, leading to a one-time wealth tax of 12 percent and 14 percent, respectively. Given the unpopularity of such a tax, we are likely to see less incendiary taxes imposed. This means that politicians must resort to the last option: inflation.

Inflation. Another option to reduce Western debt loads would be financial repression—a situation in which the nominal interest rate is below the nominal growth rate of the economy for a sustained period of time. After World War II, the U.S. and the U.K. successfully used inflation to reduce overall debt levels. In spite of today's low-interest-rate environment, we have the opposite situation: interest rates are higher than economic growth rates. As risk aversion in financial markets increases and a new recession in 2012 looms large, the problem could get even worse.

So the only way to achieve higher nominal growth will be to generate higher inflation. Aggressive monetary easing has barely moved the inflation needle in the U.S. and most of Europe, although the impact on U.K. inflation has been greater. Inflation is not being generated, because the expectation of inflation remains low and because there is still overcapacity and overindebtedness in the private and public sectors. Continued monetary easing could (and will) lead to a substantial monetary overhang that could, if the public loses trust in money, lead to an inflationary bubble. Some argue that inflation is unlikely because of the oversupply of labor and continued competition from new market entrants like China. Certainly we may see continued pressure on wages because of globalization, although the longer low growth persists in the West, the more likely it is that Western governments will resort to increased protectionism, leading to upward pressure on prices. Moreover, some observers believe that the inflation indicators do not give a true reading of the underlying rates of inflation.

It is also a matter of trust. Take, for example, the history of hyperinflation in Germany in the early 1920s. The German Reichsbank funded the government with newly printed money for several years without causing inflation. But once the public lost trust in money, people started to spend it fast. This led to higher demand and an inflationary spiral. Today the velocity of money in the U.S. is at an all-time low of 5.7. If the number of times a dollar circulates per year to make purchases returned to the long-term average of 17.7, price levels in the U.S. would rise by 294 percent over that period—unless the Federal Reserve simultaneously reduced its balance sheet by $1.8 trillion. Some inflation is probably attractive to those seeking to reduce debt levels. The problem is stopping the inflation genie once it has left the bottle.

There are no easy solutions to the debt problem. At best, we expect a sustained period of low growth in the West. Even this would require the following:

A coordinated effort to rebalance global trade flows, which would require the emerging markets, Germany, and Japan to import more, thereby allowing the debtor countries to earn the funds necessary to deleverage

Stabilizing the overstretched financial sector through recapitalization and slow de-risking and deleveraging—in contrast to today's new rules, which encourage banks to shrink their balance sheets rather than finance commercial activity (it is worth noting that the effect of monetary easing during a period when ultra-low interest rates are below the rate of inflation is essentially to provide additional support to the banking system through the provision of low-cost liquidity)

Reducing excessive debt levels, ideally through an orderly restructuring or higher inflation

Current policies fall short against all these criteria. The coordinated intervention of several global central banks on November 30 could be construed as a positive sign of global cooperation, given that the whole world fears the implications of a (disorderly) breakup of the euro zone. In reality, it was once again merely a case of pulling the only lever left—that of printing money—and so did not address the one fundamental problem facing the world economy. Even China's participation reflected its worries about its biggest export market (Europe) and the risk of another (possibly deep) recession more than a true willingness to support the West by rebalancing trade flows.

Any new recession, given growing and unsustainable debt levels, would increase the risk of short-term defaults and significantly increase the medium-term risk of higher inflation. Companies should therefore prepare for these scenarios. But they also need to consider how the situation in Europe could amplify the problem.

The Euro Zone: Pouring Fuel on the Flames

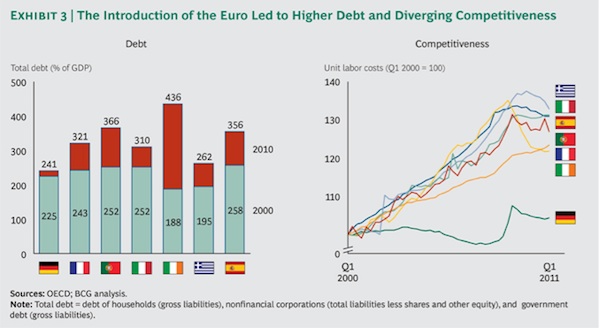

The crisis of the euro zone makes dealing with the debt overhang even more difficult. The introduction of the euro was followed by two important developments:

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Debt grew quickly in most countries of the euro zone because credit became cheap and, in many instances, negative real-interest rates fueled real estate bubbles. Consumers in the countries of the periphery, made confident by newly strong currencies and low interest rates, also embarked on a spending boom.

Competitiveness diverged between Germany and the Netherlands, on the one hand, and the countries of the south (the periphery), on the other, with the countries of the periphery failing to rein in excessive wage increases which, in the past, could be addressed through currency devaluation. Having lost the ability to adjust through exchange rate devaluations, the countries of the periphery can now only resort to painful internal devaluations (in short, salary cuts). (See Exhibit 3.)

December's EU summit was supposed to restore confidence in the future of the euro zone. The European leaders made the following decisions:

The members of the EU will change their respective constitutions and national laws in order to impose limits on allowable budget deficits.

The members of the EU will accept stricter supervision of their budgets by EU institutions (such as the European courts), including quasiautomatic sanctions should their national budget deficits breach prescribed limits (a "structural deficit" of more than 0.5 percent of GDP—reflecting the impact of the business cycle).

The European Stability Mechanism (ESM) will be implemented a year earlier and run for some time in parallel with the European Financial Stability Facility (EFSF). EU leaders increased to a total of €500 billion the financial power that can be deployed to support the weaker countries of the euro zone.

The members of the EU will consider whether to provide funding of €200 billion to the International Monetary Fund (IMF) in order to help countries deal with a liquidity squeeze.

In future debt restructurings, private-sector bondholders will be treated according to the practice of the IMF, with no automatic haircuts. All government bonds will require collective-action clauses to facilitate restructurings.

The summit was predictably vague on the subject of imbalances within the euro zone, although the politicians expressed a wish for more coordination in the future.

With the U.K. opposed to an overall EU treaty change, the other EU leaders (all the euro zone countries, along with most other EU members outside the euro zone) aim to use an intragovernment treaty to implement these changes by March 2012. It remains to be seen if such a "treaty within the treaty" will be feasible in legal terms. Even more important, it is not yet certain that the individual governments will commit to the rules as decided at the summit. We may well see some pushback and efforts to soften those rules in the coming months. And even if the new rules are fully implemented, previous experience with the commitments made under the 1992 Maastricht Treaty does not necessarily give cause for optimism that they will be followed.

Before the summit, the European Central Bank (ECB) announced new measures to support European banks. It lowered the core refinancing rate to 1 percent; offered two new long-term refinancing operations that will last for three years; widened the range of acceptable collateral; and, for the first time, made loans to small and medium-size enterprises acceptable. The ECB also made clear that it does not plan to engage in a broad-scale program to buy up the debt of countries like Spain and Italy. Rather, it sees the responsibility for dealing with the debt crisis as lying with the individual governments of the euro zone. In other words, the ECB does not wish to act as a lender of last resort—the absence of which is one of the underlying causes of the continuing weakness of the combined EU response.

In our view, these are steps in the right direction but they are not sufficient, because they do not address the core issues of the debt overhang and diverging competitiveness. The plan that emerged from the summit is unlikely to be enough to stabilize financial markets. With the U.K. opting out and the uncertainty about legal enforcement, there is valid reason to question the plan's credibility.

Any true solution of the crisis must, at a minimum, accomplish four things: buy time for fundamental reforms by introducing interest relief for the weaker countries of the euro zone, improve relative unit-labor-cost competitiveness, restructure excess debt, and establish a fiscal union. Overall, European leaders, while taking some steps in the right direction, again have not gone far enough.

Interest Relief. First, the financial markets need a credible commitment from the ECB to "ring fence" any member of the euro zone. It has become clear that only the ECB's "big bazooka" (using the unlimited purchase of the debt of troubled countries to keep interest rates down) has the firepower and the credibility to keep interest rates below critical thresholds. The EFSF lacks the firepower to take on the refinancing needs of Spain and Italy over the next two years. Starting the ESM a year earlier and running it in parallel with the EFSF will increase the funds available, as will the potential provision of additional funding for the IMF. But even then, the available funds will not be sufficient to cover the weaker countries long enough to allow for fundamental reforms.

Even if the ECB stepped in, it could only buy time: in a "benign" scenario of only 4 percent interest on Spanish or Italian government debt, the debt-to-GDP ratio would continue to grow, from 60 percent in Spain and 119 percent in Italy today to 65 percent and 131 percent, respectively, in 2015. Any attempt to stabilize debt levels would lead to the vicious circle already described.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Diverging Competitiveness. The summit did not address the issue of diverging competitiveness and the resulting trade imbalances within the euro zone. The countries of the periphery (as well as France) have to regain competitiveness by lowering their unit-labor costs and introducing more flexibility into the labor markets. Gold-plated pensions (particularly in the public sector) and rigid job-security laws make progress here very unlikely.

In

the case of Spain, unit labor costs would have to be reduced by more than

25 percent to restore competitiveness. In a system of fixed exchange rates,

this can only be achieved by significantly increasing productivity (by

requiring more working hours per week or making capital investments) and/or

lowering salaries. Lower incomes would make it more difficult to service and

reduce the high levels of debt (less revenue from taxes with which to pay back

government debt and lower personal incomes with which to fuel growth or pay off

private debt). Falling incomes, reduced tax revenues, and austerity programs

would reduce growth and further reduce debt sustainability—leading to

higher risk premiums in the capital markets.

The social cost of such an internal devaluation would be high and few people would accept it. A recent article in The Economist compared the implied adjustments for the periphery of Europe with developments during the 1930s leading to the Great Depression. Back then, adherence to the constraints of the gold standard prevented an adjustment, and Germany had to achieve an internal devaluation to regain competitiveness. Although very few expect a repetition of the tragedy of the 1930s, it is obvious that a strategy of saving our way out of the crisis will not only fail but will run the risk of triggering significant tensions in Europe.

The Debt Overhang. The summit made it clear that the governments of the periphery are expected to introduce austerity programs in order to balance their budgets and reduce their debt levels. Because many countries suffer from too much government debt and elevated private-sector debt (as shown in Exhibit 2), it is obvious that any attempt to deleverage both simultaneously will lead to a deep and long recession, as described above. We continue to believe that some kind of debt restructuring—and not only of public debt—is necessary to lay the foundation for future growth.

Establishment of a Fiscal Union. At the summit, European leaders moved toward closer fiscal coordination to ensure the euro zone's future. A fiscal union would ultimately allow for the issue of joint Eurobonds and so enable the periphery to shelter behind the stronger north. This may be one cornerstone for a long-term solution to the euro zone's problems, but it does not address the issues of diverging competitiveness and the debt overhang. Capital markets would rightly question whether the countries of the periphery would accept losing control of their budgets and of key political decisions.

Political tensions can be expected if Brussels—or even worse, Berlin—is to decide on retirement ages and pension levels. But one can also question the willingness of Germany and other countries of the north to continually fund the south. Will the German electorate accept higher taxes to support the countries of the south? And more important, will the capital markets? Some observers took the failed auction of ten-year German bonds in late November as an early-warning signal. And indeed, the German economy is not as healthy as is generally assumed. With government debt at 87 percent of GDP and interest rates of 3 percent, Germany needs nominal growth of 3 percent just to keep debt levels stable (assuming no primary surplus)—no easy task given the negative impact of demographics on future growth. The additional costs of rescue operations within the euro zone could cause the day of reckoning to arrive sooner than is generally expected.

In summary, the existing initiatives fall short. The new agreements essentially put in place some additional improvements to the existing stability and growth pact, which has not been successful to date. The politicians did not increase the size of the ring fence—the "big bazooka" necessary to avoid the viral spread of the sovereign-debt risk; there was no progress on debt mutualization through the issuance of common Eurobonds; there was no forceful monetary easing plan for the ECB; there were no tough calls made on how to address the problems of diverging competitiveness; and no strategy was articulated for reigniting growth in the euro zone—the absence of this last element perhaps not so surprising given that this is all about containment. Whatever our readers' views on the stance adopted by the U.K., we can't help but believe that the leaders of the other countries were thankful for the distraction provided by the U.K.'s position, which diverted attention from the lack of sufficient substantive progress on some of the most pressing issues.

The euro zone needs a comprehensive plan to deliver a combination of higher inflation (to reduce real debt and address diverging unit-labor costs), deleveraging in the periphery, and higher consumption in the northern countries. Employees in Italy, Spain, and Portugal—and also in France—would have to accept wage increases below the rate of inflation, while employees in Germany and the Netherlands would enjoy real-wage increases. Politicians in the north would also need to lower taxes and introduce stimulus programs to support domestic consumption. In addition, any successful strategy would need to include a restructuring of excess debt (partial defaults). Some observers believe that Germany would be unwilling to pursue such a strategy given fears of higher inflation and the moral hazard of overly indebted countries benefiting from broader cost sharing within the euro zone. We are more optimistic. We believe that Germany will—after long resistance—support such a strategy as the only way the euro zone can survive in its current form. The only real alternative, the breakup, would have major negative repercussions.

What If… ?

For some commentators, it is not a question of whether the euro zone will break up but of how and when it will break up. There is undoubtedly an increased risk of at least some (potentially disorderly) fracture in the euro zone. And some governments are rumored to be preparing just in case—by, for example, securing sufficient capacity to print new supplies of money. Not surprisingly, we have engaged with many clients to discuss this scenario and prepare for it. A country leaving the euro zone would need to do the following:

Announce and immediately impose capital controls.

Impose immediate trade controls (because companies would otherwise falsify imports in order to get their money out).

Impose immediate border controls (to prevent a flight of cash).

Implement a bank holiday (to stop citizens from withdrawing their money and running before the devaluation) and—although this is somewhat hard to imagine—stamp every euro note in the country, converting it back to the national currency.

Announce a new exchange rate (presumably not floating at the beginning, given capital and exchange controls) so that trade could continue.

Decide how to deal with existing outstanding euro-denominated debt, which would probably entail a major government and private-sector debt restructuring (that is, default). This might be easier in the case of government debt, which tends to be governed by domestic law, in contrast to the debt of major corporations, which is normally governed by U.K. law (but we would assume enactment of laws declaring a haircut here, as well).

Recapitalize the (insolvent) banks to make up for losses from defaults.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Determine what to do with the nonbank financial sector, the stock and bond markets, and every company account and commercial contract in the country.

Any breakup would lead to significant turbulence in financial markets—just think about the number of credit default swaps outstanding—and a worldwide recession. The OECD has warned that a breakup of the euro zone would lead to "massive wealth destruction, bankruptcies and a collapse in confidence in European integration and cooperation," leading to "a deep depression in both the existing and remaining euro area countries as well as in the world economy." Exhibit 4 describes a breakup scenario and its potential implications.

According to UBS, the economic costs of a breakup would be huge. Depending on whether the country leaving the EU is a "weak" or a "strong" country, the costs would range from €3,500 to €11,500 per inhabitant per year. Besides these implications for the countries of the euro zone, the world economy would be severely affected, with negative implications for the U.S.—amplifying existing recessionary and potentially deflationary pressures—and also for the emerging markets that depend on exports to the West.

The Year(s) Ahead

As they go into 2012, business leaders need to prepare for a difficult year, and perhaps for several difficult years. They should consider at least four scenarios:...

And with that, we close the year, as the letter would be too long otherwise. You can read their suggested scenarios at http://www.johnmauldin.com/frontlinethoughts/the-years-ahead-report-0112". I strongly suggest you do. They made me think a lot about my own business and investments.

Auld Lang Syne

Music plays an important part in most of our lives. I grew up listening to gospel quartets and Irish tenors (my father's favorite). Believe it or not, in my youth I sang as a high tenor with the Fort Worth Opera Chorus, in 1968. I had the privilege of being ten feet from Beverly Sills, the reigning operatic diva of the '60s and '70s as she sang the Mad Scene in Lucia di Lammermoor, the role for which she was best known. The next month we had some new Spanish tenor from the New York Opera, a guy named Placido Domingo, doing La Traviata. The most beautiful sound I have ever heard from a human voice was Domingo singing the death scene in soft, lilting head tones during the dress rehearsal, to save his voice. It was magical, and those of us who were privileged to be close have never forgotten that moment. Of course, he soon rocketed to fame.

I sang with folk groups, did some musicals, sang the tenor solos in The Messiah, tried to do a little rock and roll (I played guitar very badly), and joined various chorales. I could have had a voice scholarship, but wisely realized I would never be anything other than mediocre. I still feel a special thrill when I hear solid harmony and a beautiful tenor, but my repertoire of what I like has expanded. "Give me the beat, boys, and free my soul. I wanna get lost in your rock and roll, and drift away."

I leave you with three links. The first is a short retrospective on the music of those who left us this last year. http://www.nytimes.com/interactive/2011/12/22/magazine/the-music-they-made.html?ref=magazine

And as we close out another year tonight, this barbershop version of "Auld Lang Syne" will convey my sentiments for a truly Happy New Year for you and yours.

http://www.youtube.com/watch?v=LdlN6Mc2iYA&feature=related

And I leave you with a very bright note. Turn the sound up, and let 14-year-old Liam McNally of Britain simply take your breath away. That humans can make such wondrous sounds… If your soul does not soar with this, hasten to your soul doctor for a checkup. http://www.youtube.com/watch?v=utfkGocmCiE&feature=related

Let me express my deep and heartfelt appreciation for you, my friends, as you give me the privilege of coming into your world each and every week. Because of you, I live a dream life that I could never have imagined would be possible. I am truly grateful.

Your wishing I could still hit that high note analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin