$100 Trillion Up in Smoke

-

John Mauldin

John Mauldin

- |

- February 6, 2016

- |

- Comments

- |

- View PDF

Simple Math, Hard Answers

Drowning in Oil

Third-Order Effects

Coup de Grâce?

Cayman Islands and Home

“We aren’t addicted to oil, but our cars are.”

– James Woolsey

“The greatest asset, even in this country, is not oil and gas. It’s integrity.”

– George Foreman

If energy powers the world, then whoever owns that energy must have power over the world. That’s certainly been the case for the last century or two. Ownership of our primary energy source, crude oil, is what made billionaires of John D. Rockefeller, H.L. Hunt, and assorted Middle Eastern kings, emirs, and sheikhs.

Oil in the ground is wealth only on paper – you may own that oil, but it earns you nothing until you recover and sell it. Yet paper wealth is still wealth. It goes on your balance sheet as an asset that you can sell. You can use it as collateral to borrow cash and buy other assets.

The ongoing oil price collapse is having a severely negative impact on the wealth of those who own oil reserves. The numbers, as you will see below, are almost incomprehensibly big. They are so big, in fact, that many analysts have simply tuned out. The attitude seems to be, “These numbers blow up my models, so I will ignore them.”

Today we’ll stop dancing around the truth and call the oil collapse what it is: global wealth destruction of epic proportions.

Simple Math, Hard Answers

In mid-2014, crude oil prices were about $100, depending on which grade you wanted to buy. Now prices hover near $30 – roughly a 70% decline in 18 months. That’s well-known, but we usually discuss the price collapse in terms of particular countries or companies: we don’t look at the bigger picture.

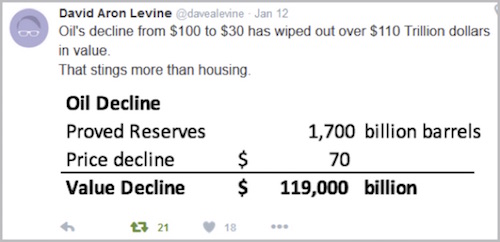

Last week someone showed me this from Twitter. I almost fell out of my chair.

Stop for a minute. Let that sink in. The total value of all the world’s oil reserves is over $100 trillion less than it was just a year and a half ago.

(By the way, I verified Mr. Levine’s reserve total by consulting the CIA’s World Fact Book. It says total world “proved” oil reserves were 1.656 trillion barrels as of January 1, 2015.)

To put these figures in perspective, consider that Google’s parent company, Alphabet (GOOG), briefly surpassed Apple (AAPL) last week as the planet’s largest publicly traded company. Both are worth around $500 billion, depending on the day. The lost value in crude oil is equivalent to a couple of hundred Googles and Apples going up in smoke.

If stock values were crashing to that degree, we would call the losses earth-shattering. Yet otherwise intelligent people are saying the oil collapse is a minor issue.

It is true that the loss of value is somewhat less dire than the raw numbers imply. The companies and countries that own the world’s oil reserves don’t usually value them at the market price. They mark the value up or down gradually, using long-term average prices or other discount mechanisms. They also account for production costs.

Nevertheless, if your wealth is tied up in oil reserves, your asset valuation is down sharply since a couple of years ago. The collective balance sheet hit adds up to a staggering amount of money.

Set aside the accounting considerations for a moment, though. Economists talk about the “wealth effect” that occurs when asset values go up. If your stocks, real estate, or other assets gain in value, you derive no immediate benefit unless you sell them. Yet you feel wealthier and more confident. That confidence changes your behavior, so you spend more freely. You’ll buy that second home, nicer car, or diamond ring. You’ll take more risks with your investments.

The wealth effect is a real phenomenon, and it has economic consequences. In a consumer-driven economy like the United States, higher spending from asset-wealthy people lets businesses expand and create jobs. Politicians and Fed officials tout the effect as a beneficial consequence of their genius plans. Yet they seldom remind us of the negative wealth effect that occurs when asset values decline.

When your perceived wealth contracts, you cut spending and turn cautious. Your altered strategy also has macroeconomic consequences – but sometimes they aren’t immediately obvious. I recall reading back during the 2009 recession that lawnmower sales had spiked higher. That seemed odd at first, but then I understood: affluent people who had lost jobs or income fired their yard services and started mowing their own grass. A good move for them, but terrible for yard workers.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

So, whatever the audited financial statements reflect, it’s safe to say that the owners of those 1.656 trillion barrels of oil are feeling much less wealthy now. Their paper losses are affecting their behavior as surely as falling US home prices affected consumer behavior in the last recession.

It isn’t just oil, either: Other commodity prices have also collapsed. All the industrial metals – copper, zinc, nickel, lead, palladium, platinum, silver, and aluminum – suffered double-digit percentage losses in 2015. Ditto for coal, natural gas, and iron ore.

Owners of all these resources are right now experiencing a severely negative wealth effect. They are changing their behavior, and the resulting trends are not good for you if your own wealth depends on their continued spending and investing.

We can’t put an exact number on this perceived wealth loss, but it is certainly in the tens of trillions – equivalent to a massive, worldwide bear market in stocks. Yet it is happening beneath the radar, almost unnoticed and unremarked.

Drowning in Oil?

Western oil companies and OPEC member states aren’t so worried about oil reserves in the ground; their more immediate headache is too much oil on the surface. Supply far outstrips current demand – which, as we know from Econ 101, yields lower prices. The International Energy Agency said in its January market report that “Unless something changes, the oil market could drown in oversupply.”

Is that really true? Drowning is certainly a poor analogy. Drowning is final: you don’t recover from it. We might be bearish on the oil market, but we haven’t written it down to zero.

The problem is finding the balance between supply and demand. The current situation is primarily a result of higher supplies and only secondarily of demand weakness. The world still burns plenty of oil and will keep doing so for many years.

The higher supply has come largely from US and Canadian shale fields as well as the 2014 Saudis’ decision to maintain production levels. Iran’s forthcoming return to the market will add even more supply.

These factors add up to an interesting group dynamic. All oil producers would benefit if production fell and prices rose – but they would not benefit proportionately unless the production cuts were also proportionate. There is no mechanism or incentive to make it happen that way. Even OPEC, which in theory is a cartel with strict quotas on its members, has no way to enforce its will.

(One thing we know about OPEC members is that they cheat. Always and everywhere, when it is possible, they cheat. Saudi Arabia simply got fed up with being the fall guy. The reasons behind the Saudi strategy are complex, but I am sure an ancillary benefit, from their point of view, is that current Saudi production demonstrates to their fellow OPEC members what noncompliance on quotas will cost them all.)

Add in the further complication that shale oil fields, by their nature, are easy to turn on and off. If your oil costs $40 a barrel to produce and you can sell it for only $35, you can cap your wells and wait for higher prices. But here we hit another problem.

If you borrowed the money to drill your wells in the first place, you need cash flow to service your debt. So you might keep pumping even if you only break even or run a small loss. That seems to be what many small US producers are doing. The alternative is to default on their bank loans or high-yield bonds.

Indeed, the high-yield bond market seems to have calculated that more defaults are coming. Bond prices have collapsed as low oil prices make it hard to stay current on debt payments.

What will be the endgame here? If companies default and go into bankruptcy, courts will sell their assets to the highest bidder. Bondholders will push for quick liquidations.

If the assets consist of oil in the ground that can’t be profitably extracted, who will buy those assets?

I don’t really know. I’ve been told the major multinational producers are biding their time, hoping to buy those reserves on the cheap. I also know for a fact that drilling rigs and ancillary production items are going for ten or twenty cents on the dollar at auction. The cost of drilling new wells is going to be down in the next cycle. The unanswered question is whether the currently producing wells will actually stop pumping during this shake-down process, and if they do, for how long. Producers face quite a dilemma.

Third-Order Effects

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I believe much of the recent market volatility really results from the second- and third-order effects of lower commodity prices. The sovereign wealth funds of oil-producing nations are liquidating non-energy assets or at least not buying them. Changes in oil import/export patterns are affecting currency flows. Stung by energy losses, portfolio managers are reducing risk elsewhere.

Why is anyone surprised? And that brings us to another key question. Conventional economic wisdom tells us that lower fuel prices ought to spur consumer spending. It seems not to be happening this time. Why not?

Here is my theory: this price decline is different because it’s affecting domestic oil and gas producers.

In previous oil downturns, more of the pain was felt overseas because we imported more of our oil. New domestic shale production changed that. So the defaults, lost jobs, and negative wealth effects are hitting closer to home this time. They are specifically hitting in Texas, Oklahoma, and North Dakota.

As a lifelong Texan, I’ve witnessed this sort of pain several times. The late-1980s oil plunge saw people living under highway bridges in Houston while newly built office buildings sat empty for years. The suffering hasn’t been so bad this time, at least visibly, but we might still be in the early stages of the downturn. Much more pain could be coming.

That 1980s oil slide also helped create the savings and loan crisis. The oil boom drove up real estate values, and S&Ls made loans based on those values. Their entire industry fell apart soon after oil prices collapsed.

To make matters worse, politicians are particularly apt to spend their energy windfalls unwisely, as if they expect downturns will never happen. North Dakota is currently learning this lesson the hard way.

BISMARCK, N.D. – Gov. Jack Dalrymple on Monday ordered deep cuts to government agencies and a massive raid on state savings to make up for a more than $1 billion budget shortfall due to depressed crude prices and a drop in oil drilling.

North Dakota had more than $2 billion in various reserve accounts just one year ago, but oil prices – a key contributor to the state’s wealth – have taken a nosedive in the last year. The legislature’s record-high $14.4 billion budget for the two years that began July 1 was built on oil prices and economic assumptions that have fallen “much greater than anyone would have predicted,” the governor said.

“After 15 years of receiving almost entirely good news about the growth in revenues for North Dakota, it seems strange to hear that things have gone in the other direction,” Dalrymple, a Republican, told state agency officials at the state Capitol in Bismarck.

“It seems strange” that energy-driven tax revenue didn’t keep rising forever, says the governor. Strange to him, perhaps, but not to anyone who has been through energy booms and busts before, as we have in Texas.

If this cycle is anything like previous ones, the contraction is only beginning. It can and probably will get much worse. I am old enough to remember four distinct major busts and have read and heard the stories about oil busts going back to the early years of the last century.

Banks are already raising loss reserves against their energy loan portfolios. Investors are fleeing high-yield energy bonds. These are only the direct consequences. We’ll see a trickle-down effect if more companies lose their financing, lay off workers, and eventually shut down. The ex-owners and employees will then start liquidating their real estate and other assets, driving prices down.

What we don’t know yet is how widespread the impact will be. Past cycles were still net-positive for the US economy as a whole because everyone spent less money on fuel. GDP barely moved when oil crashed to $12 in 1986. We noticed in Texas, but folks in New York were fine.

Note also that the negative wealth effect centers on the asset owner, not the asset itself. Florida doesn’t produce any oil that I know of, but people made fortunes in oil and moved to Palm Beach. Since their fortunes are now smaller, the Palm Beach economy will doubtless feel some impact.

While the US is feeling more pain this time, we are not the only ones. The oil-wealth wipeout is causing angst in Saudi Arabia, Indonesia, Russia, Brazil, Venezuela, Nigeria, and everywhere else oil is produced. Some of those places depend heavily on oil revenue that is now running at the lowest pace in more than a decade. Commodity-producing nations such as Brazil, Canada, and Australia are under similar pressures.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The negative wealth effect works on governments as well as individuals. Saudi Arabia is in serious belt-tightening mode. So is Russia. Both nations are also engaged in ongoing military actions (in Yemen and Syria, respectively) that are consuming resources. Every oil-exporting nation is in peril, some more than others – and therefore they are liquidating whatever assets they can.

Sovereign wealth funds (SWFs) have been huge market players over the last decade. Their steady accumulation of assets has had a lot to do with rising stock, bond, commodity, and real estate prices. The loss of that buying interest has to be negative for asset prices unless someone else picks up the slack. I don’t know who that would be.

Note also that the sovereign wealth funds can have a huge impact even if they don’t sell anything. All they have to do is stop buying. That alone could drop the hammer on market segments that grew dependent on the SWF activity. As an old mentor told me, it takes a lot of buying to create a bull market; but for a bear market to get started, people don’t have to sell; they just have to stop buying.

Coup de Grâce?

We don’t know when or if the oil price will recover. Some highly respected analysts think it will stay in a range of roughly $30 to $60, the high end being the point where currently capped-off supplies come back online. If so, then we are now at the low end and could see a big bounce.

Even a huge bounce might not make much difference. A jump from $30 back to $50 would represent a 67% rally for crude oil. That’s several years’ worth of bull market gains – but oil at $50 would still leave many reserve owners with a stranded asset.

Something else is happening, too. Renewable energy technologies have made huge strides in recent years. Costs have dropped and are still falling, even without the motivation of high fossil fuel prices. This is happening partly because governments want everyone to reduce carbon emissions. It won’t be good for oil prices if they get their way.

For example, consider this headline from the normally staid Smithsonian magazine.

Author Sarah Zielinski discusses the major problem with solar and wind-generated electricity: relying on it puts you at the mercy of weather and daylight. However, scientists Zielinski interviewed say the real problem is distribution. The wind is always blowing somewhere. We can’t harness it all because we lack the ability to move electricity efficiently across long distances.

According to scientists’ computer models, the US could reduce its carbon emissions up to 78% below 1990 levels by switching to mostly wind and solar energy and modernizing the electric grid’s architecture. We would still need natural gas and hydroelectric and nuclear power for times when the weather was uncooperative, but the need for them would be sharply lower.

This particular study might or might not be flawed; but the point is that oil, gas, and coal face serious competition from other energy sources. Meeting electricity demand with renewable sources might be closer than we think. That still leaves transportation, though.

Morocco has just commissioned a monster solar farm. NPR linked to a Guardian story with some cost numbers.

Quick math: The full Morocco project will cost $9 billion and will generate 580 megawatts. The Solar Energy Industries Association (SEIA) says one megawatt can power 164 homes on average. So 164 homes x 580 MW = 95,120 homes. Divide by $9 billion, and the cost per home is $94,617. Amortized over 20 years, the cost is $394 per home, per month. A tad high, but you also have no carbon emissions and no exposure to oil prices.

Now throw in inflation over the 20 years, and $394 a month for the final 10 of those years will probably not be nearly as high a real cost as it is today. I’ve thought for some time that solar will beat fossil fuels strictly on cost at some point. Current research data says that even without subsidies solar could be cost-effective in many locations in 10 to 15 years. This article suggests we are getting much closer. That’s bad news for conventional energy companies and OPEC.

Electric car technology is advancing quickly, too. Tesla, among other companies, has shown that the technology works; their constraint now is building efficient batteries fast enough. Fuel cell and other technologies are on the near horizon, too.

None of this means the world will stop needing oil and natural gas any time soon. Nevertheless, it tells me that potential oil supply could outweigh oil demand for a long time. If so, all that oil in the ground will be slow to regain those trillions in lost value, if it regains it at all.

I’m in a hedge fund conference in the Cayman Islands today. I was talking with some rather large (think tens of billions) managers last night. When you look at the really long term, as in 40–50 years, these guys think the price of oil goes to almost nothing, as we will have so many substitutes for fossil fuels, and we’ll find lots of oil that can be brought up for not all that much money.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

How can that happen? If I buy producing wells out of bankruptcy at $.10 on the dollar, then my cost of production just dropped by 90%. I know, I know, it can’t happen, right? Think Global Crossing. They laid thousands of miles of fiber optic under the oceans at immense cost, which auctioned off for pennies on the dollar. We should all be grateful to those unlucky investors, because they are why you and I can now enjoy cheap Internet and telecommunication prices. Why should oil be any different?

I’ve said for a long time that the entire “Peak Oil” thesis was wrong. I believe that more now than ever. Far from running out of oil, the world has way too much of it. We will be dealing with the consequences for years to come.

This story literally just came across on Bloomberg:

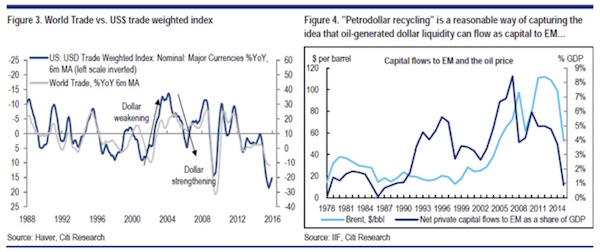

Markets are currently in a well-oiled “death spiral,” according to Citigroup Inc. analysts led by Jonathan Stubbs.

“It appears that four inter-linked phenomena are driving a negative feedback loop in the global economy and across financial markets,” the analysts write, citing the resilient US dollar, lower commodities prices, weaker trade and capital flows, and declining emerging market growth.

“It seems reasonable to assume that another year of extreme moves in US dollar (higher) and oil/commodity prices (lower) would likely continue to drive this negative feedback loop and make it very difficult for policy makers in emerging markets and developing markets to fight disinflationary forces and intercept downside risks,” the analysts add. “Corporate profits and equity markets would also likely suffer further downside risk in this scenario of Oilmageddon.”

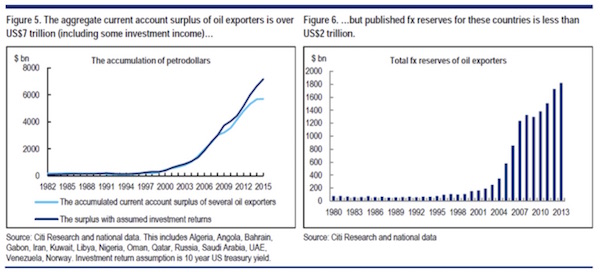

Their case is bolstered by a collection of charts showing the linkages between the four factors cited above, including the importance of lofty oil prices to the ready supply of petrodollars circulating in the world economy and flowing to financial assets. Oil exporters have enjoyed more than $6 trillion flowing into their current accounts, according to Citi’s estimates, implying some $4 trillion of capital in sovereign wealth funds (SWFs).

Source: Citigroup

Source: Citigroup

“But, the collapse in oil/commodity prices and sharp fall in the pace of world trade means that these same economies will likely experience an aggregate current account deficit for the first time since 1998,” says Citi. “In turn, this is likely to put pressure on SWF and broader emerging market liquidity as governments and emerging market economies would need to ‘lean’ on reserves in order to maintain economic, political and social stability. This has clear feedback loops across emerging markets.”

Accordingly, the impact of the feedback loop is being felt far and wide in financial markets, extending even to US inflation expectations. Where once 10-year inflation breakevens had little relationship with the price of oil, they have for the past two years moved in tandem.

This analysis feeds into my thesis that negative interest-rate policies are going to proliferate even further. Central bankers fear deflation, especially in leveraged and debt-ridden economies. I like to quip that when you become a member of the Federal Reserve, you are taken into the back room and given a DNA change, which makes you genetically opposed to any form of deflation. You become a deflation-fighting machine.

And the Fed fought that fight pretty well for a long time. The tools they have now, though, are far more limited in their effectiveness. The more I think about it and the more people I talk to, the more I am convinced that we are going to see negative interest rates in the US, too, driven in part by the self-reinforcing downward spiral that Citigroup mentions above, along with overall lower costs across the world.

That is a story for another letter on another day, but all that debt washing up on the shores of the world is going to have to be rationalized at some point. As we think through what that process looks like, as we “wargame” our portfolios and investment strategies, we need to make sure that we are not standing in front of the train of that rationalization as it comes barreling down the track.

Cayman Islands and Home

I’ve had a flurry of travel for the past few weeks, but tomorrow we go back to Dallas, where we will start to prepare the fixings for a large Super Bowl party. I really don’t care anything about the teams – I don’t have a dog in that hunt – but the game is a good excuse to get together with family and friends over bowls of beans, chili, and some barbecue. (For the record, those are separate pots of beans and chili. Real Texas chili does not have beans in it. And I make a rather good pot of chili, thank you very much.)

I know my team is planning to get me to New York for some media and send me on a few other trips here and there, but I really am trying to stay home for most of February, March, and much of April to work on my book, plus what seems to be a growing list of other projects. And I’ll be getting more serious about the gym.

I got to spend last Wednesday evening with Suze Orman and her longtime partner K.T. It was a fabulous evening, and we agreed that sometime this summer we are going to have to make a day or two of it. She has a fascinatingly different view of the world from most investment analysts, which I find refreshing and stimulating. I don’t think either one of these ladies look any different than they did 10 years ago.

The last two nights have found me in Cayman, speaking at a hedge fund conference, surrounded by friends. Tonight, the ever-brilliant investment and economics guru Raoul Pal is throwing a birthday party, which I’m sure will go late into the night. Our mutual great friend Grant Williams is in town to celebrate, and he and Raoul are doing one interview after another for their new Internet-based interview channel, RealVision, which is becoming a fabulous information portal. Some of the best technology around and, good gods, the fascinating people they get to just open up their minds. It’s inspiring. I really enjoy watching visionary entrepreneurs become successful.

On a final note, my good friend and hedge fund guru Mark Hart is also in town for Raoul’s birthday. He lives in Fort Worth, but we rarely seem to find time to get together, which is sad. He is a personally inspiring figure to me. I admire his dedication not only to his work but also to taking care of and maintaining his body. He is trying to talk me into taking jujitsu. I’m not certain that a 66-year-old man should start something like that, but then again…?

I’m actually going to hit the send button early and go sit on the beach, listen to the ocean, and maybe have a drink with a little umbrella in it. There are some things you just have to take time off and do. Have a great week!

Your thinking of Jimmy Buffett and piña coladas analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin