Yes, the big really can (and will) continue to get bigger

- Keith Fitz-Gerald

- |

- June 13, 2023

- |

- Comments

This article appears courtesy of Keith Fitz-Gerald Research.

Howdy!

Comcast, in its infinite wisdom, has decided to completely shut down our internet for the day.

So, I’ll be brief.

Yes, the big can (and will) get bigger

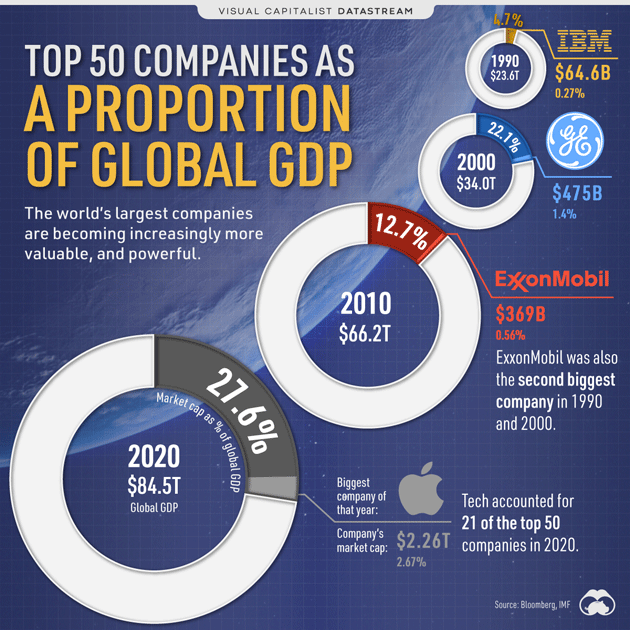

Image source: Visual Capitalist

I received a snarky email from an individual yesterday who took issue with my contention during an appearance on Varney & Co that the world’s biggest companies can continue to get bigger, especially when it comes to tech.

“Don’t you believe in the law of large numbers?” he challenged in a message that just reeked of cynicism. The implication was, of course, that I’m a financial nincompoop for having suggested such a thing.

Perhaps that’s true, but the answer to your question, R., is “Yes.”

Just not the way you do.

The law of large numbers states that as a sample size grows, its mean gets closer to the average of the entire population or data set. It’s really a proposition that, provided a set of sufficient conditions, the convergence of a sample will be to the mean.

In plain English and applied to investing, the law of large numbers is taken to mean that as a company grows, it becomes more difficult to maintain prior growth rates or even that the growth rate will decline as the company continues to expand.

It’s a great exercise in theoretical statistics and probability theory, but that’s about it.

Reality differs.

Take a hard look at this chart from the Visual Capitalist.

The big have been getting bigger and delivering better investment performance for decades. Odds are, they will continue to do so.

Apple, Microsoft, and Tesla have returned 1,221.36%, 999.91%, and 3,493.04% over the past 10 years, respectively—even though naysayers have said the entire time that they cannot possibly get bigger or more valuable. The S&P 500, by comparison, has returned 214.31%.

The law of large numbers breaks down when applied to modern financial markets... for 5 reasons:

1 – Complexity and Change. The world’s stock markets are influenced by any number of events, economic cycles, sentiment, and ongoing innovation. This introduces volatility and concentration while also making theoretical conversion all but impossible for anything other than short periods of time.

2 – Market Manipulation. Large leveraged investors, computerization, and the rise of passive investing have created distortions in market pricing that would otherwise apply in a theoretical setting. What’s more, these same distortions can and do prevent convergence associated with the law of large numbers. You can see that in the gradual breakdown of the VIX and in ratio distortion over time, particularly as liquidity has increased and risk is arbitraged out of the markets.

3 – Asymmetry. Contrary to what many academics would have you believe and what is taught as dogma at many universities today, the stock markets are not efficient. Information asymmetry leads to disparities in speed and quality that impact price discovery, portfolio management, construction, and more. All three generally prevent convergence, except at moments of extreme market angst—much the same way everyone suddenly looks for an exit when somebody in a crowded theater yells, “Fire!”

4 – Non-i.i.d. Data. The law of large numbers assumes that the information and data are independent and identically distributed (“i.i.d.”). The science of complexity and non-linear math (my specialty when it comes to computational analysis associated with the stock market) clearly shows that market behavior, trading strategies, tactics, and flows actually create non-i.i.d. data. As a result, applying the law of large numbers is an indirect exercise at best.

5 – Behavioural Bias. The law of large numbers assumes parametric distribution, i.i.d., and rational movement. The problem is that behavioural finance—for example, herd mentality, FOMO, complacency, confidence, etc.—results in collective market movements that are often directly contrary to what the law of large numbers says should happen. Depression-era economist John Maynard Keynes summed this up quite simply in a now-famous quote attributed to him: The markets can remain irrational longer than you can remain solvent.

How the markets will react to inflation data

If the data is cooler, I expect the markets to run higher… after some profit taking. There’s a lot of money on the table, and it’d be logical to shake the weak hands out. In fact, I’d count on it.

If the data is hotter, I expect the markets to sell because that’ll throw a spanner in assumptions that the Fed will pause.

Either way, there’s an opportunity.

-

If it drops, Sell Cash-Secured Puts, enter LowBall Orders, and add to stocks you may have missed the last run higher.

-

If it runs higher, relax. Sell Covered Calls to lock in profits and harvest winners using the FreeTrade whenever possible.

FTC to block Microsoft/Activision

The FTC very clearly has an agenda... and that’s okay.

What happens next, though, is inevitable.

The US Supreme Court broke up Standard Oil in 1911, and it quickly became more valuable in pieces than it was as a whole.

The so-called Baby Bells that resulted in 1982 when the government busted up AT&T are another example.

I’m not saying that they’ll bust up Microsoft, but, rather, that this isn’t the endgame many think it is.

Oracle beats on cloud revenue jump

Not a surprise.

Oracle beat top and bottom-line estimates on… drum roll, please… a jump in cloud revenue.

And the big can’t get bigger??!!

Another owner hands over the keys

Shopping center giant Westfield just walked away from its San Francisco Centre Mall by stopping payments on its loan. Management confirmed that the company wants to hand over the keys to allow their lender to appoint a receiver. (Read)

Hmmm.

Bottom Line

Many aspiring investors & traders want to do “something” because they can while failing to realize that “nothing” is a viable choice.

Wait for YOUR setup, change your tactics.

There is NO rush.

Keith

PS: If you like reading the 5 with Fitz, you may enjoy a subscription to One Bar Ahead®, my premium monthly investing journal. We have real conversations about the strategies and tactics needed to invest successfully in companies like NVDA, AAPL, TSLA, and others. Not for nothing, many OBAers are now in a position to take handsome profits while many other investors who are not part of the OBA Family are worried about playing catch-up for having missed the current run up. Yes indeed, the big CAN and ALREADY ARE getting bigger. Upgrade to Paid

This article appears courtesy of Keith Fitz-Gerald Research. Keith Fitz-Gerald Research publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at keithfitz-gerald.com