Will you invest in the world’s richest guy with me?

- Stephen McBride

- |

- January 23, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

1) Can you name the world’s richest man?

It’s not Elon Musk, Jeff Bezos, or Bill Gates.

Nor is he a hedge fund manager, tech tycoon, or Russian oligarch.

The richest person on earth is a French guy who sells women’s purses...

Bernard Arnault’s personal fortune now stands at $180 billion.

If you don’t know the name, Arnault is the CEO of luxury empire LVMH Moët Hennessy Louis Vuitton (LVMUY)—best known as the parent company of Louis Vuitton.

Bezos, Gates, and Musk made their fortunes “the regular way”—by developing game-changing products that millions of people use every day.

Eight in every 10 computers run on Microsoft’s software. Over 100 million Americans subscribe to Amazon’s Prime delivery service. Tesla is selling record amounts of high-performance electric vehicles.

Arnault got rich in a whole different way. He built a portfolio of super luxury brands like Louis Vuitton, Dior, and Dom Perignon.

And let me tell you… a prestigious brand is a powerful thing.

A no-name handbag from Target might cost $100—tops. But women line up around the block to hand over $10,000 for a Louis Vuitton. These brands are goldmines. By simply stamping its logo on an item, LVMH can charge 100X the price of its competitors!

This vaulted Arnault to the top of the world’s richest people list. And transformed LVMH from niche retailer to Europe’s most valuable firm. In fact, it’s now worth more than Tesla… JPMorgan… Walmart… and Facebook.

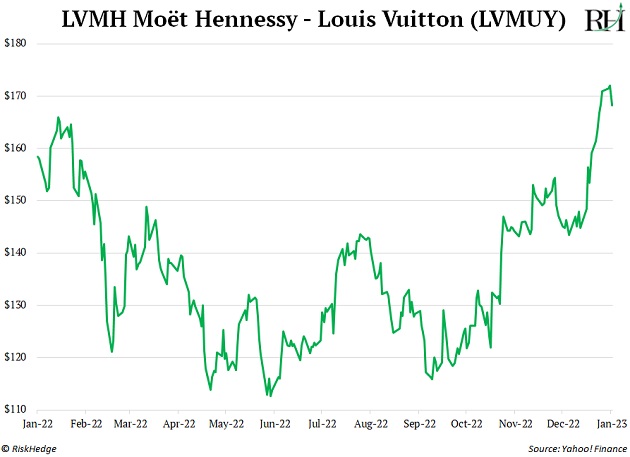

I first told RiskHedge readers about this juggernaut in June 2019. LVMH has more than doubled since then. While most stocks got pummeled over the past year, the luxury empire just hit fresh highs.

2) This all comes crashing down in a recession, right, Stephen?

You might think luxury spending would fall off a cliff if the economy tanks—but that’s not usually what happens.

Luxury sales fell by less than 10% during the last two major recessions (2001 and 2008). And keep in mind, ‘08 was the worst downturn since the 1930s. So, luxury sales falling around 9% was a “win.”

LVMH came out unscathed, with revenues “only” flatlining. It navigated the crisis better than JPMorgan, Microsoft, Disney, and Nike.

This makes sense when you think about it. Folks who spend thousands of dollars on a shirt are rich enough that they don’t have to “cut back” during a recession like normal folks do.

Today, the economy has slowed… but luxury spending keeps rising. Data from credit card giant Mastercard shows luxury sales jumped 20% over the past year.

How about cars? Bugatti, Rolls-Royce, and Bentley make ultra-expensive cars, and they achieved record results last year.

Watches? Rolex usually hikes prices once a year. Sales are so strong the Swiss giant raised prices twice in the past few months.

Investing in luxury with a recession potentially looming is counterintuitive… but it’s a smart move.

Despite being one of the most valuable firms in the world, LVMH is unloved.

You can easily buy LVMH (LVMUY) on the US stock market. But it’s a French company and not listed in major indices like the S&P 500. That’s why most US investors “miss it.”

As I mentioned, LVMH doubled since I first told RiskHedge readers about it. It’s still one of my top long-term investments for the next 5–10 years.

3) Stock market bulls claimed a big victory last week…

Inflation has been the chief concern for markets over the past year.

Our healthcare bills shot up. It costs more to fill your tank. We’re paying more for a dozen eggs.

If you’re worried 2023 will bring more inflation pain, I have great news for you.

The last year showed beyond any doubt that rapidly rising inflation crushes stocks.

But as I’ve written over and over again… the direction of inflation is what matters most to investors. In other words, is the inflation rate rising or falling?

That’s the dividing line for stock market returns.

Since 1928, the S&P 500 posted average annual gains of 6.7% when inflation was rising. But when inflation fell, stocks posted annual gains of 16.5%, on average. That’s a Grand Canyon–sized gap.

Here’s what it means for you today…

The latest US inflation numbers came in last week. Prices rose 6.4% over the past year.

That sounds bad. After all, besides the past few months, that’s still the highest level since 1982!

But it’s actually a great thing because inflation has now fallen six months in a row. That’s all that matters—and it’s a GREAT sign for stocks.

Inflation has peaked seven times over the past 70 years. The S&P 500 jumped 16% over the next 12 months, on average.

The year-over-year inflation rate topped out six months ago, in June. And guess what? The S&P 500 jumped roughly 10% since then.

My friends, inflation has peaked. I’m even more sure of this today than I was when I first made the call in September.

That means it’s time to be bold and load up on stocks.

Stephen McBride

Chief Analyst, RiskHedge

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover one of Stephen’s top investment themes and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com