Will you buy this hated investment with me?

- Stephen McBride

- |

- April 3, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

This hated asset is nearing all-time highs… But it SHOULDN’T be for this reason… 200% gains the last time this pattern emerged… In the mailbag: An exciting way to play the next gold rush…

- We could triple our money on this investment in the next five years.

You in?

Before you say “yes,” let me tell you about an important person in my life... the guy who introduced me to the stock market…

My college professor.

I owe him a lot.

I used to think investing was just for rich stockbrokers. He taught me differently.

Problem was… my mentor was a total pessimist. You know the type… always convinced the next stock market crash was right around the corner.

He owned a few stocks, but most of his money was in gold and silver. One day, he even brought in a 100-oz. silver bar in a plastic bag to show me.

His arguments for buying hard assets sounded convincing. Soon enough, I threw most of the little money I had into gold and silver.

And when governments printed trillions of dollars to bail out banks during the financial crisis, I felt like a genius.

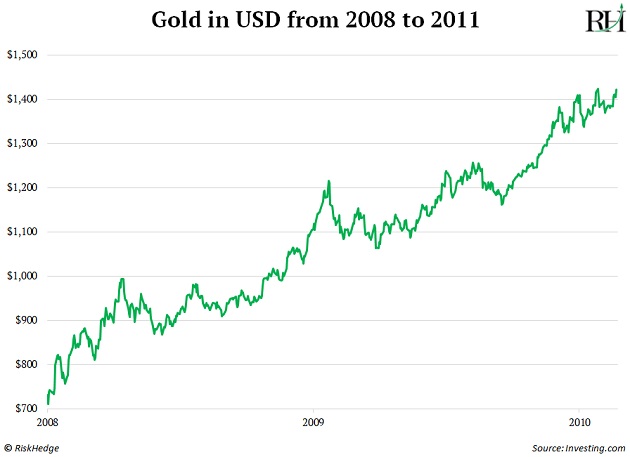

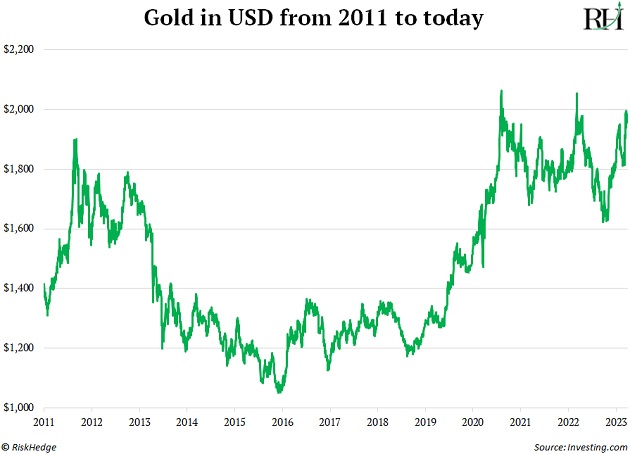

Gold more than doubled from late 2008 to 2011:

I was convinced gold was headed to $5,000/oz. I was going to be rich.

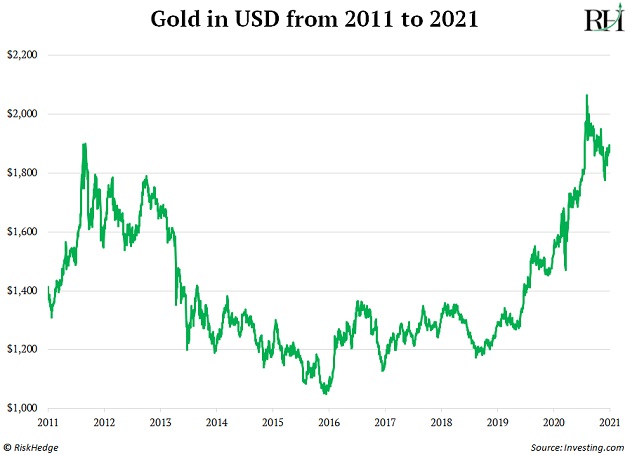

But the joke was on me. Gold went on to have a lost decade:

Gold investors became the laughingstock of the financial world. Gold was the ultimate hated asset.

But fast forward to today...

- Gold just crossed $2,000/oz...

It’s up 23% over the past six months. And it’s closing in on its all-time high of $2,074.

I believe it’s set to blow past that...

My friend who’s a professional portfolio manager recently reminded me of an important investment truth...

Some of the greatest investments come from finding “anomalies” in the market: “To find these opportunities, ask yourself: What IS happening that SHOULDN’T be?”

Gold is one of the biggest anomalies in the market today. It’s near record highs, but it “shouldn’t” be.

Here’s what I mean…

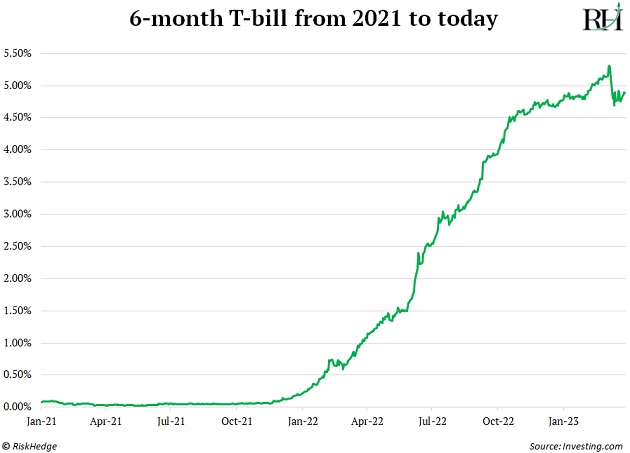

- The price of money has skyrocketed.

The US Federal Reserve hiked interest rates at its fastest pace ever over the past year.

This caused US Treasury bond yields to rocket higher. You can currently earn 4.8% lending money to Uncle Sam for six months.

That’s a massive jump from the 0.03% yields just two years ago!

Rising interest rates are usually terrible for gold.

Gold is a pet rock. It sits in a vault and doesn’t pay dividends like a stock or produce yield like Treasury bonds.

This isn’t an issue when internet rates are pinned to zero. But when you can earn roughly 5% lending money to the US government for six months? Different story.

Financial nerds like me call this “opportunity cost.” The higher interest rates go up, the less attractive owning gold becomes.

And yet… despite interest rates rising at their fastest pace ever, gold is inches away from record highs.

Gold shouldn’t be this strong, but it is. That tells me the yellow metal will go much higher.

- This pattern, which led to 200% gains, is repeating…

When you spend all day, every day “swimming” in financial markets, you spot the same pattern playing out repeatedly.

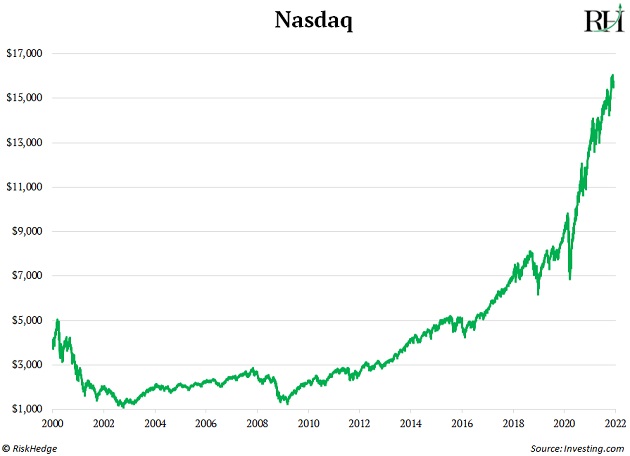

Today, the opportunity in gold is like that of the Nasdaq a few years ago.

The tech-heavy Nasdaq went on a tear during the dot-com boom, hitting 5,000 in March 2000.

But as the boom turned to bust, we wouldn’t see those heights again for 15 years! The Nasdaq experienced a lost decade and then some.

After touching 5,000 again in April 2015, the index chopped around and went nowhere for 16 months.

But when it finally broke out, boy did it run... tripling over the next five years.

Gold looks like the Nasdaq in 2016, before it went on a tear.

The yellow metal peaked at $1,900/oz. in 2011. It didn’t reach those prices again until 2020.

It’s been chopping around these levels for 20 months. Looking at the gold chart, you can almost taste the pent-up energy.

Now that it pierced $2,000/oz., we’re off to the races.

I believe gold could “pull a Nasdaq” and triple in value over the next five years.

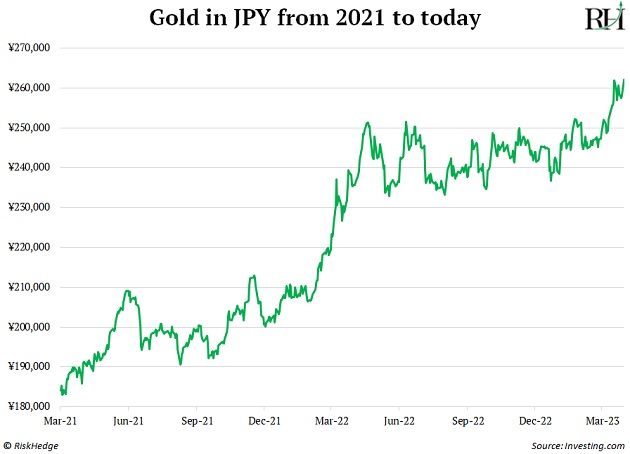

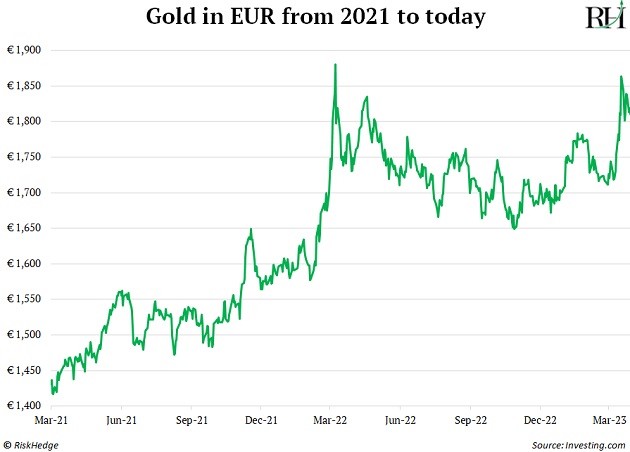

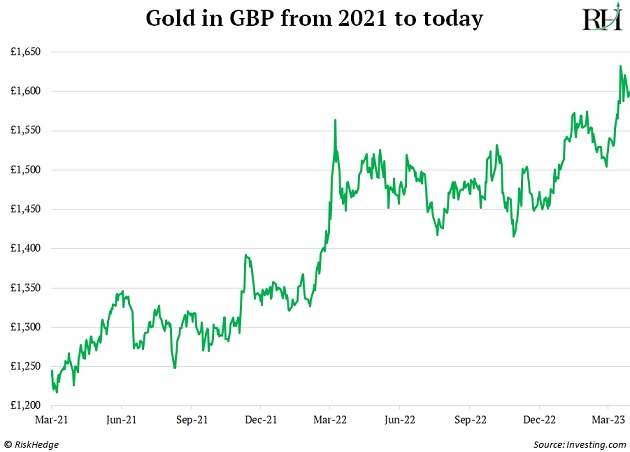

- In my corner of the world, gold is already making fresh highs.

Gold is usually priced in dollars. But you can buy it in euros, pounds, and yen, too.

In fact, the yellow metal is hitting or nearing new highs in these currencies.

Here’s gold priced in Japanese yen…

It’s nearing record highs in the euro too….

And British pounds…

Mark my words: Gold in US dollars will be next to make new highs.

Buying pet rocks isn’t exciting. It’s not disruptive. But we’re here to make money.

And after a decade of going nowhere, gold’s ready to take off.

Stephen McBride

Chief Analyst, RiskHedge

P.S. The leveraged way to profit off rising gold prices is to buy gold stocks. These companies make money finding gold and pulling it out of the ground. That’s important because it gives them “leverage” to the price of gold. When gold moves an inch, gold stocks can move a mile. They’re volatile, and not for everyone...

But for readers who understand the risks, my friend—resource expert Marin Katusa—just released a new briefing called PROJECT GOLD RUSH. In it, he reveals an exciting project that allows you to invest alongside him and some of the world’s biggest gold bugs.

***Disclaimer: Several principals of RiskHedge have personally invested significant sums of money in the small gold stock Marin is promoting at that link.***

If you’re interested, just know this offer is only available until Sunday, April 2. Go here to discover more.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com