Why you’ll never get another stimulus check

- Stephen McBride

- |

- May 26, 2020

- |

- Comments

This article appears courtesy of RiskHedge.

April 10, 2020 will go down in the history books.

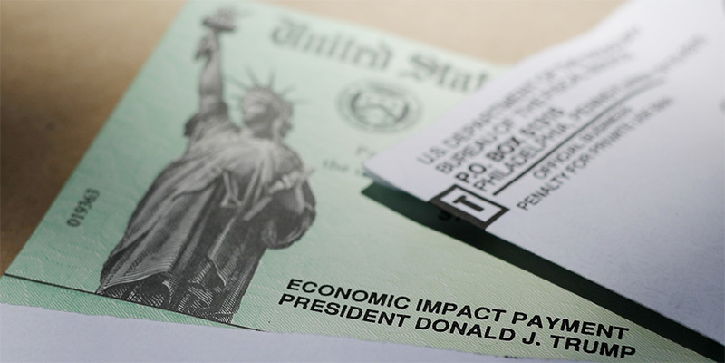

As you likely know, the US government recently handed out “coronavirus checks.”

Over 150 million Americans received the $1,200 cash injection.

This isn’t the first time Uncle Sam issued free money…

But it is the first time Americans didn’t need a bank account to get the cash.

On April 10, PayPal became the first “internet bank” authorized by the US Government to issue stimulus checks.

Folks didn’t have to wait for a check to arrive in their mailbox… or talk to a bank teller to get the money.

Instead, Uncle Sam simply funneled billions of dollars to Americans through PayPal’s “app.”

- This is another nail in the coffin for tired old banks.

As I’ll show you today, the disruption of banks is reaching a tipping point.

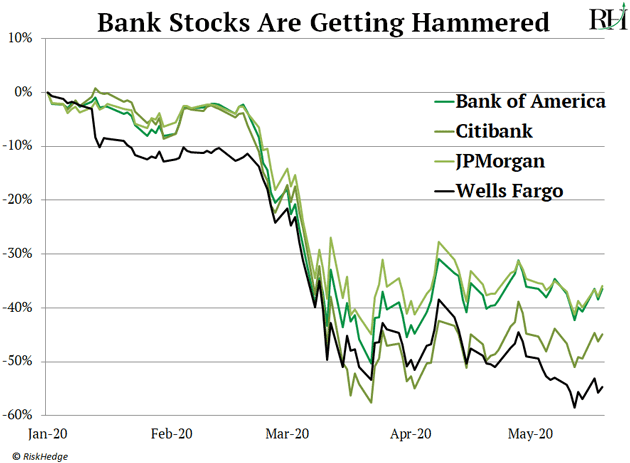

In fact, have you seen a chart of bank stocks lately?

They’ve cratered 30%... 40%... 50% since January:

JP Morgan, Wells Fargo, Bank of America...

These are the largest, most powerful financial institutions in America!

But they’re ALL crumbling to new multi-year lows. Bank of America is now selling at the same price it was in 1996!

- Longtime RiskHedge readers will remember I called “the end of the bank” last year.

For pretty much all of history, traditional banks have held a monopoly on all things money.

Need a place to deposit your weekly paycheck? Better get a bank account.

Want to borrow money? Go talk to a banker.

But now, for the first time ever, their stranglehold on money is slipping away.

You used to need a regular bank account to cash a government stimulus check... receive social security... or pay taxes.

Now you can use PayPal’s “app” to do all three.

And get this… banks don’t even dominate money lending anymore.

Last year, more than half of all mortgages were issued by “non-bank” lenders.

Quicken Loans is both America’s largest mortgage lender and the fastest-growing firm in the industry. It doesn’t operate branches. Instead, it evaluates borrowers using online forms. And it connects with its customers over the internet and by phone.

- Coronavirus is accelerating the disruption of “old finance.”

Regular RiskHedge readers know coronavirus is one of the most disruptive forces we’ve ever seen.

It’s hitting the “fast-forward” button on disruptions like grocery delivery… flying robots… and clean energy.

And it’s also boosting financial disruptors.

On May 1, PayPal (PYPL) processed more money than on any single day in its 22-year history. In short, Americans are spending more money online than ever before. And millions are choosing to checkout with PayPal.

And PayPal’s not the only company benefiting from this disruption…

Have you ever used Square’s (SQ) Cash App? It’s a smartphone app that allows you to instantly send and receive money, for free. It essentially replaces the need for a traditional bank account.

Square’s management announced over 26 million Americans are now using it at least once a month.

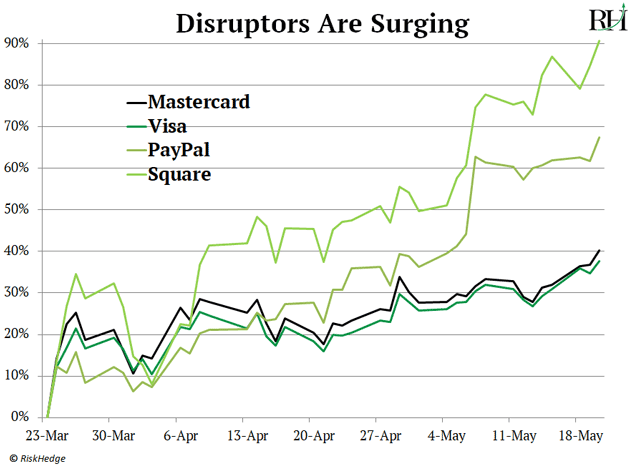

Credit card giants Visa (V) and Mastercard (MA) are also “cleaning up” right now.

As you likely know, nobody wants to handle “filthy” cash right now—instead everyone is using their card to pay for things. Combined, Visa and Mastercard’s networks processed a record $4 trillion in the past three months!

These disruptors are the big winners from coronavirus. And their stocks are at, or near, all-time highs:

- But banks are getting absolutely annihilated…

Remember, “old” financial stocks are crumbling to multi-decade lows.

JPMorgan Chase’s (JPM) profits plunged 69% in the first three months of 2020. And it set aside $8 billion to cover losses on borrowers that will likely default.

Wells Fargo’s (WFC) quarterly earnings plunged 89% to their lowest level since 2008!

Here’s the thing… most folks think “old finance” still rules the world.

Their big brand names are plastered across thousands of fancy bank branches. And we always hear about banker’s sky-high bonuses on TV…

- But the reality is banks have never been less important than they are today.

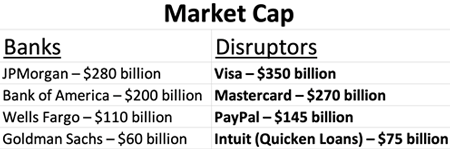

When most folks read about disruptors like PayPal, they imagine internet “start-ups” stealing only a tiny slice of these big banks’ businesses.

But get this… some well-known disruptors are now more valuable than the most powerful banks in the world, as you can see:

- Roughly $750 billion in stock market wealth is up for grabs right now.

When we discussed the disruption of banks last May, the five largest US banks were worth a combined $1.1 trillion…

Over the past year, they’ve shed $350 billion in value.

This wealth didn’t vanish. It changed hands from the disrupted… to the disruptors.

If I had told you 10 years ago that disruptors like PayPal would be worth more than big important banks like Wells Fargo or Citibank, you would have laughed at me.

But it’s easy to see how the tables have turned. Over the past decade, disruptors have picked off businesses that banks used to dominate one-by-one.

Remember, Intuit’s Quicken Loans is America’s largest mortgage lender…

Apps like PayPal’s Venmo and Square’s Cash App have largely replaced bank wires…

And robo-advisors that give you automated, financial planning services are stealing banks lucrative wealth management business.

In short, disruptors have seized banks’ most profitable businesses… and left them with the scraps.

Banks will continue losing to innovators like PayPal, Visa, and Mastercard. And this guarantees hundreds of billions of dollars in stock market wealth will keep shifting away from “old finance.”

Now is the time to own the disruptors, and bet against the disrupted.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com