What to do if you’re scared

- Stephen McBride

- |

- August 26, 2019

- |

- Comments

This article appears courtesy of RiskHedge.

“Stephen, I’m thinking of selling all my stocks, what are your thoughts?”

A RiskHedge reader asked me last week if it’s time to head for the exits.

There’s a lot of fear in the markets right now. Folks are nervous. Maybe you’re nervous.

The past two weeks have been rough for the stock market. Last Monday the S&P 500 suffered its worst day of the year. And stocks have now dipped 4% since hitting record highs in late July.

If you watch any financial TV, you’ve surely heard this blamed on a troubling economic signal triggered last week called the “inverted yield curve.”

- What the heck is an inverted yield curve… and why does it matter to you?

If you’ve applied for a mortgage, you know the two most popular options are a 15-year mortgage or a 30-year mortgage.

The interest rate you’ll pay on a 15-year mortgage is lower than what you’d pay on a 30-year one.

Which makes sense, right? With the 30-year mortgage, you’re borrowing the bank’s money for twice as long. So you must pay a higher rate.

It’s the same with the interest rates the US Government pays on its bonds. 99.9% of the time, the longer out a bond goes, the higher rate it pays. A ten year bond almost always pays higher interest than a two year bond.

But last Wednesday, the interest rate on the 10-year US bond sunk below the interest rate on a 2-year bond.

This “upside-down” situation is what investors call an inverted yield curve.

- And it’s typically a reliable sign that something is “off” with the US economy...

It’s rare for the yield curve to invert. It’s only happened nine times in the last 50 years.

It last happened in January 2006. Roughly two years later, we entered the 2008 financial crisis. US stocks cratered 57% in 08-09.

More bad news: Every time the yield curve has inverted in the last 50 years, a recession has eventually followed.

Recessions are bad for stocks. Since the 1920s, US stocks have sunk into a “bear market” ten times. Eight of the ten have come inside a recession.

- This sounds pretty bad, Stephen…

It’s important to know the yield curve inversion typically warns of a recession years in advance. From the time the yield curve first inverts, a recession hits 20 months later, on average.

Twenty months is a long time. In 20 months, America may have a new president. The 2020 Olympics will have come and gone. Your kids will be two grades older.

And in the 20 months after the yield curve inverts, stocks usually perform well... and sometimes they perform GREAT.

The last time the yield curve inverted in 2006, the S&P crept up 22% before the onset of the financial crisis.

The time before that, in 1998, stocks soared 55% before peaking. And the Nasdaq jumped a crazy 210% to form the infamous dot-com bubble.

Not only is there a long lag between this signal flashing red and stocks topping out. You could say a yield curve inversion is a BUY signal for stocks, at least in the short term.

- Although the yield curve inversion is a reliable signal, it’s at odds with the “real” economy...

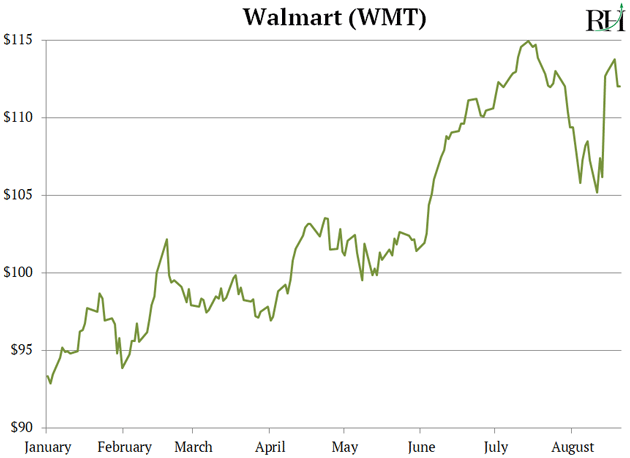

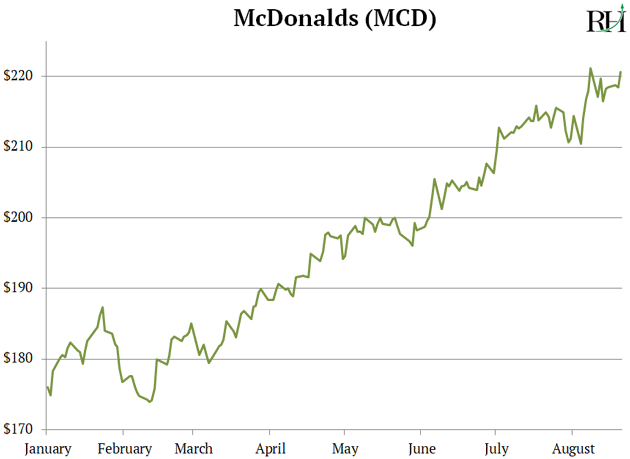

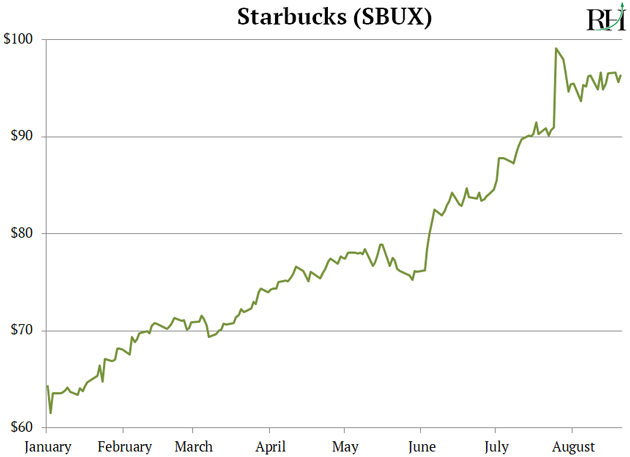

Look at these stock charts of five “everyday” American companies.

If the economy is on shaky ground, these companies should be struggling.

After 20 straight quarters of rising sales, America’s largest retailer, Walmart (WMT), recently hit all-time highs.

Fast-food giant McDonalds (MCD) is looking better than ever.

If we’re in an economic danger zone, why are tens of millions of folks paying $6 for luxury coffee at Starbucks (SBUX)?

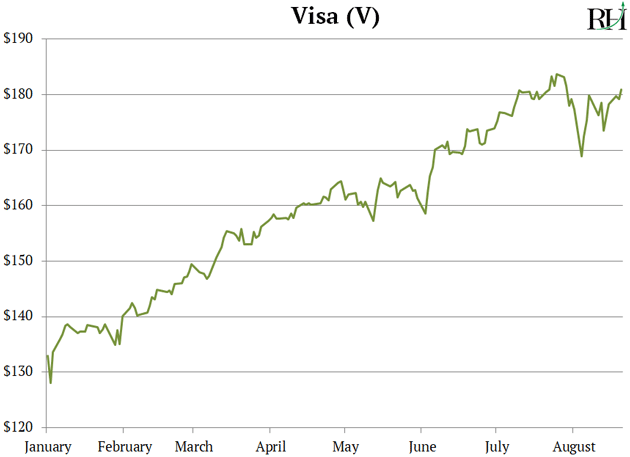

Credit card giant Visa (V) keeps zooming higher.

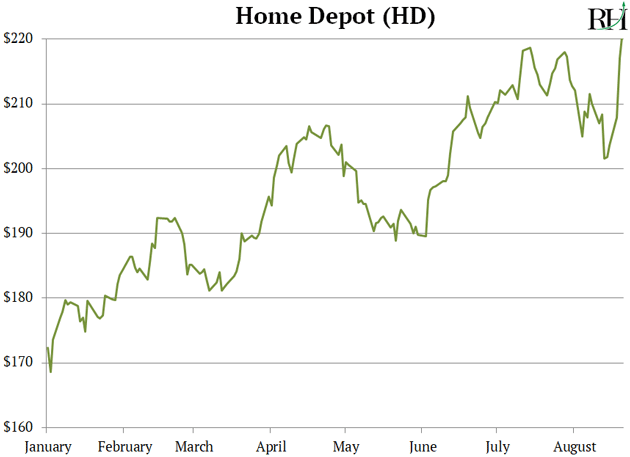

And new highs in Home Depot (HD) suggest more Americans are renovating their homes than ever before.

If the economy is about to hit the rocks, why are these stocks hitting all-time highs?

If a meltdown is coming, somebody forgot to tell the hundreds of millions of Americans who shop at these places.

- Here’s what I’m doing with my money right now.

Many investors assume they only have two choices now that the yield curve has inverted:

Sell all their stocks and park the cash in their bank accounts…

Or hang on and hope the next recession doesn’t wipe them out.

This “all or nothing” mentality is a rookie mistake.

There is a better way.

Don’t panic. PREPARE.

Prepare by committing to disciplined risk management with each stock you own. Any investor can do this by using “stops.”

As you may know, a “stop” is a predetermined price at which you’ll sell a stock. Say you buy a stock at $100, and put a 20% stop on it. If the stock falls to $80, you sell immediately. No questions asked, and no second guessing the decision.

Used correctly, stops keep any losses small while allowing your winners to ride.

That way, if US markets continue to perform well for one year... two years... three years...or more... your nest egg will keep growing.

And if markets turn down tomorrow, your stops act like a “circuit breaker” for your portfolio. They’ll get you out before a stock loses too much ground.

- Let me be clear: The yield curve inversion is a “red flag” to take seriously.

It’s one of the most reliable indicators of a recession there is. It’s definitely not a good thing. It would be irresponsible to ignore it.

But as I said, 20 months is a long time. The average person has about 35 working years, or 420 months, to build wealth through investing.

Twenty months represents around 5% of your investing life.

Are you willing to squander 5% of your investing life?

To park your money on the sidelines until a potential recession comes and goes?

With scary headlines swirling, that might “feel” like the safe, prudent thing to do.

But the data is clear. For the next twenty months or so, we’re in an environment where it has historically been good or great to own stocks.

Think carefully before you waste it.

What’s your gut feel about the markets right now? Tell me at stephen@riskhedge.com.

Stephen McBride

Editor, Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com