We’re up 524% on Nvidia… time to sell?

- Stephen McBride

- |

- July 17, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Has Nvidia (NVDA) peaked?

RiskHedge readers were among the first to know about Nvidia before it became a superstar.

I first urged you to buy it in 2018.

Now, everyone knows all about Nvidia’s near-monopoly on artificial intelligence (AI) chips… and folks are wondering how its stock can possibly keep rising after quadrupling in less than a year.

The funny thing is most of these folks don’t understand what Nvidia actually DOES.

When you understand the simple secret of its business model, you’ll see why its rise makes perfect sense…

And why, despite its stock skyrocketing over 286% in less than a year… it’s actually cheap compared to its recent history.

- Contrary to popular belief, Nvidia has never made a single chip.

Yes… it has a stranglehold on the market for high-powered, mega-expensive AI chips.

Yes… it powers over 95% of the world’s top AI systems, including ChatGPT.

But it doesn’t make chips.

How is that possible?

Nvidia is an architect. It designs chips, then sends these designs to a different company, like Intel (INTC), to make them.

This so-called “fabless” business model was ridiculed in its early days.

AMD (AMD) founder Jerry Sanders insulted fabless firms, saying: “Real men have fabs.”

The “fabs” he was referring to are chip factories… and they’re some of the most expensive and complex buildings on Earth.

- In fact, the single most expensive factory in history belongs to Taiwan Semiconductor (TSM).

Taiwan Semiconductor—or TSMC for short—has made the chips inside every Apple iPhone and Mac since 2014.

And it’s produced Nvidia’s chips since the ‘90s.

My contact, John, is an engineer who fixes chipmaking machines. He told me TSMC’s plant in Hsinchu, Taiwan is the most incredible building he’s ever set foot inside.

Once you pass through security, you must throw on a protective coverall suit, mask, and gloves. Then, you walk into an “air shower.” It’s a special chamber that blasts you with filtered air to remove any particles, like dust or hair.

The semiconductors TSMC makes are so fine, a single speck of dust can ruin them. Its “cleanroom” must be thousands of times purer than it is outside. The air is so sterile, you have to drink gallons of water to stay hydrated.

TSMC is breaking ground on two new plants in Arizona right now. Price tag: $40 billion.

To give you an idea of how expensive that really is… Los Angeles’ new 70,000-seat SoFi Stadium is the most expensive arena ever built.

The construction bill totaled “just” $5 billion.

In fact, it’s cheaper to build a nuclear power plant than a modern chipmaking fab.

- I can’t think of anything more expensive than making high-powered, cutting-edge computer chips.

The upfront costs alone are mindboggling.

And Nvidia doesn’t have to directly foot any of them.

No $40 billion buildings… no cleanrooms… no air purifiers.

Instead, Nvidia effectively shoots off an email to TSMC with the chip blueprint.

TSMC makes the chips and sends them back a few months later.

They are then sold as Nvidia chips.

Nvidia’s latest and greatest AI chip—the one powering ChatGPT—costs $40,000.

Nvidia gets all the benefits of the historic boom for cutting-edge AI chip demand with few of the direct costs!

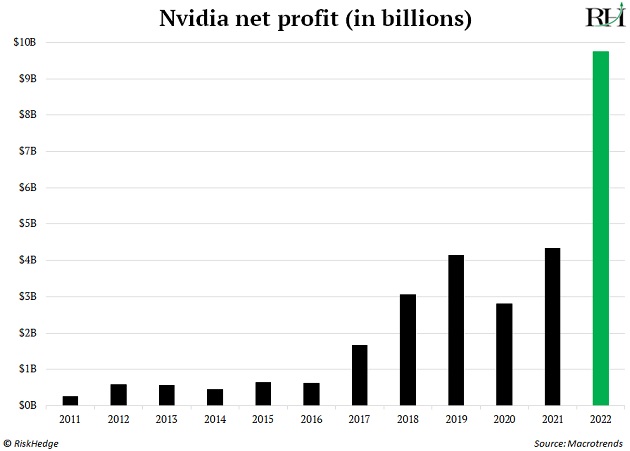

As a result, Nvidia’s profits have exploded higher:

- And this ain’t no speculative frenzy.

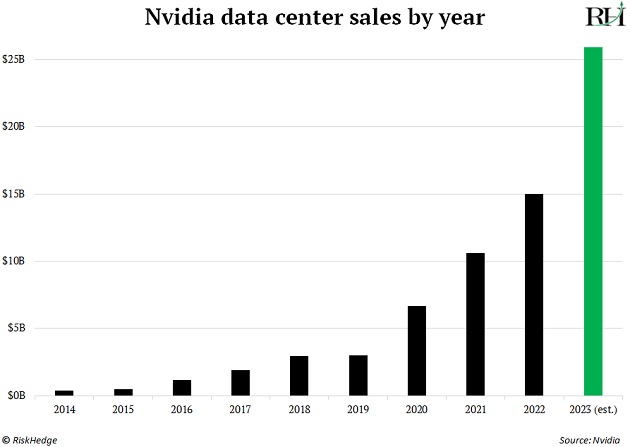

Nvidia’s AI-related data center sales hit $4.3 billion last quarter.

And get this: AI revenues are expected to surge to $8.5 billion in the current quarter.

For perspective, it raked in $7.2 billion total in the first three months of the year.

In other words… Nvidia’s AI arm will soon be larger than the entire rest of its business!

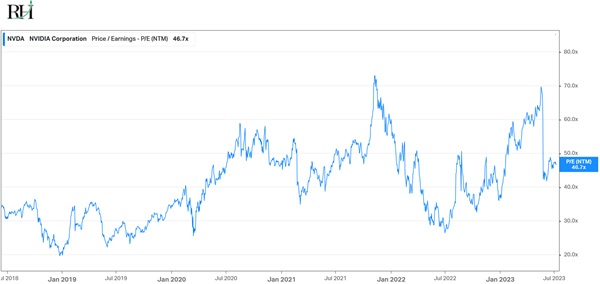

Now, you could make the case that Nvidia is overvalued. It’s trading at 46X earnings, which is certainly not cheap.

But realize that Nvidia is trading near its cheapest forward-earnings valuation this year.

Because although its stock price has surged, its expected profits have surged even faster.

Source: Koyfin

In other words, it makes perfect sense that Nvidia is one of the best-performing stocks this year.

The AI boom is only starting.

Nvidia has a near monopoly on AI chips.

And for reasons we’ll discuss another time, it’s likely to retain this monopoly for several years, at least.

- So, what am I doing with Nvidia stock?

It’s not the explosive growth opportunity it was five years ago when it was trading for one-fifth the price.

But if you’re a long-term investor, I wouldn’t hesitate to buy a little today. Nvidia controls the inputs to the most important investing theme of our time—AI.

And if you’re a paid-up subscriber to my Disruption Investor advisory, you own Nvidia shares risk-free because we took profits on it when markets topped out in November 2021.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com