We’re entering Act 2 of the AI boom

- Stephen McBride

- |

- July 4, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Act 1 was fun.

Now, it’s time to get ready for Act 2.

Chris Reilly here, and today I’m bringing in RiskHedge’s three expert analysts—Stephen McBride, Chris Wood, and Justin Spittler—to share how they’re playing Act 2 of the artificial intelligence (AI) boom.

Act 1 kicked off with the debut of ChatGPT in November 2022. Stocks like C3.ai (AI) and SoundHound AI (SOUN) rallied ~240% in seven months. Buzzfeed (BZFD) tripled overnight when it announced it was using AI to write articles.

Those stocks didn’t live up to the hype. But plenty of others did. Like Super Micro Computer (SMCI), which rocketed 1,500%. (Justin’s members had a great time trading it inside our RiskHedge Live trading room.)

Of course, through it all, the clear winner has been Nvidia (NVDA)—the AI chip kingpin powering the boom. It’s become the world’s most popular stock and briefly held the title of “largest company on Earth” (still worth over $3 trillion).

Congrats if you bought NVDA on Stephen’s initial recommendation back in 2018.

But our experts agree: Different types of AI stocks are now emerging as the new leaders.

Read on to find out how to play Act 2 of the AI boom that’s now starting.

***

Stephen McBride, Disruption Investor; RiskHedge Venture: Nvidia’s still got all the attention, and we’ve made good money on it in Disruption Investor by investing early. We’ve taken profits twice, and we’re up more than 400% on our small remaining position.

But over the next couple months, I could see NVDA trading sideways... digesting its huge gains. Fundamentally, the company is as strong as ever, and it will continue to thrive. But we’ve shifted our attention to the lesser-known companies set to capture unfathomable amounts of money pouring into the AI buildout.

In a way, Nvidia has been too successful. Its AI chips are 100X faster than they were a decade ago.

All the other parts that make up a data center—networking equipment that allows the chips to “talk” to each other and so on—have only gotten about 4X faster.

This creates a major bottleneck where Nvidia’s chips can only work 30% of the time. The other 70% of the time, these $40,000 chips sit idle… but still use full power.

I expect a lot of spending and innovation to shift toward the lagging parts of the data center equation: cooling equipment, storage, next-gen fiber optic cables, and so on.

This is where we’re investing our time and money today.

Here’s my recommendation for how to approach Act 2:

If you’re also up big on NVDA, now’s a good time to take a “parlay” approach.

Split up your winnings from NVDA (keep a small position) and spread them out into the up-and-coming AI data center buildout plays.

Chris Wood, Project 5X: We own a handful of tiny, exciting AI stocks in my Project 5X micro-cap advisory that I have high conviction in.

The fact is, micro-caps didn’t participate in Act 1 of the AI boom. All the money and attention flowed into the big stocks. So there’s a lot of untapped potential in these tiny names.

One of my favorites right now is taking a whole new approach to AI. The company set out to develop superior AIs by modeling them on how real, biological beings learn with their brains.

And that’s exactly what it did. With the help of genius neuroscientist Karl Friston—who has twice as many research publication citations as Albert Einstein—the company built an AI platform that solves many of the problems with today’s AIs. It can build AIs that understand and remember the world around them, as well as learn and adapt over time.

This is different from ChatGPT and other “generative AIs,” which can’t do any of those things. These AIs essentially work like souped-up versions of the autocomplete function on your smartphone or computer. They recognize patterns to guess what word comes next. When you release these AIs into the world, they stop learning.

That’s just one example. Feel like you missed the AI megatrend because the big stocks have run up so much? Take a look at what the tiny companies are quietly achieving. In many cases, their stocks still trade below $5. Once the money and attention shifts back in their direction, I expect them to catch up in a hurry.

Justin Spittler, RiskHedge Live: The “AI trade” is evolving.

The gains in Act 1 largely came from semiconductor companies. Nvidia has surged 999% since October 2022. Broadcom (AVGO)—another AI semi leader—has rallied 300% over the same period.

Then there’s Taiwan Semiconductor (TSM), which has gained 193% in under two years.

This is no surprise. We’re still very much in the early innings of “The Great AI Buildout.” The foundation is still being laid, and the money has flowed to the infrastructure companies laying that foundation. I expect semi stocks to continue to perform extremely well.

|

But I also see opportunity in other AI stocks, specifically software stocks. Software companies will bring AI applications to the masses. They will help everyday people and businesses alike become more productive.

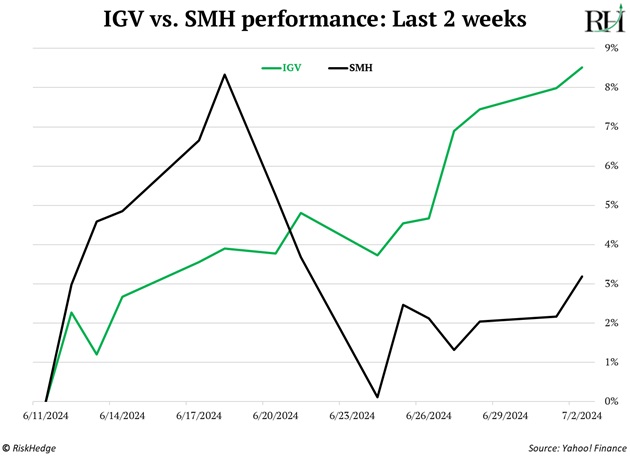

In other words, I think money will rotate into other AI plays. This is already beginning to play out. As you can see below, software stocks have outperformed semiconductors over the past two weeks:

I think this is just the beginning. In the months ahead, I expect software stocks to play “catch up” in a major way.

You could play this by simply buying the iShares Expanded Tech-Software Sector ETF (IGV). But you’re much better off owning the “best of breed” names. Here are a few of my top picks:

- ServiceNow (NOW)

- CrowdStrike (CRWD)

- Oracle (ORCL)

***

Chris Reilly again. If you’re ready to take full advantage of Act 2 of the AI boom, this is the best way to do it...

As you’ll see, it’s a way for you to access all of our RiskHedge products and get Stephen, Chris, and Justin’s ongoing expertise so you don’t miss a thing.

Go here now to see the details—including your six months of free membership.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com