“We need AI, now”

- Stephen McBride

- |

- July 25, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Editor’s Note: Artificial intelligence (AI) chip kingpin Nvidia (NVDA) has stalled out in recent weeks.

If you’ve been following along, you know Stephen said Nvidia was due for a breather. But that doesn’t mean the AI boom is over...

Today, we’re sharing an excerpt of last month’s issue of Disruption Investor to give you a better perspective of where we’re at in the AI cycle—including the opportunity Stephen’s focused on today.

Read on for more…

***

Greetings from the great city of Nashville.

I (Stephen) am in town for a private gathering at Vanderbilt University. It’s an intense two-day summit on using AI to transform how we work and invest.

Even for someone like me who’s immersed in AI, this gathering has been an eye-opener into just how game-changing this technology is. I’ll share what I’ve learned with you soon.

For now, I’ll repeat something I’ve said many times: You must use AI. People not using this technology will soon seem as outdated as those who don’t know how to turn on a computer. Don’t be one of them.

One task I’ve offloaded to ChatGPT is combing through dense research papers.

I used to spend countless hours digging through long reports on all kinds of investing themes. Now, I simply send the document to ChatGPT… tell it to assume the role of “expert research analyst”… and pull out all the main insights.

It usually does 80% of the work in 30 seconds.

AIs don’t come with a “how to” manual. You need to play around with them to learn how they can help.

Think of “jobs” that take up a lot of your time. Maybe it’s a mundane office task or helping your kids with their homework. See if AI can help.

Buy Now, Pay Later pioneer Klarna rolled out its AI customer service chatbot…

The bot now does the work of 700 (human) agents… resolves queries 80% quicker… and is estimated to drive a $40 million profit for Klarna this year.

People are quick to write off AI as just another stock market craze. They look at the hundreds of billions of dollars being spent on AI and scream, “Bubble!”

But when you see how companies are using this tech to do “more with less,” it’s clear this isn’t a fad. The juice is worth the squeeze.

For example, Alaska Air Group (ALK) saved 500,000,000 gallons of fuel last year thanks to its AI navigation system, which acts like “Google Maps in the air.”

I guarantee this covered the money it spent on AI many times over. And you can bet every other airline saw this and thought, “We need AI, now.”

|

That’s why I’m getting increasingly bullish on AI. Even small improvements are often worth billions of dollars, which makes AI spending more than “worth it.”

The AI buildout is the largest infrastructure project in history…

This year alone, Microsoft (MSFT), Amazon (AMZN), Google (GOOG), and Facebook (META) will spend more than $170 billion building data centers.

These companies will plough more money into data centers over the next 4–5 years than the US government spent putting a man on the moon or developing the atom bomb.

State-of-the-art data centers are 10X larger than those built just a few years ago. That’s because of the AI “iron law” I told you about in 2020.

The larger the AI model, the “smarter” it is.

Of course, that means you need more data and more ultra-powerful chips to train them. The “compute” needed to train the latest AI models has surged by 1,000,000X in the past decade.

We’ll hit diminishing returns at some point, but we’re not there yet. That means the firehose of AI spending is set to continue. And this is our big opportunity.

Nvidia’s AI chip sales quintupled over the past year.

It’s been the big winner from the AI spending spree so far. Disruption Investor members were early to this trend, and we’ve made a lot of money.

Nvidia will continue to thrive. But we’re shifting our attention to other parts of the data center buildout.

Nvidia buys silicon wafers from Taiwan Semiconductor (TSM)—which makes the chips from three tablespoons of sand—for roughly $700 apiece. It then packages the chips and sells them to the likes of Google and Microsoft for $40,000.

But Nvidia is moving too fast for its own good. Its AI chips are 100X faster than they were a decade ago.

All the other parts that make up a data center—networking equipment that allows the chips to “talk” to each other and so on—have only gotten about 4X faster.

This creates a major bottleneck where Nvidia’s chips can only work 30% of the time. The other 70% of the time, these $40,000 chips sit idle… but still use full power.

I expect a lot of spending and innovation to shift toward the lagging parts of the data center equation: cooling equipment, storage, next-gen fiber optic cables, and so on.

This is where we’re investing our time and money today.

Don’t forget we’re only one year into the AI infrastructure boom.

It kicked off last May, when Nvidia reported a blowout quarter that will go down in the history books. But the trend of AI transforming our largest and most important industries is a decade-long shift. In other words, we’re incredibly early.

The latest quarterly earnings from the biggest AI companies tell us there’s no slowdown in sight. And as long as companies are finding new ways to boost their businesses with this tech, the spending will continue.

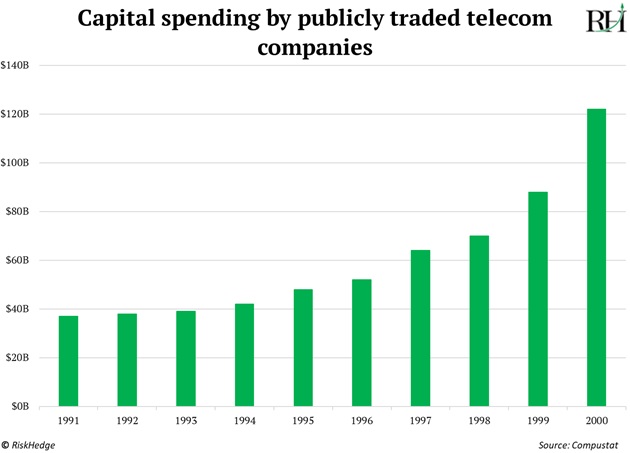

The ‘90s internet buildout spending spree lasted a decade before fizzling out.

Lesson: The AI boom can last a lot longer than you think.

To be clear, the music will stop one day. We know chip spending moves in boom-and-bust cycles.

But our research suggests the AI boom has at least another 1–2 years left to run.

That doesn’t mean AI stocks will go up in a straight line. You must be prepared for nasty pullbacks along the way. But there’s a lot of money to be made buying great businesses profiting from this trend.

One last thing…

We all know about the AI chip shortage. Even the CEOs of the world’s largest companies are begging Nvidia to send them more GPUs.

Soon, you’ll be reading about the AI energy shortage.

AI models suck up an insane amount of power. Training the original ChatGPT used the equivalent of a high-performance supercomputer running continuously for nearly 14 years.

And now multiple companies are building gargantuan clusters of 100,000 Nvidia GPUs that are all linked together.

This is why Amazon recently bought a nuclear power plant in Pennsylvania and why Microsoft is quickly moving into atomic energy. Everything tells me powering AI could be among the biggest investing opportunities over the next decade.

Stephen McBride

Chief Analyst, RiskHedge

Editor’s note: In Disruption Investor, Stephen and his partner Chris Wood are hunting down the next leaders of the AI megatrend… stocks that will not only push this technology forward but make their investors money along the way.

They call their latest recommendation an “AI company in disguise.” Similar to how everyone viewed Nvidia as just a video game chipmaker when Stephen first wrote about it in 2018… this stock has a lot more to it than meets the eye.

You can learn more about it by upgrading to Disruption Investor today.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com