The surest way to profit from internet junkies

- Stephen McBride

- |

- October 9, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Happy Friday!

I’m allergic to wasting time.

Can’t understand folks who watch movies on airplanes. Flying home from Montreal a few weeks ago, the airhostess asked, “Are you still working?” Of course. What else can you do when you’re stuck in a metal tube in the sky?!

So you can imagine the torture I endured this week when I spent four hours standing in line at the US Embassy here in Dublin.

All good. I got my new documents, and this Irishman will be in the Boston area next month if anyone is down to meet.

I also got a few useful ideas from my stint in purgatory, which we’ll discuss in a moment.

First, let’s talk about what’s going on in the markets.

- THIS will send stocks soaring higher.

Stocks got trashed over the past month, and the selling looks set to continue as I write in the wee hours.

Let’s talk about why it’s happening and what to do about it.

Interest rates are breaking out to new 16-year highs, which is spooking investors. I don’t share these fears because as I showed you, stocks typically go up during these periods.

Markets tend to obsess over one thing—and only one thing—at a time. Right now, surging Treasury yields are in control.

For the selling to stop, the market needs a new obsession. That “new shiny thing” is right around the corner.

S&P 500 companies start reporting earnings next week. I’m expecting this earnings season to be “strong to quite strong,” as Greg Focker would say.

Analysts have been revising estimates upward much faster than usual—a reliable sign lots of companies should blow them out of the water.

Earnings season shifts into high gear next Friday when the big banks report. If they’re solid, watch sentiment flip on a dime!

Remember, the kind of businesses you want to own when rates are rising are those that can grow their earnings year after year, no matter what. That’s what my colleague Chris Wood and I are focused on in our flagship advisory, Disruption Investor.

As an aside, I think rates might be peaking. Every podcast ad is trying to sell me US Treasury bonds. There’s an important lesson here.

Usually when people can’t shut up about something, the trend is nearing an end.

- Why I’m not buying the dip in FAANG stocks.

You want to know my top investing warning for the next five years?

Avoid FAANG stocks.

This headline flashed across my desk yesterday: Apple Gets Downgraded by KeyBanc, Believing Valuation Near All-Time High.

I’m with the Wall Street bankers on this one. I think Apple (AAPL) and its fellow FAANGs could be dead money for years.

For the past decade, Facebook… Apple… Amazon… Netflix... and Google were “must-own” stocks.

Remember The Far Side? The comic strip ran for years in The New York Times. My all-time favourite Far Side cartoon is “Situation’s changed, Jules…”

Source: Gary Larson

The situation for FAANG stocks has certainly changed, friends. They’re no longer the fast-growing disruptors we once knew.

Here’s a list of boring old companies that grew faster than every FAANG last quarter:

United Health (UNH)… Berkshire Hathaway (BRK.A)… JPMorgan Chase (JPM)… PepsiCo (PEP)… Union Pacific (UNP)… and Caterpillar (CAT).

That’s right, a 160-year-old railroad (Union Pacific) grew faster than Apple and Google (GOOG).

Investors were repeatedly rewarded for buying the dip in these stocks over the past few years. But the situation has changed.

FAANG is old news. The big bucks will be made investing in up-and-coming disruptors.

- Are you investing in this $200 billion/year megatrend?

Outside the US Embassy, I got talking to a kid who just graduated construction engineering and was moving to New York.

His boss told him: “You’ll be building data centers for the rest of your career.”

Data centers are giant warehouses packed full of thousands of giant supercomputers. Every time you stream movies on Netflix, scroll through Facebook, or watch YouTube… you’re connecting to a data center.

People like to get on their high horse about “digital detoxes” and disconnecting from the web. I agree putting the phone down—especially around your kids—is important.

But the reality is we’re all internet junkies and our time spent online is only going one way: UP.

More time spent online = more data centers. We’re already spending $200 billion/year building them.

A fast-growing trend with long legs: That’s our bread and butter.

Investing in businesses that own data centers like Equinix (EQIX) and Digital Realty Trust (DLR) is one way to profit from this trend. But those stocks look awful right now, and I wouldn’t nibble until they bottom out.

Chris and I are scoping out companies that sell chips and servers that go into these data centers. More soon!

4. Be a contrarian… drink some wine.

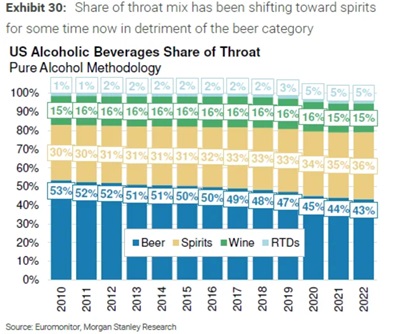

Since it’s Friday, I thought I’d include this fun chart I saw on Twitter (follow me here).

It shows the market share of alcoholic beverages in the US:

Source: Morgan Stanley

Beer (blue line) is in a bear market.

Real men drink wine (green line), which seems to have a small but loyal base. Me included!

Tomorrow night, I’ll be corking this bottle my wife and I brought home from our Tuscany trip. If you’re ever in Bolgheri, you must tour the vineyard Campo Alla Sughera.

Have a great weekend and remember, you can write me at stephen@riskhedge.com.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com