The end of Google

- Chris Wood

- |

- December 19, 2022

- |

- Comments

This article appears courtesy of RiskHedge.

The new scary-realistic AI everyone’s talking about… will it permanently disrupt Google? Plus, Apple’s latest leak...

- If you haven’t yet heard of “ChatGPT” you soon will...

It’s a new Artificial Intelligence (AI) program taking the tech world by storm. And it’s unlike anything I’ve ever seen.

Developed by OpenAI, the AI research company cofounded by Elon Musk… this “chatbot” is unique because it can answer pretty much any question in a conversational way, as if you’re talking to a human.

And no... this isn’t just a super-advanced “Siri.” ChatGPT can write computer code... answer tough math questions... even write poems and essays... all in seconds.

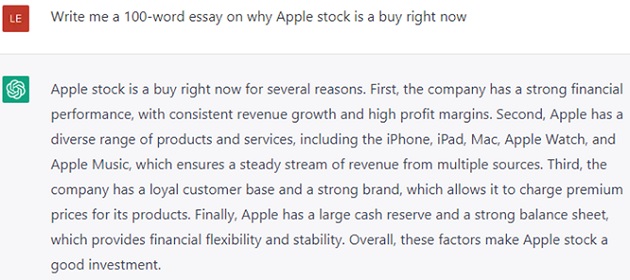

We asked ChatGPT to write a short essay on why Apple (AAPL) stock is a buy:

If you don’t like the results? Just say “make it more exciting.”

Here’s a video of a kid using ChatGPT to do his homework.

As you can imagine, folks are talking about how ChatGPT is set to disrupt everything. There’s a lot of speculation that this is the beginning of the end of one of the most powerful tech firms of our time: Google.

- So... could ChatGPT really end Google?

The disruption of Google (GOOGL) would send shockwaves through the market.

Google’s search engine accounts for a whopping 92.2% of all search queries. “To Google” is a verb. That’s how entrenched the brand is in our minds. Since I started following Google stock in a previous newsletter in 2012, it has appreciated 430% to grow into the fourth-biggest company on earth.

The argument is ChatGPT is essentially “smarter” and more precise than Google’s search engine. ChatGPT can give searchers exactly what they’re looking for immediately. Google, on the other hand, gives you a bunch of links to sift through… and allows companies to force their results to the top through ads.

I understand the “thesis.” But ChatGPT is not a real threat to Google.

Folks seem to be forgetting that Google is the biggest and best AI company in the world. It's been doing AI since day one. It spends a fortune building and refining large language models like GPT. If Google wanted to create an AI chatbot superior to ChatGPT—it could, easily.

So why isn’t it? The return on investment isn’t there yet. Google says the costs to integrate something like this into its big products like search and Gmail need to be about one-tenth of what they are today for it to make sense.

Few companies are better at staying ahead of the tech curve than Google. A little private company like OpenAI isn’t going to sneak up on and outclass Google. And if it did…. Google stands ready to write as big a check as needed to buy it.

What do you think? Is ChatGPT a real threat to Google? Let me know at chriswood@riskhedge.com.

- Did you catch the latest leak from Apple?

It’s about the company’s highly anticipated—but shrouded in secrecy—virtual reality (VR) and augmented reality (AR) programs.

I’ve been speculating the company will release a mixed-reality (VR + AR) headset in early 2023 and a pair of sleek AR glasses in 2024. And we seem to be getting close to the mixed-reality headset release…

The “leak” confirms Apple renamed the operating system that will power the device to “xrOS.” At the same time, a secretive shell corporation called Deep Dive LLC began trademarking the xrOS name.

This isn’t unusual for Apple. The company has used shell corporations in the past to register trademarks in front of big releases. It doesn’t want to spoil the surprise.

It’s a sure sign Apple is getting close to releasing its mixed-reality headset. I expect it could hit the shelves as soon as January.

- The sleek AR glasses are an even bigger opportunity for Apple…

I’ve long predicted that AR glasses will be the “next smartphones.” At first, they’ll probably be an accessory to your phone. Eventually, when the tech is good enough, they’ll replace your smartphone.

Google was one of the first to see this opportunity. It tried to front-run the market when it released Google Glass in 2013. But it was a total flop. The tech wasn’t good enough yet to do anything useful or solve real problems like a smartphone could.

What makes Apple’s product launches so successful is they’re never the first, but they’re almost always the first best.

The iPhone wasn’t the first smartphone. Companies like Palm and Blackberry (BB) had been selling smartphones for years. But Apple was the first to tie lots of features together, including cameras and touch screens, in a sleek way that people liked. Same thing with the iPad.

There’s good reason to think Apple’s mixed-reality headset and AR glasses will be instant successes. In addition to Apple’s track record, Apple has tens of millions of die-hard fans who’ll buy anything the company makes. There are about a billion iPhone users in the world today.

That’s an enormous user base. Many of them will be easily converted to AR/VR headsets… and generate billions in sales in the process.

Apple is already the largest company on earth, worth around $2.2 trillion. As I’ve said before, it will become a $10 trillion company over the next decade on the back of consumer AR.

Chris Wood

Editor, Project 5X

In the mailbag...

Today, readers share their thoughts on where stocks are headed in 2023...

Thanks for your emails, they are very informative. I read them very carefully. My guess for the stock market in 2023 is it will cycle up and down for most if not all year, possibly gradually increasing slightly. 2024 is anyone’s guess but I suspect it will still cycle but it will slowly trend upwards. –John

The bad news is the 3M/10Y inverting in late October which never missed a recession in the past. Shortest time to a recession post inversion is five months, but average is 10-11 months and max is 17 months. I think given that I don’t expect a deep recession, as that would only be triggered by a Black Swan event like a nuclear incident or China collapse, it’s reasonable to think that we would have a recession in about 10 months—meaning August 2023 and as markets typically bottom four months ahead of actual recession markets would bottom in 2Q. –Leo

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com