The boom nobody believes in

- Stephen McBride

- |

- October 14, 2019

- |

- Comments

This article appears courtesy of RiskHedge.

Bill Brame edited Star Trek films before he took up “house flipping.”

During the housing boom, Bill was often “turning around” 14 houses at once… with three crews of renovators working full time.

In 2004 he paid $400,000 for a house in Hollywood, California. A year later he flipped it for $1.2 million.

Back then flipping houses was the most profitable side-job in America. Buy a house… fit it with a new kitchen… sell it for a big mark-up... repeat.

In 2006, one in every ten homes was bought to flip!

- As you know, this craziness blew up in 2008.

The housing market melted down, and the average home lost over a quarter of its value.

Flippers went bankrupt when they got stuck owning rapidly depreciating homes no one wanted to buy.

Many ordinary Americans, who never intended to speculate on housing, were financially devastated too.

Some lost hundreds of thousands of dollars. Others lost their jobs or their businesses.

This all shocked millions of folks who believed the lie that US housing was a slam-dunk, can't-lose investment.

The housing crash was hands down the most financially disruptive event of the century. It scorched one thing into the minds of Americans: “I’ll NEVER get burned like that again.”

Housing is what I call a "hot stove" investment. It burned a whole generation of investors... and they’ll be damned if they ever touch that stove again.

- Which is too bad, because housing stocks are one of the best money-making opportunities out there today.

As regular RiskHedge readers know, housing stocks are booming.

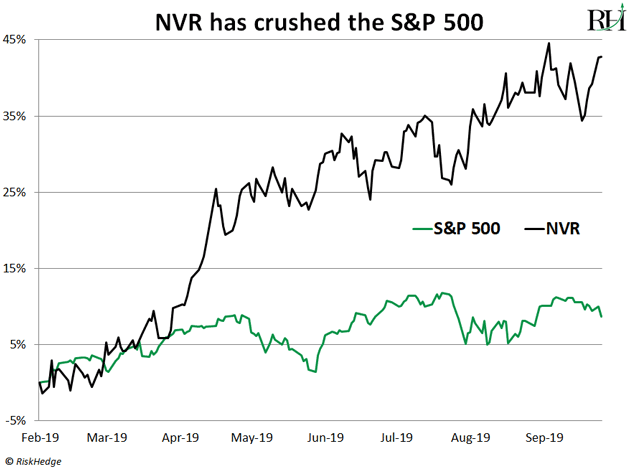

In February, I told you why buying homebuilder stocks was a near lock to make you money in 2019. I recommended buying homebuilder NVR Inc. (NVR).

If you bought NVR back in February, you’re sitting on a 45% gain. Meanwhile, the S&P 500 is up around 10%, as you can see here.

Readers who got in early have already made a bunch of money. But if you're not yet riding the trend with us, it’s not too late.

My research suggests this boom has years to run. Today I’ll show you another way to profit from it.

- Let me tell you about my talk with Barry...

I picked up the phone and called housing expert Barry Habib.

If you don’t know Barry, he’s the founder and CEO of leading real estate advisor MBS Highway. Barry is an “insider’s, insider.” He spends his days talking to the biggest players in the US housing market. In short, he knows what’s really going on in housing.

Here’s what Barry told me…

“Stephen, you’ve been proven right on housing, and I think you’re about to be proven even more right. The most important driver of home prices is supply and demand. And right now, there is a chronic undersupply of homes in America."

As I said, the 2008 bust turned a lot of folks off from investing in housing. It shattered the confidence of homebuilders, too.

Census Bureau data shows an average of 1.5 million homes were built each year since 1959. Yet since 2009, just 900,000 homes have been built per year. In fact, less homes were built in the past decade than in any decade since the 50s!

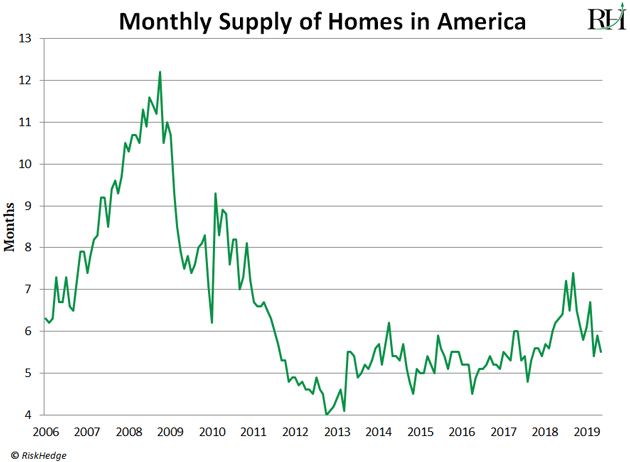

We have a serious housing shortage in America today. It would take less than six months to sell every existing home on the market, as you can see here:

- Barry says a tidal wave of homebuyers is about to flood the market…

“On average, folks buy their first home at age 33. Guess what the median age of millennials is right now? 34.”

Today’s young adults, as you probably know, are called “millennials.” They’re the biggest generation in US history—bigger even than baby boomers.

There are a lot of rumors out there about millennials. They’re famous for living in their parents’ basements, delaying marriage, and earning less money than their parents did.

But as I explained back in June, millennials are finally growing up and buying houses. According to the National Association of Realtors, one in three homebuyers today is a millennial.

Barry emphasized we’ve only seen the tip of the iceberg so far:

“Stephen, the housing market is like a rollercoaster train car. When the first few train cars go over the bump, it’s kind of slow, right? The real momentum kicks in when more and more cars go over the hump.

… In the past year or two, the first wave of young homebuyers came into the market. But every year for the next decade, tens of millions of millennials will hit home-buying age.”

In other words, a whole generation of homebuyers will soon flood the market. At a time when there is a massive shortage of homes in America!

Remember, the most important driver of home prices is supply and demand. Today, supply is tight. And with record numbers of house hunters entering the market, it all but guarantees the housing boom will continue and likely accelerate.

- This setup can only lead to one thing…

Homebuilders HAVE to build more houses.

As I mentioned, builders have been super cautious over the past decade. Who can blame them? Many saw their friends and competitors go out of business when the market crashed.

But with the housing boom showing no signs of slowing, they’re finally getting to work.

This past month new home “starts” jumped to their highest level since June 2007.

And the number of building permits granted shot up to its highest level since May 2007.

This is all great news for my favorite homebuilder NVR. I expect it’ll continue marching higher.

But I’m going to give you a different idea to profit from this thriving market.

- Before I tell you what it is... let me warn you...

It’s not sexy.

It’s not disruptive.

To tell you the truth, it’s boring.

But sometimes boring stocks make great investments.

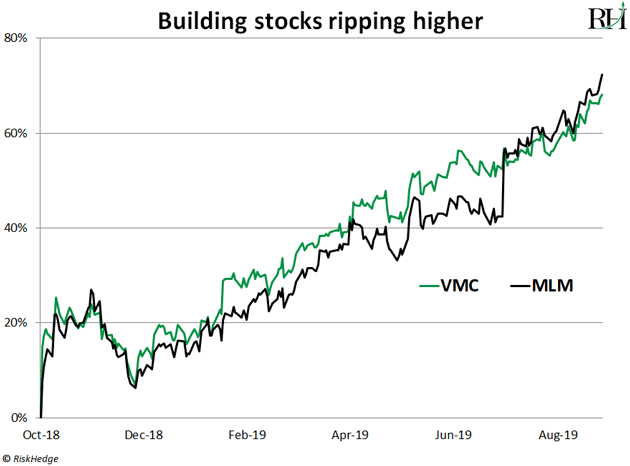

Vulcan Materials (VMC) and Martin Marietta Materials (MLM) sell concrete and gravel that goes into housing foundations… roads… and sidewalks.

Not exactly the next Amazon or Netflix, right?

But as you can see here, these boring stocks have ripped over the past 12 months.

- These stocks may be dull...

But their revenues are hitting all-time highs as homebuilders construct new neighborhoods.

I’ll say it again: The American housing boom has years to run. The best time to buy housing stocks was earlier this year when I first wrote about it. The second best time is right now!

If you’re not invested in this trend yet, now’s the time to put your money to work in any of the three “hot stove” stocks I mentioned that most folks won’t touch.

Do you enjoy the RiskHedge Report? If so, please pass it along to anyone who’s interested in the markets and in disruption.

Talk to you next week,

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen's top "disruptor" stock pick and to try a risk-free subscription.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com