RIP Google Search

- Stephen McBride

- |

- August 13, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

The S&P 500 has bounced back strongly after last Monday’s panic.

Japanese stocks, which were at the epicenter of the selloff, also recovered most of their losses. And bitcoin (BTC) has jumped back above $60,000.

For reasons I wrote on Friday, I still expect markets to remain challenging heading into November’s US election.

Let’s get after it…

- RIP Google Search?

Last week, a federal judge ruled Google (GOOG) illegally preserved its search monopoly.

Google was paying Apple (AAPL) $20 billion/year to make its search engine the default on the iPhone. The judge said these “backhander” payments must stop.

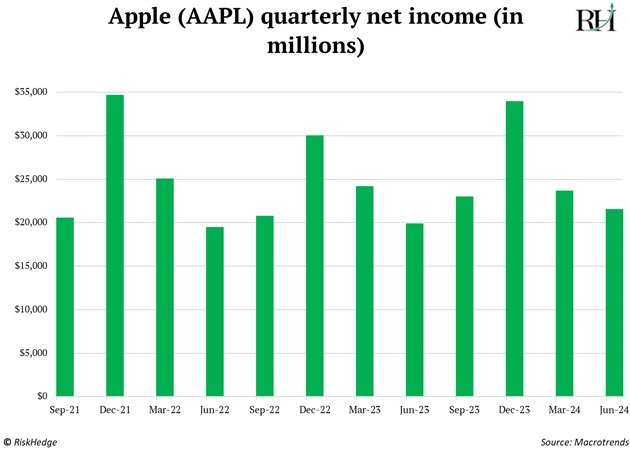

First off, this is bad for Apple. That $20 billion was pure profit. Roughly one-fifth of Apple’s earnings just went up in smoke.

Its profits have been flat for three years, as you can see below. This ruling guarantees 2024 will be a down year.

It also marks the beginning of the end for Google’s search dominance. But not for the reasons many think.

This ruling doesn’t mean Google will disappear from your iPhone. What’ll likely happen is you’ll have a menu of options to choose from instead of one.

This is how it works in Europe. Thanks to “digital protection” laws, using the internet is like visiting the doctor’s office. Endless disclaimers and ticking boxes. Great job, Brussels bureaucrats (not).

In short, most people will still choose Google. Well… until they start using artificial intelligence (AI).

I was a Google power user. Now, I use AI chatbot Claude instead. No more sifting through 10 blue links. Claude just gives me the answer. And you can easily ask it follow-up questions when needed… or for references when you suspect it’s making stuff up, which happens sometimes.

Many of my friends have dumped Google for AI, too. Try using Claude 3.5 Sonnet (or Perplexity) for a week. Let me know what you think at stephen@riskhedge.com.

I’m not exaggerating when I say this: Chatbots = RIP Google Search.

This won’t happen overnight. It’ll be a slow bleed over years.

Final thought on this: Last time a federal judge ruled a tech giant was illegally using its market power was back in the early 2000s with Microsoft (MSFT).

Microsoft’s stock went nowhere for 12 years after that decision. We’re in a different market environment today, but these rulings usually mean trouble.

Apple and Google have been two of the best stocks to own over the past decade. Stock market “MVPs” year after year.

But their best days are behind them. There are much better businesses to own going forward. See how to access our portfolio of quality disruptors here.

- Why you must invest in one chart.

Here’s how the value of cash stacked up against the S&P 500 over the past decade.

Folks who owned stocks almost tripled their money. Those sitting in cash are 30% poorer.

Gotta invest.

Source: Federal Reserve Economic Data

Amazon (AMZN) founder Jeff Bezos says the best opportunities often come from asking, “What's not going to change in the next 10 years?”

Uncle Sam revving the money printer is one thing we know won’t change.

The US national debt recently jumped above $35 trillion. We’ve added $13 trillion to the scrap heap in just five years. More of our tax dollars now go toward repaying this debt than on the military… Medicare… or education. Yikes!

When people talk about the out-of-control debt, usually the next words out of their mouth are “market crash.”

They have it backward.

The value of the dollar will keep sliding as we print more money. And just like your morning coffee and grocery bill is priced in dollars, so too are stocks.

Dollar down means stocks up.

|

I’m preaching to the choir, but this is why you must invest.

To borrow a line from one of my favorite films, Trainspotting:

Choose to protect your wealth from endless money printing. Choose to take control of your financial destiny. Choose to build a legacy for future generations. Choose assets.

Because in a world where the value of your savings is being eroded by the day, owning things that hold their value isn’t just smart—it's essential.

- A little-known way to buy the world’s hottest “off-limits” startups.

There are two stock markets in America.

Public markets, where anyone can buy shares in companies like Apple and Google.

And private markets, where mostly venture capitalists and accredited investors invest in hot startups like SpaceX and OpenAI.

The number of public companies has been cut in half over the past 25 years. US-listed stocks are becoming an endangered species!

Meanwhile, private market growth has been off the charts. Companies are choosing to stay private longer. That’s bad for ordinary investors who can’t buy them until they’re already worth many billions of dollars.

But there’s a backdoor way to invest in the world’s most valuable private companies.

The Destiny Tech100 (DXYZ) is a fund that allows you to own a slice of companies like SpaceX… OpenAI… Fortnite creator Epic Games… and payments giant Stripe.

Put this in the “fun money trade” bucket. A cool opportunity, but don’t throw more than 100 bucks into it.

The Destiny Tech100 is a closed-end fund, meaning it can trade above or below its underlying value. And it comes with a 2.5% management fee.

- Today’s dose of optimism…

40 years ago, tobacco companies were sponsoring the Olympics!

Source: Neon Talk

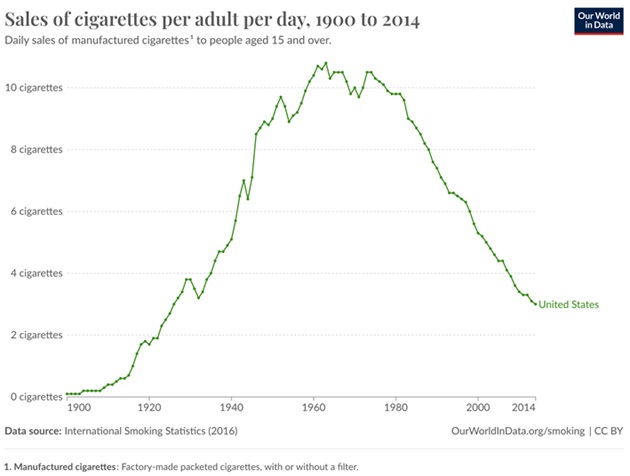

Thankfully, we’re long past “peak smokes.” Cigarette sales per adult in America have collapsed 70% since the 1960s:

Source: Our World in Data

Smoking used to be cool. Now, when I see someone with a cigarette, I’m surprised.

One of the many ways the world is getting better.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com