Qs from last night

- Stephen McBride

- |

- November 23, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Happy Wednesday!

First off, thanks for all the support for our big AI event last night. Your participation was unlike any other event I’ve been a part of—over 100 questions came in!

If you’re a ticketholder and you missed the event, we’re holding a special rebroadcast today at 12 p.m. EST. Go here to watch it. (Note: The link will only work for ticketholders.)

We’re getting a lot of questions on the “buy up to” prices of our five AI stock recommendations from the event. For good reason: One of our recommendations jumped 40% yesterday morning on blow-out earnings results.

Here’s an excerpt from our Disruption Investor Owner’s Manual on how to deal with this:

Q: What if a recommended stock is above its buy-up-to price?

A: Exercise patience. We include these so investors don’t get overly excited about a rising stock and “chase” it by buying at higher prices than necessary. We are constantly evaluating all our recommendations and will often update our buy-up-to prices.

This is just the latest example of things moving at warp speed in AI.

Let’s get after it!

- “What’s wrong with people?” asks my friend JC…

In NYC, I had drinks with JC Parets of All Star Charts.

Half of the time, we debated wine (what’s better: Barolo or Brunello?); the other half, we discussed the markets.

JC said, “This is a raging bull market. What’s wrong with people who are betting against stocks?”

JC is a technical analyst. He studies charts to see how markets are actually behaving to make investing decisions.

He doesn’t care about GDP, the yield curve, or anything macro.

He cares about making money.

I have maximum respect for JC’s work. He never deviates from what he’s best in the business at doing—investing according to what’s actually happening in the markets. As opposed to what most people do—invest according to what should be happening.

Actually happening: The S&P 500 and the Nasdaq are closing in on all-time highs.

Actually happening: Nvidia (NVDA) is making new all-time highs (it had dipped almost 20% since summer).

“Should be” happening: Recession.

I say a recession “should be” happening because many smart people who I respect say so. They’re mostly looking at the yield curve. In short, it inverted almost two years ago and is now steepening, which has in the past predicted recessions with a very high reliability.

I get it. I respect it. Makes sense.

Maybe this will matter someday. But right now…

Actually happening: Four in five US companies are beating earnings. The S&P 500 just posted its longest winning streak in two years. Inflation is cooling.

Things are good. Invest accordingly. For my preferred way of investing, that means buying great businesses profiting from megatrends.

AI is the mother of all megatrends.

- “OpenAI is kicking everyone’s ass.”

AI expert Zvi Mowshowitz didn’t pull any punches when I interviewed him recently.

His Don’t Worry About the Vase blog is read by some of the most influential people in AI. It’s a must-read.

He told me OpenAI was crushing its competitors in the AI race.

UPDATE on the OpenAI drama: Sam Altman is back in as CEO of OpenAI. The “doomers” that fired him are out. Full steam ahead for AI development. This was the best possible outcome long term. I’m bullish.

Some other quotes from my chat with Zvi:

- “Google is an embarrassment. Why is Bard so bad?”

- “If you’re slow to AI over the next few years, you will be left behind. Anyone putting restrictions on AI is finished.”

- “AI is a total game-changer for education. My kid says to me: ‘Dad, can we ask the box (ChatGPT) that knows everything?’”

I’ll share insights from our interview with Disruption Investor members soon.

- ChatGPT for stocks… it’s coming.

FinChat.io is building ChatGPT for your portfolio.

It’s an AI bot that can model out different investing scenarios.

Example: “What will happen to Amazon’s earnings if the growth of its cloud business gets cut in half?”

Or: “Provide a list of US stocks down more than 50% year to date.”

I met Braden (FinChat.io’s founder) at a private gathering in Manhattan a few nights ago. He’s giving me a demo this week; I’ll let you know how it goes.

More broadly, I’m pumped that useful AI apps are starting to emerge.

Specialized AI apps are the next phase of the AI revolution.

There will be TaxGPT for accountants… DrGPT for surgeons… GPTesquire for lawyers.

Demand for ChatGPT is so off the charts that ChatGPT creator OpenAI had to pause subscriptions because their systems can’t handle it.

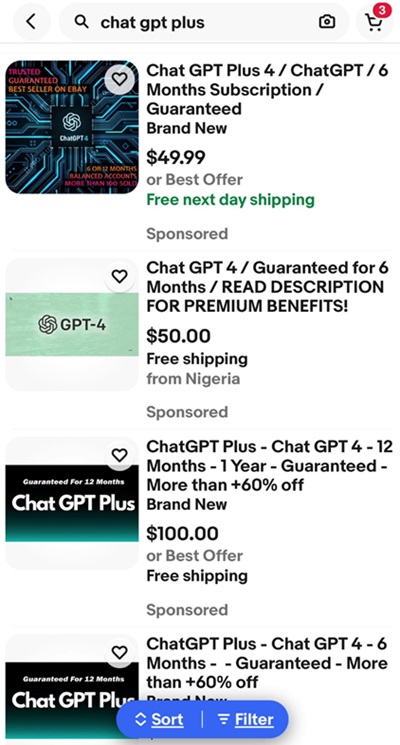

People are now selling their ChatGPT subscriptions on eBay. Take a look!

As my hedge fund friend in London told me, “You just gotta stay long.”

Have a wonderful Thanksgiving, and I’ll be back with a special issue of The Jolt for you on Friday. No days off!

Ticketholders: There will be a second showing of our Trillion Dollar A.I. Investment Portfolio event TODAY at 12 p.m. EST.

Go here to watch it. (Again, the link will only work for ticketholders.)

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com